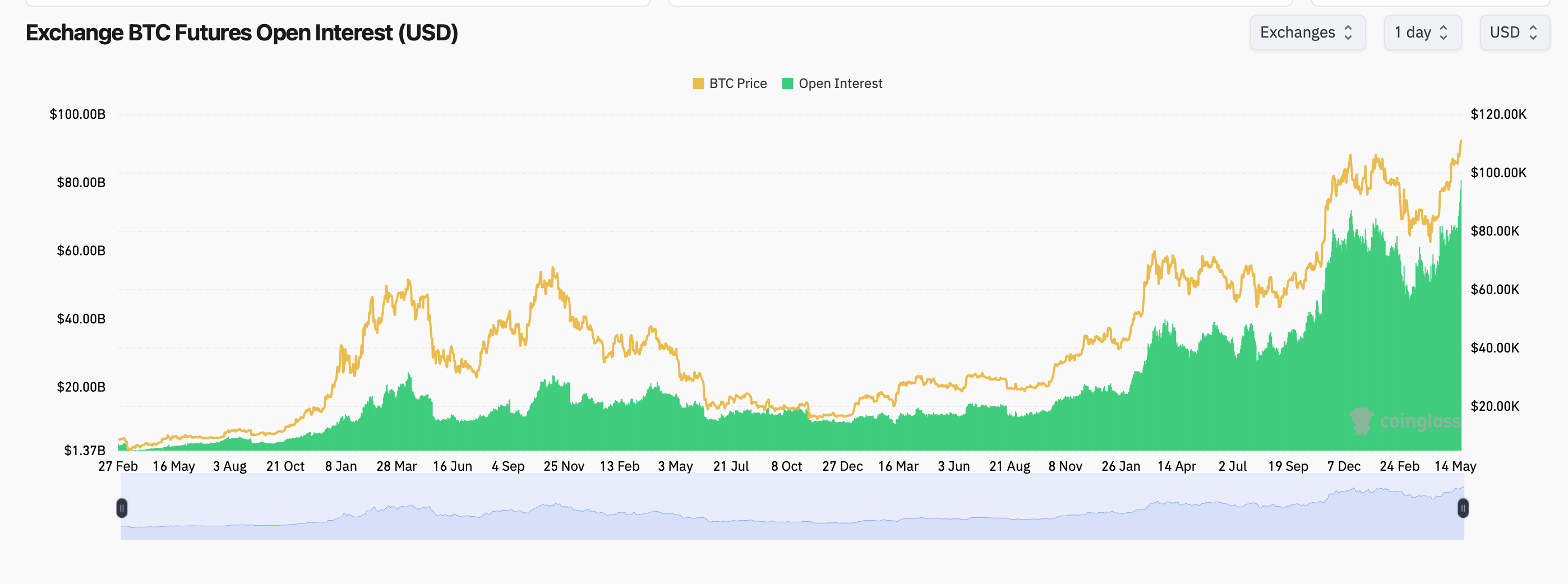

The total open interest in bitcoin futures reached an all-time high of $80.73 billion, representing 723,990 BTC in active contracts, according to coinglass.com’s derivatives data. Futures allow investors to bet on bitcoin’s future price without owning the asset, with gains or losses settled in cash. The surge signals heightened speculation and institutional participation, particularly on regulated platforms like the Chicago Mercantile Exchange (CME), which holds $18.28 billion in open interest—22.64% of the market.

Source: Coinglass.com

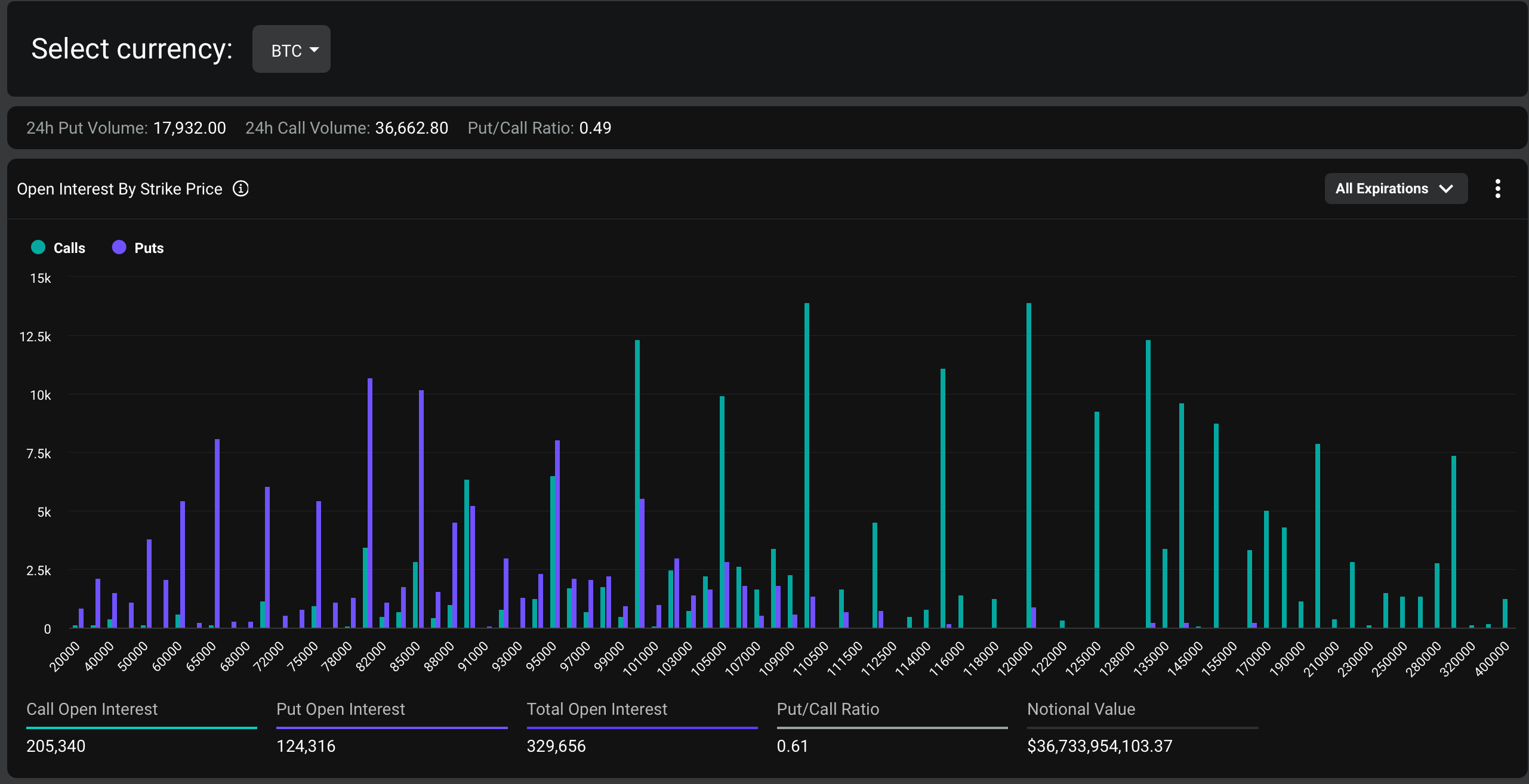

Retail-heavy exchanges such as Binance and Bitget also saw double-digit growth, underscoring global demand across the board. Meanwhile, bitcoin options—contracts granting the right to buy or sell at a set price by a specific date—hit $42.5 billion in notional open interest on Deribit, a leading crypto derivatives platform. The put/call ratio of 0.61 reveals a clear bullish tilt, with traders overwhelmingly favoring calls (bullish bets).

The most active strike prices cluster between $100,000 and $120,000 for June and July expiries, reflecting expectations for a near-term rally. Notably, open interest for $300,000 call options has emerged as a standout, though these contracts represent a minority. Such “out-of-the-money” calls—requiring bitcoin to surge over 350% from current levels—are typically low-cost, high-risk wagers.

Source: Deribit

Their popularity suggests some traders anticipate extreme upside scenarios, potentially driven by macroeconomic shifts or regulatory developments. The futures rally aligns with growing institutional engagement, with CME’s bitcoin open interest rising 2.8% in 24 hours. By contrast, retail-focused platforms like Binance and Whitebit posted sharper gains, up 5.19% and 7.63%, respectively.

Oftentimes, elevated open interest often precedes volatility, as large leveraged positions can amplify price swings. In options markets, June 2025 expiries dominate, with over 65,000 contracts open. The concentration of BTC long-dated calls indicates traders are positioning for sustained upward momentum. While $300,000 strikes remain speculative, their presence showcases the market’s appetite for asymmetric bets—a hallmark of the current risk-on sentiment.

Bitcoin’s derivatives boom mirrors its spot price resurgence, with both markets reflecting optimism about its medium-term trajectory. However, the scale of leveraged activity raises caution flags, as unwinding large positions could exacerbate price declines. For now, the data paints a picture of a market bracing for volatility—and banking on historic gains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。