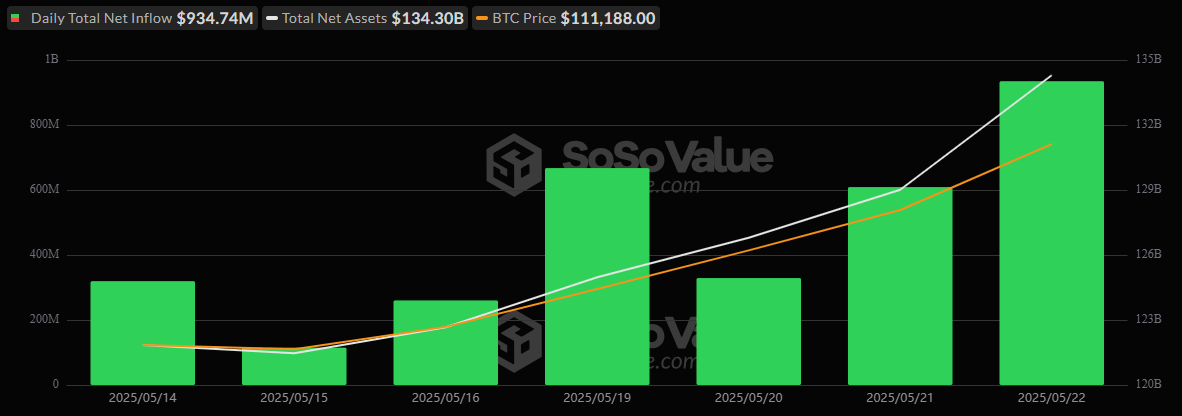

Bitcoin ETFs See Massive $935 Million Inflow As Ether ETFs Near $10 Billion in Assets

Institutional enthusiasm is showing no signs of cooling off. Bitcoin ETFs extended their winning streak to a seventh day with a colossal $934.74 million in net inflows, driven largely by persistent demand for Blackrock’s flagship fund.

IBIT dominated the trading tables again, pulling in $877.18 million alone, more than 93% of total daily inflows. Fidelity’s FBTC added a solid $48.66 million, while ARK 21shares’ ARKB closed the day with an $8.90 million injection. No ETF in the group of 12 reported outflows. Trading volume soared to $5.39 billion, and total net assets jumped to $134.30 billion, cementing bitcoin ETFs as a central force in institutional crypto exposure.

Source: Sosovalue

The ether market mirrored the bullish momentum. Ether ETFs locked in their 5th consecutive day of inflows, drawing $110.54 million across four funds. Grayscale’s ETHE led with $43.75 million, closely followed by Fidelity’s FETH at $42.25 million. Grayscale’s Ether Mini Trust contributed $18.86 million, and Bitwise’s ETHW added $5.69 million. Total value traded hit $697.46 million, and net assets reached $9.33 billion, just shy of the $10 billion threshold.

As both bitcoin and ether ETFs continue to stack daily inflows, institutional conviction appears stronger than ever.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。