3Jane, a protocol focused on creating uncollateralized credit rails for decentralized finance (DeFi), has exited stealth mode with a $5.2 million seed round. The round was led by Paradigm, with participation from Coinbase Ventures, Wintermute Ventures, Robot Ventures, Bodhi Ventures, and Breed.

A group of well-known angels also joined the round, including Andre Cronje (Yearn), Guy Young (Ethena), Julian Koh (Ribbon), Kain Warwick (Synthetix), Laurence (Wildcat), Zabeer (Split Capital), Joshua Lim (Arbelos), Yuchen (BounceBit/OKX), Octoshi, Alfaketchum, and DeFi Dad.

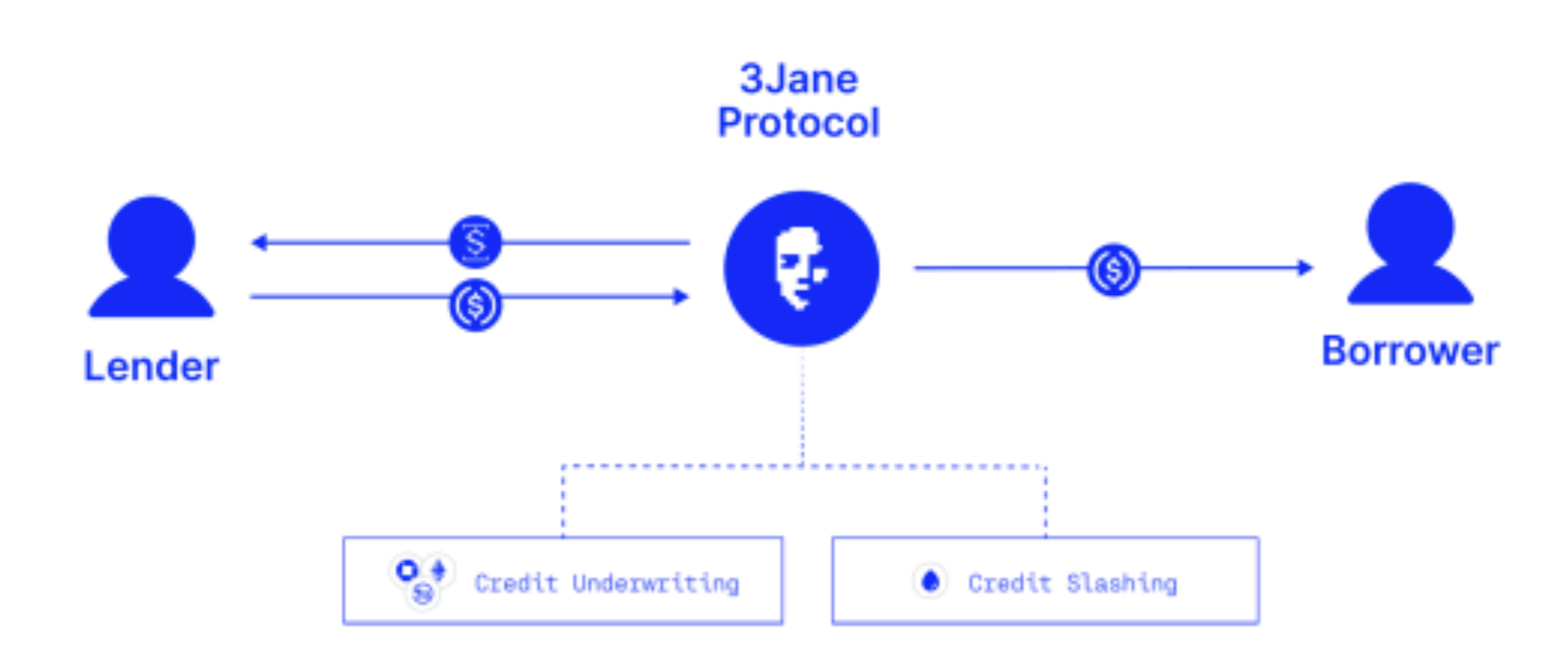

Source: 3Jane Protocol documentation.

3Jane positions itself as a crypto-native alternative to traditional banking credit systems, offering USDC-denominated credit lines to traders, yield farmers, businesses, and artificial intelligence (AI) agents. Unlike conventional DeFi lending platforms, which rely on overcollateralization, 3Jane explained that it enables borrowing against credit scores, DeFi assets, centralized exchange (CEX) assets, bank deposits, and future cash flows—without upfront collateral.

According to 3Jane, DeFi lacks a scalable credit primitive. Overcollateralized lending is capital inefficient, while unsecured lending is often limited to institutions or reputation-based deals. Traditional finance (TradFi) and banks remain cautious due to risk and regulatory constraints. 3Jane disclosed on Wednesday that it aims to fill this gap by creating a peer-to-pool credit market native to Ethereum, with a focus on unlocking the estimated $60 billion in productive crypto capital across EVM chains.

The protocol supports a two-token system: USD3, a stablecoin-yieldcoin backed by active credit lines, and sUSD3, which offers levered yield with subordinate claims. Credit risk is managed via a mix of onchain and off-chain credit data using Cred Protocol, Blockchain Bureau, and VantageScore 3.0 via zkTLS.

To enforce repayment and manage defaults, 3Jane leverages onchain auctions with U.S. debt collectors. Its phased rollout starts with fine-tuning credit models, onboarding suppliers, and gradually expanding unsecured lending. Each cycle improves underwriting accuracy and compresses credit spreads.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。