Is it a retreat or a defense?

Written by: Tuo Luo Finance

With strong support from the United States, the world seems to be relaxing regulations on the cryptocurrency market, but one country is going against the tide.

On May 30, the Monetary Authority of Singapore (MAS) released the final policy guidelines for Digital Token Service Providers (DTSP), announcing that the new regulations for DTSP will officially take effect on June 30. According to the new regulations, all cryptocurrency service providers registered or operating in Singapore must cease providing services to overseas clients by June 30, 2025, if they do not obtain a DTSP license.

This move caught the cryptocurrency market off guard, leading local practitioners to lament, and the market echoed with calls for a mass exodus from Singapore's Web3. Is it a retreat or a defense? Is it a planned action or an aggressive dictatorship? The sudden change in regulatory circumstances is disrupting the market, and the compliance horn is sounding globally, making it difficult for the industry to avoid following the tide.

01 Leveraging Regulatory Advantages, Singapore Becomes a Hotbed for Web3 Development

Let's rewind to four years ago, during a time when China was undergoing a major crackdown on its cryptocurrency industry, and Hong Kong had yet to release its virtual asset declaration. The sovereign status of the Western cryptocurrency world was on the rise, and Chinese Web3 entrepreneurs unanimously chose Singapore as their next safe haven.

The choice of Singapore is simple. Singapore is considered the best springboard to Western markets, not only boasting a developed economy and political stability but also a cultural environment that is more compatible for the Chinese. Against this backdrop, talent, projects, derivative investments, and service institutions flocked to Singapore, making it a hotbed for Chinese Web3 investment. At that time, over 47 cryptocurrency exchanges were located in Singapore, with well-known exchanges like Coinbase, Binance, and FTX establishing their Asia-Pacific headquarters or R&D centers there. Industry leaders even regarded Singapore as a safe haven; Zhao Changpeng had a record of long-term residence in Singapore, and Wu Jihan is now a permanent resident.

Of course, the core of all this is Singapore's open policies. From a regulatory perspective, Singapore introduced the Payment Services Act in 2019, which clarified the licensing of digital tokens and required local businesses providing cryptocurrency exchange services to apply for licenses based on the nature and scope of their services, including "currency exchange" licenses, "standard payment institution" licenses, and major payment institution licenses. In 2020, Singapore passed the Crypto Sale Guidelines and proposed the Financial Industry Comprehensive Act, laying a clear foundation for cryptocurrency licensing and responsibilities. Looking at the global cryptocurrency market at that time, China had already issued clear bans, U.S. regulators were embroiled in a power struggle, and European countries struggled to unify their systems. Singapore was truly the first to create a relatively relaxed and clear regulatory environment, with exemption clauses temporarily allowing specific payment services.

Yet, on May 30, Singapore released the final policy guidelines for Digital Token Service Providers (DTSP) and subsequently issued the final response document to the regulatory consultation on DTSP under Section 9 of the Financial Services and Markets Act 2022, clearly stating that no license means no service, and no transition period was provided, leaving all practitioners in a state of panic.

02 Cliff-like Regulation? Singapore Introduces the Strictest New Rules

It is important to clarify that the "mass exodus" and "cliff-like regulation" circulating in the market are indeed exaggerated. Signs of Singapore's regulatory tightening in the cryptocurrency sector had already emerged. In 2022, the MAS introduced the Financial Services and Markets Act, which specifically introduced a licensing system for Digital Token Service Providers (DTSP) in Section 9, marking the first time this system appeared in Singaporean legislation. In June, the head of fintech policy in Singapore stated that the country would take "brutal and relentless measures" against misconduct in the cryptocurrency industry.

The collapse of FTX at the end of 2022 was a key turning point. The fallout from FTX left a series of investment institutions in disgrace, including Singapore's sovereign wealth fund, Temasek Holdings. Due to FTX, Temasek was forced to write off a $275 million investment. Following this incident, the Singapore government clearly stated that its reputation was damaged and even imposed salary cuts on the investment team and senior management at that time.

In May 2023, the Financial Services and Markets (Amendment) Act was passed, strengthening the sharing of client information among financial institutions to combat money laundering and terrorist financing regulations, and in August of the same year, stablecoins were incorporated into the regulatory framework.

In 2024, the MAS initiated a consultation document on the regulatory approach, regulations, notifications, and guidelines for digital tokens under this law. The language in the document is quite noteworthy: "Due to the internet-based and cross-border nature of digital token services, Digital Token Service Providers (DTSPs) are more likely to face money laundering/terrorist financing (ML/TF) risks… The main risk posed by DTSPs to Singapore will be reputational risk, meaning that if they are involved in or misused for illegal purposes, it could damage Singapore's reputation."

Ultimately, on June 30 of this year, the new regulations for Digital Token Service Providers (DTSP) were officially implemented. Looking back at this regulatory process, it has actually had a preparation period of three years from proposal to execution, during which the government has provided clear progressive signals, indicating that there is clearly no cliff-like regulation.

Globally, licensing systems are at the core of cryptocurrency regulation, as seen in the U.S., Hong Kong, and Europe. Singapore's previous payment legislation also used licensing as a means of subject control. The reason why this seemingly small licensing issue has caused such a stir must return to regulatory arbitrage.

The cryptocurrency industry operates on a global scale, but regulatory systems are typically territorial, which creates the possibility of arbitrage—obtaining licenses in regulatory havens and then conducting business globally has become a consensus in the industry. In Singapore's previous regulatory framework, while there were strict requirements for local operations, there were very lenient regulations for overseas business, allowing companies registered in Singapore to freely provide services to overseas clients, which naturally aligned with cryptocurrency operations. It was against this backdrop that many exchanges chose to flock to Singapore.

However, this kind of arbitrage will officially come to an end with the new regulations. From the specifics of the DTSP, the regulations are extremely stringent. First, the subjects are clearly defined and widely covered; any individual or business operating in Singapore must obtain a DTSP license if they are involved in digital token-related business, regardless of their operational location. Secondly, the definition of "operating location" is very broad; the authorities clearly state that "operating location" can be any place used for conducting business, even including temporary or mobile locations like street stalls. This point is a special regulation targeting the cryptocurrency industry, especially for remote workers and businesses working from home. The regulated services cover almost the entire industry chain, including token issuance, custody, brokerage, trading matching, transfer payments, verification governance, and even custody technology development, ensuring that no one slips through the regulatory net.

In addition to the content regarding licensing regulations, the entry threshold for obtaining a license is also very high. The regulatory authority, MAS, has clearly stated that it will only issue DTSP licenses in "extremely limited circumstances," requiring applicants to have a reasonable business model and an operational approach that does not lead to regulatory disputes, meaning they must also obtain regulatory approval in their operational locations, and even organizational structures must meet certain requirements, including governance frameworks and capital adequacy. In fact, the strictness of the license issuance can be seen from the current number of licenses issued. In the cryptocurrency boom of 2021, over 500 institutions submitted license applications to Singapore, but four years later, as of now, the MAS website shows that only 33 companies, including BITGO, CIRCLE, COINBASE, GSR, Hashkey, and OKX SG, have obtained DTSP licenses, with an approval rate of less than 10%.

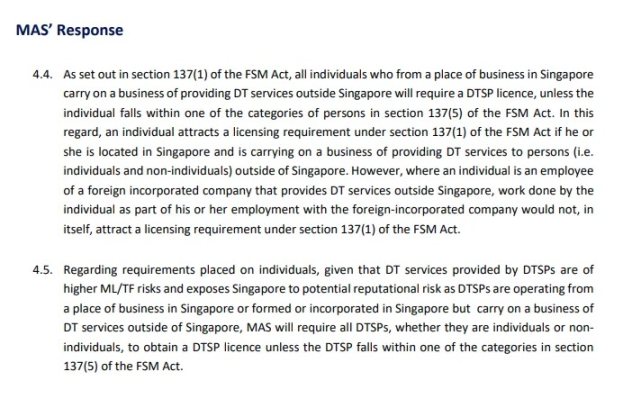

It is worth noting that the licensing system has certain exemption provisions. Companies that have already obtained licenses under Singapore's Securities and Futures Act, Financial Advisers Act, and Payment Services Act do not need to reapply for DTSP licenses; they only need to fulfill the auditing, risk management, and other requirements of the new regulations. This is relatively friendly for companies that had applied for licenses during the previously more lenient phase. According to the official website, 24 companies, including COBO, ANTALPHA, CEFFU, and MATRIXPORT, are on the exemption list. On the other hand, if an individual is merely working remotely as an employee and contracted with an overseas registered entity in Singapore, serving only overseas clients, they do not need to apply for a license. However, if they participate in business locally in Singapore as an individual, they will be subject to the regulations.

In summary, entities that have not applied for a license and fall within the regulatory scope must quickly arrange their processes; otherwise, both individuals and businesses will face the outcome of being shut down before June 30. As can be seen from the above, this almost encompasses the entire industry chain. Especially for startup projects, the minimum paid-up capital requirement is 250,000 SGD, and the annual fee for licensed institutions reaches 10,000 SGD. The high costs only lead to another mass migration for startups. Currently, not only are individual practitioners planning to leave Singapore, but some cryptocurrency exchanges are also considering relocating. "Compared to other regions, Singapore's costs are already not advantageous. In the context of tightening compliance, some exchanges may move to Hong Kong for market considerations, and individual practitioners will have more choices. Besides other Southeast Asian countries with lower costs, Dubai and Japan are also popular destinations. Even without the new regulations, the number of practitioners leaving Singapore has been increasing in recent years," said a cryptocurrency practitioner working at an exchange in Singapore.

In response to Singapore's new regulations, Hong Kong has also launched a recruitment declaration. Recently, Hong Kong Legislative Council member Wu Jiezhuang posted on social media, stating, "Since Hong Kong released its virtual asset declaration in 2022, we have actively welcomed the industry to develop in Hong Kong. According to informal statistics, over a thousand Web3 companies have established themselves in Hong Kong. If you are currently engaged in related industries in Singapore and intend to relocate your headquarters and personnel to Hong Kong, I am willing to provide assistance and welcome you to develop in Hong Kong!" This indicates that what seems to be a new regulation could have far-reaching implications for the global cryptocurrency industry landscape in the long run.

03 Small Players Withdraw, Large Institutions Step Forward

From a policy perspective, Singapore's actions are very resolute. Not only does it directly face the project losses that the stringent regulations will bring, but it also clearly expresses the government's zero-tolerance regulatory attitude towards arbitrage and loophole exploitation, sounding the alarm for the development of Singapore's local Web3 industry. The era of leniency is gone, and tightening is the way forward. By imposing high compliance costs, small and gray projects are thoroughly reshuffled, while large enterprises with strong backgrounds, capabilities, and ample capital are clearly encouraged to settle in. A healthy and sustainable industry is the starting point of Singapore's policy.

From an essential perspective, why is Singapore so resolute in tightening regulations? Beyond the local rule of law spirit, the key lies in the fact that the industry's benefits do not outweigh its negative externalities. From a national standpoint, the cryptocurrency industry appears to be thriving, but due to its unique decentralized nature and global operations, tax revenues are significantly lower than those of comparable industries. At the same time, the cryptocurrency industry has been breeding increasing instances of fraud and gray market activities. According to data from the Singapore Police Force, cryptocurrency scams have become a prevalent issue in Singapore's fraud cases, rising sharply from about 6.8% in 2023 to approximately 24.3% in 2024, indicating a worsening situation. It is worth mentioning that cryptocurrency also played a significant role in the previous multi-billion dollar money laundering case in Singapore. With low tax revenues and high crime rates, coupled with the need to squeeze local residents' production and living resources, leading to internal conflicts, it is reasonable for Singapore, which has always adhered to strict governance, to release regulatory policies at this time.

In fact, this is also a consideration in our regulatory strategy. Compared to Singapore, our country has a large population base, higher regulatory complexity, and a more astonishing degree of policy arbitrage. Ultimately, our country has chosen a more stringent "one-size-fits-all" approach, while Singapore has retained part of the market to achieve a balance between regulation and innovation.

Looking at the broader picture, Singapore's shift also reflects the global regulatory transformation. For the cryptocurrency industry, the trend towards compliance is unstoppable, and compliance has shifted from being optional to mandatory. In the past, the development strategy of global cryptocurrency companies was to seek regulatory havens, clustering in increasingly gray areas. However, now that clear regulatory mechanisms have been established in the U.S., Europe, Hong Kong, and Singapore, only by embracing compliance and moving towards transparency can companies truly secure long-term development. Moreover, compliance, to some extent, determines the foundational color of industry development. The bargaining and competitive capabilities of large institutions will far exceed those of other companies, and opportunities for startups will inevitably be significantly squeezed. From the mainland to Hong Kong, then from Hong Kong to Singapore, and now setting sail again, for startups, it is not frightening to follow the grass; finding the most suitable place that aligns with their business may be the issue that needs to be addressed in the development process.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。