Bitcoin and Ether ETFs Soar with Nearly $520 Million in Combined Inflows

Momentum doesn’t seem to be fading in crypto ETF markets, with both bitcoin and ether funds charging into another day of aggressive accumulation.

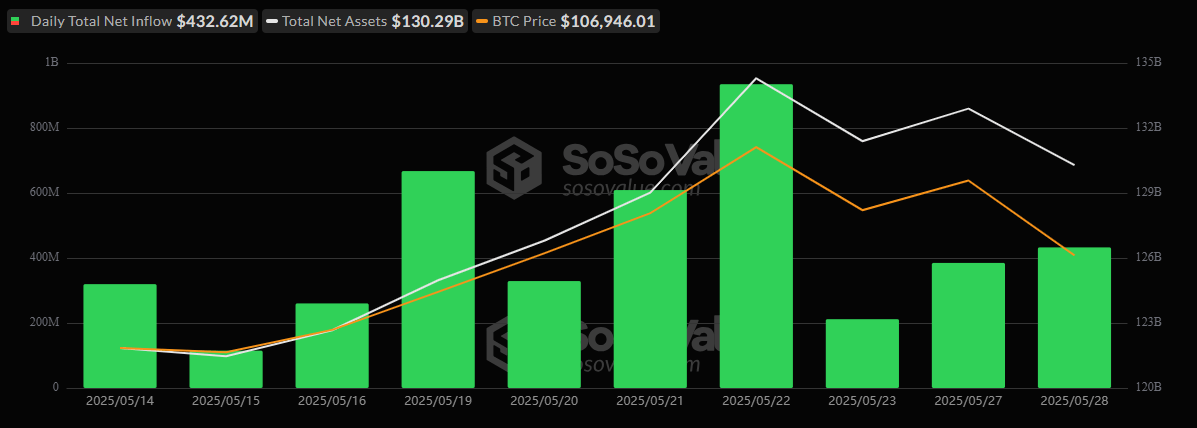

Bitcoin ETFs celebrated their 10th consecutive day of net inflows, pulling in $432.62 million. The entire haul came from Blackrock’s IBIT, which continued to assert dominance with a $480.96 million injection.

Despite outflows from Ark 21shares’ ARKB ($34.29 million) and Fidelity’s FBTC ($14.05 million), the strength of IBIT’s appeal kept the streak alive. Total trading volume reached $3.50 billion, and total net assets settled at $130.29 billion.

Source: Sosovalue

Meanwhile, ether ETFs saw $84.89 million in inflows, pushing their streak to 8 days in a row. Leading the way was Blackrock’s ETHA with $52.68 million, followed by Fidelity’s FETH ($25.71 million), Grayscale’s Ether Mini Trust ($4.93 million), and Invesco’s QETH ($1.57 million). Total value traded came in at $459.49 million, with total net assets closing at $9.48 billion.

Even as broader markets fluctuate, institutional appetite for crypto exposure through ETFs remains decisively bullish, powered by consistent capital rotation into top-performing funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。