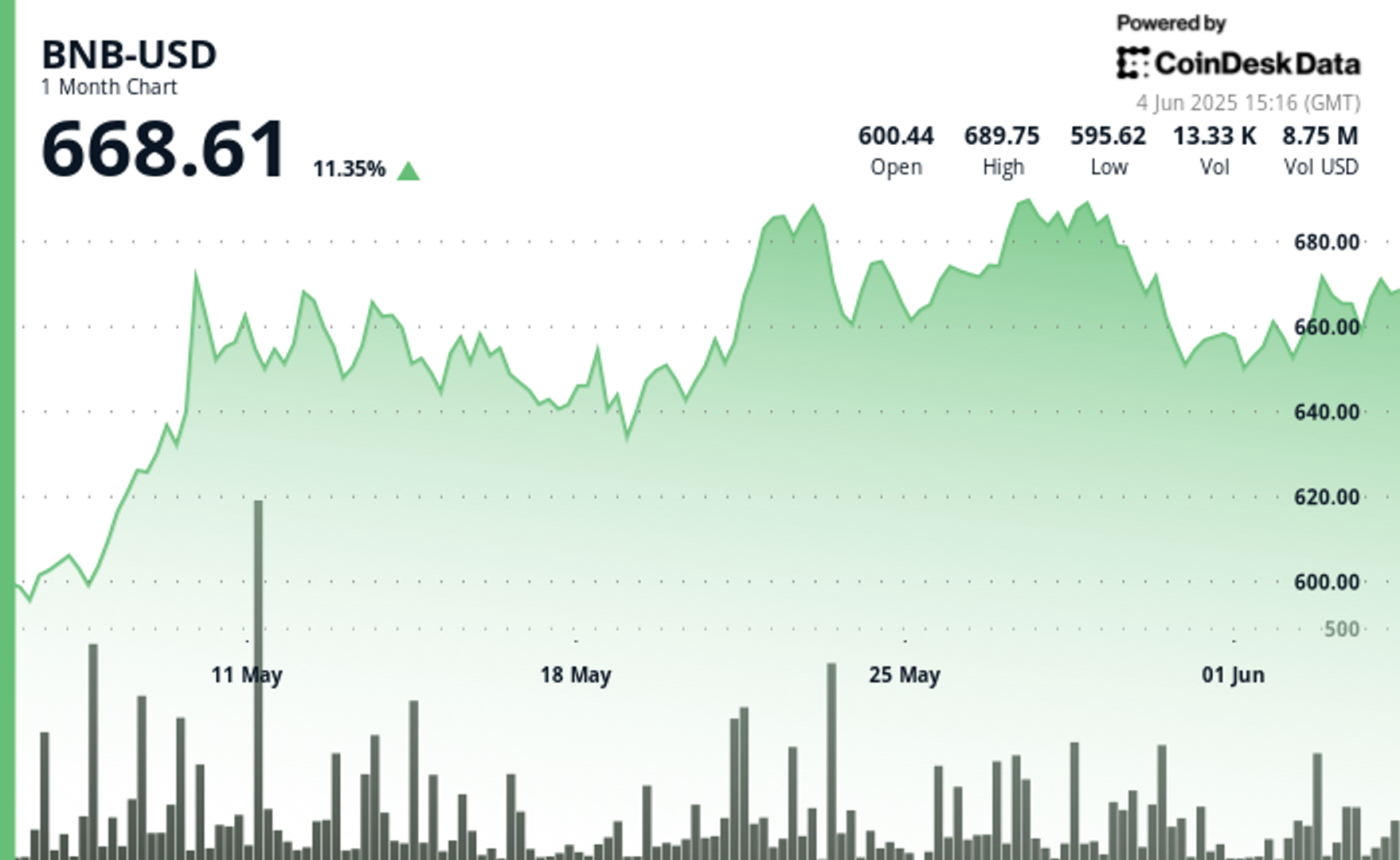

BNB is holding steady around $668 as positive developments in its ecosystem are meeting with regulatory tension and broader market volatility.

The token has gained over 11% in the past month, aided by strong decentralized finance activity and the end of the U.S. Securities and Exchange Commission’s long-running lawsuit against Binance.

Binance’s crackdown on bots exploiting its Alpha Points reward system has highlighted the exchange’s controls, likely boosting investor confidence. Users were relying on automation to farm points to secure additional rewards.

Alpha Points helped drive a wave of new BNB Chain activity, bringing decentralized exchange (DEX) trading volumes up to $187 billion in May, giving the network a 36% market share according to Dune Analytics.

Rising automated activity threatened to erode trust in the system’s fairness.

At the same time, PancakeSwap, BNB Chain’s flagship decentralized exchange, pulled in $6.72 million in the last 24 hours, according to DeFiLlama. The figure puts it above the $6.35 million Circle, the issuer of the second-largest stablecoin USDC that’s eyeing an IPO at a $7.2 billion valuation, brought in over the same period.

BNB Chain itself recorded a surge in activity in May, processing 198 million transactions, up 148% from the previous month, and surpassing Ethereum in value transferred, Dune’s data shows.

BNB’s price action has remained technical, with support forming around $663 and resistance near $691, according to CoinDesk Research's technical analysis data model.

A breakout could push prices toward $790, though any dip below $648 risks a correction, the model shows.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。