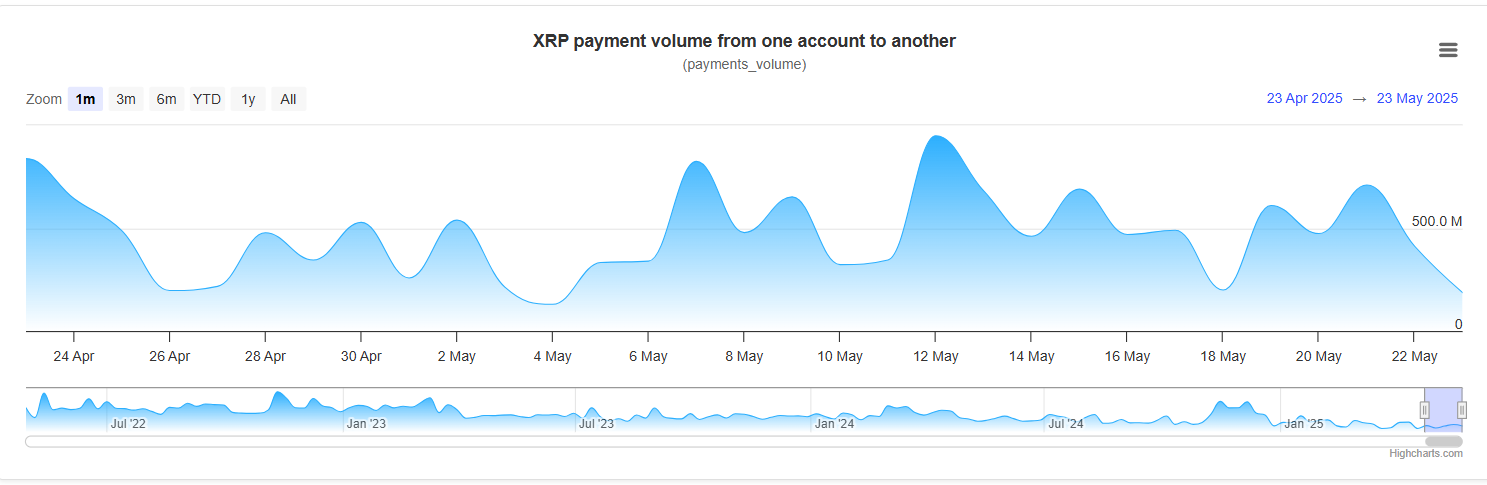

From over 700 million XRP earlier this week to about 412 million on May 22, XRP has experienced a sharp decline in payment volume, losing almost 300 million tokens in a single day. Particularly since the asset is still navigating important technical zones on its price chart, this sharp decline raises questions.

A major change in sentiment has occurred as XRP technically broke out of a downward channel that had been in place for months. Following its ascent above the 50-day and 100-day exponential moving averages (EMAs), XRP is currently consolidating beneath the $2.50 threshold. The 200 EMA, which frequently predicts mid- to long-term trend reversals, was among the several moving averages that it regained during the most recent bullish push.

The payment volume, a crucial indicator of real transactional usage, has precipitously decreased even though the price has been making an effort to recover. This decline might indicate a short-term lull in institutional flows or declining user activity, both of which are critical for a utility-focused token like XRP. Earlier in May, payment volume peaked, with multiple spikes above 700 million XRP coinciding with price breakouts.

HOT Stories Bitcoin ETFs Record Nearly $1 Billion Worth of Inflows Another XRP ETF Delayed. What's SEC Waiting for? XRP Targets $3 Following Major Developments Derivatives Behemoth CME Group Praises XRP's Utility

Source: XRPScan

These two metrics decoupling now raises the possibility that the rally is waning unless usage increases. In the future, the $2.30-$2.35 range, which corresponds to the 100 EMA and a previous breakout zone, is supporting XRP. A return to $2.60 and above is still possible, as long as it stays above this band. The price may decline toward the $2.15-$2.20 region if this support breaks.

You Might Also Like

Thu, 05/22/2025 - 20:22 Derivatives Behemoth CME Group Praises XRP's Utility ByAlex Dovbnya

The altcoins and the rest of the cryptocurrency market should consider XRP a bellwether for payment-driven tokens. Its volume dynamics frequently mirror general opinions regarding the relative importance of cryptocurrency's use cases versus speculative trading. As long as network usage improves, there is the potential for another leg up as the RSI remains below the overbought zone and shows no significant bearish divergence.

Bottom line: XRP must have steady on-chain activity to support its breakout. If not, there is a chance that this technical rally will become just another brief rebound.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。