Macroeconomic Interpretation: In the macroeconomic dimension, the dual game of U.S. fiscal policy has become a key variable affecting crypto assets. Credit Suisse points out that U.S. Treasury yield trends are facing a tug-of-war between "fiscal sustainability" and "global capital flows." With the breakthrough progress of the "GENIUS Stablecoin Act" in the Senate, the phenomenon of 15 Democratic lawmakers switching sides to support it suggests the irreversibility of the legislative process. If this bill is ultimately enacted, it will not only establish the legal status of the U.S. dollar stablecoin but may also generate hundreds of billions of dollars in annual Treasury purchase demand through a mandatory reserve mechanism. This policy arbitrage space has attracted Wall Street's attention, with JPMorgan analysts observing a synchronized expansion of technological innovation capital in the new economy and crypto asset allocation, particularly forming a cross-market capital siphoning effect between AI computing power investment and Bitcoin mining infrastructure.

After Bitcoin broke through the $111,000 threshold, its total market capitalization first surpassed $2.2 trillion, with a 24-hour trading volume climbing to $71.68 billion. Behind this seemingly simple price breakthrough lies a deep coupling of multiple factors, including institutional investment model innovation, global monetary policy linkage, and the establishment of regulatory frameworks. Notably, the CME Bitcoin contract open interest remains at $18.23 billion, significantly higher than that of spot exchanges like Binance, indicating that the depth of participation by traditional financial institutions has surpassed that of crypto-native capital.

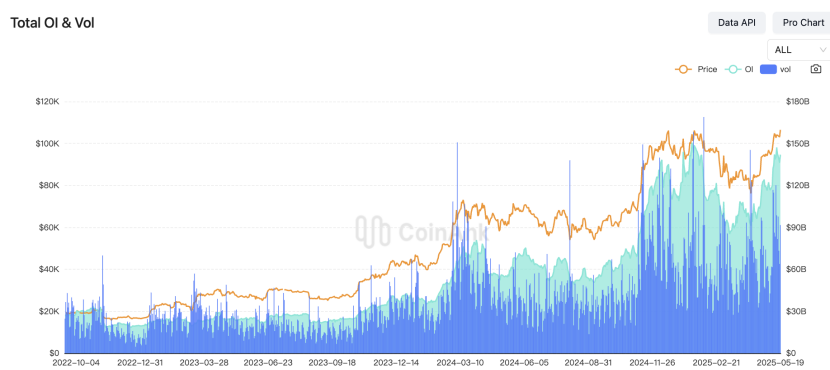

In terms of capital flow, the phenomenon of institutional dollar-cost averaging is reshaping the market supply-demand structure. Unlike the emotional trading of retail investors, systematic funds exceeding $10 billion are flowing into the Bitcoin market at a fixed weekly frequency, effectively stabilizing price fluctuations through this ETF-like allocation strategy. On-chain data shows that since the LUNA collapse, the Bitcoin reserves of centralized exchanges have shrunk by 85%, currently maintaining a liquidity level of only 426,000 coins, which starkly contrasts with the continuously growing institutional holdings. This structural shortage is particularly evident in the derivatives market, where the total open interest of Bitcoin contracts has surpassed $80.8 billion, with nearly 40% of positions concentrated on regulated platforms like CME, reflecting that institutional investors are establishing strategic positions through compliant channels.

Changes in the market microstructure are also noteworthy. After experiencing a severe sell-off at the end of 2024, the proportion of profitable addresses in the Ethereum ecosystem rebounded sharply from 32% to 60% within five months, marking the highest volatility intensity since 2017. Although the extreme volatility of ETH has diverted some market attention, Bitcoin's "digital gold" narrative is gaining broader recognition. In China's new economic transformation, the policy-supported AI industry and crypto infrastructure construction present an interesting contrast—while the former receives targeted credit support from the government, the latter relies on spontaneous allocation of global capital, which precisely confirms the value of Bitcoin's "anti-intervention" property.

At this current juncture, the Bitcoin market faces three major resonating catalysts: first, the institutional dividends brought by stablecoin legislation may trigger exponential expansion of fiat currency channels; second, structural contradictions in the U.S. Treasury market compel institutions to seek uncorrelated asset allocations; and finally, the digital reconstruction of the global payment system is enhancing Bitcoin's monetary network value. It is particularly important to note the ongoing expansion of CME Bitcoin contract premiums, which is often seen as a leading indicator of professional capital engaging in hedging operations. If combined with the continuous depletion of exchange balances, the market may have entered the eve of "liquidity tightening," and this supply-demand imbalance could drive Bitcoin into a new price discovery phase after breaking historical highs. For investors, while enjoying the joy of new highs, it is crucial to remain vigilant about the short-term risks brought by amplified volatility, as any black swan event could trigger a chain reaction when both open interest leverage and spot liquidity reach extremes.

BTC Data Analysis:

According to CoinAnk data, as of May 22, 2025, the Bitcoin derivatives market is showing significant expansion, with total open positions across the network surpassing 724,200 BTC, with a nominal value of $80.82 billion, marking a nearly 19% increase in a single day and setting a new historical peak. Among them, CME holds 163,400 BTC ($18.23 billion), accounting for 22.55% of the market share, while Binance ranks second with 122,100 BTC ($13.64 billion). This data reflects a continuous breakthrough growth compared to $43.3 billion in October 2024 and $34.48 billion in January 2025, indicating a sustained deepening of market participation.

From a market structure analysis, CME's dominant position highlights the deep involvement of institutional funds, with its standard contract design (each representing 5 BTC) and micro contracts attracting professional investors, especially those looking to avoid the risks of directly holding crypto assets through cash settlement mechanisms. Research shows that the surge in open interest is positively correlated with Bitcoin price volatility, and a high-leverage environment may exacerbate liquidation risks. Although current market sentiment leans towards optimism, it is essential to be cautious of the systemic pressure brought by increased position concentration. Historical data indicates that after open interest surpasses historical highs, the market often enters a short-term adjustment phase to digest excessive leverage.

For the crypto market, the institutional-led expansion of the derivatives market not only enhances liquidity but also injects mature factors into the price discovery mechanism. However, it is important to note that the market share competition between CME and Binance (CME surpassed Binance with a 24.87% market share in February 2025) reflects the long-term game between regulatory compliance and offshore trading models. Additionally, the inflow of funds into Bitcoin ETFs (such as over $12 billion accumulated in 2024) and the synergistic effect with the derivatives market may further amplify market volatility. Investors are advised to pay attention to divergence signals between open interest and price trends to guard against liquidity shocks in a high-leverage environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。