Original Title: "Uniswap: The Crypto Unicorn Under Regulatory Constraints, The Largest Dex Protocol on Blockchain"

Original Source: Trend Research

Since the recent surge in ETH prices, ETH has risen 48% online in the past month, driving up the prices of various ETH ecosystem projects. Historically, blue-chip assets in the ETH ecosystem tend to exhibit a multiplier effect during upward cycles. UNI is one of the blue-chip assets that Trend Research focuses on within the ETH ecosystem portfolio, currently up 28% in the past month, showing potential for further gains if the market continues. Additionally, UNI has certain alpha potential under the beta of the ETH market, driven by potential expectations of macro regulatory easing, leading business data, and structural price increases of the token.

I. Macro Regulatory Situation

Regulatory Ambiguity Period (2021-2023): On September 3, 2021, the SEC launched an investigation into Uniswap Labs, focusing on its marketing methods and investor services. SEC Chairman Gary Gensler has repeatedly stated that DeFi platforms may involve securities regulations, emphasizing the need for more regulatory authority. This investigation sparked widespread discussion in the industry, making it a key issue in crypto regulation whether UNI and similar governance tokens are considered securities. On August 30, 2023, Uniswap won a collective lawsuit against it, with the court dismissing the charges, ultimately ruling that the Uniswap protocol is primarily used for legitimate purposes (such as ETH and BTC trading) and lacks clear regulatory definitions to support the plaintiffs' securities claims.

Regulatory Pressure Period (2023-2024): On April 10, 2024, the SEC issued a Wells Notice to Uniswap Labs, accusing the Uniswap protocol of potentially operating as an unregistered securities exchange, with its interface and wallet possibly acting as unregistered securities brokers, and UNI tokens and liquidity provider (LP) tokens potentially being viewed as investment contracts. On May 22, Uniswap Labs submitted a 40-page Wells response document, refuting the SEC's accusations. Uniswap Labs described its protocol as a general technology platform, not specifically designed for securities trading, and noted that 65% of its trading volume involves non-security assets (such as ETH, BTC, and stablecoins). Chief Legal Officer Marvin Ammori stated that the SEC needs to redefine "exchange" and "broker" to regulate it and believes the SEC's accusations are based on a misclassification of the tokens.

Regulatory Easing Period (2025 to Present): On February 25, 2025, the SEC announced the termination of its investigation into Uniswap Labs and would no longer pursue enforcement actions. Uniswap Labs announced this outcome on X, calling it a "major victory for DeFi" and emphasizing the legitimacy of its technology. This event reflects a shift in the SEC's attitude towards crypto regulation following the Trump administration's arrival. On April 8, 2025, the SEC invited Uniswap Labs and companies like Coinbase to participate in a crypto roundtable to discuss crypto trading regulation. On May 5, 2025, several Republican members of the U.S. House Financial Services Committee and Agriculture Committee jointly released a new discussion draft on crypto industry regulation, continuing and expanding upon the core content of the previous "Financial Innovation and Technology Act of the 21st Century" (FIT21 Act), further refining and expanding the regulatory framework for digital assets. The new draft aims to clarify that transactions involving the sale of digital goods do not constitute securities as long as they do not involve the buyer obtaining ownership rights in the issuer's business, profits, or assets. The House plans to release an updated text of the lower house's digital asset market structure bill on May 29. The updated text follows the discussion draft released on May 5, and this advancement in market structure legislation is widely seen as the foundational blueprint for the future of U.S. regulation and trading of digital assets. The House will review the crypto market structure bill on June 10.

Currently, from the beginning of 2025 when the SEC effectively terminated its investigation into Uniswap Labs to the current definition of what does not constitute a security in the crypto market structure bill, Uniswap's current token economics scheme means that UNI no longer faces litigation risks. With the arrival of Trump and his administration, the direction of crypto regulation is designed to adapt to the development of the crypto industry regarding asset classification methods, the Howey test, and the division of regulatory agency functions, and discussions with leading U.S. crypto teams. Uniswap Labs has also played an important advisory role in this process. After comprehensive deregulation, there may be further positive expectations for regulation in the future.

II. Project Business Situation

1. Top Business Data

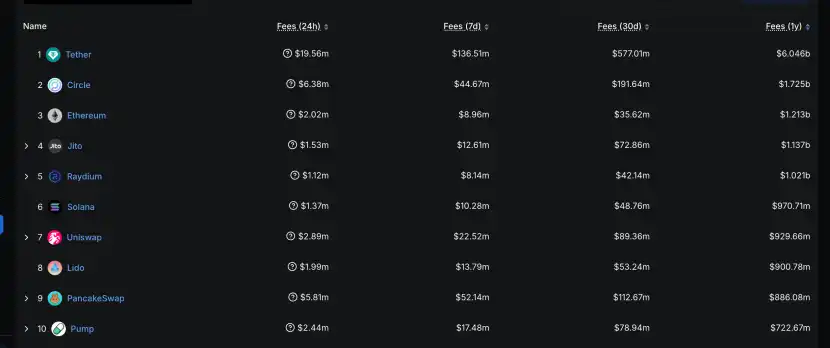

Uniswap is the earliest and largest Dex protocol in the crypto market, currently with a TVL of $5.12 billion and a trading volume of $84.5 billion in the past 30 days, ranking second after Pancake. Before the launch of Binance Alpha features, Uniswap's trading volume consistently ranked first in the market, generating $929 million in revenue over the year, ranking seventh. If calculated using traditional valuation methods, the P/E ratio is approximately 4.5–6.4, while Coinbase's P/E is about 33–42, Apple's P/E is about 28–35, and Tesla's is about 50–70. If UNI's "fee switch" can be activated in the future or if regulatory easing allows it to expand its financial application scenarios (currently, UNI holders do not participate in profit distribution), its current market value is significantly undervalued relative to its business profitability.

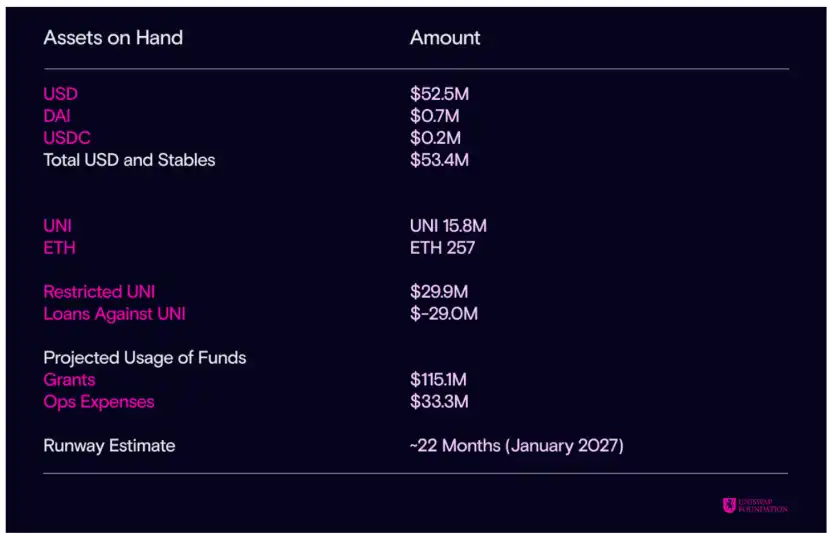

According to the Uniswap Foundation's Q1 2025 financial summary, as of March 31, 2025, the foundation holds $53.4 million in USD and stablecoins, 15.8 million UNI (valued in UNI), and 257 ETH, which, based on the closing exchange rate on May 28, 2025, amounts to approximately $150 million in tokens. The expected turnover period will last until January 2027, and it currently has a good financial condition.

2. Token Economic Empowerment Attempts

In the past, the methods for generating income from UNI's token economics mainly involved adding UNI to specific trading pools as LPs, staking UNI to participate in DAO governance to propose buybacks or liquidity incentives. However, these earnings are indirect and often yield low returns, and directly holding UNI does not generate income, which is a primary reason why UNI's token price has not risen to high levels. However, Uniswap Labs has been continuously attempting to empower its token economics, repeatedly proposing a fee switch, which has not been substantively approved or implemented due to regulatory risks. The latest fee switch proposal was restarted in February 2024, and passed a technical vote in May, with further on-chain voting expected in the second half of 2025. With the gradual advancement of the regulatory framework, the fee switch may be activated in the future.

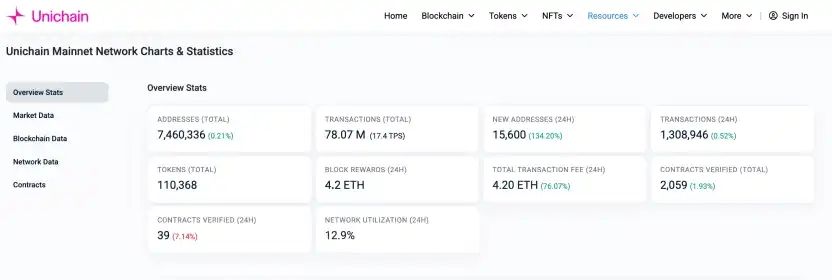

In addition to the fee switch, Uniswap's newly launched Unichain also provides new application scenarios for UNI. Unichain is a Layer 2 (L2) blockchain announced by Uniswap Labs on October 10, 2024, based on the Optimism OP Stack's Superchain framework, officially launching its mainnet on February 13, 2025. Uniswap Labs CEO Hayden Adams believes, "After years of building and expanding DeFi products, we have seen where blockchain needs improvement and the conditions necessary to continue advancing the Ethereum roadmap. Unichain will provide the speed and cost savings achieved by L2, better cross-chain liquidity acquisition, and greater decentralization."

Like other L2s, Unichain also has a validator network that uses UNI as the staking token. Node operators must stake UNI on the Ethereum mainnet to become validators in the UVN (Unichain Validator Network). The amount staked determines the probability of being selected as an active validator. Earnings come from 65% of net chain revenue (including base fees, priority fees, and MEV), distributed according to staking weight. Currently, the official has not disclosed specific staking scales, but Uniswap Labs continues to support Unichain, and if its yield and ecological scale gradually expand, more UNI staking may be introduced to become validators and earn rewards.

III. Token Situation

UNI currently has a circulating market value of $4.2 billion, an FDV of $6.7 billion, with the token fully circulating and approximately 37% locked in staking.

The contract holding volume is 448 million, with an OI/MC of approximately 10.6%. The aggregated long-short ratio is 1.02, with a long-short ratio of 2.16 on Binance accounts and 3.87 for large account holdings. More long positions come from large holders, and since the ETH price increase, UNI's OI has also been gradually rising, indicating active trading in the derivatives market.

In the spot K-line, during the pattern of ETH's rise last November, UNI exhibited a similar trend to ETH in terms of shape, but with a volatility approximately 2-3 times that of ETH. However, in the recent rise of ETH in April, both showed similar trends, but ETH's increase was higher than that of UNI. If the market continues, UNI may have further potential for gains.

III. Conclusion

Since Trump was officially elected President of the United States in 2025, how to regulate and integrate the crypto industry has become the most important theme. As the largest Dex protocol in the crypto market, how the U.S. regulates UNI will serve as a model for the entire industry. Uniswap Labs is also actively participating in the formulation of regulatory rules. Combined with the multiplier effect of ETH, it may usher in structural opportunities. The project's own business data occupies a leading position in the market, with considerable profits and good financial health. The advancement of the Unichain project and the proposal of the fee switch may bring new empowerment to the token. If the future market looks promising, UNI is one of the blue-chip assets worth paying attention to in the ETH ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。