The allocation of altcoins by publicly listed companies resembles a high-risk, high-reward gamble.

Written by: Deep Tide TechFlow

Question MicroStrategy, understand MicroStrategy, become MicroStrategy.

Since MicroStrategy first incorporated Bitcoin (BTC) into its asset reserves in 2020, an increasing number of publicly listed companies in the U.S. and globally have followed suit, making holding cryptocurrencies an evident trend in the stock and crypto markets.

By 2025, the number of companies holding crypto assets has surged from single digits to dozens.

However, this trend of companies holding cryptocurrencies has diversified into several different currents:

Bitcoin, with its strongest consensus, remains a safe choice; Ethereum (ETH) and Solana (SOL), due to their widely recognized foundations, have also attracted many followers;

Now, this trend of companies buying cryptocurrencies has even extended to the smaller market cap altcoin sector, such as Fetch.ai's $FET and Bittensor's $TAO in the AI sector.

Looking back at history, ETH experienced a single-day drop of about 26.7% in June 2022, and SOL fell by 43% in November 2022 due to the FTX bankruptcy, while the fragility of AI coins is even more apparent— for instance, the emergence of the DeepSeek open-source AI model triggered a collective pullback of on-chain AI Agent tokens. The slightly larger market cap FET and TAO have had volatility rates of approximately 15% and 18% over the past 30 days, respectively.

Is it feasible for publicly listed companies to allocate these more volatile altcoins?

Who is positioning in AI coins?

To answer this question, let's examine which companies are already positioning themselves in these AI tokens, along with the strategies and risks behind them.

- ### Interactive Strength (TRNR): Buying FET, a leap in fitness + AI

Interactive Strength is a Nasdaq-listed company primarily selling professional fitness equipment and related digital fitness services, owning the brands CLMBR and FORME.

In simpler terms, it sells hardware devices like fitness mirrors and climbing machines, complemented by fitness courses and digital platforms.

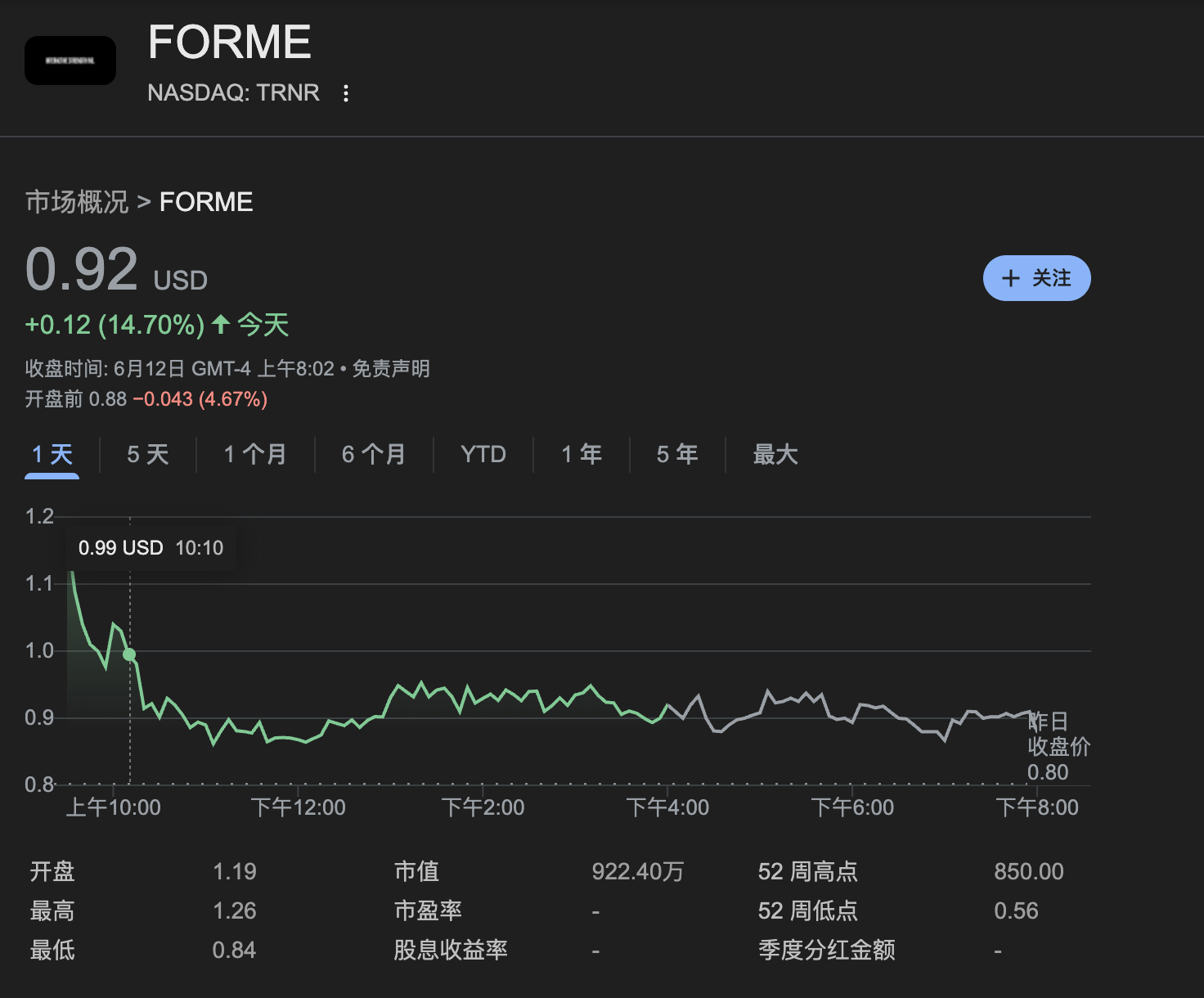

Recent data shows that the company's market cap is approximately $8.4 million.

On June 11, the company announced plans to invest $500 million to buy $FET tokens as part of its crypto strategic reserves, intending to use these tokens to support AI-driven fitness products.

CEO Ward stated that choosing FET over more widely held assets like Bitcoin reflects the company's plan to incorporate Fetch.ai's technology into its product offerings.

Currently, Interactive Strength has secured $55 million in startup funding from ATW Partners and DWF Labs.

The source of this funding is a so-called "securities purchase agreement," which simply means the company sells stock to the aforementioned investors in exchange for cash, while the purchased FET tokens are held by BitGo, a professional custodian; additionally, the transaction method chosen was to buy FET directly from the market rather than through over-the-counter (OTC) trading.

ATW Partners is a private equity giant, while DWF Labs is a seasoned market maker in the crypto space; why are they willing to invest?

The answer may lie in the bundling of interests.

ATW is interested in TRNR's fitness + AI story, while DWF also has a need to market $FET.

DWF Labs received 10 million FET from Fetch.ai in September 2024, then deposited these FET into exchanges and acted as a market maker for FET.

After all, if the $500 million investment is fully realized, it could buy about 6.41 million $FET (based on a price of $0.78 per token), and buying directly in the market might have a positive impact on the price in the short term.

After the announcement, the market responded positively.

On the 11th, TRNR's stock price rose by 15%, and $FET also increased by 7%, although it has since pulled back.

However, like some previous companies that bought ETH, the company's total market cap is only $8.4 million, making it quite challenging to raise $500 million to buy FET; it will need to gradually increase its stock price. If the market cools or the $FET ecosystem falters, this money could go to waste.

In the short term, this move seems like a gamble; in the long term, success may depend on whether the AI fitness business has room to grow.

- ### Synaptogenix (SNPX): Buying TAO, a biotech company leveraging connections for a turnaround

Synaptogenix is a biopharmaceutical company focused on developing products based on Bryostatin-1, primarily for treating neurodegenerative diseases like Alzheimer's. The company's market cap is only $5 million.

On June 9, the company announced an initial investment of $10 million to purchase Bittensor's $TAO tokens, with plans to gradually increase the purchase amount to $100 million.

As for the funding, the initial source is the company's existing cash reserves, with future plans to supplement through a $550 million Series D convertible preferred stock private placement. Similar to MicroStrategy's approach, holders initially hold preferred shares (which enjoy fixed dividends) and can convert to common stock under specific conditions, such as when the stock price reaches an agreed level, to attract institutional funds (hedge funds or family offices).

The mastermind behind this token purchase is well-known investor James Altucher.

James is a widely followed entrepreneur, investor, and bestselling author who has founded or invested in over 20 companies across various fields, including technology, finance, and media; he was also a hedge fund manager involved in early investments in several startups.

Long before Bitcoin was widely accepted, James publicly promoted the potential of blockchain technology and became an early supporter in the field. During the 2017 crypto boom, he was dubbed the "Bitcoin Oracle" due to his extensive online advertising.

In SNPX's operations, he is responsible for formulating and executing the $TAO investment strategy. Specifically, he leads the token purchase plan, including selecting phased market purchases to optimize costs and screening Bittensor subnets (such as Subnet 1, which focuses on machine learning tasks) for staking to pursue higher yields.

Recently, he has been continuously sharing the logic behind SNPX's purchase of TAO on X, candidly stating that buying SNPX stock is akin to buying TAO at half price.

The involvement of a prominent figure is crucial as it can leverage connections to attract private equity funding and draw institutional investors' attention to SNPX's transformation.

Considering the company's motivations, this transformation stems from the bottleneck in its biopharmaceutical business. The clinical data for Bryostatin therapy has not met expectations, the FDA approval outlook is uncertain, and the company's stock price has been languishing for a long time.

SNPX hopes to achieve asset appreciation through holding $TAO and staking yields, and public information even indicates plans to rename the company and its stock ticker to strengthen its AI token positioning.

After the news on the 9th, SNPX's stock price surged by 40%, reflecting the market's short-term optimism about the transformation.

However, the initial investment of $10 million already exceeds the company's market cap by more than double; if the price of $TAO falls below $300, the asset value could shrink by over 25%, posing significant financial risks.

The success of the $550 million private placement largely depends on James Altucher's influence and market sentiment; if the funds do not materialize, the transformation plan may be interrupted. The staking yields of $TAO and the 30-day volatility of the $TAO token, at 18%, seem unstable in comparison.

This is clearly a high-risk, high-reward turnaround battle.

- ### Oblong (OBLG): Buying TAO, a cautious layout in the IT field

Oblong, Inc. (Nasdaq: OBLG) is a technology service provider focused on IT solutions and video collaboration technology. Its core product, Mezzanine, is a platform that supports multi-user, multi-device visual collaboration, widely used in corporate meetings and remote collaboration; the company's market cap is around $5.3 million.

On June 6, Oblong announced it would raise $7.5 million through a private placement of stock to purchase Bittensor's $TAO tokens and participate in its Subnet 0 staking program.

After the announcement, Oblong's stock price initially rose by 12%, but has since fallen back to $4.04 as of the time of writing.

This placement involves selling approximately 1.98 million shares of common stock or equivalent securities, priced at $3.77 per share, below the current market price. This also means the company is offering shares at a discount to attract investors.

At this scale of funding, based on current prices, it could purchase about 1,890 $TAO tokens, which is not a large quantity.

However, you can view this purchase of TAO as a strategic shift from traditional IT business towards the AI and digital asset sector.

The video conferencing solution market is highly competitive; although the company's Mezzanine platform has a certain market presence in video collaboration, revenue growth has slowed by about 5% since 2023, primarily due to competition from software like Zoom and Microsoft Teams.

The company's CEO, Peter Holst, stated that the intersection of AI and blockchain is key to future innovation, and $TAO is seen as a potential asset for crypto AI infrastructure, similar to the early institutional adoption phase of Bitcoin.

At the same time, the company plans to achieve asset appreciation through holding $TAO and staking yields while exploring the development of software tools based on Bittensor, such as AI-driven meeting assistance features.

However, Subnet 0 in the TAO subnet primarily focuses on AI directions like text prompt tasks (e.g., natural language processing), and Oblong's choice to stake in this subnet seems somewhat tenuous in relation to its video conferencing business, leaning more towards considerations of staking yields and signaling.

This layout is more of a strategic trial, testing the long-term potential of AI tokens.

Risks and Rewards Coexist

The trend of companies holding cryptocurrencies has expanded from single assets to diversified choices.

However, apart from BTC, the volatility of altcoins is significantly higher than that of BTC. Taking TRNR as an example, its market cap of $8.4 million plans to raise $500 million; if the price of FET drops significantly, high-leverage financing to buy tokens itself poses a substantial financial burden.

Regulatory risks cannot be overlooked either; the primary consideration for publicly listed companies should be compliance. The SEC has classified SOL as a security, while the compliance of AI tokens remains unclear. If regulations tighten, will companies holding tokens face fines or liquidation?

However, as long as legal prohibitions are in place, capital has always pursued profit. In the current window period, various companies are competing to imitate crypto reserve strategies, perhaps already calculating their moves:

After all, they are small-cap companies, seizing the wave of capital markets gradually embracing crypto assets to gamble on higher volatility altcoins, especially since the AI narrative is enduring; if it succeeds, the ROI will naturally be high.

Overall, the allocation of altcoins by publicly listed companies resembles a high-risk, high-reward gamble.

For small-cap companies, this is a capital game betting on the future, with success or failure depending on market sentiment, the continuity of the narrative, and actual implementation capabilities.

As altcoin bull markets become stock-like, both companies and investors should remember:

Risk is the essence of high-volatility assets, while returns are the rewards for seizing narratives and timing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。