The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and I refuse any market smoke screens!

Today, from Lao Cui's perspective on the coin circle, whether it is the stablecoin legislation or interest rate cuts, I have already analyzed them in depth with everyone. This has led many friends to feel that Lao Cui's predictions about trends are very clear and have certain reference value. A phrase I often say is that Lao Cui is not predicting but rather guiding the inevitable direction of human nature. Since everyone has entered the financial market, there must be an awareness of interests and equivalent exchanges. I greatly appreciate the police's case-handling logic; any case must have an intuitive beneficiary, and the biggest beneficiary is often the one behind the scenes. This theory is very applicable to the coin circle. Looking back at this bull market, perhaps capital has already started laying out through ETFs. The ETFs for Bitcoin and Ethereum, as well as the actions against USDT and the layout of stablecoin legislation, show that the ultimate goal of the Americans is also very clear: to bring all gray industries in the world into their fold. Through this series of measures, it reflects back to us ordinary people, which is simply to go with the flow. Long before the ETF was approved, I communicated with everyone that at that time, the price of Bitcoin was still below 40,000, and my slogan was to break through 50,000 and look towards 100,000. Although many friends did not understand, fortunately, there were still loyal fans who took action. This profit belongs to individuals, but the honor is shared by all of us, and I am very grateful for everyone's trust.

At the same time, the recent issues are also very clear. Many friends feel that small coins yield higher returns than Bitcoin and Ethereum; this has led most users to prefer investing in small coins. I have no bias against the selection of coins myself. Coincidentally, a few new users came yesterday, all inquiring about the DOGE coin, which they are all stuck in. This has also drawn my attention to Dogecoin. Perhaps I have not explained such coins to everyone before, and many users' choices are almost blind obedience. DOGE and SHIB can be seen as competitors. If you look at SHIB's trend, it is not difficult to see Dogecoin's future. It can be said that at this stage, without Elon Musk's endorsement, Dogecoin would have long followed in SHIB's footsteps. The Shiba Inu meme is considered the internet culture of DOGE, which itself does not possess the circulation attributes of cryptocurrency. It has only relied on the birth of internet culture to support DOGE until now. You can also pay attention to the involvement of traditional capital; it is not difficult to see that traditional buying is not optimistic. Moreover, the original intention of DOGE's creation was to mock the concept of Bitcoin, and the team itself never thought it would attract so many investors, only because its concept was favored by Musk, which once surpassed Bitcoin's growth. However, due to its characteristics, DOGE was born with the same properties as Litecoin, and at that time, DOGE's block generation speed was the fastest choice in the blockchain.

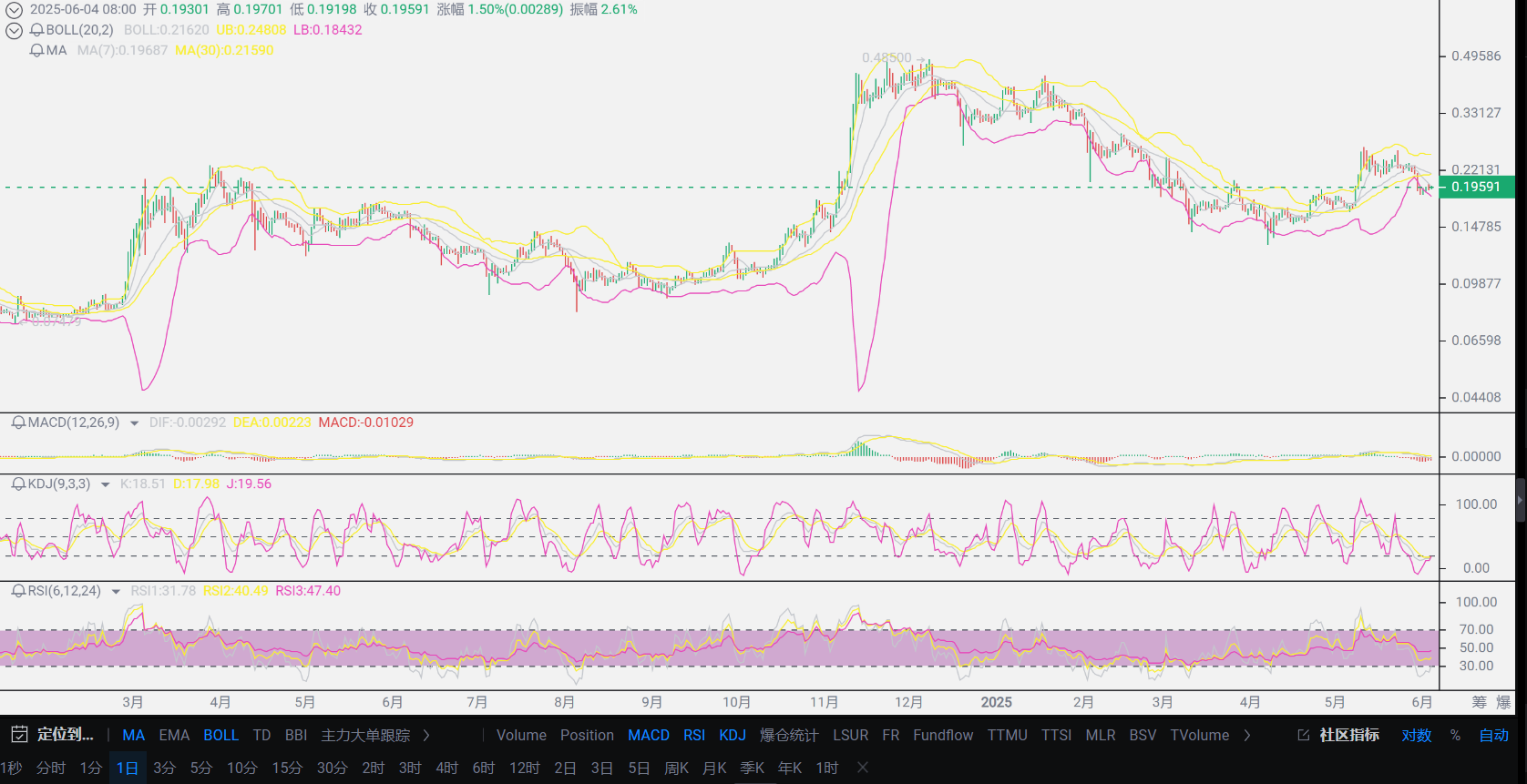

The fast block generation speed was only in terms of the technology at that time, with a speed of 1 minute setting the fastest record. In 2025, DOGE will also welcome an upgrade, with the block generation speed increased to 30 seconds, and the transaction capacity will increase to 8 times that of 2024, reaching 450 TPS. Even if it reaches this value, compared to the current blockchain king SOL, the technology is still lagging behind. SOL's theoretical peak transaction capacity reaches 50,000+ TPS, with a block generation speed of 400 milliseconds. At this point, I believe everyone is very clear that DOGE's technical level has completely fallen behind this era. In terms of innovation, it is far inferior to Bitcoin and Ethereum, and even SOL. Bitcoin pioneered the blockchain era, Ethereum forged the smart contract era, and SOL has controlled costs down to 0.000005 SOL. In comparison, DOGE may only have sentiment and capital hype left. The issuance mechanism of DOGE is also a drawback, maintaining the generation of 5 billion coins each year, which is also an important factor for its low price. Compared to Bitcoin's return rate, last year's lowest point was around 38,540, and the highest point was 108,366, nearly three times the return. The only relatively observable return last year was DOGE, which reached six times the return, nearly one time higher than Bitcoin. The premise of this volatility is the push of capital. The most critical point is that the historical peak of DOGE reached 0.74, and the later high point was only 0.48, which did not break the historical high. This indicates that when observing DOGE on an annual basis, it is actually in a correction phase and has not entered a bull market.

This is quite terrifying. Many friends are influenced by the anchoring effect, always treating the previous new high as DOGE's target for impact, and when they reach a new high, they do not cash out. This is the important reason for everyone's current losses. My estimation is that as other coins are listed, DOGE's influence and sentiment will gradually dissipate, and it will be very difficult for it to go public through ETFs. After all, DOGE is almost entirely controlled by Musk, and for such a coin to go public, it can only rely on Musk and the "king of understanding" to play the emotional card. Musk's involvement in the coin circle is more about wanting to increase the liquidity of his assets and create a channel for return. It is easy to understand that Musk's overseas assets want to flow back to America, and the coin circle is the best way. At the same time, the emergence of DOGE provided him with a channel, which is why he strongly advocates DOGE. This clue can be seen from Tesla's previous support for Bitcoin payments, which was merely a way to seek a tax evasion route. Ultimately, under pressure from various parties, this channel had to be closed. Now, as the regulations in America continue to improve, the space for DOGE's survival is becoming smaller and smaller. The financial rules of the coin circle also apply to the law of survival, the law of nature, survival of the fittest; eliminating DOGE is just a matter of time.

Lao Cui summarizes: Everyone can observe such coins from the perspective of capital. A trend coin that rises with the internet should follow the trend and fade into obscurity. With no upper limit on issuance, generating 5 billion coins each year, slow technological updates, and the coin being almost entirely in the hands of an absolute core, relying solely on the title of the world's richest person, and the thoughts of the world's richest person are not simple. Would you choose to invest in such a coin? In this round of the bull market, it can be said that only Bitcoin has stood out, exceeding everyone's imagination, while other coins have their own thoughts to varying degrees. I have always emphasized selling ETH at high positions; how are SOL and DOGE any different? It's just that the amount sold compared to Ethereum is negligible. The realization of DOGE has always been in Musk's hands, and its destruction mechanism is also maintained at around 5% each year. As the issuance amount increases, DOGE's price will only continue to decrease. With the market value unchanged and the unit price decreasing, this is actually diluting the chips in everyone's hands in traditional finance. Observing this round of the bull market, everyone can clearly feel that after 0.48, it directly depreciated to 0.12, a fourfold price difference, while SOL and Ethereum are less than twice, and Bitcoin hasn't even halved. This has already reached the harvesting limit for altcoins. DOGE has almost become the representative of altcoins, which is why many of you found Lao Cui. At the beginning of the year, my advice was to let everyone feel the need to sell and convert to Bitcoin, even if it was in the form of contracts, you would not suffer such losses. The result is already clear. If everyone had bottomed out at Bitcoin 80,000, now not to mention profits, at least the principal would have all returned to your hands. My evaluation of DOGE is that it is not worth long-term investment; it is only suitable for speculative forms like Livermore, where you eat a wave and then leave. Not to mention doing DOGE in the form of contracts; no matter how much principal you have, it will leave you with nothing. I wish everyone to escape the sea of suffering soon; sometimes letting go may be the best homecoming for oneself.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes the big picture, and does not focus on one piece or one area, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.**

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。