The cryptocurrency market is never short of drama. Recently, the "whale's gamble on the edge of a cliff" has once again pushed market sentiment to a critical point.

James Wynn, a major player known for his aggressive style, recently placed a bet on Bitcoin's rebound with 40x leverage. His $147 million long position is currently less than $300 away from the liquidation price—meaning that even a slight push downward in the market could cause this position to explode. As of now, his unrealized loss has exceeded $1.13 million.

But what is most intriguing about the market is that it has not collapsed as expected. Near the liquidation line, Bitcoin not only avoided a cliff-like drop but instead stabilized and rebounded. Is this a coincidence, or a precursor to a signal reversal?

Who exactly is betting on Bitcoin's bottom?

Market Background: BTC Pullback + Whale Liquidation's "Chain Suspense"

In recent weeks, Bitcoin's price has fallen from a high of $111,900 in May to the $105,300 range. The overall pullback is not exaggerated, but under the leverage system, it is enough to trigger a series of liquidations. Especially for large positions like Wynn's, which are highly leveraged, even a 1% drop could obliterate the position.

More dramatically, this round of pullback is not a singular market behavior; there are macro catalysts behind it:

- Trump announced a 50% tariff on the EU, triggering global risk-averse sentiment and causing BTC to briefly drop below $105,000;

- Market rumors suggest that some institutions or market makers are intentionally pushing prices down to "hunt liquidation points," particularly targeting leveraged positions like Wynn's, which are "bullseye-level."

This is why we are focusing our attention on this range—it could be the starting point of a stampede or the fulcrum for a shift in market sentiment.

The liquidation critical point is not the end, but possibly the starting point for a reversal?

On the surface, Wynn's liquidation price is the "life and death line" for Bitcoin's short-term trend. However, from multiple dimensions, it appears to be a node that the market is carefully "protecting."

- Technical Aspect: Liquidation Price = Multiple Support Resonance Zone

The liquidation price is located near:

- Daily trend support, which roughly corresponds to the rising trend line from late March to mid-April (pink line);

- The 38.2% Fibonacci retracement zone, which is typically viewed as a "healthy pullback" position in a trending market;

- According to the chip distribution chart on AiCoin, the liquidation price is also in a previously dense trading area.

In other words, not only is Wynn betting on the support strength at this position, but many technical traders are also using real money to verify whether it can hold.

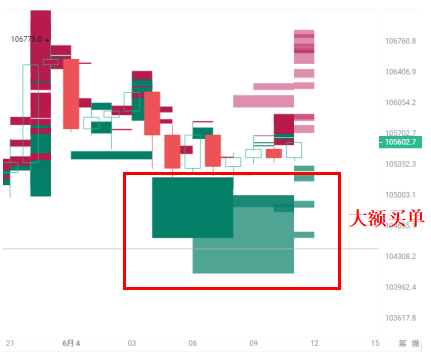

- On-chain Movements: Large Buy Orders and Capital "Bottom-Protecting" Behavior Emerge

According to on-chain data and some exchange order book information, there are multiple large BTC buy orders hanging in the $104,100-$105,200 range, suspected to be whales or institutions positioning to defend the market's key level.

Additionally, Wynn has not moved assets or added to his position, which may also indicate that he still has confidence in this position.

- Short-Selling Momentum Weakens: Liquidation Stampede Did Not Occur, but Rebound Strength Begins to Accumulate

If the liquidation point were truly breached, we would expect to see a sharp decline and a surge in liquidations.

However, the current trend shows that: the breakdown did not occur, trading volume has decreased, and there is a rebound at lower levels. This indicates that the shorts have failed to "break through the bottom line," and are instead depleting their ammunition, likely brewing a short-covering rally.

Who is quietly bottom-fishing? The Invisible "Counterparty"

This raises a key question: Who is betting on BTC's bottom?

· Are other whales accumulating?

According to observations from NFTEvening and some on-chain analysis platforms, there have indeed been new institutions increasing their BTC holdings around the $105,000 mark. This indicates that, despite Wynn being on the brink of liquidation, not all major players are retreating; some are choosing to go against the trend.

· The market structure hasn't deteriorated?

BTC is currently still holding above the 50-day moving average and the midline of the trend channel, and it hasn't even touched the $100,000 psychological level. The structural bull market logic remains intact; the market is merely in a "de-leveraging" process rather than a true trend reversal.

· Is it hedging against favorable news from mining companies like Cango?

It is worth mentioning that the foundation for bullish sentiment in the market is also continuously accumulating. For example:

Cango mined a total of 954.5 BTC in April and May, worth over $100 million, indicating a recovery in Bitcoin mining profitability. The company also announced a full transition to Bitcoin mining, selling off its traditional business, indicating that traditional capital is accelerating its all-in on BTC. This positive news, while unrelated to Wynn's high leverage, is a supporting force behind market confidence.

When one whale is on the brink of liquidation, another traditional giant is betting on Bitcoin's future; this "collision of bulls and bears" often serves as an important signal for a bottom.

Bull-Bear Watershed: A Breakdown Means a Stampede, Holding Means a Counterattack

We can understand the current structure as follows:

Situation

Market Outcome

Interpretation

If it breaks below the $104,976 liquidation price

Wynn's position liquidates, triggering a chain liquidation, and the market tests the $100,000 psychological level

Bears win, bulls retreat, sentiment collapses

If it holds the $104,000-$105,000 range

Bears lose momentum, short-covering triggers a short-term rebound, forming a V-shaped structure

Bulls win, price reversal initiates, retesting $110,000

From a short-term speculative perspective, this liquidation price is no longer just a simple "stop-loss line," but a true "watershed" for the market.

Whether Wynn's position liquidates actually leads to a more critical consideration. Surrounding this position, the market is revealing two distinctly different forces:

- One is attempting to create a downward movement through panic;

- The other is quietly accumulating bullish momentum at lower levels.

Who will ultimately laugh last does not depend on which direction the price moves first, but on who holds the chips in the end.

As you consider your next move, you might also ask yourself:

"This time, is the person standing on the edge of liquidation being forced back, or are they luring the enemy deeper?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。