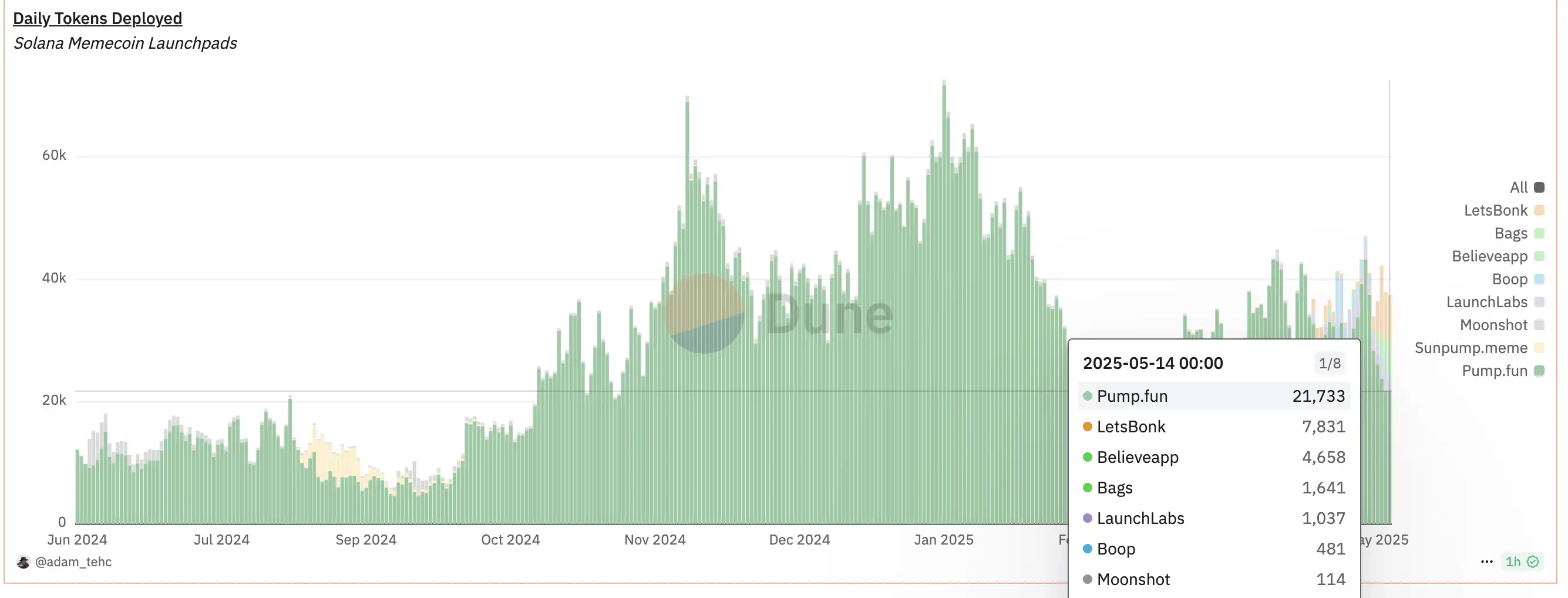

In the past year, the Meme coin issuance platform Launchpad on the Solana chain has experienced explosive growth and quickly formed a highly competitive landscape. Pump.fun, as one of the earliest platforms to rise, is seen as a catalyst for the prosperity of Solana's "on-chain casino." The platform allows any user to issue tokens without barriers, adopting bonding curve pricing and pioneering a fair issuance model with no pre-sale and no team shares.

With the advantages of Solana's low-cost and high-speed transactions, Pump.fun ignited a meme coin frenzy in 2024. In just 13 months, platform users issued over 8 million tokens, peaking on October 24, 2024, with a daily output of over 36,000 tokens, averaging 25 new tokens created every minute. This unprecedented scale of token creation allowed Pump.fun to dominate the market, leading to Solana being referred to as the largest "casino" on-chain. However, Pump.fun's success also brought concerns. On one hand, a large number of low-quality projects emerged, with a graduation rate of less than 1%, and the vast majority of tokens being short-lived. On the other hand, while the platform was highly profitable, users generally suffered losses; statistics show that nearly 90% of users lost their principal or made less than $100 in meme coin trading, while the platform earned about $98 million in just six months.

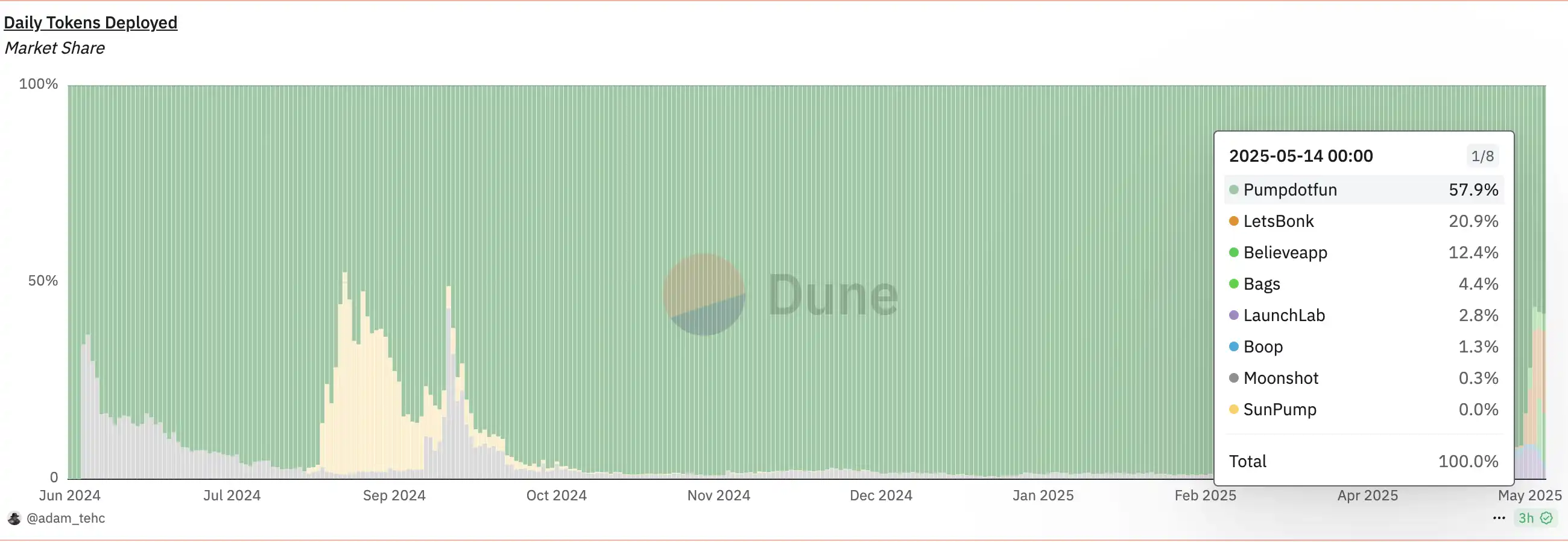

By the end of 2024, Pump.fun's official revenue had exceeded $223 million (approximately 1.15 million SOL), and it continued to cash out the SOL earned. In just a year and a half, the platform's fee account sold about 3.403 million SOL (approximately $629 million), becoming the second-largest source of selling pressure after early Solana investors FTX/Alameda. Such a massive outflow of funds raised concerns in the community about the platform's sustainability and ecological impact. In the face of Pump.fun's dominance, market participants quickly took action, leading the entire Meme Launchpad track into a heated competition. Within the Solana ecosystem, the established decentralized exchange Raydium launched LaunchLab to compete with Pump.fun; the popular meme coin BONK opened the LetsBonk.fun launchpad; and the on-chain aggregator Jupiter also attempted to launch similar services.

Daily token deployment situation, data from @adam_tehc's DUNE

Challenges of Pump.fun

As a pioneer of the one-click meme coin launch platform, Pump.fun established a basic operational model. Users only need to fill in basic information such as token name and symbol, and can automatically deploy token contracts and establish trading pools without programming skills, significantly lowering the barrier to issuing tokens. The platform employs various bonding curve pricing models to balance initial prices and market demand, allowing issued tokens to be traded immediately in the platform's AMM pool without the need for prior liquidity injection.

The platform innovatively introduced an LP share destruction mechanism, which automatically injects part of the liquidity into the Raydium trading pool and destroys the corresponding LP tokens when a new coin reaches a specific market cap threshold, ensuring that project parties cannot withdraw liquidity and run away, thus enhancing liquidity security.

With the "no-code token issuance, instant trading" experience, Pump.fun quickly gained popularity in 2024, spawning a large number of creative meme tokens, including many that saw hundredfold or even thousandfold increases, attracting numerous speculators. The platform became one of the most profitable on-chain applications in 2024 by extracting trading fees.

However, as development progressed, Pump.fun's problems gradually became apparent: less than 1% of the over 8 million issued tokens successfully "graduated" to external liquidity pools; user earnings became severely polarized, forming a zero-sum game; the platform monetized transaction fees and continued to sell SOL, creating selling pressure on the Solana network; and the completely anonymous and unreviewed model, while in line with the spirit of crypto, brought regulatory and trust risks. Consequently, Pump.fun's growth slowed in early 2025, with daily trading volume dropping from a peak of $544 million in January to $270 million in February, a decline of nearly 50%.

Pump.fun's token graduation rate has shown a continuous downward trend weekly

The Wheel War of LaunchPad—LaunchLab, Boop, Believe

LaunchLab's On-Chain Degen Approach

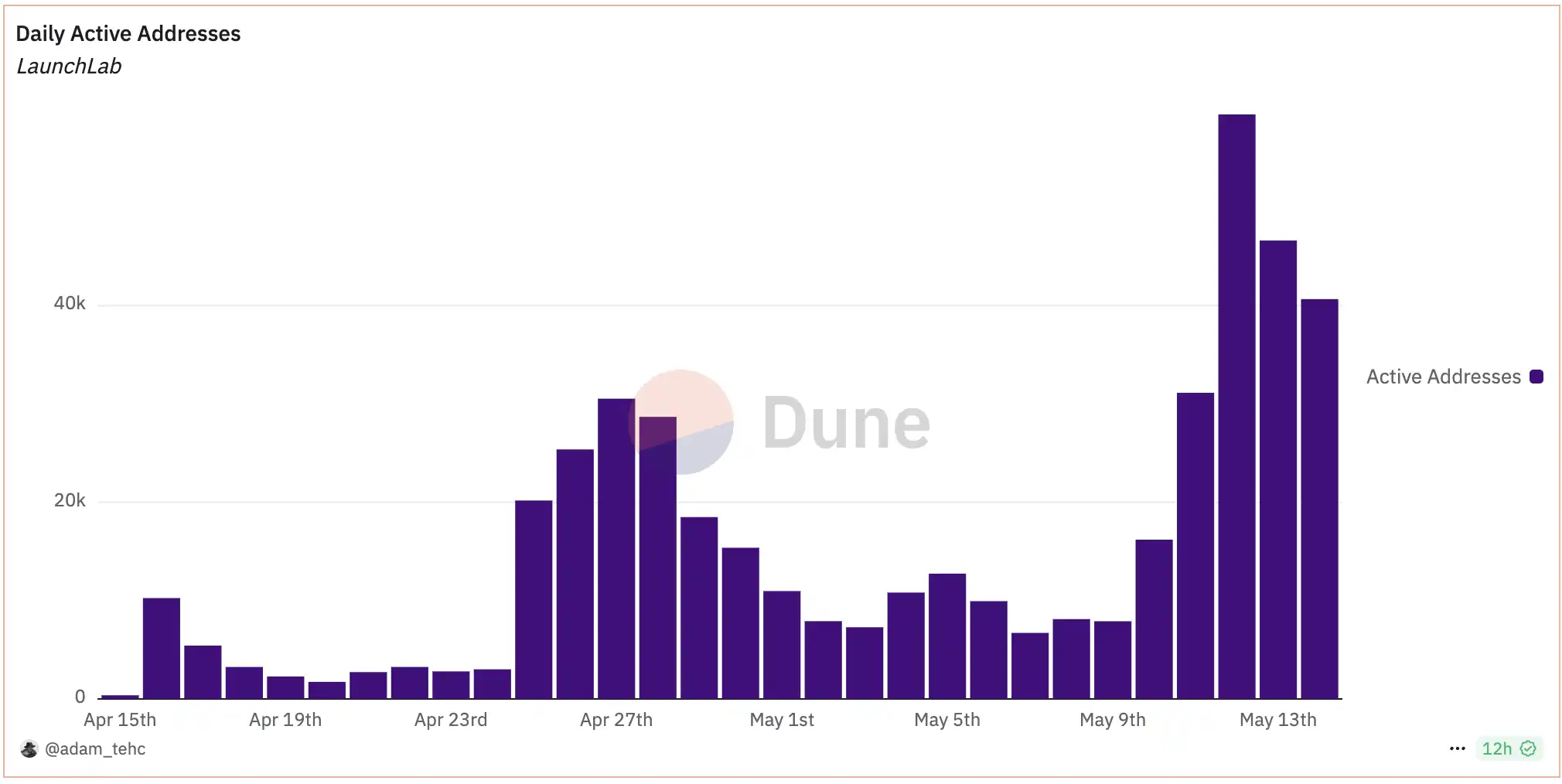

Raydium LaunchLab is one of the most direct competitors to Pump.fun within the Solana ecosystem. Raydium itself is an important AMM protocol on Solana, which benefited early on from Pump.fun projects contributing 41% of its Swap fee revenue. However, as Pump.fun launched PumpSwap independently, Raydium's traffic and trading volume were significantly impacted.

In March 2025, Raydium launched LaunchLab, seen as a direct counterattack against Pump.fun. The overall mechanism of the platform is highly similar to Pump.fun, both supporting one-click token issuance and curve pricing, but with targeted optimizations in details.

It supports multiple pricing curves, allowing project parties to choose linear, logarithmic, or exponential models based on token positioning; it sets a lower trading fee rate of only 1%, lower than Pump.fun's 2%, and has no additional migration fees; the graduation threshold has also been lowered, requiring only 85 SOL (approximately $11,000) to transfer to the Raydium AMM pool; at the same time, it introduces a creator revenue-sharing mechanism, allowing founders of graduated tokens to continue receiving 10% of the fee revenue; the platform has also strengthened ecological integration, including fee buybacks for the platform token RAY, supporting LP locking, and introducing pricing diversity among other innovative designs.

On the day of the announcement, the RAY token rose by 14%, and the market had high hopes for Raydium LaunchLab. Although the official statement indicated that LaunchLab was "providing an alternative choice," it has successfully attracted some projects to shift, weakening Pump.fun's dominance.

Additionally, platforms such as LetsBonk.fun, launched in collaboration with the BONK community, as well as Meteora, Boop, Genesis Launches, and several others are also striving to break through, pushing the entire Launchpad market into a phase of full competition.

LaunchLab's daily active user growth is rapid

A Different Approach with Believe, Creative Narrative Productization Concept

As the Meme Launchpad track becomes increasingly crowded, the "rebirth" of the Believe project has attracted widespread attention in the industry.

Founded by Australian entrepreneur Ben Pasternak, Believe was formerly a social token platform called Clout. Ben had created several blockbuster applications and successfully monetized them, but Clout quickly faded due to over-reliance on celebrity effects. At the end of April 2025, Ben returned to the market with the upgraded platform Believe, shifting the concept from "Believe in Someone" to "Believe in Something," emphasizing the value belief in creativity and ideas, marking a strategic transformation of the platform from social asset trading to a creative incubation factory.

Ben himself commented on this transformation, stating, "This is a shift from influence to trust. We no longer hype celebrities but seek meaningful projects."

Believe adopts a unique product mechanism, using the social platform as a token issuance entry point, achieving a seamless connection between Web2 and Web3. Users only need to @LaunchACoin on the X platform and attach the token name, and the system will automatically create the token using Meteora's joint curve, without needing to log into a DApp or fill out a form. This "discussion equals token issuance" interaction model allows any valuable idea to be immediately transformed into a token, significantly lowering the participation barrier. The platform also established a "B point" mechanism, where when the token fee income reaches a critical value, the founder can withdraw funds to support the project; if the threshold is not met, it is considered a market rejection. Although the B point is not a hard numerical threshold, its underlying logic is similar to a Kickstarter-style crowdfunding mechanism, where "transaction heat equals market voting."

Imran Khan, founding partner of Alliance DAO, commented, "Founders or Scouts mark @LaunchACoin, and a token is born. The market will assign value based on the importance of the problem this idea aims to solve," in short, market heat determines the project's fate.

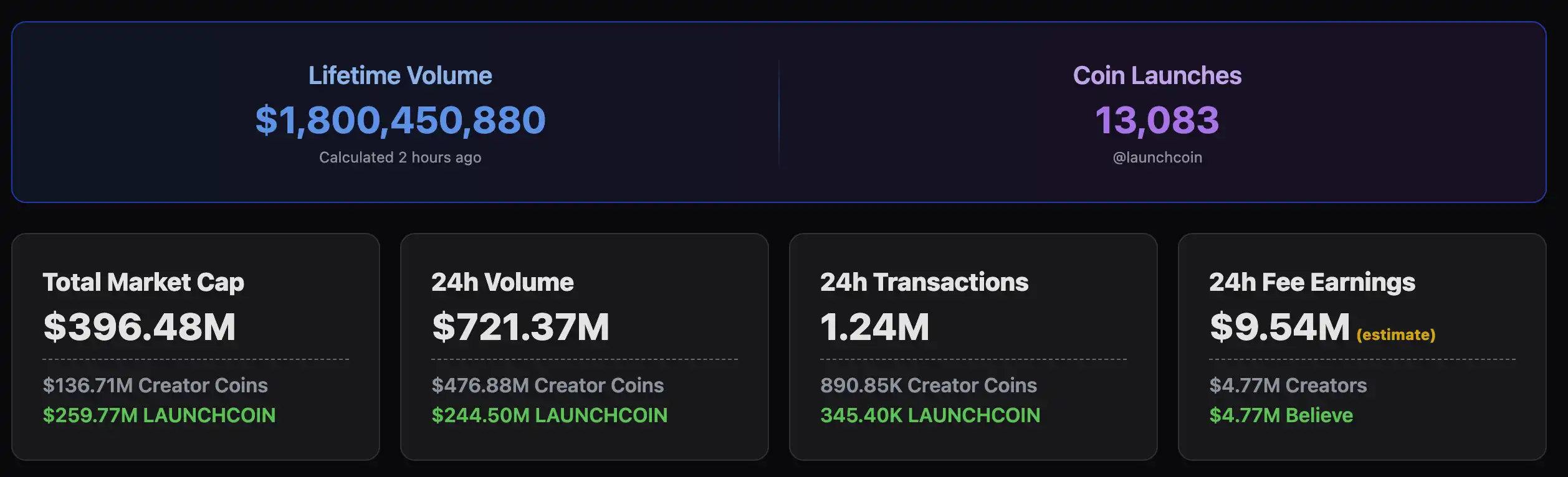

In terms of revenue structure, Believe has also implemented a series of innovative designs. A 2% fee is charged on each transaction, and unlike other LaunchPads, its tokens still have a 2% trading tax for buying and selling within the contract after launch, but the distribution structure is highly incentive-oriented: 1% goes to the token creator (founder), 0.1% rewards the Scout (the user who first discovered or promoted the token), and the remaining 0.9% goes to platform operations. This mechanism not only provides immediate revenue assurance for creators but also incorporates "token discoverers" into the revenue-sharing system for the first time, greatly incentivizing the community to actively discover and spread quality ideas.

Since its launch, Believe has recorded a total transaction volume of $1.8 billion, bringing $9.5 million in direct income to creators, of which $4.7 million belongs to the trading of Believe tokens.

According to BelieveScan panel data, Believe's fee income in the past 24 hours was approximately $10 million

While opening up token issuance, Believe also attempts to govern the platform's order to avoid becoming a dumping ground for junk coins.

In terms of creator incentives, Believe's mechanism is to share with issuers, returning 1% of each transaction directly to creators; there are no reserved holdings or token ratio controls, allowing founders to freely define distribution; a Scout incentive mechanism is established to promote decentralized content discovery; the platform actively displays data such as transaction volume and creator income to enhance transparency. The involvement of some Web2 entrepreneurs has also strengthened Believe's meta quality, with RizzGPT developer Alex Leiman and renowned hacker Ruben Norte having issued personal tokens on the platform, with project market caps once soaring to millions of dollars, pushing Believe's image from a pure meme playground towards a "creative value testing ground."

This narrative logic is particularly evident in the LaunchCoin incident. The token originated as PASTERNAK, issued by Ben personally, and was renamed LaunchCoin when it went live on the platform, endowing it with functional significance. LaunchCoin surged 200 times on its launch day, with a market cap exceeding $200 million, sparking intense discussions within the community.

Some users viewed it as a sign that the platform had officially entered the governance token phase; others questioned whether Ben was using his founder status for arbitrage. Ultimately, Ben sold off most of his holdings in batches, profiting about $1.3 million. The fate of LaunchCoin sparked heated debates in the community around the core theme of "trust." Whether supporters or skeptics, this incident successfully brought Believe's brand positioning back to the center of discussion and validated the attention on its value direction.

The trust narrative emphasizes the value behind creativity, no longer merely encouraging speculative operations, attracting more rational builders and entrepreneurs, while the interest-binding mechanism ensures that creators, Scouts, and the platform all have revenue mechanisms, binding participants' economic interests and continuously incentivizing quality content. Under this mechanism, although many Web2 talents are currently launching tokens with products, the real feedback from community participation is that after the tokens go live, robots acquire most of the chips, and due to the high tax present at the beginning, there are fewer sell orders. Quality projects can quickly reach market caps exceeding $5-10 million, after which trading taxes decrease, and robots with large amounts of chips will sell off in bulk. This has led to many tokens rising to hundreds of thousands or even millions in market cap, but their sustainability is not very good. Some in the community believe this is beneficial for entrepreneurs, Scouts, and the platform, but these costs are borne by retail investors.

Ben hopes to seek a dynamic balance between "empowering real value projects" and "curbing blind speculative bubbles" through Believe. Although there is still controversy over whether it can truly sustain in the long run, at the current stage, Believe has successfully established a differentiated label in the Meme Launchpad battle through innovative mechanisms, topical events, and blockbuster data.

Key Differences Among Leading Platforms

After experiencing Pump.fun's dominance and the subsequent imitation by various platforms, the current Meme Launchpad market has formed several leading camps. Below is a horizontal comparison of Pump.fun, Raydium LaunchLab, Boop, and Believe across key dimensions.

Issuance Methods and Thresholds

Pump.fun, LaunchLab, and SunPump all adopt a DApp page-style one-click token issuance, requiring users to log in and fill in relevant token information to complete the deployment process. Believe, on the other hand, completely breaks out of the DApp paradigm, triggering token issuance through Twitter social links, without needing to enter the platform page.

In terms of thresholds, Boop, Pump.fun, and LaunchLab have almost no requirements for issuers, allowing any user to issue tokens at any time. Believe appears to have no threshold, but in reality, it forms a kind of "natural selection" through social networks, with followers of entrepreneurs like Ben and Alex becoming the first creators and participants.

Regarding the "graduation threshold," Pump.fun initially set it at a market cap of $69,000; LaunchLab's initial setting was 85 SOL (approximately $11,000), but it can set a minimum launch mode of 30 SOL, making the threshold even lower; while Believe does not set a fixed threshold, it judges whether the idea is accepted by the market based on "B point" transaction fee income.

Fee Structure and Distribution Mechanism

Pump.fun charges a 2% transaction fee, initially all going to the platform, but starting in May 2025, it began returning 50% to creators; LaunchLab's transaction fee rate is 1%, with 25% used to buy back the platform token RAY, and founders can additionally apply to receive up to 10%; Believe charges a 2% transaction fee embedded within the token contract, with 1% going to creators, 0.1% to Scouts, and 0.9% retained by the platform. From the data, Believe offers the highest revenue share to creators among all platforms, while also pioneering the Scout revenue-sharing incentive, allowing discoverers to continue benefiting.

Community Participation and Governance

Pump.fun follows extreme libertarianism, with no review or governance mechanism, relying on spontaneous community organization for hot topic dissemination, but this also makes it susceptible to manipulation by whales, leading to retail investors "losing more and winning less."

Raydium LaunchLab leverages its AMM background, binding DeFi community resources, and facilitating internal circulation through platform token incentives; Boop relies on Dingaling's previous influence in the community.

Believe attempts to incorporate community consensus decision-making elements into governance. Through token holding governance, Snapshot voting, and other methods, it discusses whether tokens should enter DEX liquidity pools, whether to support promotion, etc., forming a preliminary framework of "token issuance equals governance." If it matures in the future, its user community stickiness is expected to far exceed that of current mainstream platforms.

Creator Economic Model

In terms of creator incentives, Believe and LaunchLab are the most attractive. Believe constructs a flywheel effect of token issuance → user acquisition → re-issuance of tokens based on returning 1% of transaction fees to creators, along with the Scout reward mechanism.

LaunchLab retains creators through low thresholds, high freedom, and RAY buybacks, while Pump.fun has lost some attractiveness in the new environment due to a lack of early incentive mechanisms.

Market Outlook for LaunchPad

As the Meme Launchpad market transitions from an explosive phase to a mature phase, some key trends are emerging, providing reference directions for platform competition and industry evolution.

Data Frenzy Retreats, Refined Competition Begins

On-chain data shows that the frenzy of meme coin issuance is receding. For example, Pump.fun has seen a significant decline in daily trading volume and daily token issuance at the beginning of 2025, making the "get rich overnight" myth difficult to replicate on a large scale.

This indicates that the phase of wild growth is coming to an end, and competition among platforms will shift to refined operations. Those who can continuously create blockbuster products, improve creator yield, and enhance user trading experience will be able to take the initiative before the next wave. The data showing Pump.fun users voting with their feet (a halving of trading volume) also indicates that if the platform cannot improve participants' profit and loss structure and emotional experience, even first-mover advantages will gradually be eroded.

Business Models Shift from "Harvesting" to "Win-Win"

Pump.fun's early profit model was simple and brutal: the platform collected fees while users had a very low chance of winning, forming a one-sided structure of "platform wins, users lose." In contrast, new platforms represented by Believe and LaunchLab generally adopt a growth strategy that benefits creators and the community.

For example, Believe directly returns 1% of the transaction fee to founders, encouraging creators to continuously produce content; LaunchLab builds a more internally growing ecological loop through fee sharing and RAY buybacks. Future Launchpads will emphasize a win-win situation among platforms, creators, and users, forming a true "content incentive network."

Pump.fun's recent introduction of a creator revenue-sharing mechanism can also be seen as a response to this new model from older players.

Multi-Chain Landscape Becomes the Norm, Each Ecosystem Explores Its Own Meme Soil

As competition among Solana-based platforms (Pump.fun, LaunchLab, BONK) intensifies, other public chains are also accelerating the deployment of their own Meme Launchpads: Tron’s SunPump, Solana’s Boop, Base’s Genesis Launches, and even projects from the ICP and Avalanche ecosystems are starting to test the waters.

Essentially, meme coin issuance platforms have become powerful tools for public chains to compete for active users. Meme coins, due to their low barriers and strong topical attributes, are naturally suited for building on-chain traffic.

In the future, major public chains may give rise to one or two leading Meme Launchpads, deeply integrating with wallets, social tools, and NFT tools, becoming important indicators of ecological activity and user loyalty.

Community Culture and Narrative Building Will Become the Platform's Moat

The core of memes lies not in technology, but in narrative. The platforms themselves are no exception:

Pump.fun started with "extreme freedom, absolute openness," but thus fell into issues of whale dominance and poor project quality;

Raydium emphasizes "fair launches, technical optimization," shaping an "Avenger" image to attract native user return;

Boop focuses on the value recovery of the core token by leveraging the personal brand "Dingaling" and the $Boop ecosystem;

Believe follows the "trust and value" route, attempting to attract the builder community and positioning creativity as the source of memes.

In the future, community culture will directly determine what kind of user groups the platform attracts: whether they are more Degen (pure speculation), KOL (influencer-driven), Builder (value-oriented), or general users (primarily for entertainment). The platform's differentiated positioning will extend beyond product mechanisms to emotional consensus and cultural atmosphere.

In terms of daily token deployment ratio, Pump.fun's market share has shifted from significant monopoly to 57%.

From Meme to ICM, New Entrepreneurial Incubation Paths Emerge

Although currently 99% of meme coins are still short-term speculative products, some projects have begun to attempt "moving from meme to product." Some founders are using transaction fees to establish initial funding pools, starting to build teams and develop prototypes; some platforms, like Believe, encourage founders to fulfill their roadmaps through a mechanism of "releasing startup funds after reaching the B point."

The community has begun to conduct long-term observation and governance on certain tokens, such as LaunchCoin, which possesses experimental value in governance, revenue sharing, and functional expansion. If a small number of meme projects successfully incubate into actual products through the Launchpad in the future, their "symbolic" significance will have a profound impact on the entire industry: it will prove that Launchpads can not only incubate speculative coins but also nurture Web3 projects. At that time, the Launchpad will no longer be merely a "issuance tool," but rather a "project cold start infrastructure."

Summary

Meme Launchpad is at the critical point of transitioning from a phase of wild explosion to refined operations. The dominance of Pump.fun has been broken, with platforms like Raydium LaunchLab and Believe entering the market through differentiated strategies, gradually capturing user and creator shares.

In the future, the winner of the industry will not necessarily be the one with the lowest fees, but rather the one that can build a content flywheel, community consensus, and platform trust mechanisms. Currently, Believe is establishing its own differentiated moat through social distribution models, Scout incentive mechanisms, and governance exploration, demonstrating strong potential for iteration and growth. Of course, this is still a marathon-style competition. The platform that can truly stand out must achieve a balance across multiple dimensions of "cultural identity, creator win-win, ecological governance, and safety compliance."

As Ben Pasternak said, "We are not just building a platform; we hope to give every good idea a monetization possibility." This may very well be the most credible direction for the next stage of the Meme Launchpad.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。