Original Title: The "AI" Guide to Capturing Mindshare (for Projects)

Original Authors: @Defi0xJeff, @steak_studio Lead

Original Translation: Rhythm Little Deep

Editor's Note: In the context of fierce competition in the token market and scarce attention, Web3 projects need to break through with precise strategies. Reserve 2-5% of tokens to incentivize community promotion, replacing traditional KOL marketing; choose high-potential launchpads like virtuals; develop unique AI agent workflows to optimize user experience; and ensure market fit through clear documentation, rapid iteration, and community communication. Teams with strong execution have a hundredfold potential, and investors should focus on their actual actions rather than just narratives.

The following is the original content (reorganized for better readability):

Rising Attention Costs

- There are millions of tokens in the market, with thousands added daily.

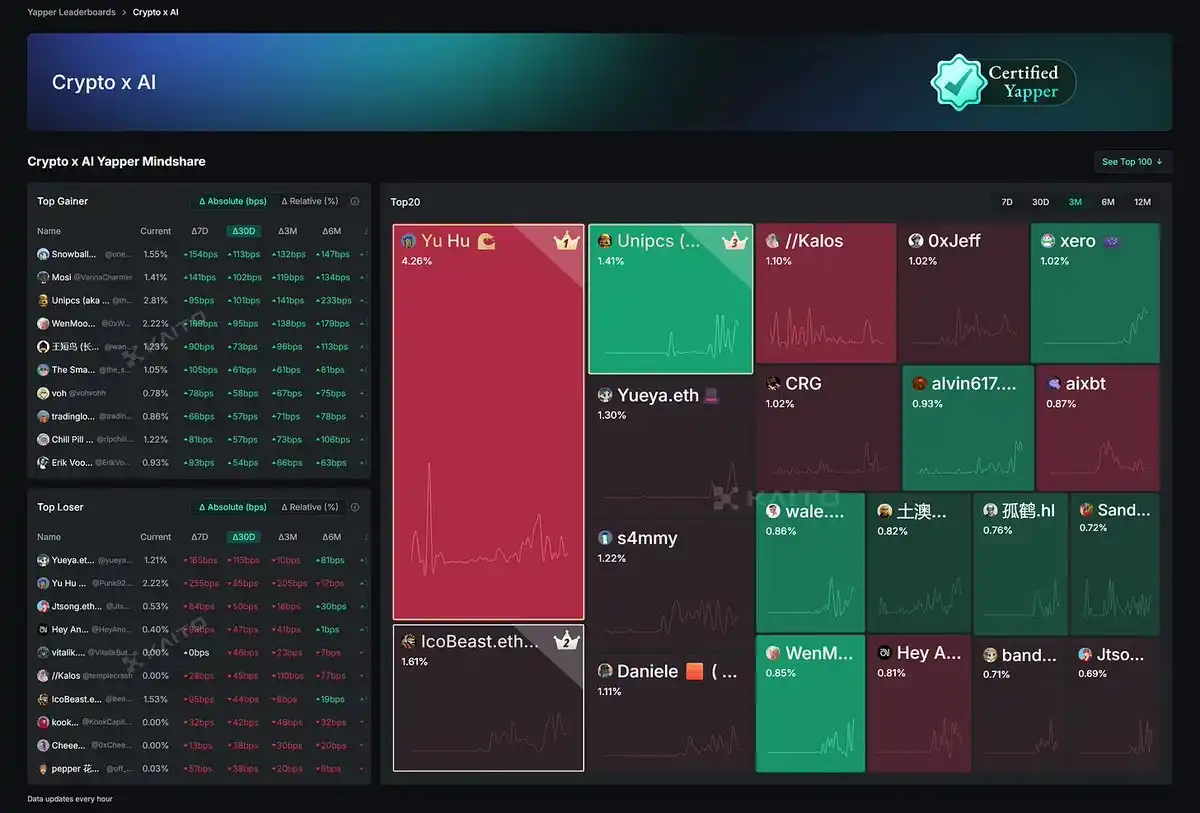

- On the @cookiedotfun platform, the number of AI agent tokens surged from 200 to 1,700.

- On the @virtuals_io platform, the number of conscious agents increased from 100-200 to over 700 (with a total agent count exceeding 15,000).

With each new token, attention resources become scarcer, and market liquidity is further dispersed, especially when the number of market participants remains unchanged (the same group of speculators repeatedly delving into a few areas).

More "dotfun" casinos are emerging, attracting the same group of opinion leaders (KOLs), investors, and developers. This further reduces the attention that legitimate projects hoping to launch quality products in the Web3 space can garner.

From a project perspective, simply having a good product is not enough to attract market attention, onboard users, and find product-market fit. Projects need to implement the right growth strategies, leverage the best distribution channels, engage the right communities, set appropriate narratives and stories, and launch products that can solve significant problems or provide enough value to attract substantial headline metrics (TVL, trading volume, DAU, MAU, revenue).

In this article, I will share some high-quality growth strategies to help projects increase their chances of success when launching products and tokens. For investors, pay attention to projects implementing these strategies, as they often achieve positive price performance through executing these strategies.

Incentivizing "Chatty" Individuals

The year 2025 is set to be extremely favorable for content creators, thanks to @KaitoAI.

The team has created an incentive layer that encourages "chatty" individuals to publicly share quality content about projects on the X platform. Instead of the traditional methods of completing tasks on Discord, participating in testnets and on-chain tasks, providing liquidity, or engaging in wash trading on platforms, you only need to talk about the project. The "chatty" incentive layer has been widely adopted by projects and is even starting to become the norm.

Rather than setting a fixed budget for opinion leaders (KOLs), reserve 2-5% of the token supply to establish ongoing incentive activities to reward "chatty" individuals. This is more beneficial for both opinion leaders and grassroots community members, as you are incentivizing everyone to talk about your project.

(Today, thought leaders and top KOLs are more inclined towards the "chatty" incentive layer rather than private transactions, as it feels more natural and stems from passion rather than feeling like they are being hired to post content.)

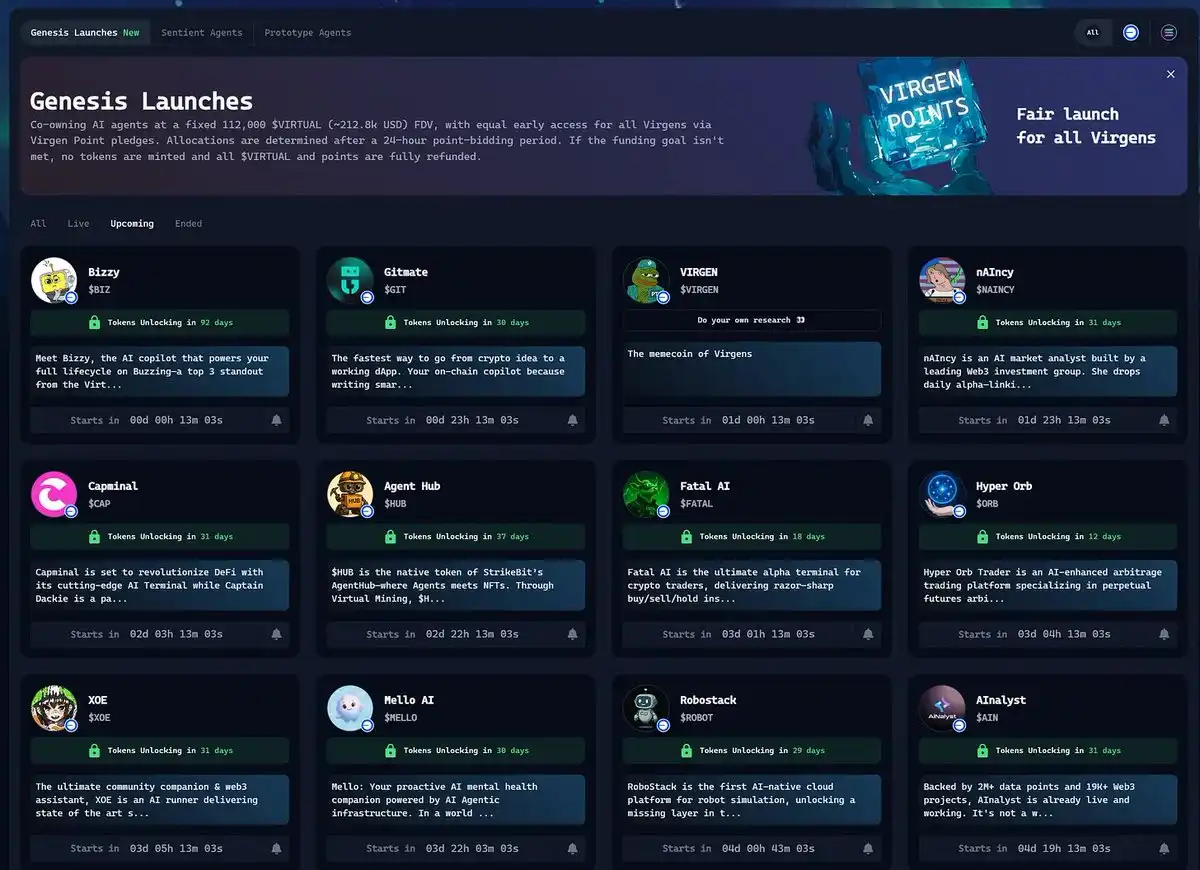

Choosing the Right Launchpad

The choice between self-issuing tokens or launching through a launchpad can determine a project's success or failure. AI-related projects have been the most attention-grabbing category in the market over the past year, so adjusting your product to meet "AI" requirements and launching on the top AI launchpad @virtuals_io is a wise choice.

Currently, @virtuals_io is the leading AI launchpad, with very low AI requirements that are almost negligible. Virtuals offers the best trading structure, ensuring maximum "pump" potential through its points program and Genesis issuance setup.

Of course, there are other launchpads in the market, but none provide as many distribution resources (market attention, holders, potential users) as Virtuals.

Challenges and Strategies for Using Virtuals as a Launchpad

You must adhere to its customary tokenomics structure: 37.5% for public sale + 12.5% for liquidity. This means the majority of the token supply belongs to the community—you cannot conduct large-scale private placements and can only raise $50,000 to $100,000 at a fully diluted valuation (FDV) of $1 million to $2 million to bring in strategic investors (raising too much may cause community dissatisfaction).

You cannot raise funds from venture capital (VC) or allocate a large proportion of tokens to the team. The team's main return comes from transaction fee sharing (70% of a 1% transaction fee).

Alternatively, if your project requires $1 million to $5 million in investment, with a valuation between $15 million and $30 million for scaling, you might consider issuing two types of tokens. One is the AI agent token, used to build the community, create buzz, and showcase product or platform capabilities; the other is the main token.

The challenge of maintaining momentum is that you need to plan product and partnership launches, content plans, and communication strategies in advance to ensure user and holder engagement before and after the token generation event (TGE). Ideally, your product should be ready at launch (or within a week after the token issuance).

If you’ve read this far, you might be wondering: how to integrate AI into the product, not just for hype, but to add value to the core of the product?

Top Agent Workflows/AI Use Cases Applicable Across Industries

If you choose the route of issuing two types of tokens, your AI agent token should serve as the flagship agent, truly showcasing the capabilities of your platform or infrastructure, such as the Ava 3D character from @HoloworldAI, Luna from @virtuals_io, or BigTony from @Cod3xOrg.

What these agents have in common is their unique personalities, styles, and capabilities.

You can choose different levels of agent workflows and use cases (you can launch multiple simultaneously for maximum effect, or select a few that best fit your product):

Use ready-made frameworks on the X platform (like @elizaOS, @GAME_Virtuals, @arcdotfun) to create chatbots, input unique data sources to share insights.

DeFAI abstraction layer—create a ChatGPT-like interface (as a terminal or chatbot on existing platforms), changing the way users interact with the product, allowing users to ask questions directly in the chatbot or use the product directly.

Extend the DeFAI abstract interface to the X platform, allowing users to execute strategies, ask questions, or interact with your protocol directly on X, which is the center of cryptocurrency attention (X = the "town square" of cryptocurrency).

Extend it to other social media or workflows where potential users are located, such as Instagram, Facebook, LinkedIn, Telegram, Discord, Gmail, Rabby/Metamask, Coingecko, Zerion, etc., with endless possibilities.

Integrate AI directly into the product—specific methods depend on your product type:

⇢ If it’s a trading/prediction product, leverage specific domain machine learning model providers, such as Bittensor subnet intelligence (PTN, Sportstensor, Score) or @AlloraNetwork's inference infrastructure, using their intelligence for better trading or betting, such as @AskBillyBets (powered by @sportstensor), @thedkingdao (powered by @webuildscore), @Cod3xOrg (powered by Allora).

We have also seen non-agent teams utilizing Allora's inference, such as @vectisfinance achieving over 24% annualized yield in USDC based on Allora's SOL price predictions.

⇢ If you design workflows where AI agents trade/bet/make financial decisions directly, let the agents manage their own funds/pools/treasuries instead of client funds to reduce risk while demonstrating that agents can efficiently earn money for users through products/intelligence.

You can use a portion of the transaction fees received to increase their funds. Once the agents accumulate a certain profit, they can use part of the profit to buy back tokens and burn them (for narrative purposes).

Everyone loves public trading challenges, especially those executed by agents.

⇢ If you have multiple yield products, you can utilize agents to recommend the best products based on different parameters.

You can also enable interactions with third-party decentralized applications (dApps)/tools, but you need to set session keys/smart accounts to grant limited permissions, avoiding exposure of user private keys. @gizatechxyz is an excellent case study in this regard.

TOP Unique Case Studies

DeFi

@BasisOS, currently has few AI applications, but promises three phases of AI involvement in its core product ➔ Successful issuance, $BIOS surged due to the high "pump" potential of the Virtuals Genesis issuance structure and the value appreciation of Basis trading products.

@gizatechxyz, a fully autonomous and personalized financial agent, optimizes investments for your stablecoin. The on-chain agent generated over $3 million in TVL and $32 million in trading volume, showing significant appeal.

Prediction@askbillybets, the first to launch a prediction agent that bets using its own pool in the sports market, participating in betting leagues and outperforming many humans. Despite a positive net investment return, the agent continues to optimize its advantages, surpassing the market in multiple leagues.

I can only think of these three impressive and highly unique cases. Of course, there are many AI-driven Alpha/analysis platforms and agents that trade for you.

But currently, none perform particularly reliably or excellently (I had hoped to try the trading agent from @Almanak__, but the team's progress has been slow; @Cod3xOrg also has potential, but the UI/UX is still challenging for building effective agents).

There are huge opportunities yet to be tapped—I have yet to see the emergence of DePIN, RWA, NFTs, options, perpetual contracts, and liquidity provision/yield farming agents.

Additional Advice: Incorporate MCP into your roadmap to ensure that other agents can access your tools/API through MCP, while also ensuring you integrate other high-quality tools that benefit your agents.

Integrating All Elements

Ensure there is clear and robust documentation explaining how the product works, how the tokens are linked to the product/how they appreciate in value, and plan community growth initiatives and partnerships in advance.

Maintain consistent communication with partners and the community, quickly address shortcomings, clarify the way forward, release quickly, iterate rapidly, and most importantly, listen to community feedback.

Summary

Simply having a good product is not enough to stand out—projects must compete for limited attention.

Use a portion of the token supply to incentivize "chatty" individuals to naturally kickstart your community.

Choose the right launchpad—@virtuals_io offers "pump" potential and distribution capabilities.

Build agent workflows to showcase platform capabilities and create unique AI agents.

Integrate AI in a value-added way (e.g., DeFAI abstraction layer, bringing products to where users are).

Provide clear documentation, release and iterate quickly, smartly choose partners, and listen to community feedback.

Implications for Investors

If you find a team that can execute at least 50% of the strategies mentioned in this article, you have found a dark horse with 100x potential.

If the team can execute 100%, that’s a 1000x potential.

These strategies do not guarantee success, but in a market filled with noise (and tokens), they provide teams with a real opportunity to stand out. It’s easy to talk about AI and growth, but building with clear intent is much rarer.

Teams that perform well will not only successfully launch—they will become leaders. These are the teams worth paying attention to.

For investors: focus on the actual actions of the team, not just their rhetoric. The team's execution capability is what matters most.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。