Who hasn't made money? Answer: New investors.

Author: Jeff Dorman, CFA

Translation: Deep Tide TechFlow

Crypto Treasury Companies: Facts and Misunderstandings

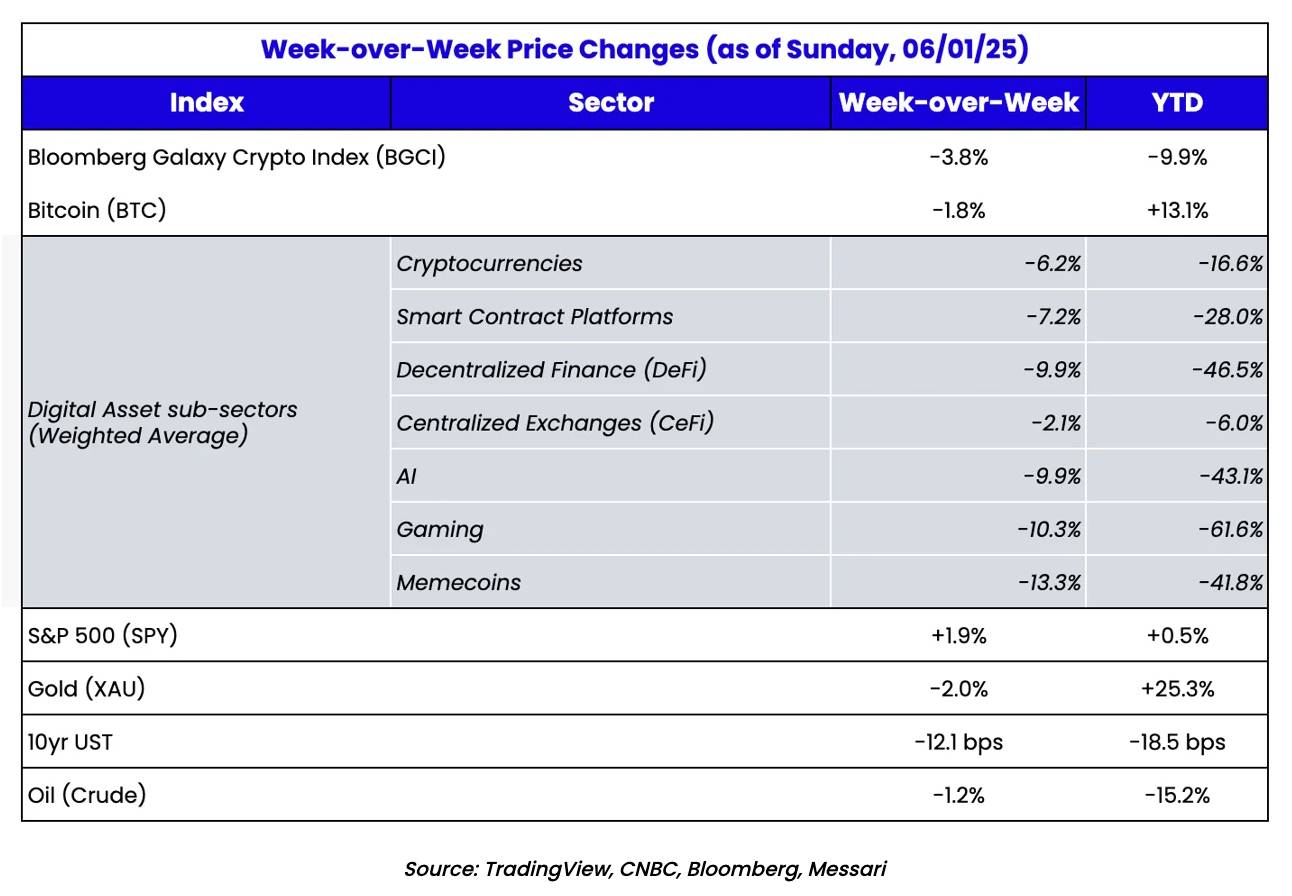

After six consecutive weeks of gains, the Bloomberg Galaxy Crypto Index (BGCI) finally pulled back last week, while stocks and U.S. Treasuries both rose. Despite ongoing discussions about the "failure" of the U.S. Treasury market, it is worth noting that the yield on the U.S. 10-year Treasury has actually fluctuated within a 100 basis point range over the past two years, which is another typical example of a narrative-driven fact.

Speaking of narratives, the increasing number of U.S. publicly traded companies purchasing Bitcoin and other digital assets has undoubtedly become a market hotspot. However, as usual, this trend is accompanied by many misunderstandings. Therefore, we will strive to clarify the facts and misconceptions behind these new digital asset buyers.

Some refer to these companies as "Bitcoin Treasury Companies," while others call them DATs (Digital Asset Treasury Companies). Regardless of the name, these companies are essentially just new shell companies for holding digital assets. This is different from the original Bitcoin treasury companies. For more than five years, we have been discussing the phenomenon of some publicly traded companies incorporating Bitcoin into their balance sheets for various reasons.

These companies can be categorized into several types:

Some are ordinary companies that tentatively hold Bitcoin, such as Tesla and Block (formerly Square);

Some are crypto-native companies, like Coinbase and Galaxy, that naturally hold these assets through their core business;

Others are Bitcoin mining companies, whose core business is to hold Bitcoin.

The growth of Bitcoin on these companies' balance sheets is easy to track and can sometimes drive stock prices up. However, in most cases, the amount of Bitcoin held does not overshadow their core business. Furthermore, until recently, the accounting standards set by the Financial Accounting Standards Board (FASB) regarding holding Bitcoin posed a significantly higher downside risk to earnings per share (EPS) than upside potential.

Conversely, these companies' influence on Bitcoin prices is often limited, as they typically do not purchase large amounts of Bitcoin on the open market. Most companies simply accumulate Bitcoin through their daily operations, and for those that do purchase Bitcoin, the amounts are relatively small.

Source: BitcoinTreasuries.net

Meanwhile, MicroStrategy (ticker: MSTR) has gradually become the first true "Bitcoin company," with its sole goal as a publicly traded company being to purchase Bitcoin. We first took notice of MSTR five years ago when it announced its initial Bitcoin purchase plan, which caused its stock price to surge 20% instantly, attracting widespread market attention. As we wrote in August 2020:

"MSTR's stock price rose 20% after the announcement last week, likely leading junior employees in corporate finance departments around the world to have a busy weekend frantically researching Bitcoin. Remember 2017? Companies were eager to mention 'blockchain' in their earnings calls, even though they had no idea how to actually use blockchain and had no plans, simply because the market rewarded those who seemed to be ahead of the technology curve? Now, get ready for a repeat with Bitcoin."

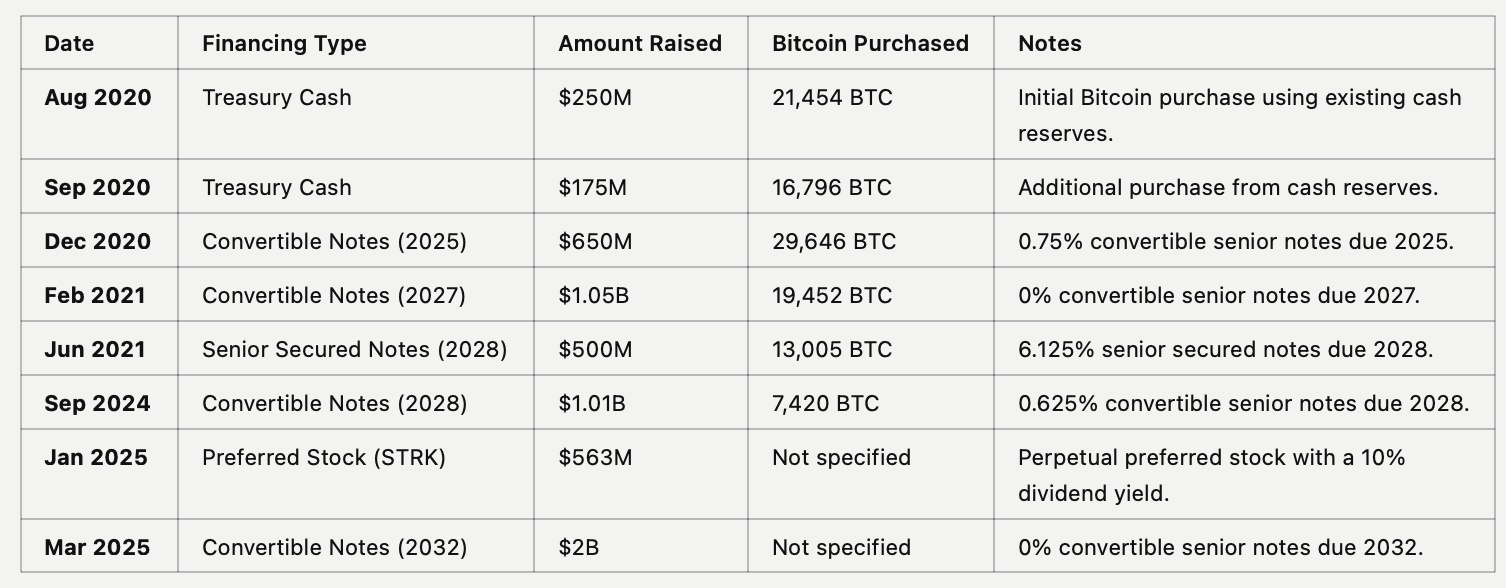

MSTR's initial Bitcoin purchases were made with cash on its balance sheet, but over the past five years, its real "brilliance" has been in how easily and frequently it has leveraged capital markets. While MSTR has a core business that generates $50 million to $150 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) through business intelligence and enterprise software analytics services, this business has quickly been overshadowed by its Bitcoin purchasing activities.

Unlike other publicly traded companies trying to imitate it, MSTR's existing cash flow comes from its subsidiary (formerly core) business line, which can be used to cover company expenses and debt interest. This sets it apart significantly from other publicly traded companies.

Source: ChatGPT and Microstrategy Financial Reports

By utilizing debt, convertible bonds, preferred stock, and equity markets for new rounds of financing to purchase Bitcoin, MSTR has opened the door for a whole new group of investors, allowing them access to previously unavailable crypto asset investment opportunities.

While I am too lazy to delve into the specifics of each financing round (these details are not crucial to my argument, after all, this is content generated by ChatGPT), MSTR's "magic" in the capital markets is indeed impressive: over the past five years, it has demonstrated the pure brilliance of capital market operations.

Source: ChatGPT

Each new round of financing and Bitcoin purchases has further driven up the price of Bitcoin (BTC) due to the scale of the transactions and the signaling effect of future purchases. At the same time, this has also pushed up MicroStrategy's (MSTR) stock price, as the market began to focus on new metrics that previously did not exist, such as "Bitcoin per share" and "Bitcoin yield." Essentially, the sole goal of this "company," MicroStrategy, has shifted to increasing its Bitcoin reserves, and all participants benefit from this process.

Holders of convertible bonds and preferred stock are essentially playing a game of "cheap volatility," profiting from the volatility of MSTR stock and Bitcoin prices. Meanwhile, direct debt holders only care about fixed income returns, which is made easy by the EBITDA that MSTR can still generate from its old core business. At the same time, equity investors profit from the premium on MSTR stock, which is far higher than the net asset value (NAV) of Bitcoin on its balance sheet.

Everyone wins! Of course, when everyone profits, two things usually happen:

- The voices of skeptics grow louder

Critics begin to angrily post online, trying to find ways to question the feasibility of this strategy. We first started responding to these absurd accusations back in 2021. At that time, many market participants firmly believed that MSTR would be forced to sell Bitcoin, completely misunderstanding how debt covenants work, not to mention confusing the difference between directly holding Bitcoin and holding leveraged futures positions with liquidation prices.

To this day, we still often have to deal with claims that MSTR poses systemic risk to Bitcoin, although we have largely given up on countering this endless debate. We wish Jim Chanos good luck in his recent "long Bitcoin, short MSTR" trade (although based on the reasons we list here, this strategy may not work either). "Shorting MSTR" has become the new "shorting Tether," a tantalizing trade that seems low risk and high reward, but the actual probability of success is quite low.

- Imitators emerge in droves

Welcome to the crazy new era of crypto. Let's explore this phenomenon further.

Source: Bloomberg and Arca Internal Calculations

If 2024 is the year of the "crypto ETF," then 2025 will be the year of "SPACs and reverse mergers." We once described crypto ETFs as "two steps forward, one step back":

"Many believe that ETFs are a victory for real-time settlement assets, but the reality is quite the opposite. Bitcoin ETFs are essentially cramming a real-time settlement system (blockchain) into an outdated T+1 settlement product (ETF). Isn't that a step backward? As an industry, we should strive to bring global assets onto the blockchain, rather than force on-chain assets into Wall Street's outdated systems."

While we acknowledge that this is a necessary step to drive adoption and interest, this viewpoint still holds. There is a significant difference between "blockchain technology" and "crypto assets." We are more focused on bringing the world's most popular assets (like stocks, bonds, real estate) onto the blockchain, rather than forcing low-quality crypto assets into outdated systems. However, the trend of cramming crypto assets into stock shells will not stop. Let's take a look at what is currently happening.

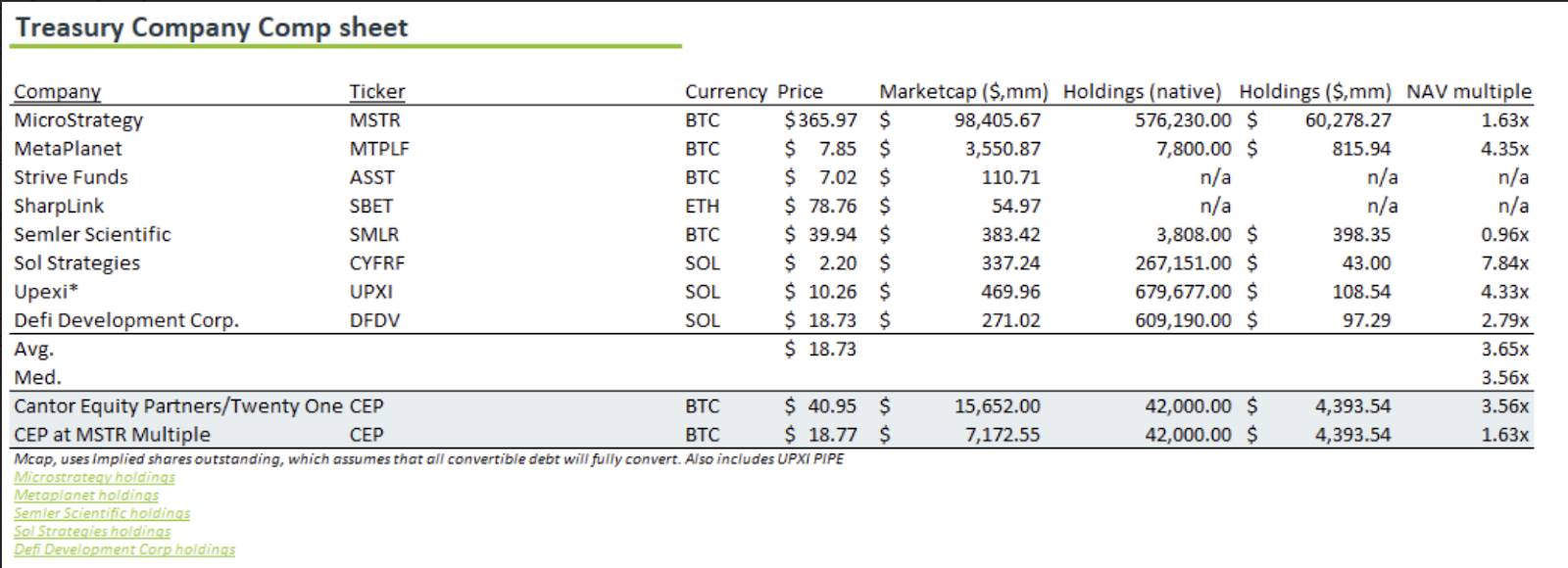

SPACs (Special Purpose Acquisition Companies) and reverse mergers have been around for a long time but have rarely been fully adopted for single purposes. However, that is the current situation. If you have a publicly traded stock shell, it can be used to acquire crypto assets and hopes to trade at a significant premium to net asset value (NAV). These new structures are often slightly different from MicroStrategy. Some companies only hold Bitcoin, trying to completely replicate MSTR's model (although their brand recognition and capital market expertise are far inferior to MSTR); while others have purchased new assets—some hold Ethereum (ETH), some hold Solana (SOL), and others hold TAO, with more new assets emerging. Arca currently receives 3 to 5 new proposal ideas from investment banks every week.

Here are some recent transactions that have been announced and are currently in financing (this list may not be exhaustive):

SharpLink Gaming (SBET)

Recent Activity: May 2025

Financing Method: $425 million private investment (PIPE)

Acquired Crypto Asset: Ethereum (ETH)

Trump Media & Technology Group (DJT)

Recent Activity: May 2025

Financing Method: Raised $2.3 billion through stock and convertible bond sales

Acquired Crypto Asset: Bitcoin (BTC)

GameStop Corp. (GME)

Recent Activity: May 2025

Financing Method: $1.5 billion convertible bonds

Acquired Crypto Asset: 4,710 Bitcoins (BTC)

Jetking Infotrain (India)

Recent Activity: May 2025

Financing Method: Raised 6.1 million rupees through equity sales

Acquired Crypto Asset: Bitcoin (BTC)

Meliuz (CASH3.SA - Brazil)

Recent Activity: May 2025

Financing Method: Raised 150 million reais through stock issuance

Acquired Crypto Asset: Bitcoin (BTC)

Details: Brazilian fintech company Meliuz announced an initial stock issuance plan to raise 150 million reais (approximately $26.45 million) for the acquisition of Bitcoin. The company plans to distribute 17,006,803 shares of common stock as the initial batch.

Sol Strategies Inc. (CSE: HODL, OTCQX: CYFRF)

Initial Investment: January 2025

Financing Method:

$25 million unsecured revolving credit facility provided by Chairman Antanas Guoga;

$27.5 million (approximately $20 million) convertible bonds from ParaFi Capital;

Up to $500 million convertible bond facility from ATW Partners, with the first $20 million completed in May 2025.

Acquired Crypto Asset: Solana (SOL)

Cantor Equity Partners / Twenty One Capital (CEP)

Recent Activity: May 2025

Financing Method: Added $100 million to its crypto business Twenty One Capital, bringing total financing to $685 million. Existing shareholders (including Tether, Bitfinex, and SoftBank) have committed Bitcoin in kind through the existing equity structure.

Acquired Crypto Asset: Bitcoin (BTC)

Upexi Inc.

Recent Activity: April 2025

Financing Method: Raised $100 million to establish a Solana reserve

Acquired Crypto Asset: Solana (SOL)

Details: Purchased SOL through a $100 million PIPE (private equity investment) and plans to further increase "Solana per share" through equity and debt issuance.

DeFi Development Corp (formerly Janover)

Recent Activity: April 2025

Financing Method: Raised $42 million to establish a Solana reserve fund and plans to raise an additional $1 billion

Acquired Crypto Asset: Solana (SOL)

These cases indicate that an increasing number of publicly traded companies are incorporating crypto assets into their financial strategies, often funding these acquisitions through the proceeds of debt or equity issuance.

But who has made money from these transactions?

- Investment Banks

Investment banks earn fees by underwriting PIPEs or executing reverse mergers, a strategy that carries almost no risk; regardless of the success or failure of the transaction, investment banks profit. Therefore, they will not stop facilitating such deals.

- Shell Company Owners/Management

Assuming $100 million is raised through a new PIPE issuance, with $85 million allocated for acquiring crypto assets and the remaining $15 million for "operating expenses." These "operating expenses" include higher salaries—this is a substantial income for the management team.

- Stockholders Before Reverse Merger or SPAC Announcement

Most of these shell companies typically have a market capitalization of less than $20 million before being transformed into crypto stock shells. Some investors holding these stocks may have learned through insider information that the stock would be converted into a crypto company, while others may have simply been lucky. But there is no doubt that the real profits come from these stocks surging 500%-1000% or more after the announcement.

Who hasn't made money? — New investors.

Unlike MicroStrategy, we have five years of historical data proving that its debt, convertible bonds, preferred stock, and equity holders can profit. However, for new investors in these new types of transactions (those providing funds for PIPEs or SPACs), there is currently no evidence that they will make money. These transactions are relatively new, and most private investors have not yet converted their private shares into public shares (which typically requires at least 90 days). Therefore, these transactions continue, and investors are still buying.

If these stocks continue to trade at a significant premium to net asset value (NAV) after new investors unlock their shares, we will see more similar transactions emerge. But if these stocks begin to decline significantly, even falling below NAV, then the game will be over.

It may take us a few more months to know how the market will react when these shares are unlocked.

However, there is already a misconception circulating in the market: these unlocks pose a risk to shell company equity investors, not to the underlying crypto assets they hold. Unless there is a failure to pay interest through debt financing (i.e., default), there is almost no mechanism that would force the sale of the underlying crypto assets. Moreover, these new shell companies are currently too small to enter the debt market. This operation is currently limited to MicroStrategy (MSTR) and a few other large players.

For equity and preferred stockholders, they have no rights to demand the sale of the underlying assets unless the stock price falls far below the net asset value (NAV) to the extent that a radical investor starts buying shares in bulk and attempts to take over the board with the aim of selling the underlying crypto assets to repurchase stock. This scenario may happen in the future, but it is not a significant risk today. Once such an event occurs, most stocks will quickly narrow the gap with NAV, as the market will realize that this operational model can be repeatedly exploited.

This situation is very similar to the state of the Grayscale Trust before the launch of the ETF. At that time, there was no risk of Grayscale being forced to sell its underlying crypto assets… The real risk was that the trust (stock) traded below its net asset value (NAV). Ultimately, this situation did occur, causing damage to equity investors, but had no impact on crypto asset holders.

Today, every crypto venture capitalist holding a large amount of high-inflation, low-demand junk tokens is discussing how to cram these tokens into an equity shell company. But this will not automatically create demand, just as most newly launched ETFs have failed to attract investors. Creating an investment tool and creating demand are two different things. While these investment tools will continue to be created, it remains uncertain whether these stocks will truly attract market demand.

Is there a possibility that these shell companies can maintain a premium above NAV in the long term? The answer is possibly, but the conditions are stringent.

Perhaps one day, MicroStrategy (MSTR) will become the "Berkshire Hathaway" of the crypto space. At that point, Bitcoin may become an extremely scarce and sought-after asset, and the company may even be willing to accept a lower acquisition offer from Michael Saylor simply because he can pay with precious Bitcoin.

Another potential way to sustain the premium of shell companies is for these companies to become more creative in selecting underlying assets. For example, they could hold high-quality tokens like HYPE, which are currently not listed on any centralized exchange, thereby providing new investors with access to HYPE. This scarcity and uniqueness may attract investors willing to pay a premium. However, these scenarios are merely long-term possibilities.

In any case, just like ETFs, some shell companies will succeed, while others will not. But if bankers want to keep the "profit train" moving, they must start becoming more creative. If they simply cram crypto assets into an equity shell company, they will need to continuously innovate the content within the shell company—making it valuable and difficult to obtain through other means.

However, I believe these equity shell companies will not negatively impact the crypto assets themselves, at least not in the short term. Without debt in the capital structure, there is no forced sale mechanism. Moreover, I think we may continue to try to eliminate misunderstandings about these shell companies for a long time, just as we have done on many crypto topics.

Tokens can still serve as tools for capital formation

The recent shift from token financing to shell company equity financing can be seen as "two steps forward, one step back." But this does not mean that token sales have stopped; it is just that the related discussions have decreased.

We often say: "Tokens are the greatest capital formation and user engagement mechanism in history, capable of uniting all stakeholders and creating lifelong brand advocates and core users." The idea is simple: instead of issuing equity or debt that prevents investors from becoming users of the product and customers from benefiting from the company's growth, why not issue tokens directly to customers, thereby unifying all stakeholders at once? This was precisely the direction attempted by the ICO (Initial Coin Offering) in 2017, until U.S. regulators put a complete stop to it.

The good news is that regulatory pressure is easing, allowing some token financing to return. The bad news is that most token financing is still limited to the "pure crypto" space—namely, those crypto and blockchain-native companies that could not exist without blockchain technology. What is missing is a world where non-crypto-native companies (such as regular gyms, restaurants, and small businesses) can also start issuing tokens to finance their operations and unify stakeholders.

"Internet Capital Markets" is a term used to describe this emerging theme. This concept is not new (in fact, we have been writing about it for seven years—my first blog post about crypto involved this concept when Arca didn't even have a website). But now, this idea has finally been adopted to some extent.

Launchcoin is one of the key platforms driving the next generation of token issuance. Launchcoin (which also has its own token) supports Believe, a token issuance platform that is leading the emerging narrative of "Internet Capital Markets." On the Believe platform, tokens make their debut through bonding curves, and then move to the Meteora platform to enhance liquidity. This platform is highly attractive because many credible Web2 companies have already achieved tokenization (creating tokens) through Believe. Although direct token value accumulation has not yet been realized, its potential is immense, making Launchcoin a pioneering force in this narrative.

In other words, Launchcoin and Believe are working towards a vision where every municipality, university, small business owner, sports team, and celebrity can issue their own tokens.

We have already seen many instances where tokens can fill gaps in a company's balance sheet or be used for restructuring. For example, Bitfinex successfully raised funds through its LEO token, and Thorchain did so through its debt token. This type of token financing model is what makes the crypto industry exciting, rather than merely relying on equity shell companies.

However, both models currently coexist, and understanding the differences is crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。