U.S. President Donald Trump announced that he had just finished a “very good phone call” with Chinese leader Xi Jinping on Thursday morning, initially sending stocks upward, but bitcoin ( BTC) barely budged, and stocks later retreated.

“I just concluded a very good phone call with President Xi, of China, discussing some of the intricacies of our recently made, and agreed to, trade deal,” Trump said, referring to the agreement in May in which the two countries scrapped the triple-digit retaliatory tariffs previously imposed on each other. “The call lasted approximately one and a half hours and resulted in a very positive conclusion for both countries,” the president added.

Stock markets jumped on the news, with the S&P 500, Nasdaq, and Dow all initially climbing 0.41%, 0.72%, and 0.26% respectively, according to CNBC, but those gains had disappeared at the time of reporting. Coinmarketcap data shows that bitcoin edged lower by 1.84% and is currently trading just below the $104K mark.

Even a successful $1.05 billion initial public offering (IPO) by stablecoin issuer Circle (NYSE: CRCL), which went live today on the New York Stock Exchange, failed to buoy BTC and the wider crypto market. Coinmarketcap shows the crypto sector shrunk 2.24% to a market capitalization of $3.24 trillion.

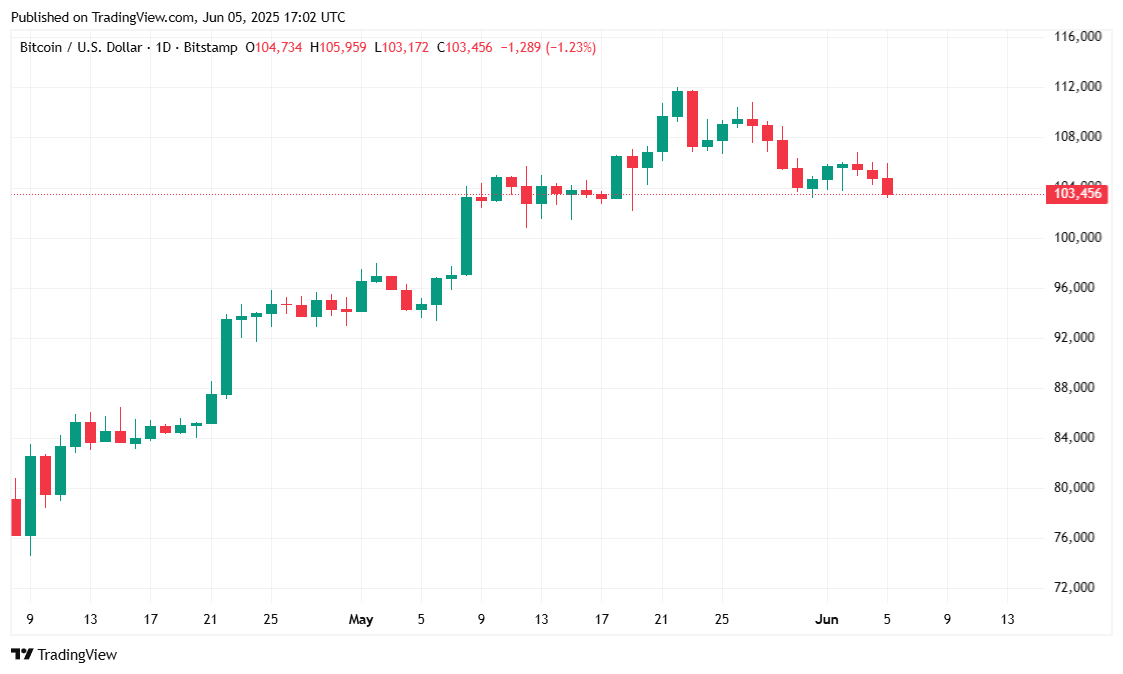

Bitcoin has dipped 1.84% over the past 24 hours to a current price of $103,517.75, according to Coinmarketcap. The decline extends a broader 7-day slide of 3.05%, with price action constrained between $103,483.65 and $105,936.69. The subdued movement suggests a wait-and-see approach among traders despite news about US-China trade developments and Circle’s IPO.

( BTC price / Trading View)

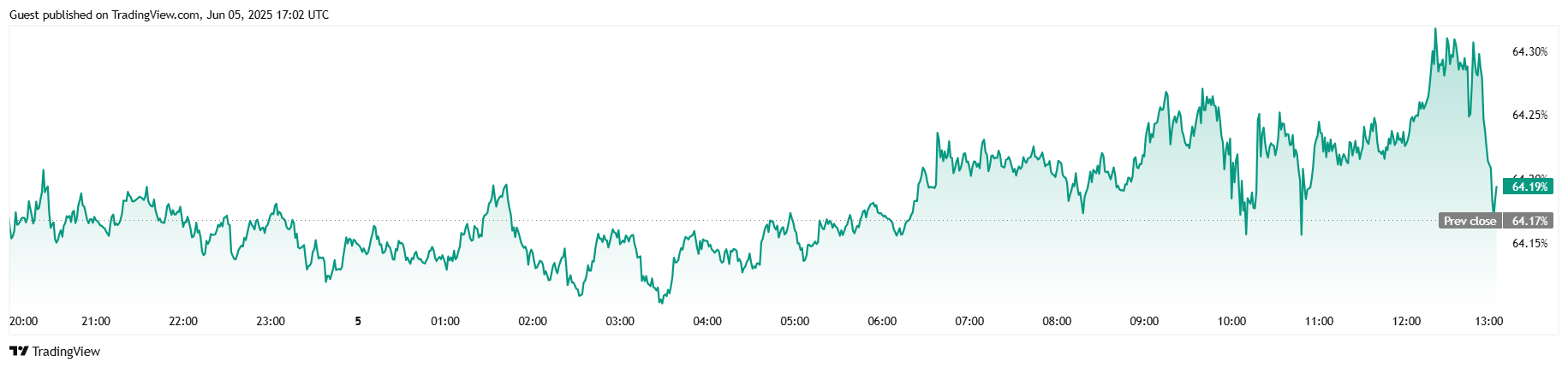

Market activity mirrored the price lethargy, as 24-hour trading volume dropped 8.06% to $41.84 billion. Bitcoin’s market capitalization declined by 1.85% to $2.05 trillion, while BTC dominance inched up 0.08% to 64.21%, hinting at relatively weaker performance from altcoins. Futures markets trended slightly higher, with total open interest rising 0.40% to $71.03 billion, reflecting a steady appetite for speculative positioning.

( BTC dominance / Trading View)

Margin trading data from Coinglass reveals an interesting shift: total liquidations were initially thin at around $83,770 earlier today, but later ballooned to $12.93 million, with bulls who went long getting liquidated to the tune of $12.84 million, while shorts came in at a much smaller $84,390.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。