Original | Odaily Planet Daily

Author | Azuma

With the position of the "big whale" James Wynn being completely wiped out, the market seems to have returned to normal. (See details in “From Whale to Ant, the On-chain Contract Legend James Wynn's Fall?”)

From last night to this morning, the market has once again welcomed a significant rise. According to OKX, BTC briefly broke through 110,000 USDT, reaching a high of 110,650 USDT, with a 24-hour increase of 3.95%; ETH also strengthened, breaking through 2,700 USDT, with a peak of 2,727.9 USDT, and a 24-hour increase of 8.36%; SOL, which had been relatively flat recently, also briefly broke through 160 USDT, reaching a high of 161.83 USDT, with a 24-hour increase of 5.21%.

In addition to BTC, ETH, and SOL, altcoins also showed a general upward trend, possibly influenced by the “SEC Chairman emphasizing that they are formulating exemption policies for DeFi,” with the DeFi sector showing particularly prominent gains. As of the time of writing, AAVE is reported at 288.2 USDT, with a 24-hour increase of 13.87%; UNI is reported at 7.2 USDT, with a 24-hour increase of 13.5%; MKR is reported at 2012 USDT, with a 24-hour increase of 14.2%.

As the industry rises, the total market capitalization of cryptocurrencies has also surged. According to CoinGecko, the total market cap of cryptocurrencies has surpassed 3.563 trillion USDT, with a 24-hour increase of 2.1%. The trading enthusiasm among crypto users has also noticeably increased, with today’s fear and greed index reaching 71, categorized as “greed.”

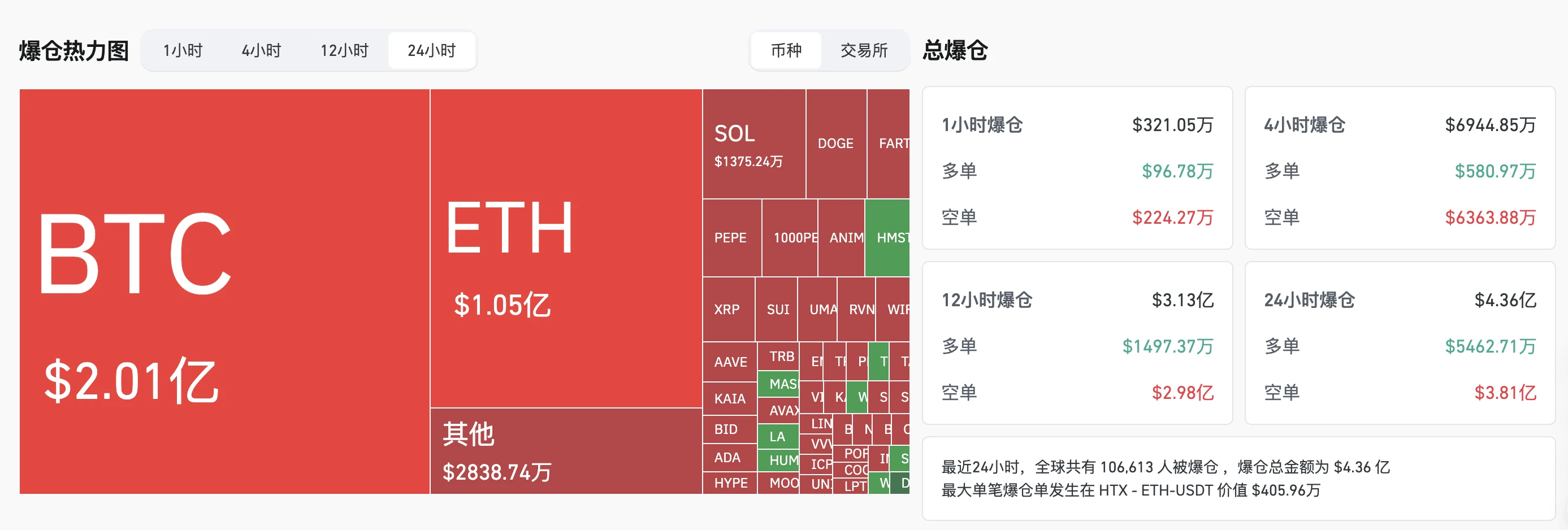

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has seen liquidations of 436 million USDT, with the vast majority being short liquidations, amounting to 381 million USDT. In terms of cryptocurrencies, BTC saw liquidations of 201 million USDT, and ETH saw liquidations of 105 million USDT.

Analysis of the Reasons for the Rise

Regarding the specific reasons for this market rise, aside from the clear benefits for the DeFi sector, there seems to be little news affecting the overall market. Correspondingly, the traditional financial markets did not show similar trends yesterday, with the S&P 500 and Nasdaq indices closing almost flat last night.

Combining analyses from several professionals, the driving force behind this rise seems to stem more from the accumulation of recent “small positive” sentiments and the internal structural adjustments within the cryptocurrency market.

Well-known trader Ansem mentioned on X last night that his interest in cryptocurrency investment has never been so high, with companies like Strategy purchasing billions of dollars worth of Bitcoin on their balance sheets (last night, Strategy announced an additional purchase of 1,045 BTC; CircleIPO was oversubscribed by 25 times, having risen 5 times since opening; a public offering valued at 500 million USD was filled in two minutes; Polymarket is set to collaborate with X; and the U.S. government is actively pursuing regulatory clarity…).

Bitfinex analysts pointed out in a report on Monday that after Bitcoin fell 10% to around 100,000 USD, and over 1.9 billion USD in leveraged positions were liquidated in the crypto derivatives market over the past week, the crypto market has now stabilized and is expected to initiate a new round of increases.

Cubic Analytics founder Caleb Franzen also stated: “Describing this wave of market movement as a ‘calm rise’ is quite fitting. Simply put, it’s about consistently making higher highs and higher lows. As soon as any signs of weakness appear, buyers will step in to defend the trend."

Additionally, some traders have adopted a minimalist analysis strategy, believing that everything except the broad money supply (M2) is noise. As shown in the chart below, comparing the BTC price with M2 data over a 78-day offset, BTC's movements almost entirely follow the fluctuations of M2.

Ironically, the now-defunct whale James Wynn was also a believer in the M2 theory, but with his aggressive operations, over a hundred million dollars in unrealized gains have vanished. Because of this, some conspiracy-minded traders believe that this rise is merely a continuation of the market from two weeks ago, and the fluctuations in the past two weeks were just due to certain forces targeting James Wynn's massive position. Now that James Wynn has fallen from grace, the market should return to its original path.

Next Step: Focus on CPI

This week, the Federal Reserve enters a quiet period ahead of the mid-June monetary policy meeting, so it is unlikely that any Federal Reserve officials will make public statements.

Undoubtedly, the most impactful news for the market this week will be the CPI data for May, which will be released on Wednesday evening at 20:30. Wintermute trader Jake O pointed out: “The data front is quiet before Wednesday, and the CPI data will provide new clues about U.S. inflation."

E finally strengthened, will the altcoin season arrive?

Looking back at the rebound over the past two months, the performance of ETH, which has been in a long-term downtrend during this cycle, can be described as unexpectedly stunning. Firstly, the rebound of ETH from its recent low has even exceeded that of BTC; secondly, the discussion sentiment surrounding ETH has gradually shifted from FUD to a more bullish tone.

You can find many answers regarding the reasons for ETH's rise. For example, SharpLink Gaming hopes to build a growth flywheel around ETH similar to Strategy; the Ethereum Foundation has finally shown some signs of reform, starting to “slim down”; and institutions like Trend Research have expressed bullish views and increased their positions…

As the “barometer” of altcoins, ETH's strong rise has rekindled hopes in the market for the seemingly never-returning “altcoin season.” In this regard, several traders believe that as industry attention continues to rise, funds may overflow into altcoins, but they also emphasize that there will not be a situation of “all coins rising together” again, and only a few protocols will be able to attract this influx of funds.

Ansem posted on X: “The vast majority of altcoin/BTC trading pairs have fallen to historical lows, while industry attention is at an all-time high — this divergence will lead to funds being highly concentrated in a very small number of protocols (not just BTC).”

Another well-known trader, Eugene, also posted on his personal channel, stating that looking back at the development history of altcoins in the market, especially after the meme coin frenzy and HYPE, market patterns have become clear. Projects with the following three characteristics will gain market premiums: sustainable growth business models (preferably independent of the crypto market's bull and bear cycles); extremely low token inflation achieved through unlocking mechanisms (investors or teams selling); and teams that prioritize the interests of token holders, usually reflected in using part of their income for public market token buybacks (note: this is fundamentally different from the destruction of tokens with no actual value).

Eugene added that currently, projects that meet all three of these criteria are rare, with HYPE being one of them, but it is foreseeable that the next batch of market winners is in the making.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。