This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

Bitcoin ranged last week. The week started with bitcoin briefly topping $105,000 as U.S. Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng worked on resolving the trade war. While weekly bullish bitcoin news continues to come out, it feels like we’re consolidating before the next leg up. Last week, another bitcoin treasury company with big backers was announced, this time backed by BTC Inc. CEO David Bailey and Vaneck.

Next, what has the potential to be the beginning of a major trend shift, a Chinese publicly traded company DDC Enterprise (NYSEAM: DDC) announced plans to acquire 5,000 bitcoin by mid-2027. The fact that a Chinese-linked company has publicly announced it is buying bitcoin, increases the likelihood that the Chinese government is softening its stance towards bitcoin and crypto.

Bitcoin didn’t really go anywhere, but the crypto market increased to $3.33 trillion as altcoins like Ethereum, up 44.8% from the lows, and others posted impressive gains, fueling speculation that an altcoin season may be approaching. Despite the excitement, this altcoin season indicator remains low at 24—well below the 75 needed to confirm the trend.

Many have called the top of the BTC.D (Bitcoin Dominance) chart, or the bottom of the ETH/ BTC chart (people have been calling this bottom for 18 months), but I’m sticking with what I wrote last week. Namely, it seems more likely that bitcoin will lead alts with another leg up, and probably top in the lower 70% dominance range.

Coinbase had a rollercoaster ride of a week. The highs: On Monday, S&P Dow Jones Indices announced that Coinbase will be added to the S&P 500, making it the first cryptocurrency company to join the illustrious index. Coinbase “is about to be in everyone’s 401K.” The lows: On Thursday, Coinbase announced that, “Cyber criminals bribed and recruited rogue overseas support agents to pull personal data on <1% of Coinbase MTUs.” My best to Brian Armstrong and the Coinbase team, who weather crises at a world-class level.

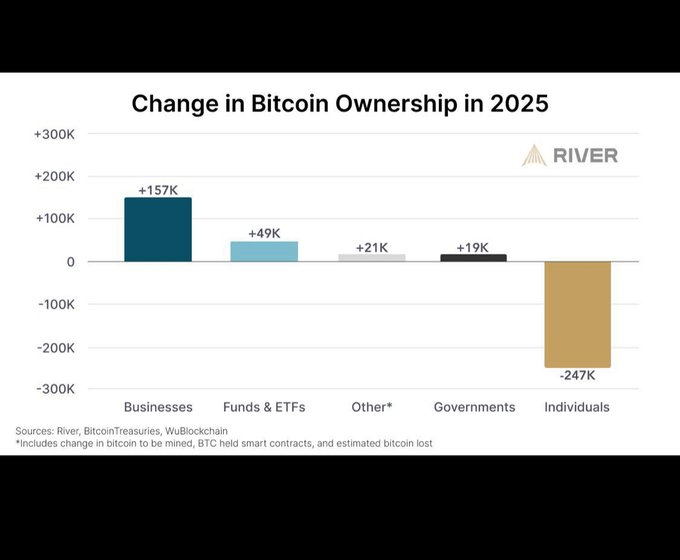

Let’s end with a grab bag of news. As a consistent critic of Pumpfun, it wasn’t surprising to find out from Su Zhu that their 50% creator revenue share is actually just an additional fee they’ve passed on as a cost to traders. That 50% share only applies for graduated coins, for the “99%+ of coins which never graduate out of the bonding curve [the creator revenue share is] 5%.” Dastardly. On a somewhat related note, this X post showing the change in Bitcoin ownership in 2025 is a downer. The individual share of bitcoin holdings continues to shrink. As discussed in last week’s episode of Token Narratives, I can envision a future 100 years from now where 99%+ bitcoin is owned by businesses or institutions. So much upsetting the existing centers of power and money.

Speaking of Token Narratives, last week marked the 1-year anniversary of the podcast! I’d like to thank my co-host Graham Stone, who is more akin to the show’s host, and I’m more like a semi-permanent guest. I’ve missed a handful of shows due to traveling to conferences. Also, a big thanks to Bitcoin.com CEO Corbin Fraser who carved out time from his schedule in those early days of the podcast to give it some legitimacy, and to make sure we didn’t suck too badly. I take the fact that he’s stepped away from appearing every week as tacit approval of what we’re doing!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。