The essence of trading is survival, and only then comes profit. Therefore, before each operation, think carefully about whether your actions are reasonable and whether your capital is safe. You need to develop a trading mindset that belongs to you, continuously optimizing and improving it. Although the suggestions from the crypto circle academicians may not make you rich overnight, they can help you persist. Only those who survive in the crypto space for the long term and stick it out until the end can achieve the results they desire. I hope you understand this.

I am a warrior in the crypto circle, always protecting the retail investors. I wish my followers financial freedom by 2025. Let's work hard together!

Crypto Circle Academician: Latest Bitcoin (BTC) Market Analysis on May 30, 2025

The current price of Bitcoin is 107,000. It is now 1:30 AM Beijing time, and the market has been stagnant for a day. The shorts have not yet arrived. Everyone is talking about Trump betting 3 billion on the crypto market? How is he betting? Is he betting on Bitcoin at 110,000? Don't be ridiculous; don't let the aggressive traders in the North market brainwash you. Think clearly: if you were Trump, would you bet at the historical peak? Don't blindly chase trends in trading. My simple thought is that above 110,000 is an opportunity to short. At least since the 26th, when it was 110,000, those who got in have already seen over 3,000 points in profit before this article is published.

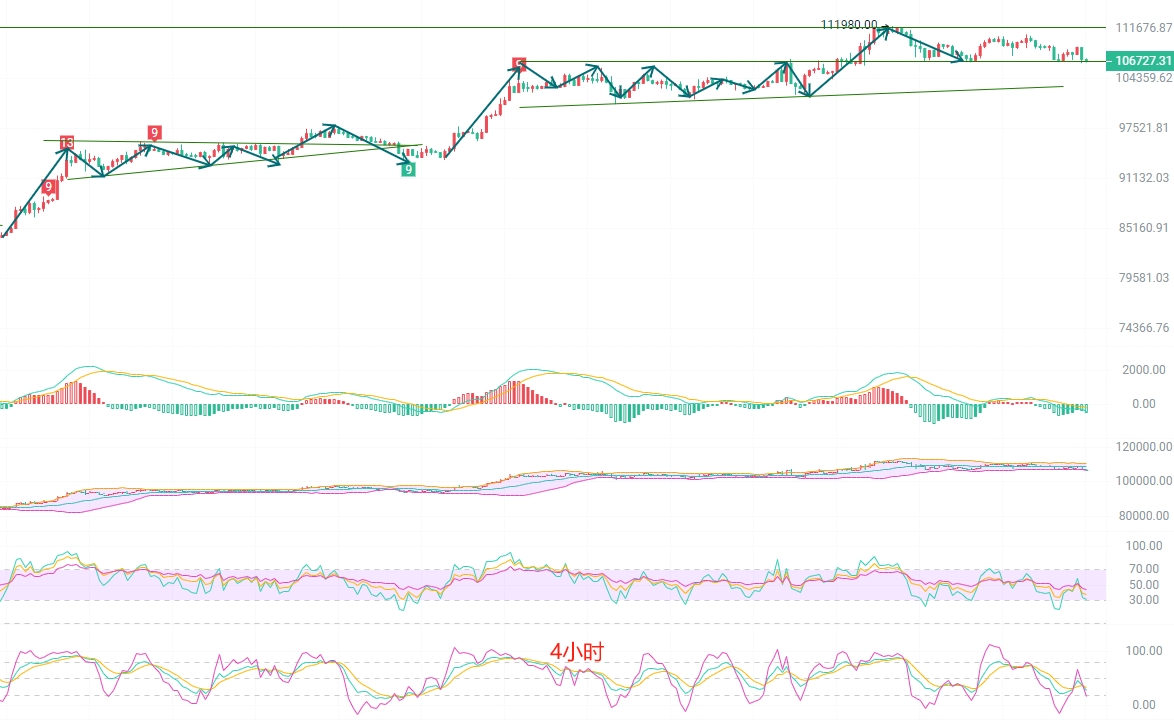

The daily K-line has three consecutive bearish candles, with a high of 108,900 and a low of 106,500, breaking below the EMA15 trend support at 106,800. Pay attention to the next trend support EMA30, which is the trend exchange point I have been mentioning these days at 103,000. The bearish momentum is already very obvious in the short term, and it is not ruled out that the main force may return to the 100,000 mark for sideways trading. The MACD top divergence has lasted too long, continuously reducing volume and increasing positions, with the bearish sentiment strengthening. After the Bollinger Bands contracted, the upper resistance level has reached 111,000, while the lower support level is at 101,000.

The four-hour K-line has broken below the EMA90 trend support at 106,700. Currently, the trend indicators are contracting downwards, with MACD reducing volume and increasing positions. The DIF and DEA have fallen below the 0 axis, and the K-line has reached the lower Bollinger Band at 106,500, enhancing the bearish momentum. As long as there is an effective break below the entity, without any positive stimulus, the bearish sentiment is basically without suspense. For those who are looking at us eating meat while waiting for the next opportunity below 110,000,

Short-term reference: The market is never 100% certain, so always set stop-losses. Safety first; small losses and big gains are the goal.

For the North market, try a position between 103,500 and 103,000 long, with a stop-loss at 102,500, risking 500 points, targeting 104,500 to 105,500, and if broken, looking at 106,500.

For the South market, reference points are 110,000 to 109,500 short, with a stop-loss at 109,000, risking 500 points, targeting 108,000 to 107,000, and if broken, looking at 106,000.

Specific operations should be based on real-time market data. For more information, you can consult the author. There may be delays in article publication; the suggestions are for reference only, and risks are borne by the reader.

This article is exclusively contributed by the Crypto Circle Academician and represents the unique views of the Academician. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions are not real-time and are for reference only. Risks are borne by the reader. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The Academician also hopes that all investors understand that the market is always right. If you are wrong, you should summarize where the problem lies. Don't let the profits that should be yours slip away. There is no need to be smarter than the market in investing. When a trend comes, respond and follow it; when there is no trend, observe and remain calm. It is not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often happen unexpectedly. Develop the habit of strictly setting stop-losses and take-profits for each trade. The Crypto Circle Academician wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。