Key Points

Bitcoin's supply tightens after the halving (74% of on-chain assets are long-term locked, 75% have not moved for ≥6 months), with a significant reduction in floating supply, further bullish outlook.

Trading activity remains strong (average daily active addresses around 735,000 over 30 days, daily transactions 390,000–400,000), NVT golden cross at 1.51, indicating that BTC/USD valuation has real usage support.

Holder metrics (realized market cap over $900 billion, SOPR ≈1.03, MVRV ≈2.3×) show strong confidence, moderate profit-taking, and controllable selling pressure.

Continuous net outflows from exchanges, high hash rate, and various on-chain valuation models (S2F ~$248–369K, NVT) consistently point to a potential Bitcoin bull market reaching $150,000–200,000 by 2025, but macro and regulatory risks should still be monitored.

The halving in April 2024 will cut Bitcoin's daily issuance to about 900 BTC, resulting in a significant supply shock. Currently, 74% of circulating Bitcoin has been locked for over two years, and about 75% has remained dormant for the past six months. Record hoarding behavior has further tightened the tradable supply, creating a strong bullish atmosphere for BTC/USD contracts and BTC/USDT spot markets.

This article will deeply analyze all major on-chain metrics—from active addresses, NVT, to SOPR, MVRV, as well as hash rate, exchange liquidity, and valuation models (Stock-to-Flow, NVT signals)—to help you understand why most expect Bitcoin to return to or even exceed its historical highs by the end of 2025, and how to position through Bitcoin spot, Bitcoin contracts, or Bitcoin staking.

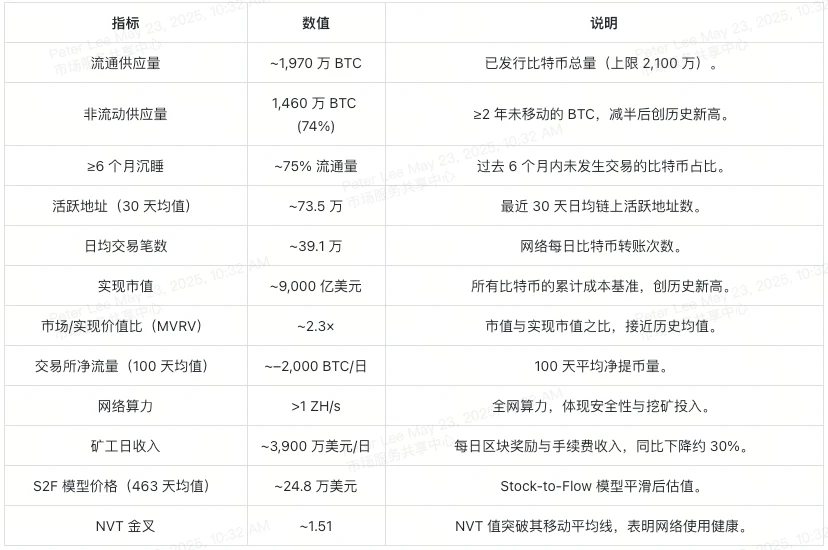

2025 BTC On-Chain Data Overview

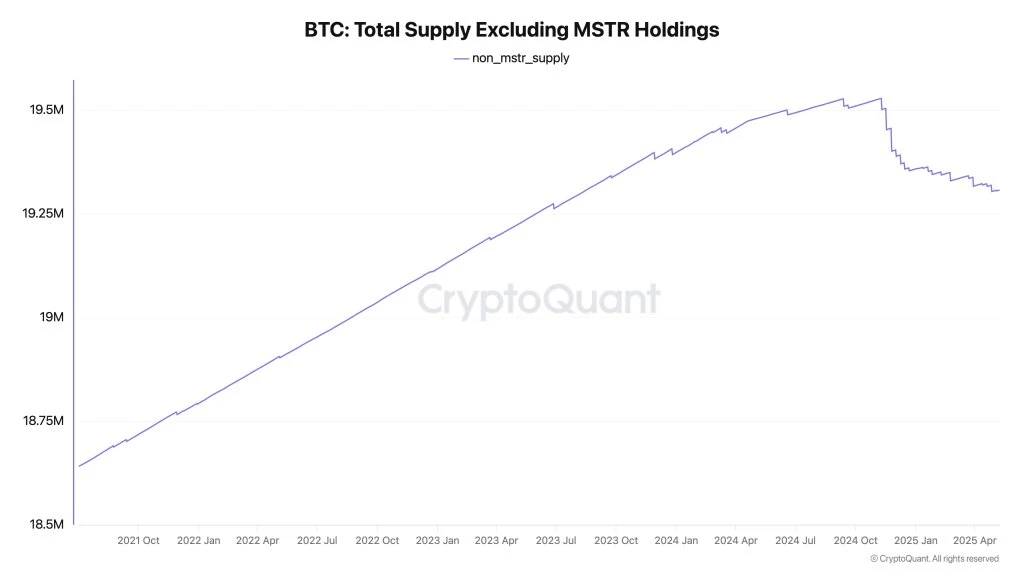

BTC Supply Dynamics

The supply pattern of Bitcoin has changed dramatically after the halving:

Circulating vs. Illiquid Supply

Daily new issuance has been halved to about 900 BTC, slowing the rate of new coin issuance.

Out of 19.8 million in circulation, only 14.6 million BTC have moved in the past two years—74% are long-term locked, with little liquidity.

HODL Wave and Dormant Coins

About 75% of Bitcoin has had zero transactions in the past 6 months.

25% of circulating coins have aged 3–4 years, showing deep conviction in holding.

Insight: Supply Squeeze

The scarcity effect brought by the halving, combined with hoarding behavior at historical highs, has significantly compressed the floating supply of BTC available for sale. Thus, even small-scale Bitcoin spot purchases or Bitcoin contract inflows can exert substantial bullish pressure on Bitcoin prices.

Image Credit: Total Supply and New Supply (CryptoQuant)

BTC Trading Activity

On-chain usage remains robust, not just a temporary speculation:

Active Address Count

- An average of about 735,000 unique addresses are active daily (30-day average), around 60% of historical levels.

Transaction Volume

Daily on-chain transaction count is about 390,000–400,000, with an average transfer value of about $45 billion.

There was a surge in agreements in 2024, after which the volume returned to being driven by core financial demand.

Network Value to Transactions (NVT)

The NVT value golden cross is about 1.51 (not the "bubble" warning line of 2.2), indicating that Bitcoin prices are supported by real value flow rather than pure speculation.

Robust on-chain activity not only solidifies Bitcoin's position as a trading asset but also reinforces its "digital gold" attribute.

Image Credit: Total Bitcoin Transactions (CryptoQuant)

Bitcoin Holder Behavior

Investor confidence remains strong:

Realized Market Cap

- Exceeds $900 billion (a historical high), indicating that a substantial holding cost baseline has been locked in.

Profit Metrics (SOPR & P/L Ratio)

SOPR≈1.03: Tokens that have moved are just slightly profitable.

The realized profit and loss of short-term holders are close to cycle highs but have not yet reached the extreme profit-taking zone.

MVRV Analysis

- Market Cap/Realized Market Cap ratio is about 2.3×; long-term holders have an average profit of +230%, while short-term holders have +13%.

Selling Pressure Risk

- Although selling pressure risk has increased, it remains lower than the peaks of 2017 and 2021, indicating that profit-taking is moderate and has not triggered panic selling.

Overall, holders are selectively cashing out some profits while still retaining core positions, effectively alleviating downward pressure on Bitcoin prices.

Image Credit: Bitcoin MVRV Ratio (CryptoQuant)

Bitcoin Miner Dynamics

Mining economics directly impact BTC prices:

Hash Rate and Difficulty

- Global hash rate has surpassed 1 ZH/s, with mining difficulty reaching new highs—this reflects both the network's security and compresses miners' profit margins.

Miner Sell-Off and Income

On April 7, 2025, miners sold about 15,000 BTC (approximately $1.1 billion) to cash out.

Daily miner income is about $39 million, down about 30% year-on-year.

The rise in difficulty and reduction in block rewards have forced some small mining operations to exit, creating short-term selling pressure; however, it has also optimized the distribution of network hash rate, providing stronger support for long-term BTC prices.

Image Credit: Bitcoin Miner Outflow (CryptoQuant)

Exchange Fund Flows

Exchange flow metrics reveal market liquidity:

Net Flow Trends

- The 7-day moving average net outflow depth is at a near-year high, the most intense since early 2023.

Exchange Holdings

- From April to May 2025, Binance's holdings dropped from about 595,000 BTC to 544,500 BTC, with a net withdrawal of over 51,000 BTC.

Liquidity Impact

- Withdrawals significantly exceed deposits → market available supply becomes tighter, increasing short-term volatility risk.

Institutions and large holders are increasingly turning to cold wallets, reducing the available BTC for sale in the spot market, which means a new wave of spot or contract buying is more likely to drive up BTC/USD contracts and BTC/USDT spot prices.

Image Credit: Bitcoin Exchange Reserve (CryptoQuant)

On-Chain Valuation Models

Quantitative models provide pricing references for BTC:

Stock-to-Flow (S2F)

Model valuation ranges from about $248,000 (463-day average) to $369,000 (10-day average).

Limitations: Recent performance has been slightly low, and the fit for the market after 2021 has declined.

Network Value to Transactions (NVT)

- The NVT value golden cross is about 1.51, confirming that the current valuation is supported by real transaction volume rather than pure speculation.

Other Signals

- Indicators such as the Mayer multiple (around 1.1–1.2), Pi cycle, MVRV Z-score rebound, and Value Days Destroyed (VDD) all point to a healthy bull market phase.

In summary, major on-chain models consistently suggest that Bitcoin prices still have room to rise before fundamentals become overheated.

Image Credit: Stock-to-Flow Ratio (CryptoQuant)

BTC Historical Cycles and Patterns

Bitcoin experiences a bull-bear cycle approximately every four years, driven by halving:

Four-Year Cycle Framework

- Bull market phases after halving: 2013, 2017, 2021 (typically peaking 1–1.5 years post-halving).

Mid-Cycle Correction in 2025

- The MVRV Z-score once dropped to ~1.43 at the cycle bottom; Value Days Destroyed (VDD) entered the "green zone," indicating long-term holders are accumulating at low levels.

Next Peak Timing

- If history repeats, the third or fourth quarter of 2025 is likely to become the peak of this cycle—but macroeconomic and regulatory dynamics may accelerate or delay the arrival of the peak.

Past cycles indicate that the adjustment from about $100,000 to $75,000 in early 2025 is a healthy mid-cycle breather rather than the end of the cycle, laying the groundwork for the next upward wave.

On-Chain Expert and Institutional Predictions

Most on-chain experts and institutional strategists, based on increasingly tightening supply indicators and growing demand signals, have set a target range of $150,000–200,000 for 2025:

Standard Chartered, relying on the "digital gold" theory, is optimistic about the continuous influx of spot ETFs, helping BTC/USD contracts and BTC/USDT spot markets climb to $200,000 throughout the year.

Goldman Sachs Bernstein also pointed out that large-scale institutional entry and enhanced liquidity in contracts and spot markets will strengthen the Bitcoin market depth.

Michael Sigel from VanEck, using a dual-peak cycle model, predicts a cycle peak of about $180,000 in 2025.

PlanB's S2F model continues to serve as a benchmark, expecting prices to reach around $160,000 by the end of the year.

On derivatives platforms, Kalshi's market implied probability shows a 43% chance of BTC exceeding $150,000.

CryptoQuant's GLBX emphasizes that the continued accumulation by long-term holders is a key bull market signal for locking in liquidity and supporting prices.

This series of predictions (ranging from $150,000 to $200,000) reflects the enhanced on-chain scarcity, growth in spot and contract liquidity, and new yield opportunities like BTC staking, collectively driving the next bull market.

Competitive Landscape

As the momentum of Bitcoin's surge in 2025 becomes increasingly evident, investors are weighing various assets:

Bitcoin vs. Altcoins: Altcoins like Ethereum and Solana offer smart contract applications but come with higher protocol risks. Bitcoin, with its massive market cap, solid security, and long market history, remains the premier "digital gold" store of value.

Bitcoin vs. Gold and Precious Metals: Gold and silver have low yields and are not easily portable. Bitcoin's programmable scarcity, portability, and high liquidity—whether spot or contract—provide a more flexible hedging option.

Bitcoin vs. Stocks and Bonds: Stocks and bonds are heavily influenced by economic cycles, with limited upside potential. Bitcoin has low correlation with traditional assets and high growth potential, making it an attractive diversification tool through spot ETFs or futures contracts.

Crypto Yield Products: Liquid staking derivatives offer additional yields but come with smart contract risks; centralized platforms like XT Earn provide regulated fixed/variable interest on BTC or USDT.

Futures and Derivatives: Futures contracts support leverage and hedging but come with rollover costs and margin risks—spot or staking yields are usually more stable for long-term holders.

Summary Outlook

The historic wave of locking and record non-liquid supply post-halving has made Bitcoin an unprecedented scarce asset. Robust on-chain usage rates, strong holder metrics, and continuously decreasing exchange reserves all indicate that the bull market will persist until the end of 2025. Although macroeconomic headwinds and regulatory changes may introduce volatility, the forces of tightening supply and rising demand will drive Bitcoin prices back to or even beyond historical highs. Whether through BTC spot, BTC contracts, or BTC staking, market participants have multiple pathways to capture the next upward trend.

Common Questions About Bitcoin

- What drives Bitcoin prices post-halving?

The halving mechanism reduces new coin supply, amplifying the scarcity effect when demand remains stable or increases. On-chain indicators (non-liquid supply, HODL waves) visually reflect this tightening.

- How do on-chain models like Stock-to-Flow predict BTC prices?

Stock-to-Flow links scarcity to value, predicting that prices will enter the mid to high six-figure range post-halving. It provides a useful reference framework, but accuracy has fluctuated since 2021.

- What is the NVT ratio? Why is it important?

NVT (Network Value to Transactions) measures the relationship between market cap and on-chain transaction volume. A lower NVT (like 1.51) indicates that prices are driven by real usage rather than pure speculation.

- How can I earn yields on Bitcoin assets?

Options include: liquid staking of tokens, DeFi lending, and centralized interest products like XT Earn, all offering flexible or fixed-term yield plans.

- Should I trade spot or Bitcoin futures?

Spot trading allows direct ownership of assets, which is safer and more stable; futures contracts support leverage and hedging, making them more suitable for short-term strategies. Long-term holders may prioritize spot or staking profits.

- When might Bitcoin reach $200,000?

Mainstream views suggest that the peak of the post-halving cycle is likely to occur in the third or fourth quarter of 2025, but macro and regulatory factors may also accelerate or delay the peak's arrival.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a rich variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。