In June 2025, Hyperliquid has become an undeniable force in the cryptocurrency market.

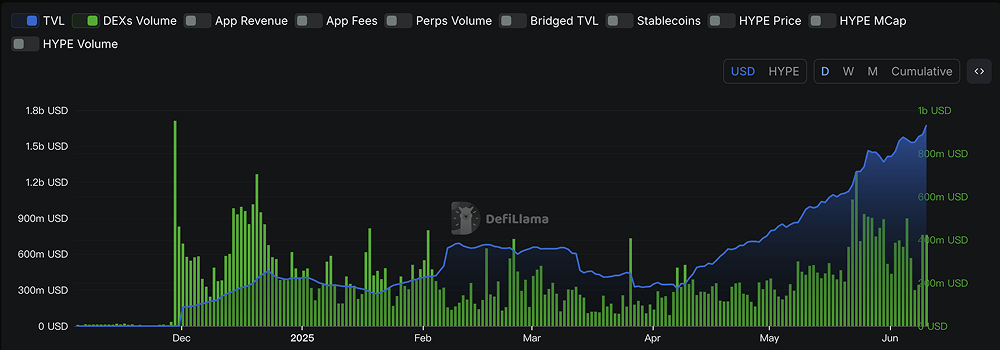

Its native token $HYPE reached $39 at the beginning of June, with an annual increase of over 110%, standing out among the top 100 assets by market capitalization. The data serves as the best footnote for its rise: in May, its perpetual contract trading volume reached $248 billion, a year-on-year increase of 843%, accounting for 10.54% of Binance's traffic during the same period; the total locked value (TVL) surged from $403 million at the beginning of the year to $1.67 billion. Hyperliquid's rapid expansion is not coincidental but rather the result of a synergistic effect in its technical architecture, community building, and market strategy.

1. Technical Foundation: A Dedicated L1 Born for Performance and EVM Compatibility

Hyperliquid's core barrier is its high-performance Layer 1 blockchain designed specifically for on-chain derivatives trading. Through its self-developed HyperBFT consensus algorithm, the network achieves the capability to process 100,000 orders per second and sub-second block confirmation times, directly competing with centralized exchanges (CEX) and effectively addressing the speed, cost, and liquidity bottlenecks commonly faced by traditional decentralized exchanges (DEX).

Unlike platforms like GMX that rely on automated market makers (AMM) or dYdX that use partial off-chain solutions, Hyperliquid employs a fully on-chain central limit order book (CLOB). This design replicates the matching efficiency and trading experience of CEX within a decentralized framework, providing the necessary infrastructure for professional traders.

Launched in February 2025, HyperEVM is a key step in its ecological strategy. As an Ethereum Virtual Machine (EVM) execution environment that shares consensus with L1, HyperEVM allows seamless migration of Ethereum ecosystem applications and direct interaction with L1's spot and perpetual contract order books. This move not only attracted top DeFi protocols like Curve Finance (whose TVL on HyperliquidX chain has reached $12.29 million) but also paved the way for high-frequency trading, arbitrage strategies, and other performance-demanding application scenarios.

Additionally, the platform's zero gas fee mechanism is a disruptive innovation. Users only pay fees in a few scenarios, such as creating wallets or cross-chain transactions, which can save high-frequency traders tens of thousands of dollars annually, constituting a strong competitive advantage. Its Dutch auction listing mechanism introduces a market-oriented pricing and selection process for new asset issuance, with the GOD token auction price reaching as high as $975,700, enhancing project quality while boosting ecological vitality through capital competition.

2. Community Engine: Precise Incentives and Value Consensus

Hyperliquid's growth is closely tied to its community-first token economics. The genesis airdrop in November 2024 precisely distributed 310 million $HYPE tokens to 94,000 early users, with the average token value per user amounting to approximately $26,000 at that time, efficiently completing the project's cold start and community cohesion.

In 2025, Hyperliquid plans to further release 388.88 million tokens through trading mining, developer incentives, and liquidity subsidies. This ongoing incentive model aims to build a positive flywheel: token incentives attract users and liquidity, thereby enhancing protocol revenue and ecological value, which in turn benefits the community. The $120 million cross-chain bridge development fund approved in the first quarter of 2025 directly accelerates the ecological integration of HyperEVM.

The strong consensus within the community is fully reflected on social media. Its narrative of "no VC, no insider financing" rewards genuine contributors through airdrops, forming a solid community base.

As noted by X user @shubit, this fair launch method is at the core of its community cohesion. Meanwhile, the platform introduces social trading elements through features like the HLP treasury and Vaults, allowing users to copy the strategies of experts, enhancing platform engagement and user stickiness.

3. Market Boost: Bull Market Background and Capital Gathering Effect

The macro bull market environment in 2025 provides ideal external conditions for Hyperliquid. With Bitcoin prices breaking $110,000 and hot money flooding the derivatives market, Hyperliquid has naturally become one of the main hubs for capital. Its open interest (OI) once surged to $8.9 billion, with the USDC locked on the platform accounting for over 5% of the total circulation of that stablecoin.

Its low-cost, high-efficiency, and high-transparency characteristics make it the preferred platform for whale traders seeking high-leverage opportunities. "40x leverage whales" represented by James Wynn have operated positions exceeding $1 billion here, showcasing the platform's capacity while amplifying its market heat.

Investor confidence is also reflected in the secondary market. According to @0xwanchongshan, a dormant whale address purchased $4 million worth of $HYPE on June 6.

Rapid growth has also been accompanied by controversy. In March's "JELLY incident," Hyperliquid was accused of violating decentralization principles by delisting a certain token, drawing criticism from industry figures including BitMEX co-founder Arthur Hayes. This incident also served as a stress test for its governance model.

4. Evolution Path: From HFT to Integrated DeFi Ecosystem

The founding team of Hyperliquid is led by Harvard alumnus Jeff Yan, with core members having backgrounds in top financial and tech institutions like Citadel and Google. From 2020 to 2022, the team was active in the market as high-frequency trading (HFT) market makers. The collapse of FTX became a turning point for their transformation, prompting them to shift to the DeFi space and commit to building a trustless, self-funded trading platform.

Its development path is clear and steadfast:

November 2023: Launched a points program to accumulate airdrop eligibility through trading activities, attracting early core users.

November 2024: Genesis distribution of $HYPE tokens, completing community building and value discovery, with market capitalization quickly surpassing $28 billion.

February 2025: Launch of HyperEVM mainnet, marking its strategic transition from a single DEX to a comprehensive financial public chain.

June 2025: With the deployment of protocols like Curve, its position in the multi-chain financial ecosystem is further solidified.

5. Conclusion: Opportunities and Challenges Coexist

The rise of Hyperliquid is the product of a triple resonance of technology, community, and market timing. The combination of its high-performance L1 and HyperEVM gives it the potential to challenge existing public chains like Solana.

However, the road ahead is not smooth. Centralized governance is the primary concern it faces, with the initial 16 validator nodes and the team's holding of 23.8% of the token supply (according to reports from VanEck and Messari) being potential risk points. Although the team has committed to gradually open-sourcing the code and expanding the validator network, this still requires time and practice to prove.

For investors, $HYPE has shown considerable growth potential during the bull market cycle. The long-term value of Hyperliquid ultimately depends on its ability to find a sustainable balance between performance and decentralization, continuously attracting developers to build a prosperous and diverse on-chain ecosystem. If it can successfully promote new narratives like stablecoins, its value ceiling may further expand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。