According to several reports, the president has unveiled a bold new plan: a 50% tax on imports from the European Union and a 25% tariff on iPhones made overseas, both scheduled to kick in on June 1. According to the Trump administration, the aim is twofold—put pressure on the EU amid ongoing trade tensions and nudge production of popular tech gadgets back on American soil.

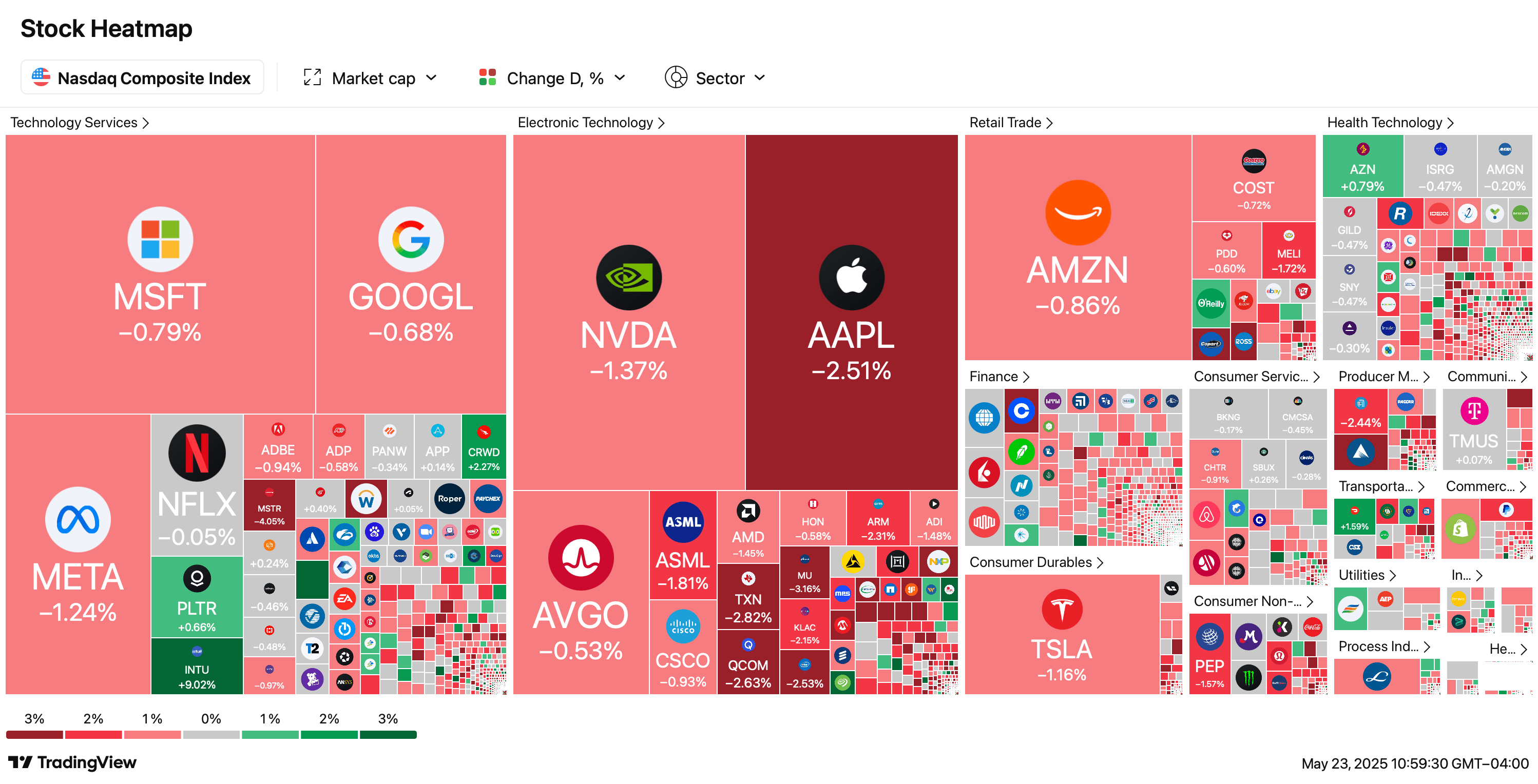

Nasdaq at 11 a.m. ET.

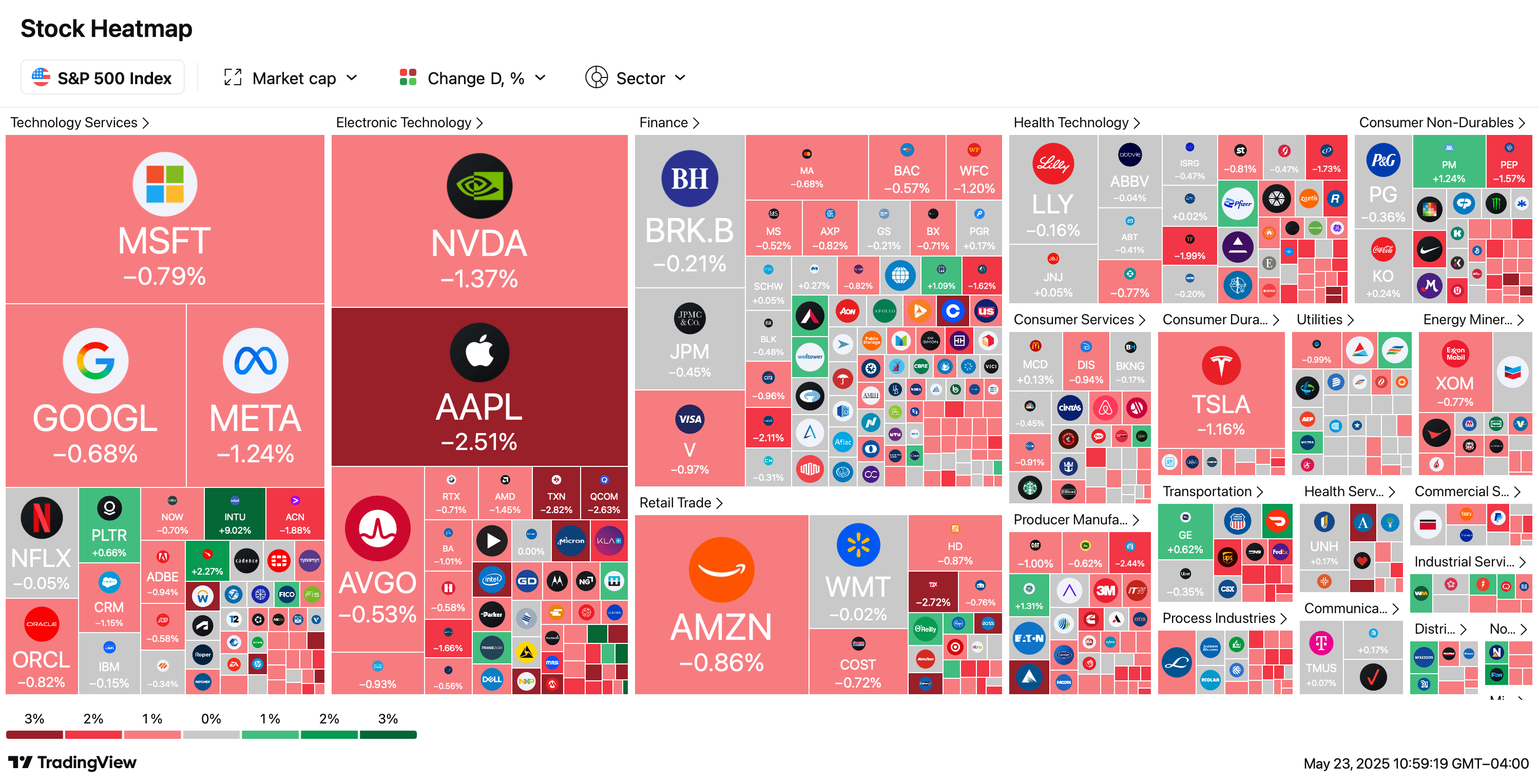

Wall Street wasted no time reacting. The Dow Jones Industrial Average tumbled, and the S&P 500 and Nasdaq followed suit with steep losses. This quick retreat highlights growing investor anxiety over the possible domino effect on international trade and corporate bottom lines.

S&P 500 at 11 a.m. ET.

Apple, front and center in this shake-up, watched its shares slide as investors worried that added costs might lead to higher prices and weaken demand for the popular iPhone. Other global giants in tech, autos, and consumer goods are also bracing for a bumpier, costlier road ahead.

Since Trump took office, economists have been waving caution flags, warning that these tariffs could push up prices for everyday shoppers and drag on the pace of economic expansion. Meanwhile, the EU could hit back with its own set of duties, raising the stakes and threatening smoother trade flows.

Although the White House insists the tariffs are a strategic move in trade negotiations, there’s still no breakthrough in talks. U.S. and EU officials remain locked in discussion, and everyone knows a prolonged deadlock could extend the market’s jitters.

With the threat of pricier U.S. goods and tighter household budgets looming, the situation adds fresh challenges for consumers and investors alike. As Wall Street buckles up for more ups and downs, the true impact of these proposed tariffs is still unfolding.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。