Fidelity-Led Exit Ends Bitcoin ETF Inflow Run as Ether ETFs Rally With $13 Million Bump

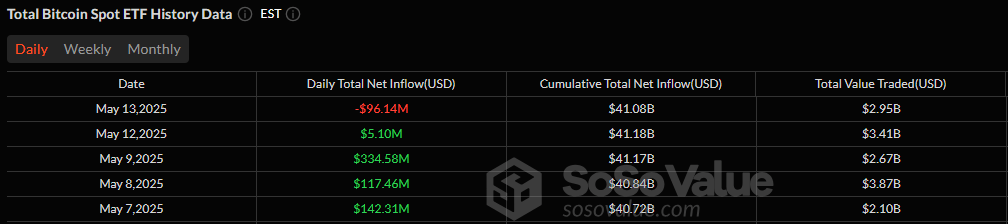

After four consecutive days of green, bitcoin exchange-traded funds (ETFs) finally hit a red light. The market saw a net outflow of $96.14 million, snapping the inflow momentum that had carried through the previous week.

The sharpest pullback came from Fidelity’s FBTC, which recorded a $91.39 million withdrawal. In an unexpected twist, Hashdex’s DEFI, usually dormant, logged a $4.75 million exit, adding to the day’s downturn. Despite the outflows, total value traded remained firm at $2.95 billion, with net assets finishing at $122.92 billion.

Source: Sosovalue

In contrast, ether ETFs made a much-needed comeback, racking up a $13.37 million inflow, their strongest showing in several days. The bulk of the inflow came from Grayscale’s Ether Mini Trust, which attracted $7.36 million. Franklin’s EZET and Vaneck’s ETHV chipped in with $3.06 million and $2.95 million, respectively.

With ether ETF trading volumes surging to $795.56 million, net assets rose to $9.27 billion, reflecting renewed investor interest. While bitcoin’s momentum may have temporarily stalled, ether’s brief bounce suggests that sentiment in the digital asset ETF space remains fluid and responsive to fund-level shifts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。