In June 2025, the cryptocurrency market was once again dramatically stirred by trader James Wynn's high-leverage operations.

From a recent astonishing start with 40x leverage to the public outcry of "online begging," and then to a billion-dollar game against short sellers, Wynn staged a condensed reality show of greed, fear, and madness in the crypto market within a week.

Entry Point: James Wynn's Recent "Ant Warehouse" Declaration and High-Stakes Bet

Just yesterday, on-chain data platform Hypurrscan monitored that James Wynn opened a Bitcoin long position on the decentralized derivatives exchange HyperLiquid with a principal of $468.62, using 40x leverage. The nominal value of this position was only $18,737.66, with an opening price of $105,537.5 and a liquidation price as high as $104,190.

This was essentially an "ant warehouse" that could be swallowed by market ripples at any moment, but Wynn boldly declared on platform X that he had "bet his entire fortune," instantly igniting the community. This move not only reaffirmed his signature aggressive trading style but also resembled a declaration of war to the market. Analysts believe that choosing such high leverage to go long during Bitcoin's high-level consolidation exposed Wynn's extremely bullish expectations for the future. However, the less than 1.5% narrow space between the liquidation price and the opening price meant that any slight market pullback could cause it to drop to zero instantly, making it a gamble with no margin for error.

June 2: Billion-Dollar Long Position Under Pressure and "Online Begging" Controversy

Let’s review Wynn's recent trading history.

According to ChainThink and BlockBeats, Wynn opened a massive long position of 944.93 BTC with a nominal value of nearly $100 million at 40x leverage, with an opening price of $105,890.3 and a liquidation price of $104,580.

However, the market did not go as he wished. As Bitcoin's price fluctuated downward, Wynn's position quickly slid toward the liquidation abyss, with the liquidation price being pushed closer to $103,610, just $20 away from the market price. In a life-and-death moment, Wynn made a shocking move—he publicly initiated a "crowdfunding" campaign on platform X, calling on supporters to transfer USDC to help him supplement his margin, promising a 1:1 return after a successful trade.

This act of "online begging" quickly thrust him into the spotlight of public opinion. On-chain analyst Yu Jin monitored that within just two hours, his address received over $40,000 in donations. While this move temporarily lowered his liquidation price and allowed him to escape danger for a moment, it also drew ridicule and criticism from many industry insiders, including "Overseas Cool." More critically, the real-time transparency of on-chain data made his position coordinates fully visible to the market, turning it into a "hunting ground" for market makers and arbitrage robots. Wynn attempted to combat the market with community power but ended up exposing his last card to the public.

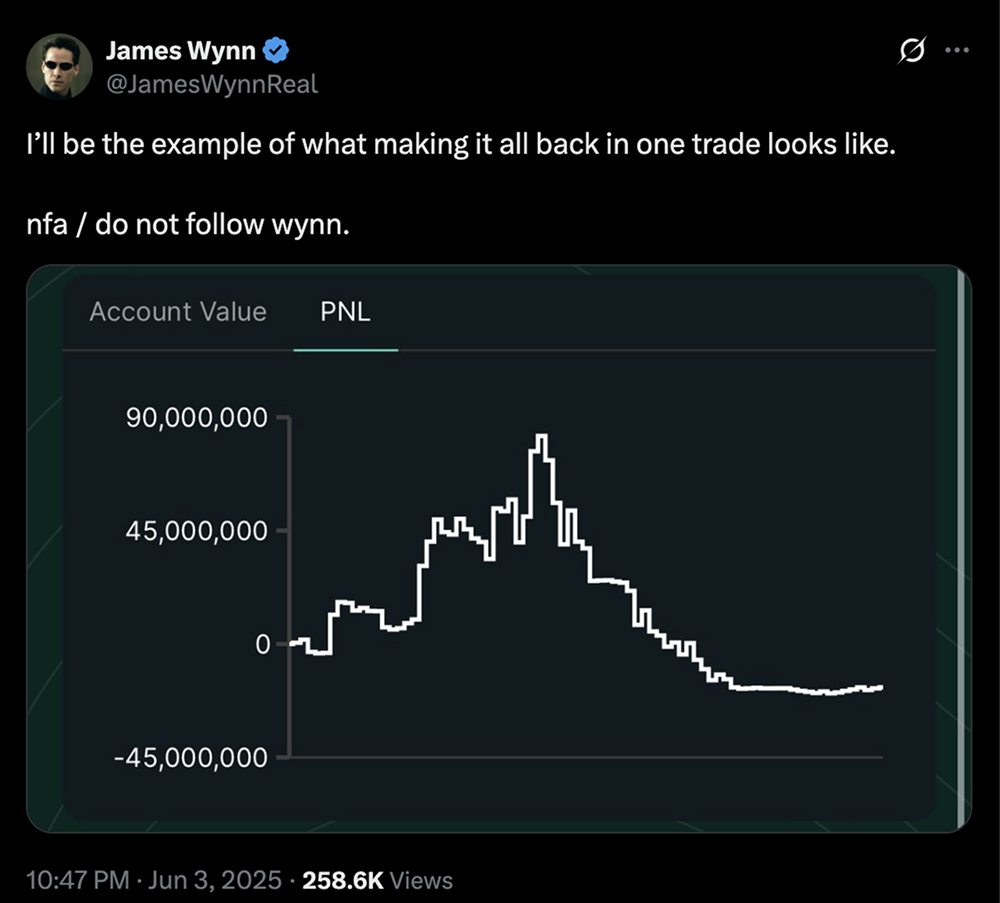

June 3-4: Desperate Rebound and Long-Short Stranglehold

On June 3, the market's trend dramatically reversed, providing Wynn with a thrilling survival opportunity. Bitcoin's price quickly surged after touching the liquidation line of $103,610, reaching as high as $106,500. Wynn's billion-dollar long position not only turned from crisis to safety but also briefly returned to profitability. After the price rebound, Wynn quietly deleted his previous "help" tweet, seemingly intending to downplay this somewhat embarrassing financial turmoil, boldly claiming, "I will be a model for turning a trade around."

However, the market's mercy was short-lived. On June 4, an anonymous whale seized the opportunity, launching a short position worth over $62.25 million (600.14 BTC), aiming to precisely target Wynn's long position liquidation line. A battle between long and short positions surrounding Wynn's position officially began. Fortunately, Bitcoin's price rebounded again, forcing the short trader to exit at a loss, allowing Wynn to narrowly escape a disaster.

June 6-9: The Legend Ends and the "Gambler" Rebirth

The market's patience was ultimately exhausted. On June 6, according to HyperInsight monitoring, amidst Bitcoin's continued decline, Wynn's legendary long position finally succumbed, being liquidated around $103,940, resulting in a loss of 279.9 BTC (approximately $29 million). The nominal value of his position plummeted to $41 million.

Wynn subsequently posted a self-deprecating and reflective message on platform X: "I leveraged like an idiot to make $100 million, and then lost it all in a week." He used his personal experience to warn traders about the importance of risk management and took the opportunity to share his HyperLiquid discount code "WYNN," showcasing his trader persona.

However, this nearly $30 million liquidation did not extinguish Wynn's gambler flame. On June 9, after closing a small loss short position, he once again went long on Bitcoin with $283 and 40x leverage, declaring, "Everything is on the line." Wynn quickly regrouped, attempting to start a new trading narrative, but this time, he was left with only his last chips on the table.

Market Insights: A Transparent Hunting Ground and a Cautionary Tale of High Leverage

James Wynn's trading drama resembles a micro-movie that encapsulates the high risks, high rewards, and human psychology of the cryptocurrency market. It reveals several profound insights:

The Double-Edged Sword of High Leverage: High leverage is a shortcut to financial freedom but can also lead to an irreversible abyss. Wynn once created a myth of turning hundreds of dollars into billions in floating profits, only to be brought back to reality overnight.

The Cost of On-Chain Transparency: Wynn's story also serves as a wake-up call for emerging Perp DEXs represented by HyperLiquid. The public transparency of on-chain data leaves whales' positions, margins, and liquidation lines nowhere to hide, turning them into "public opponents" in the entire market. This extreme transparency, while enhancing market fairness, also exacerbates the risk of targeted hunting.

Trading Narrative and Emotional Games: Wynn understands the power of social media, using public operations, high-profile declarations, and even "online begging" to construct his trading narrative, attracting traffic and support. However, when the fragility of the funding chain is laid bare, this narrative becomes vulnerable.

Whether Wynn's next gamble can turn around remains uncertain, but his experience has undoubtedly become an unavoidable cautionary tale in the 2025 cryptocurrency market, reminding every participant that in the face of alluring wealth effects, risk is always the only measure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。