➤ Why are we optimistic about the cross-chain sector?

The logic is simple. There are over 100 Layer1 and Layer2 projects in the market—can you believe that? However, there are probably fewer than 10 cross-chain interoperability projects connecting these ecosystems.

At least the commonly used cross-chain interoperability projects like ChainLink, LayerZero, Wormhole, Axelar, Debridge, and Celer combined are fewer than 10.

In 2021, only the Ethereum and BSC ecosystems were relatively active. By 2025, there will be more Layer1s like Solana, SUI, Sonic, and Bear Chain, as well as Layer2s like Base and Arbitrum.

The more intense the competition between ecosystems, the stronger the demand for cross-chain solutions.

Perhaps the cross-chain sector may not be as crazy as MEME, but it is definitely a stable and growth-oriented sector.

With the market recovering, various on-chain ecosystems will gradually start to compete, and funds will soon begin to flow back and forth among these cross-chain protocols…

➤ Which cross-chain project do you favor more?

In fact, ChainLink, LayerZero, Wormhole, Axelar, Debridge, and Celer are all good projects. However, as investors, we need to consider which project has more investment potential.

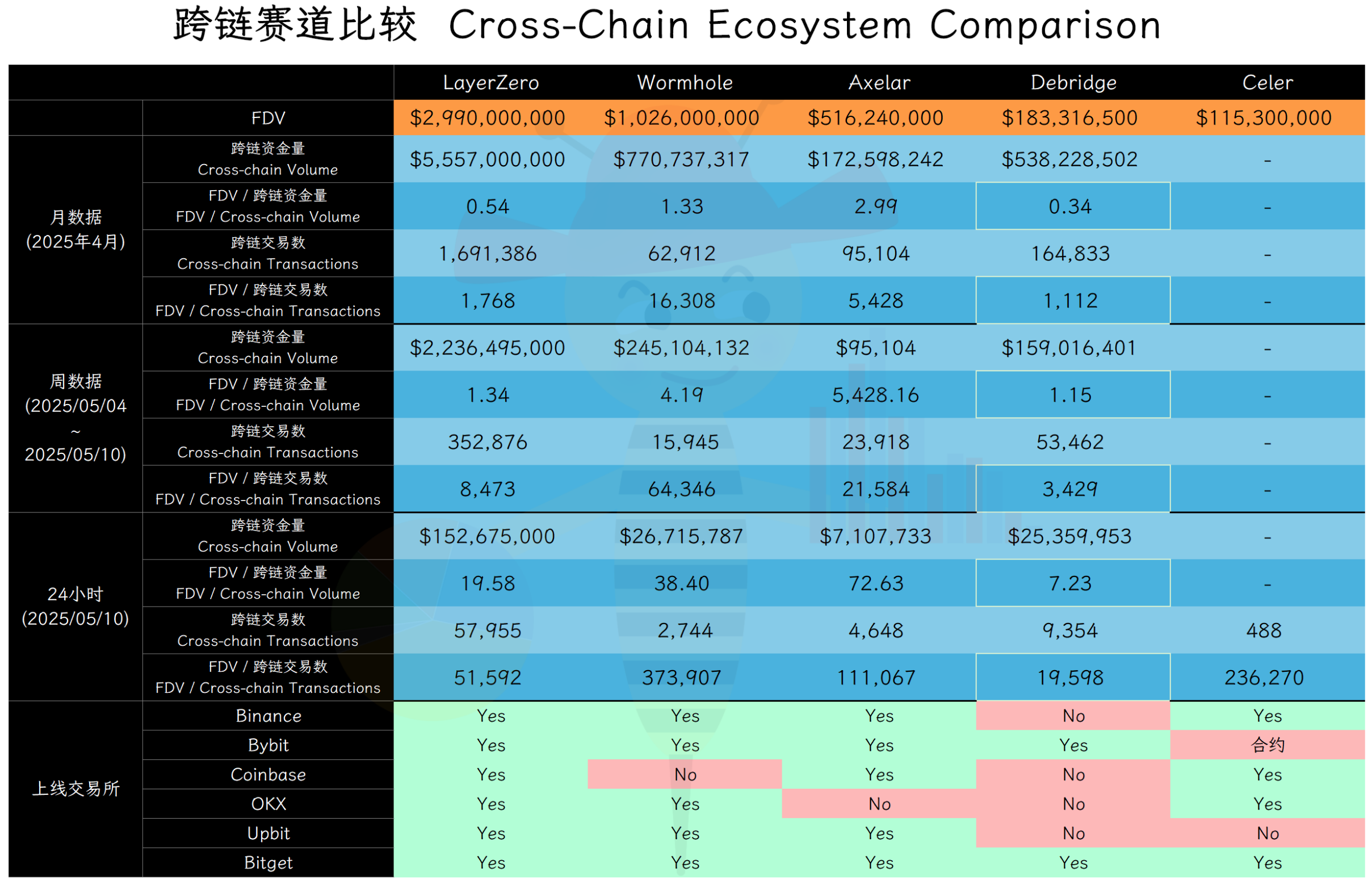

So, Brother Bee has compiled the FDV of the five projects: LayerZero, Wormhole, Axelar, Debridge, and Celer, along with the ratio of cross-chain trading volume and transaction count, in order to find undervalued projects.

Trading volume and transaction count can reflect the market scale of cross-chain products. The FDV/cross-chain trading volume is similar to the price-to-earnings ratio, as cross-chain transactions and the income from cross-chain protocols are positively correlated.

The comparison clearly shows that DeBridge ($DBR) is the most undervalued cross-chain project. Whether on a monthly, weekly, or daily basis, the FDV of $DBR relative to trading volume and transaction count is the lowest.

Besides $DBR, LayerZero ($ZRO) also has relatively low ratios.

In fact, the cross-chain scale of DeBridge is only slightly lower than that of Wormhole. In February, DeBridge's cross-chain scale even surpassed that of Wormhole. However, the exchanges where $DBR is listed are also the fewest, so the potential of $DBR may be the greatest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。