If you do not rely on existing infrastructure, you cannot launch a first-class, truly global cryptocurrency wallet.

Written by: Christian Catalini, Co-founder of Lightspark and the MIT Cryptoeconomics Lab

Translated by: Luffy, Foresight News

A few weeks ago, Alex Blania of World (formerly known as Worldcoin) unveiled the company's latest plans in front of a group of insiders from the cryptocurrency industry. The company made its debut in the relatively friendly regulatory environment of the United States, which is noteworthy in itself, but the real turning point is World’s sprint towards the mainstream market, signaling that cryptocurrency is moving from the small circle of early adopters into everyday business.

Undeniably, World’s bet is bold: convincing Americans to exchange an iris scan for a cryptographic "I am human" identifier, regardless of privacy guarantees, is no easy task and may be premature. However, the team has quietly mitigated the risks of the plan in several ways over the years (details below).

What lessons can founders and developers of cryptocurrency projects learn from World’s development journey?

Build real utility first, then enhance appeal with tokens

World once heavily relied on cryptocurrency tokens to drive user adoption. However, this strategy, often seen as the successful formula of Bitcoin and replicated countless times, completely reverses the causal relationship. As World discovered in its early promotions, it also led to unintended consequences: privacy advocates and others criticized that excessive incentives overshadowed early users' demand for real utility.

The popularity of Bitcoin stemmed from its introduction of a neutral, fixed-supply asset that is not controlled by central banks. Admittedly, mining rewards and the expectation of soaring prices attracted speculators, followed by institutional investors and some sovereign nations, but long-term builders of Bitcoin were drawn to its disruptive potential as a new type of asset and payment system, rather than merely viewing it as a tool for quick wealth. Since then, we have witnessed thousands of Bitcoin replicas attempting the same strategy, but today most have become part of the crypto graveyard.

Cryptocurrency cannot transcend the fundamental laws of economics. Like any startup, cryptocurrency projects need to first build real utility before using tokens to accelerate user adoption or address market failures within their ecosystems. In short, while economists may be eager to play the role of engineers, their ideas can only truly shine when the project already possesses a certain level of appeal.

Blania (co-founder of World Alex Blania) uses dating, gaming, and credit sectors (where bots have mixed with humans) as examples, viewing World’s "proof of personhood" framework as a solution, and explaining why submitting an iris scan to the system might be a worthwhile gamble.

It is not surprising that World, co-founded and chaired by Sam Altman of OpenAI, is tackling this issue. As AI becomes increasingly complex, the demand for a reliable, cryptographically secure method of human verification will become crucial. World may be ahead of this trend, but it is addressing a significant societal challenge that we will soon all face.

Navigating the "reverse integration" of crypto infrastructure

In the early days of the cryptocurrency industry, we were all swept up in the hype. When I was designing the Bitcoin experiment at MIT, I genuinely believed that cryptocurrency would change payments and financial services within a few years. But a decade later, we are just getting started.

Providing real utility outside the crypto bubble means matching the user experience that consumers and businesses receive from traditional solutions. Yes, this requires building bridges between old and new infrastructures, and this compromise may seem completely illogical to crypto purists.

You cannot skip the awkward phase of overlapping old and new infrastructures. Andreas Antonopoulos referred to it as "infrastructure backward compatibility." Imagine the scene in the 1990s when a 56k modem occupied an analog phone line, or the first car bumping along a gravel road meant for horse-drawn carriages.

In this phase, new technologies are genuinely at a disadvantage, limiting them to narrow point solutions rather than comprehensive systemic change. For a similar perspective in the AI field, see the research by Ajay Agrawal, Avi Goldfarb, and Joshua Gans (https://www.youtube.com/watch?v=aRoicN4k5LI). Before technology can truly shine, the entire ecosystem needs to transform and adapt.

Early World attempted to skip the reverse integration phase, placing tokens at its core. The current reboot disrupts this notion: it adopts a reverse infrastructure strategy and first launches real utility.

Without relying on existing infrastructure, you still cannot launch a first-class, truly global wallet. The inflow and outflow of funds need to feel effortless, much like the magic PayPal exhibited when online payments were still unstable, and this seamless flow is essential for any cryptocurrency wallet to penetrate the mainstream market.

This is precisely where the integration of World App with Stripe and Visa is compelling, as it brings familiarity, trust, and immediate utility from day one. This backward compatibility demand also allows existing businesses to participate, enabling them to track new players and actively launch new services.

The same dynamic is bringing cryptocurrency into the backend of cross-border payments for businesses and consumers. In the long run, this technology may become the focal point, but for now, it must coexist with traditional infrastructure to drive adoption and eliminate friction. Many cryptocurrency concepts can only shine after scaling, but without user-friendly entry points, they will stagnate before reaching that goal.

The success of cryptocurrency depends on excellent execution

Like any new technology, the adoption of cryptocurrency is by no means guaranteed. More precisely, decentralization (the core principle of cryptocurrency) is far from a foregone conclusion.

The success of stablecoins indicates that the demand for connecting cryptocurrency with traditional systems has birthed a useful tool, but they have the potential to reintroduce centralized control and closed networks into a financial system that should be open. I bet that open architecture will prevail; otherwise, what is the point of all this? But the traditionalists have motives to prevent it.

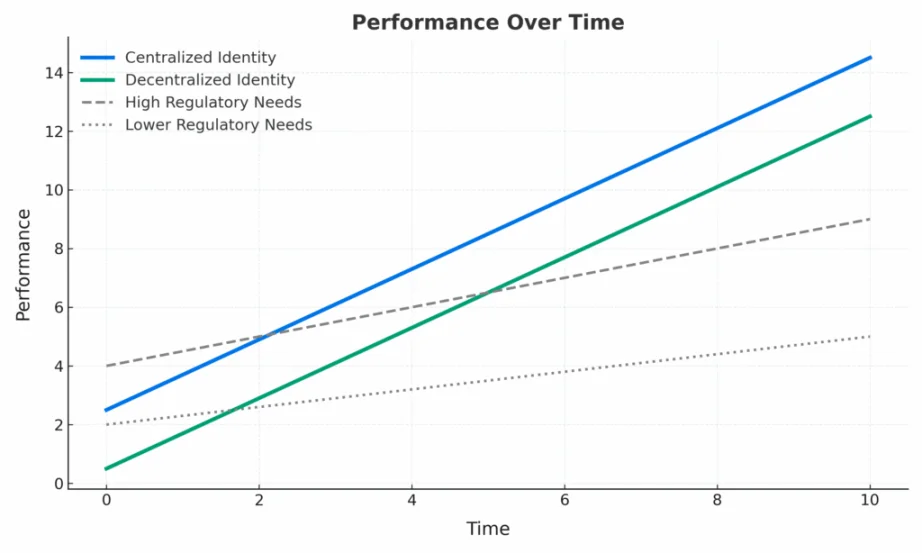

Blania and his team bet that consumers will value decentralized control over their data, while businesses will build better experiences on that foundation. I have previously written about the challenges of decentralized identity disrupting the status quo and how centralized players initially hold a clear advantage in user experience and functionality. To surpass these existing enterprises, World must first convince users to entrust their biometric data to it. With the launch in the U.S. market, we will soon see whether the team strikes the right balance between trust and convenience.

One can imagine a gentler entry point: providing an immediately useful benefit before asking users for an iris scan—a familiar verification identifier that unlocks additional features in apps users already love. Of course, the trade-off here is weaker verification, which is prone to abuse.

Blania may be right that in the endless cat-and-mouse game with AI, the highest level of biometric recognition will be the only reliable proof of personhood. However, he could have allowed users to gradually adapt instead of demanding an iris scan on day one. Those chasing airdrops may queue for tokens, but once the subsidies stop, that sweetener will vanish. Sustainable momentum will only thrive when you provide tangible daily value, and that is where the true potential lies. The payment experience of World App, combined with a frictionless global flow of funds, is likely key to achieving this.

As aggressive promotional plans come into play, we will soon see whether cryptocurrency can penetrate the mainstream market, especially if World can prove that cryptographic technology means privacy and convenience. Apple achieved this by saving a few seconds with each unlock through Face ID; Clear did it by guiding travelers through shorter TSA security lines. World needs to provide a similar "wow" moment the first time a user clicks to pay.

Conclusion

Regardless of the outcome of World’s experiment, I hope more cryptocurrency teams will shift their focus from token economics and price fluctuations to building products that people truly use every day. Because this absolutely unglamorous shift is the bridge that the cryptocurrency industry must cross to secure a place in the mainstream market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。