From mindset to strategy, uncovering 18 practical experiences for survival in the crypto market!

Author: SuperEx

Whether you are in the crypto market or not, if you pay any attention, you will always be tempted by those stories of making hundreds or thousands of times your investment, unable to resist putting yourself in their shoes and stepping onto the playing field.

However, only by truly participating will you discover that behind the few lucky ones who become wealthy, the vast majority are just silent cannon fodder, often losing everything.

After years of deep involvement in the crypto market, I have learned these 18 lessons:

01

Do not assume anyone will think of you

Even if you feel like you are part of the cryptocurrency Twitter community, feeling like you belong to a big family, in reality, you are fighting alone in this market. The cryptocurrency market is a "player versus player" arena, where everyone is pursuing their own interests.

No one will genuinely consider your well-being; all decisions and actions revolve around self-interest. Therefore, you need to stay vigilant, rely on your own judgment, and not expect goodwill from others.

02

The information asymmetry on Twitter is extremely high

On social media platforms like Twitter, the phenomenon of information asymmetry is very serious. Some influential people may have more insider information or market dynamics, while ordinary investors often find themselves at a disadvantage. To make informed investment decisions in the cryptocurrency market, you need to clearly identify who the truly valuable sources of information are.

By following the right people, you may gain significant "alpha"; blindly following the wrong people could lead to total loss. Learning to discern the reliability and motives of information sources is key to successful investing.

03

Trust your own judgment

When market sentiment fluctuates, the advice of others is often unreliable.

When the market is rising, if you ask others what to buy now, they might say: "Buy at market highs? Are you stupid?"

When the market is down, if you ask others what to buy now, they might say: "It's all over, buying now is foolish behavior."

These responses often reflect the extreme emotions of the market rather than objective advice. Therefore, learn to trust your own analysis and judgment, and do not be swayed by the emotional remarks of others.

04

Stay away from echo chambers

On Twitter, it is easy to fall into an "echo chamber," where you only hear voices that align with your own views. Do not use social media to seek confirmation bias; instead, use it to test and challenge your investment perspectives.

For example, if you are considering investing in a popular token (like "HYPE"), in addition to following supportive voices, actively seek out opposing opinions. You might be overlooking some key risks or issues. Keeping an open mind will help you make more comprehensive decisions.

05

Spend time on valuable things

Instead of arguing online with anonymous individuals, spend your time on more productive activities, such as:

Reading project whitepapers to gain a deeper understanding of the project's technology and business logic;

Experimenting with related applications on-chain to personally experience their functions and potential;

Interacting with the community on Telegram or Discord, asking questions, and obtaining first-hand information;

Documenting your investment thoughts and writing down your investment logic.

Thinking on paper can help you clarify your thoughts. Writing down your investment arguments before investing allows you to evaluate decisions more rationally and avoid emotional trading.

06

Do not waver in your beliefs due to others' gains

Seeing others make a lot of money in a short time may instill fear, doubt, or fear of missing out regarding your long-term holdings. But remember, the logic of long-term holding is measured in years, not weeks or days.

If your investment thesis still holds, stick to your position; but if the market or the fundamentals of the project change, sell decisively. Never "fall in love with your position"; maintaining flexibility and rationality is crucial.

07

Emotional management in trading

In trading, emotions are often the biggest enemy. Here are some suggestions:

If you feel overly excited about a position, consider selling;

If an asset's price suddenly skyrockets, sell decisively.

The market cannot rise forever; the key to long-term survival is learning to lock in profits. Greed may cause you to miss the best exit opportunities.

08

Understand the sources of yield in decentralized finance (DeFi)

On DeFi platforms, if you cannot clearly explain the source of yield in two sentences, you are likely the "source" of that yield. In other words, you may be providing liquidity or taking on risks for others without realizing it. Before investing in DeFi projects, make sure to understand their economic models and risk points.

09

Narrative drives everything

In the cryptocurrency market, narrative is the core force driving prices. The stories constructed by market participants can greatly influence asset values. For example, Dogecoin once had a market cap close to $100 billion, which was entirely driven by narrative.

This reminds me of a saying: "Do you want to make money, or do you want to prove you are right?" In the market, following the narrative often yields better returns than being fixated on being "correct."

10

Do not chase highs

When you discover a new project and think, "Wow, this idea is amazing," but delay investing for weeks, when its price suddenly skyrockets, do not chase the high. Your best investment opportunity was missed weeks ago. Jumping in now may lead you to buy at a local peak. Learn to accept missed opportunities and patiently wait for the next one.

11

Emotions are temporary

When you start making money, you may feel extreme excitement, which can become addictive, making you want to recreate that feeling continuously. However, overtrading or frequently rotating positions often stems from chasing that feeling rather than making rational investment decisions. Learn to control your emotions and stay calm to avoid unnecessary losses.

12

Understand market cycles and sector rotation

In a bull market, not all assets will rise simultaneously. Typically, the market goes through different phases, with certain sectors (like DeFi, NFTs, Layer 2, etc.) performing in rotation. Pay close attention to emerging narratives and trends, positioning yourself in advance rather than chasing already started sectors. Planning your investment strategy will help you gain an advantage during market rotations.

13

Mistakes are cheaper when you are young

Making mistakes in your 20s is far less costly than making them in your 40s; a lesson learned from losing $1,000 is much easier to bear than one learned from losing $100,000. When I first tried leveraged trading, I lost several thousand dollars in minutes, but that failure taught me valuable lessons. Failure is part of growth, but ensure that the cost of failure is within your means.

14

Why most people do not make money in the crypto market

Ordinary investors often find themselves at a disadvantage in the cryptocurrency market for the following reasons:

A YouTuber or influencer promotes a project on Twitter, and the price starts to rise;

The token enters the top 100 on CoinGecko, attracting more attention;

KOLs, venture capitalists, or early investors start selling as the price rises;

The project becomes "well-known," and ordinary investors begin to buy in;

Retail investors buy, pushing the price up, but the increase is limited;

KOLs, VCs, etc., sell all their holdings;

The token price plummets (usually while you are asleep), and you are forced to cut losses.

Understanding this pattern can help you avoid becoming a "bag holder."

15

Give yourself time

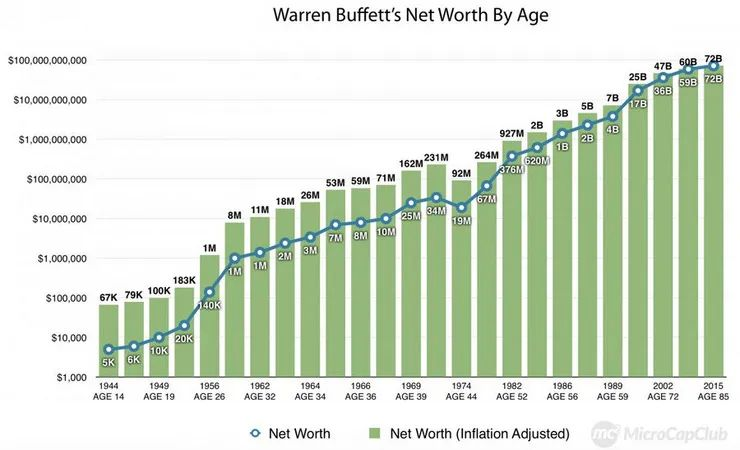

We all want to get rich quickly, but success in the cryptocurrency market takes time. Slow and steady wins the race. Of Warren Buffett's $84.5 billion fortune, $81.5 billion (over 96%) was accumulated after he turned 65. This reminds us that patience and long-term commitment are key to wealth accumulation.

16

What you want is not retirement, but freedom

Many people think retirement is the goal, imagining themselves lounging on a beach in the Caribbean. But retirement can become boring after a week. The real goal is freedom—waking up every day to do what you want, creating value with interesting people, while having enough time to spend with family and friends. The cryptocurrency market may provide you with financial freedom, but do not forget to pursue more meaningful life goals.

17

The cost of going full-time in cryptocurrency

If you want to quit your stable 9-to-5 job and dive full-time into the cryptocurrency market, ask yourself if you are ready to be online 10 to 16 hours a day, seven days a week, for several years. Even then, there is no guarantee of success. Going full-time in the crypto market requires extreme self-discipline, patience, and mental resilience.

18

Reflection after success

When you "succeed" in the cryptocurrency market, you may find that it is not what you initially wanted. You have money, but you are still the same you. Money does not solve all problems. If your only goal is money, you may feel empty or even depressed after achieving success. Therefore, set goals that are more important than money, such as personal growth, family happiness, or social contribution, to make your success more meaningful.

Article link: https://www.hellobtc.com/kp/du/05/5871.html

Source: https://mp.weixin.qq.com/s/AQLzJ17kvbrVHTJmyNTPEA

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。