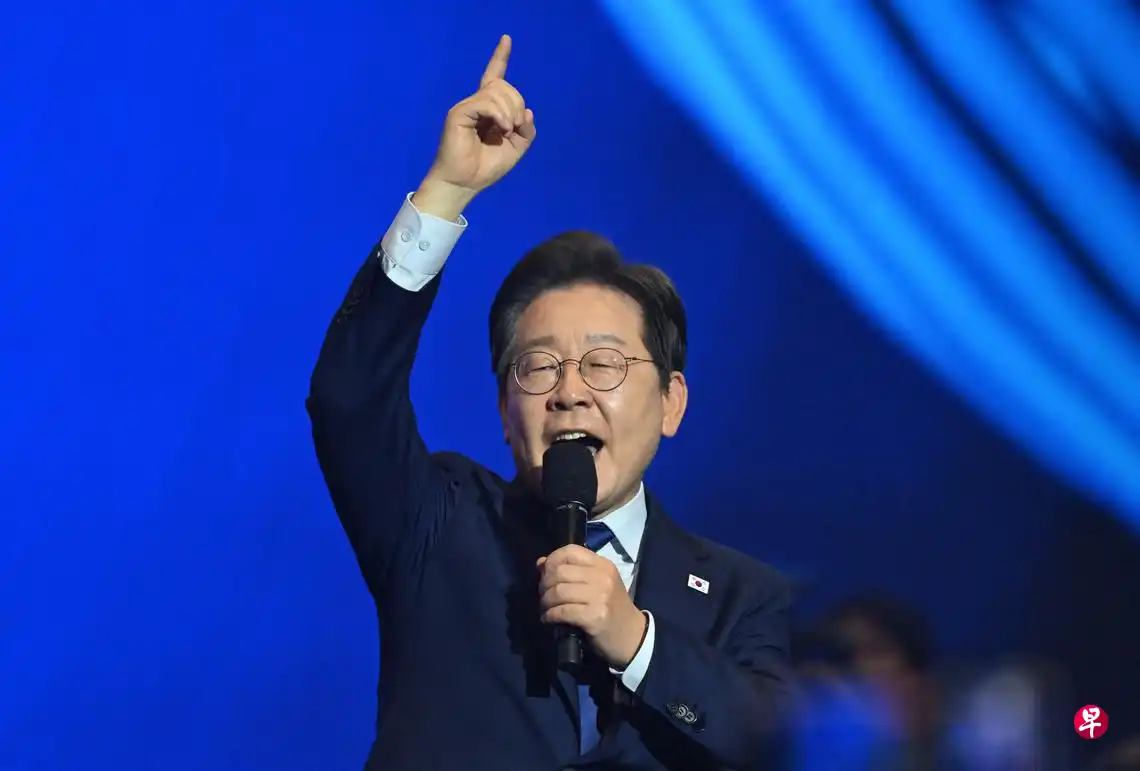

South Korea, this prosperous cryptocurrency market, has chosen a president, Lee Jae-myung, who will promote the Korean won stablecoin and cryptocurrency ETFs.

As a core member of the Democratic Party, Lee Jae-myung narrowly lost to Yoon Suk-yeol in the 2022 presidential election. At that time, he positioned cryptocurrency policy as an important political stance, trying to attract the support of young people and retail investors. However, after two consecutive election defeats, he was once labeled as the "eternal candidate."

Until that day. In December 2024, the political landscape in South Korea changed dramatically. President Yoon Suk-yeol was quickly impeached due to a constitutional crisis triggered by his attempt to impose martial law, under the dual pressure of public opinion and the National Assembly. This crisis not only left the presidential seat vacant two years early but also broke the existing power balance, unexpectedly creating an opportunity for Lee Jae-myung, this resilient political figure, to rise to power.

But as the power structure collapsed and the National Assembly fell into turmoil, Lee Jae-myung quickly seized the opportunity. He summoned lawmakers into the National Assembly hall, initiated a live broadcast, and, with the support of the public, climbed over the wall to enter the National Assembly.

From that day on, Lee Jae-myung became the more suitable presidential candidate in the hearts of South Koreans. "I must let as many citizens as possible understand this situation as soon as possible," he called on the public during the live broadcast to witness the process of the National Assembly overturning the martial law.

Ultimately, in the presidential by-election announced last night, Lee Jae-myung won with 49.2% of the votes, leading his opponent Kim Moon-soo (36.8%), successfully becoming the 21st president of South Korea. For his supporters, this was a victory of "winning at all costs," a battle for recognition after three attempts at election.

For the South Korean cryptocurrency industry, Lee Jae-myung's victory may have even more far-reaching significance: he is not only a political winner but also one of the staunchest advocates for cryptocurrency policy. His election marks a fundamental institutional shift in the regulation of digital assets in South Korea.

Lee Jae-myung's Commitment to South Korean Cryptocurrency

Even before taking office, Lee Jae-myung proposed a series of clear digital asset policy positions during his campaign.

He positioned virtual assets as a key part of national financial reform and included them for the first time in a presidential-level commitment system. His goal is to reshape the legitimacy and security of the cryptocurrency market through top-level institutional design.

Lee Jae-myung's commitment to the "Korean secret industry" includes core content such as:

- Promoting the legalization of virtual asset spot ETFs;

- Guiding the large South Korean National Pension Fund (approximately $884 billion) to allocate cryptocurrency assets;

- Building a stablecoin system anchored to the Korean won, serving as a strategic tool to prevent capital outflow and strengthen the financial sovereignty of the local currency.

Among these, his persistent advocacy for the Korean won stablecoin is particularly noteworthy. In a YouTube live broadcast, Lee Jae-myung openly stated: "To prevent the outflow of national wealth, a stable currency market based on the Korean won needs to be established." This statement not only reflects his keen insight into the international competitive landscape of digital assets but also directly addresses regulatory concerns about the increasing share of dollar stablecoins like Tether (USDT) and USD Coin (USDC) in transactions within South Korea.

According to data from the Bank of Korea, in the first quarter of 2025, the trading volume of stablecoins pegged to the dollar reached 57 trillion won, accounting for more than half of the total trading volume of stablecoins.

To achieve these goals, Lee Jae-myung plans to "lead the market restructuring by the government, reduce transaction fees, establish a comprehensive regulatory system," and promote the establishment of a dedicated "Digital Asset Regulatory Bureau." The core idea is to provide a safer trading environment for ordinary investors through official leadership, promoting the transition of cryptocurrency assets from "speculative tools" to "asset allocation options."

This is not Lee Jae-myung's first time speaking out in the field of digital finance. As early as 2021, he advocated for postponing the virtual asset income tax originally scheduled to be implemented in 2022, emphasizing "regulation first, taxation later." He also proposed raising the tax threshold from 2.5 million won to 50 million won, on par with stock investments, and allowing losses to be deducted to alleviate the burden on retail investors and enhance policy fairness.

Now, this policy roadmap centered on ETFs, stablecoins, and regulatory systems is no longer just a campaign slogan; it is gradually being transformed into concrete proposals as Lee Jae-myung takes office. For the South Korean cryptocurrency industry, this may signify a new stage of development—moving from the margins of the financial system to the core of institutional governance.

Once Luna collapsed, will we fear stability for a decade?

However, Lee Jae-myung's vigorous push for the Korean won stablecoin plan is not without controversy.

Shortly after he proposed building a domestic Korean won stablecoin market, new reform party presidential candidate Lee Jun-sik launched a fierce attack on social media. He wrote: "Candidate Lee Jae-myung's economic views are always dangerous and experimental. He carelessly throws out untested ideas, clearly lacking an understanding of the market, merely repeating hollow slogans."

Lee Jun-sik specifically mentioned the globally shocking Terra/Luna incident—a "stablecoin" project that claimed to be pegged to the Korean won but relied on algorithms to maintain its price. The collapse of this project left hundreds of thousands of investors with nothing, casting a huge shadow over the term "stablecoin" in the minds of the South Korean public and becoming a major breakthrough point for the conservative camp to attack Lee Jae-myung's policies. Lee Jun-sik accused Lee Jae-myung's proposal of "repeating the same mistakes," stating it was "endorsing an illusory structure with national credit."

In response, the Democratic Party camp quickly countered. Former lawmaker Kim Byeong-wook publicly stated: "To completely deny the Korean won stablecoin based solely on the Terra and Luna incidents is clearly contrary to international regulatory trends." He explained: "Major regulatory agencies in the U.S., Europe, Japan, and others have explicitly excluded 'algorithmic stablecoins' (like Terra/Luna) from the category of compliant stablecoins, deeming their volatility too high to be a reliable store of value."

Kim Byeong-wook emphasized that a true compliant stablecoin should adopt a "1:1 full collateralization" model, meaning it should be fully backed by safe assets such as cash or short-term government bonds, with real-time disclosure of reserve status and an obligation for immediate redemption. He pointed out that current mainstream stablecoins like Tether (USDT) fall into this category. In contrast, Lee Jun-sik's blanket rejection of all stablecoins exposes his misunderstanding of the global cryptocurrency regulatory framework.

Another Democratic Party lawmaker, Min Byeong-deok, responded with more irony: "If we were to eliminate the entire printing technique because one photocopier broke, that would be ridiculous." He compared stablecoins to a stage in the development of financial technology, emphasizing that their development should be regulated through institutionalized oversight rather than being completely banned due to individual failures.

The South Korean cryptocurrency ecosystem is entering a new "nationalization" cycle

Against the backdrop of Lee Jae-myung's victory, the South Korean cryptocurrency industry is quietly entering a new policy-driven cycle.

Unlike the previous period of wild growth and platforms fighting their own battles, the current market resembles a game reshuffled around "institutional dividends."

South Korea is already one of the most active cryptocurrency markets in the world. According to the Financial Intelligence Unit (FIU) of South Korea, by the end of 2024, the number of cryptocurrency investors who completed real-name verification reached 9.7 million, a year-on-year increase of 25%. Notably, there has been significant growth in investors aged 30 to 50, with approximately 78% of high-net-worth individuals holding assets worth over 100 million won being over 40 years old. This structural change indicates that cryptocurrency assets are gradually shedding the stereotype of being "speculative tools for young people" and becoming part of asset allocation for the middle class and above.

At the same time, the South Korean cryptocurrency trading market is experiencing explosive growth in 2025, with total trading market value surpassing 100 trillion won, even at one point exceeding the trading volume of the domestic stock market. This round of growth is stimulated by expectations of domestic policy easing and is also related to the global political and economic situation. Especially in the context of Donald Trump being re-elected as U.S. president, which has triggered risk aversion towards dollar assets, a large influx of local South Korean investors into the Korean won-denominated virtual asset market has formed a regional capital return trend.

In response to the market's activity, regulation is also gradually catching up. The government has announced that the virtual asset transfer income tax originally scheduled for implementation in 2025 will be postponed until 2027, citing "the technology is not yet mature" and "the investor protection system is still incomplete." This move effectively calmed market sentiment and bought time for Lee Jae-myung's new regulatory framework.

However, postponing taxation does not equate to relaxing regulation. The "Virtual Asset User Protection Act" (VAUPA) enacted in 2024 has officially come into effect, imposing stricter compliance requirements on trading platforms, including asset custody mechanisms, insider trading prevention, and user asset segregation management. The government's intention is clear: to prevent a repeat of trust crises like Terra/Luna through more robust institutional design, laying the foundation for the "normalization" of the cryptocurrency market.

This series of policy signals conveys a clear message: the South Korean government is committed to integrating cryptocurrency assets into the national financial governance system, promoting the market's transition from laissez-faire to "nationalization" of institutional embedding. This aligns with the vision Lee Jae-myung has outlined—a digital asset market guided by the government, secured by rules, and driven by innovation.

In the future, South Korea's cryptocurrency policy may not be smooth sailing. The controversies surrounding stablecoins, the implementation of taxation, and the coordination of international regulation still exist. But it is certain that during Lee Jae-myung's term, cryptocurrency will no longer be a gray area to avoid discussing; instead, it will be written into the national strategy of presidential commitments. The South Korean cryptocurrency industry has finally welcomed an institutional starting point.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。