Bitcoin (BTC) enjoyed its weekly dose of volatility late Sunday, rising to around $107,000, before decisively plunging back to $102,000.

The crypto market typically experiences a bump in volatility at this time on Sunday as it coincides with the opening of the CME futures market, which takes a few moments to recalibrate to the lower liquidity 24/7 crypto markets.

This weekend was slightly different. Whilst on the surface the price action will go down as a bearish rejection from a key level of resistance, which bitcoin has now failed to break at three attempts. BTC actually spiked first on the CME, indicating that the price action was led by institutional U.S. traders as opposed to retail crypto traders.

Over the past few months the CME has often opened lower than it closed on the Friday, creating a "gap" on the chart, which did not occur this week. As price whiplashed around this $5,000 range, the move wiped out liquidity on both sides, creating a rather crucial inflection point.

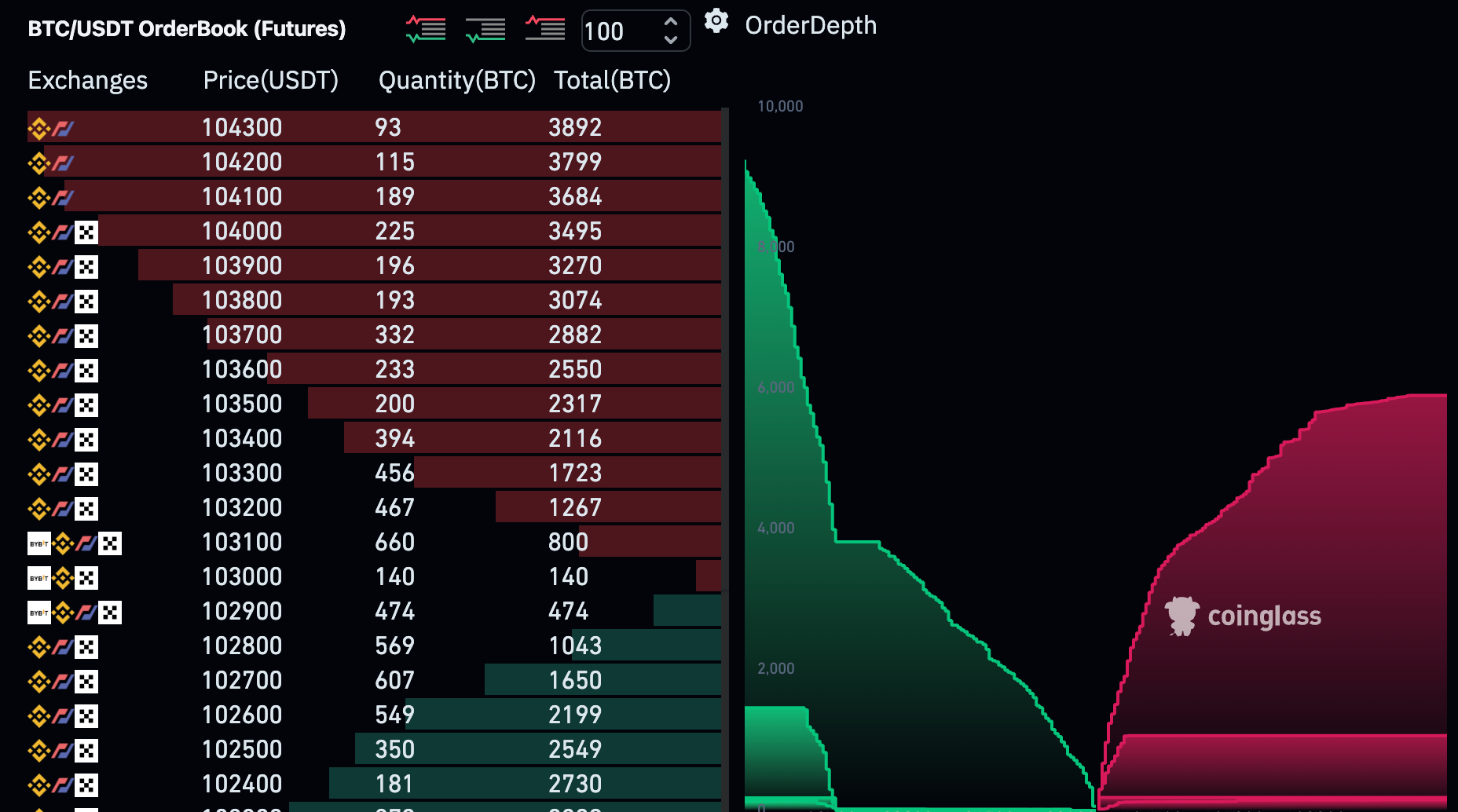

Now, market depth all the way up to $110,000 is minimal compared to limit orders lining the book down to $100,000. This means that any upside thrust will likely take this level out and see bitcoin trade at a new record high.

However, it's worth considering the other side of the coin. It is also conceivable that the Sunday evening price action was a typical stop-loss hunt, which involves traders targeting a zone where those in short positions would want to exit, thus creating an impulse in buy pressure as short traders scurry to buy back their position.

This strategy often takes place alongside entry into a larger short position. For example, if a trader wants to short BTC with a risk tolerance of 4%, it would be advantageous to open that position at $107,000 with a stop loss at $111,280 as opposed at $105,000 with a stop at $109,200. Astute traders can secure that entry by assessing levels of liquidity and squeezing short positions into closing, which temporarily lifts price to an ideal entry.

Either way, with liquidity now relatively low around record highs, bitcoin is one news catalyst away from that awaited upside thrust, and these potentially fresh short positions at $107,000 could provide the ammunition to that eventual break out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。