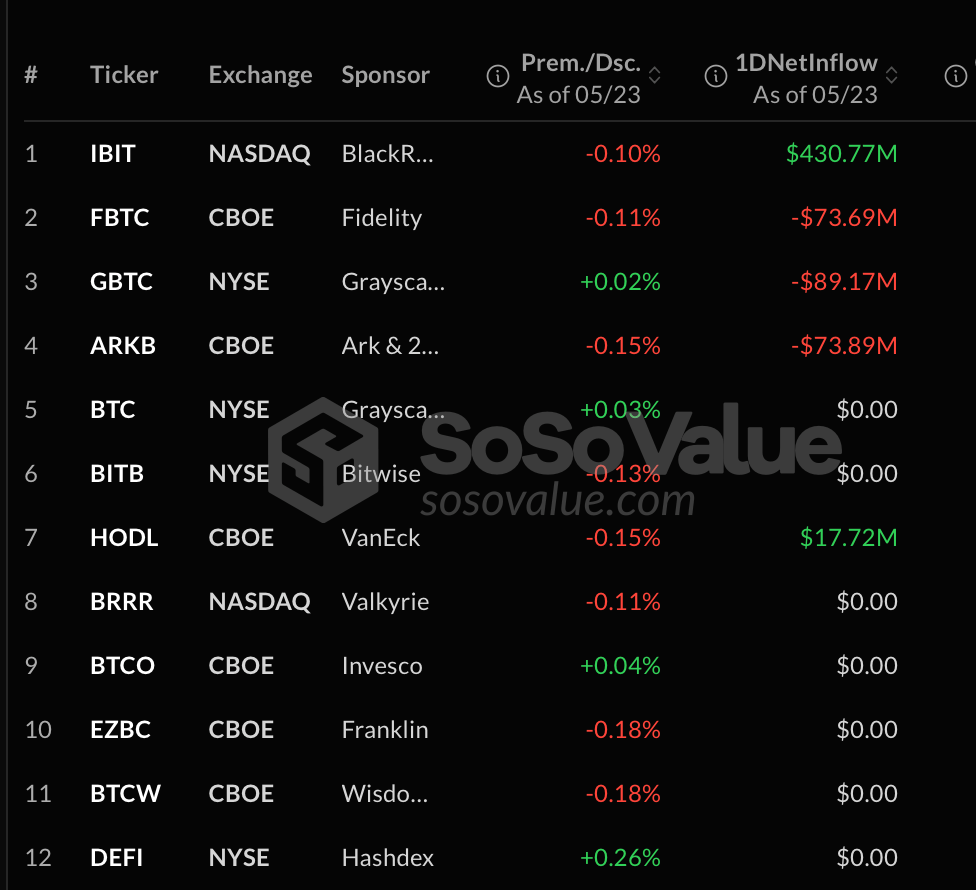

Sosovalue.com stats show spot bitcoin ETFs attracted $211.74 million during the May 23 trading session, pushing cumulative inflows to $44.53 billion since their Jan. 11 launch. The largest gainer was Blackrock’s IBIT, which pulled in $430.77 million.

Spot bitcoin ETF flows as of May 23, 2025.

Vaneck’s HODL also saw modest gains at $17.72 million. However, several prominent funds recorded outflows: Grayscale’s GBTC shed $89.17 million, Fidelity’s FBTC lost $73.69 million, and Ark Invest’s ARKB saw $73.89 million exit.

A number of funds, including Grayscale’s Mini Bitcoin fund, Bitwise’s BITB, and Valkyrie’s BRRR, were flat on the day, showing no net inflow or outflow activity. The U.S. bitcoin ETFs collectively hold $131.39 billion in BTC or around 6.11% of BTC’s market cap.

On the ethereum side, ETFs brought in a combined $58.63 million, lifting total net inflows to $2.76 billion since the funds started trading on July 23, 2024. Blackrock’s ETHA led with $52.84 million in new capital.

Grayscale’s Mini Ethereum fund added $5.79 million, while its ETHE product remained neutral. All other funds, including those offered by Fidelity, Bitwise, Vaneck, and 21shares, posted no inflows or outflows.

The split between high net contributions and neutral or negative flows highlights ongoing investor selectivity in both the bitcoin and ethereum ETF markets. Inflows suggest that institutional appetite remains steady—and it’s clearly tilting in bitcoin’s favor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。