This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

Bitcoin set a new all-time high on Thursday, May 22, 2025, comfortably punching through $111,000 per orange coin. More on the BTC ATH in a moment, but first it needs to be acknowledged that Thursday happens to be Bitcoin Pizza Day. A day celebrated in the bitcoin and crypto community whose message is basically to caution against spending or selling your bitcoin as Laszlo Hanyecz did in 2010 when he paid for two pizzas with 10,000 bitcoin. Perhaps I’m reading too much into it, but the messaging seems both overly harsh and antithetical to “Bitcoin: A Peer-to-Peer Electronic Cash System.” Anyway, I digress.

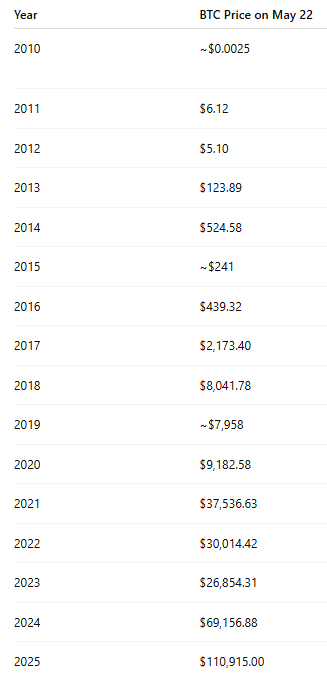

From a mere fraction of a cent to over $111,000, bitcoin’s journey over the past 15 years has been nothing short of extraordinary. Check the chart below to see approximately how much bitcoin was valued on Pizza Day.

The X timeline was afire with enthusiasm over repeated new all-time highs. I confess to taking part in the excitement. Whenever a whole bunch of people, everyone you “know,” gets excited about price action it’s a good habit to take a deep breath and ask yourself several questions. Is this enthusiasm warranted? What could invalidate my bullishness?

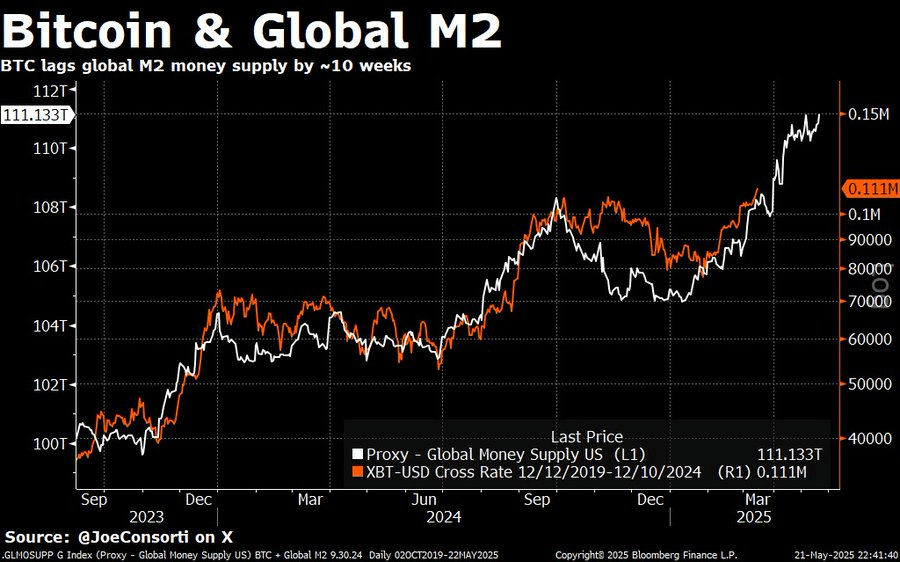

There are many indicators that can give you a sanity check. Here are a few. Global liquidity is one of the most powerful macro indicators for anticipating major moves in bitcoin. As global liquidity rises, bitcoin tends to rise with it, and the reverse is true. As I’ve written about before, we are currently in a rising phase of global liquidity.

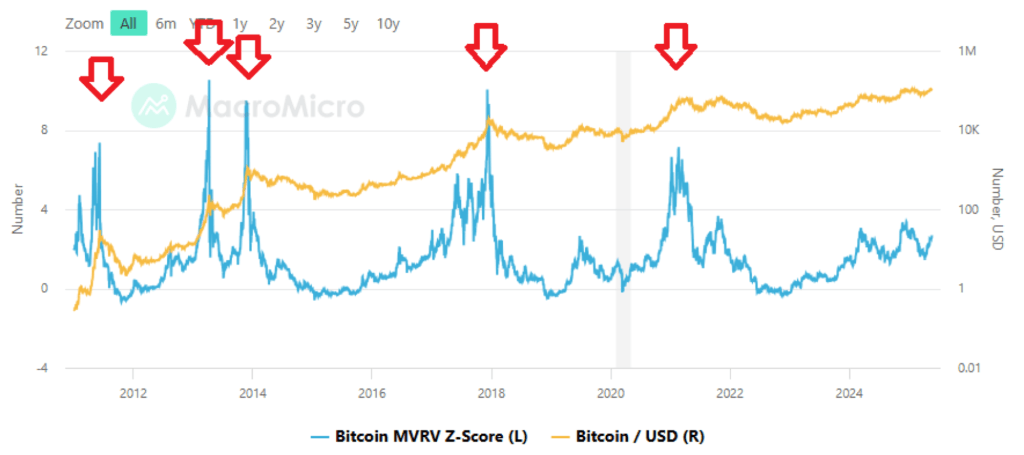

Check out bitcoin’s MVRV Z-Score, an onchain metric used to assess whether bitcoin is overvalued or undervalued relative to its “fair value,” based on historical trends. It’s a good tool to help identify market tops and bottoms. In the following graph, it’s easy to see at what point bitcoin has become overvalued. We’re nowhere near that yet.

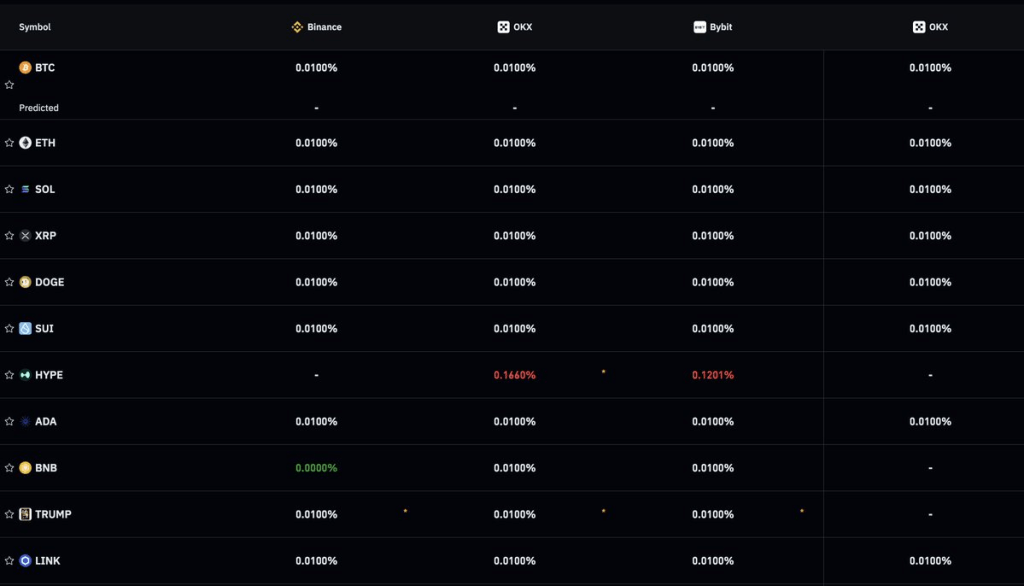

The MVRV Z-Score is a more longterm tool. A shorter time frame indicator is the funding rates of the major exchanges offering perpetual derivatives. Excessively high funding rates in perpetual futures often indicate speculative excess and a likely reversal. Check the funding rate of bitcoin on the major perp exchanges. If the funding rate is strongly positive, meaning long positions pay short positions–people are leveraged long bullish–there’s a higher likelihood of a pullback, at least in the short term.

Right now, despite bitcoin hitting a new all-time high (above $110K on May 22, 2025), funding rates across nearly all major assets are fixed at just 0.0100%, which is considered unusually low. This suggests there is no massive speculative leverage. Traders are not overextending on long positions, despite the bullish price move.

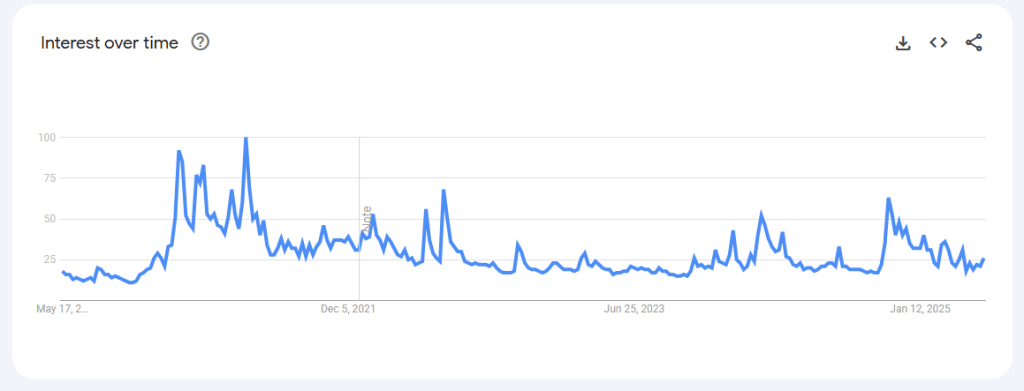

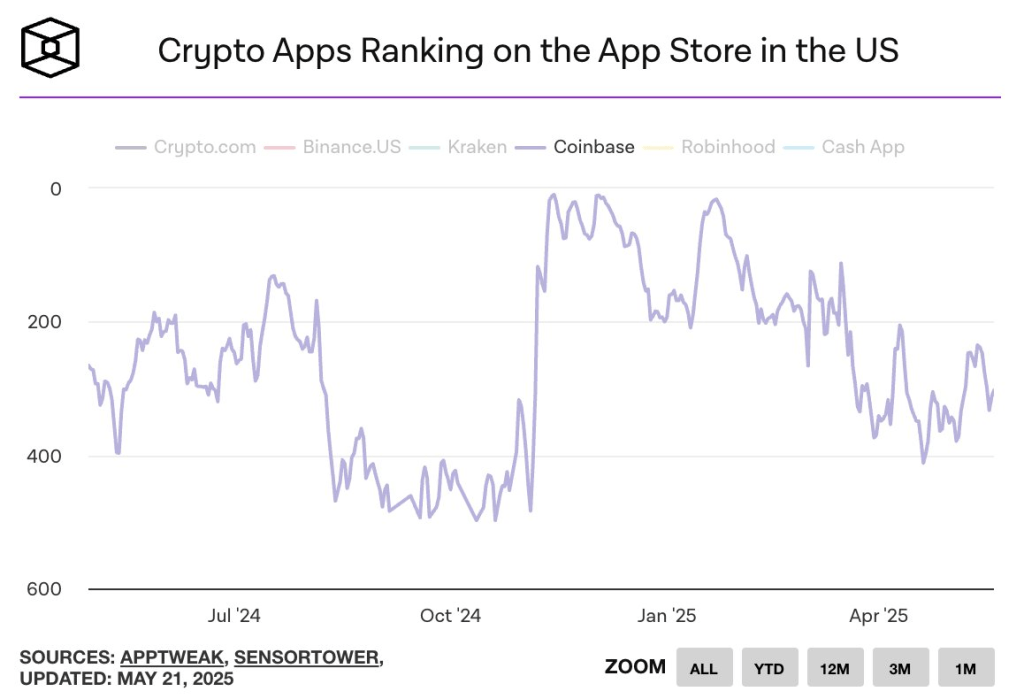

Finally, a couple of sentiment indicators. In the last cycle as we neared the top, searches for key terms like “bitcoin” via Google skyrocketed as retail piled into crypto. We’re well below November of last year, let alone the heights of 2021. Another way to gauge retail’s interest is the ranking of crypto apps in Google and Apple App stores Right now we are below October of last year.

So, while there’s exuberance in the air, I think it’s more likely we’re entering price discovery than a crash. Remember, these are just tools to help guide you. They shouldn’t be used in isolation. They cannot prognosticate. They can only give hints to the answer to that age-old question, is this a bubble?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。