The Hangzhou-headquartered enterprise, Jiuzi Holdings (Nasdaq: JZXN), stated that its board approved the dual-path acquisition strategy as part of a broader initiative to diversify its holdings and tap into bitcoin’s projected long-term value. The decision reflects JZXN’s conviction in blockchain’s promise amid the widening adoption of digital currencies.

Funding for the acquisition will stem in part from an upcoming equity offering, while the balance will be covered by internal capital and third-party financing. The company emphasized that the strategy is designed to balance risk while paving the way for sustained profitability.

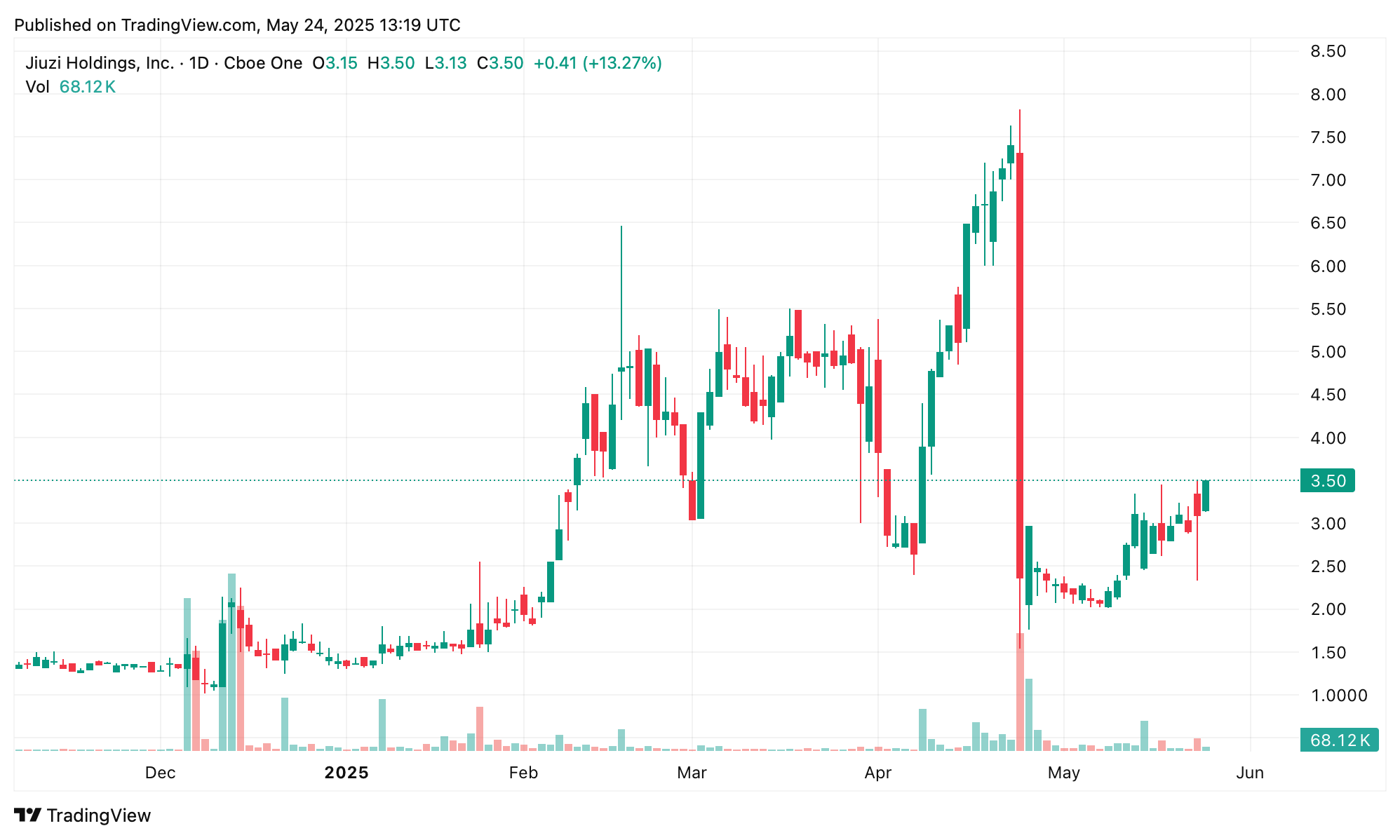

JZXN shares.

JZXN shares jumped 13.27% on Friday following the news. Bitcoin’s liquidity and potential for value appreciation played central roles in shaping the move, JZXN said, while noting the cryptocurrency’s price volatility. The CEO pointed to a “long-term bullish belief” in blockchain’s potential applications beyond cryptocurrencies.

“Through this acquisition, we will further enrich our company’s asset structure and enhance our risk resistance and profitability,” the CEO noted, further stating that JZXN will pursue additional blockchain-related initiatives across various industries.

No specific timeline or financial parameters were disclosed regarding the planned stock issuance. The announcement comes as corporate interest in cryptocurrency continues to expand, with JZXN joining other companies that are incorporating digital assets into treasury and innovation strategies despite regulatory ambiguities and market flux.

Founded in 2010, Jiuzi Holdings operates across the automotive and tech sectors. Its 2021 debut on the Nasdaq marked a push toward international growth. The bitcoin ( BTC) acquisition marks its latest move toward evolving financial technologies.

JZXN becomes the latest entrant in an expanding cohort of firms turning to bitcoin for treasury allocation, joining names such as Abraaj Restaurants Group, Digiasia, Twenty One Capital, DDC Enterprise, Meliuz, Heritage Distilling Holding Company, Inc., and Basel Medical Group—all of whom made similar moves within the past week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。