In the past two years, TON (The Open Network) has undergone a remarkable transformation from silence to explosion. Leveraging Telegram's hundreds of millions of users, it quickly established a strong presence in the crypto community. The gamified ecosystem, bot economy, Stars payment system, and official statements—TON's narrative tension was once at its peak. However, in the face of price fluctuations, market cap declines, and decreasing activity, TON has also exposed its deep-seated structural issues: concentrated chips, homogeneous ecology, and weak infrastructure.

This article will systematically sort out TON's chip distribution, token economy, user and capital flow, development ecology, and TAC architecture, attempting to answer a core question: Does TON's short-term prosperity have the structure to support its long-term value?

TON's Extreme Chip Concentration: The Rift Between Whales and Retail Investors

TON is a project that did not start smoothly. From the beginning, it bore the structural issues of significant chip concentration and historical miner lock-ups, and now it attempts to reshape itself amidst these "sunk costs." We can glimpse the true picture of its ecological development from its chip structure, token trends, and capital flows.

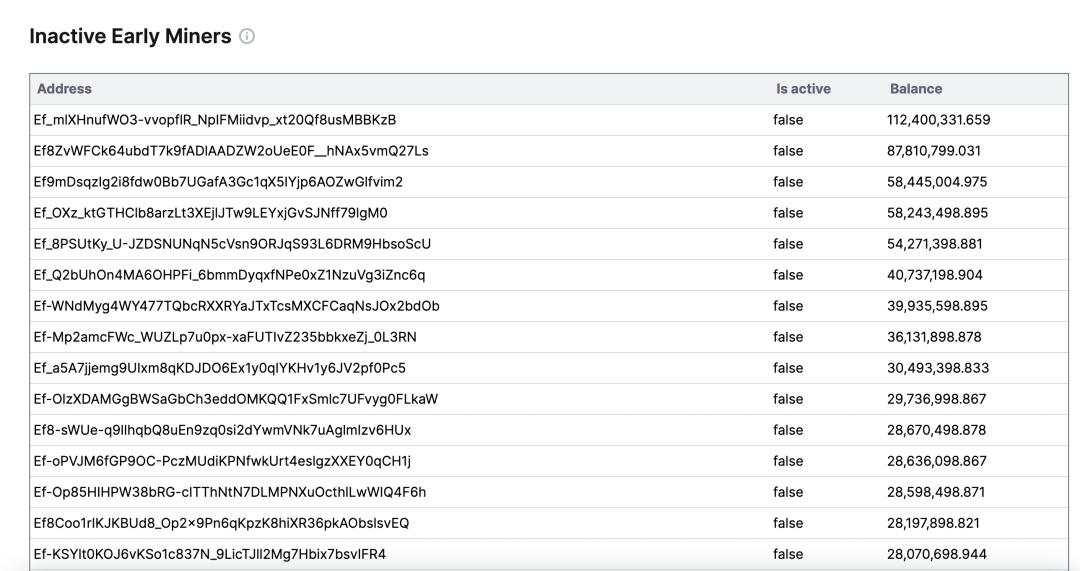

TON's history has led to most chips being held by a few miners. The TON team has attempted to address this issue through OTC: TON was created in 2018, and when it prepared to issue tokens and launch the mainnet in 2019, it was prohibited by the SEC. The project was officially halted in May 2020 but was restarted by a developer team called new TON. During this period (up to June 2022), TON coin was fully mined through POW and has now transitioned to POS.

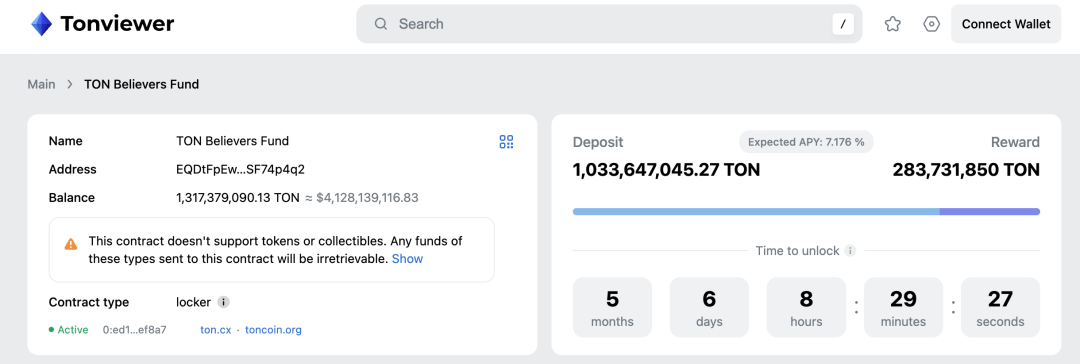

Assets marked as "TON Believers Fund" are confirmed to be frozen until October 12, 2025, with data showing a total of 1,317 mTON locked (approximately 52%). To stabilize selling pressure, these frozen assets have an APY as high as 7.176%.

Due to the halt and takeover by the development team, in June 2020, 98.55% of the total supply of TON was available for mining until mining ended on June 28, 2022, meaning most tokens are in the hands of early miners. The TON project team launched a service to purchase tokens in bulk at a discount from early miners, and if whales lock their tokens for a long term (4 years), they can receive an APY of 6-7%.

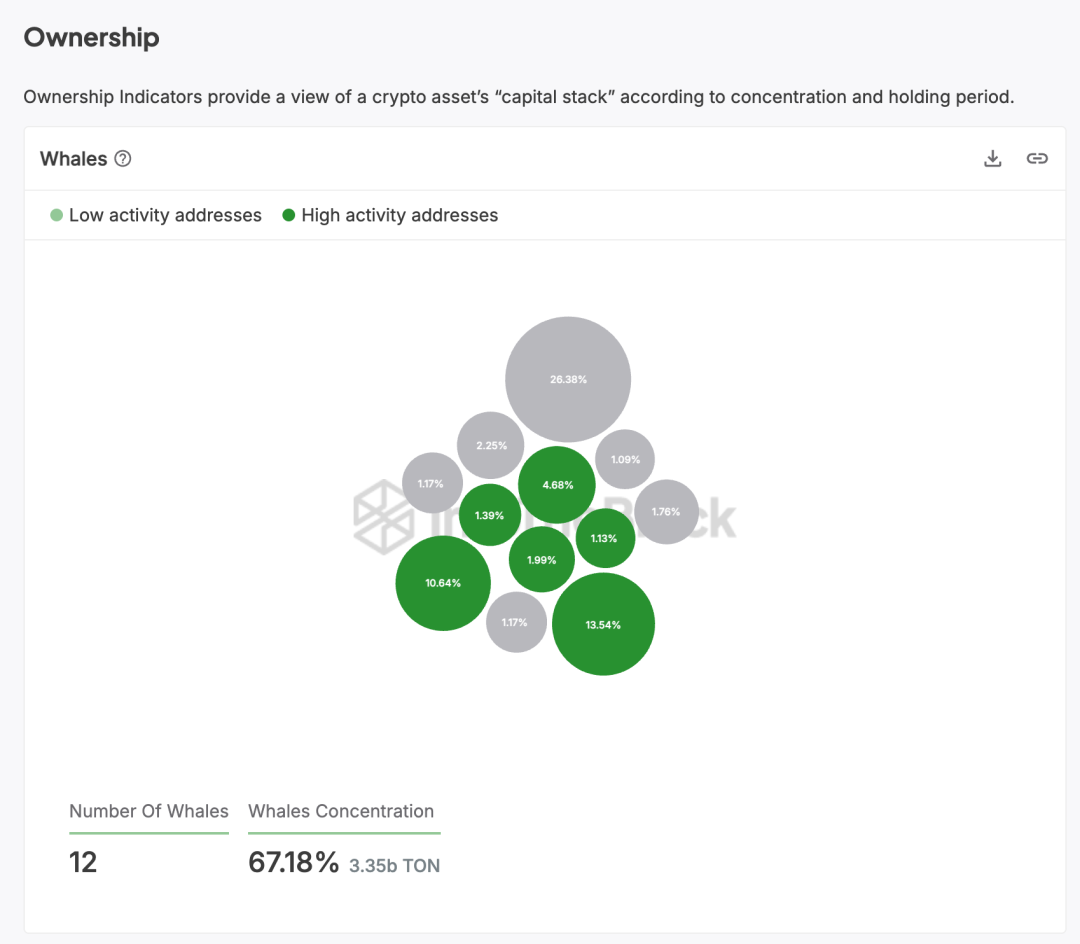

Whales on TON are frozen/inactive miners: According to Into the Block data, there are 12 whale addresses holding more than 1% of the total supply, of which 6 are low-activity addresses (defined as addresses with fewer than 300 transactions in their lifetime). According to community TON voting, addresses marked as "frozen" refer to inactive early miner addresses, which can be viewed at https://tontech.io/stats/#/early-miners, totaling 171 addresses, locking up 1,081 mTON.

Assets marked as "TON Believers Fund" are confirmed to be frozen until October 12, 2025, with data showing a total of 1,317 mTON locked (approximately 52%). To stabilize selling pressure, these frozen assets have an APY as high as 7.176%.

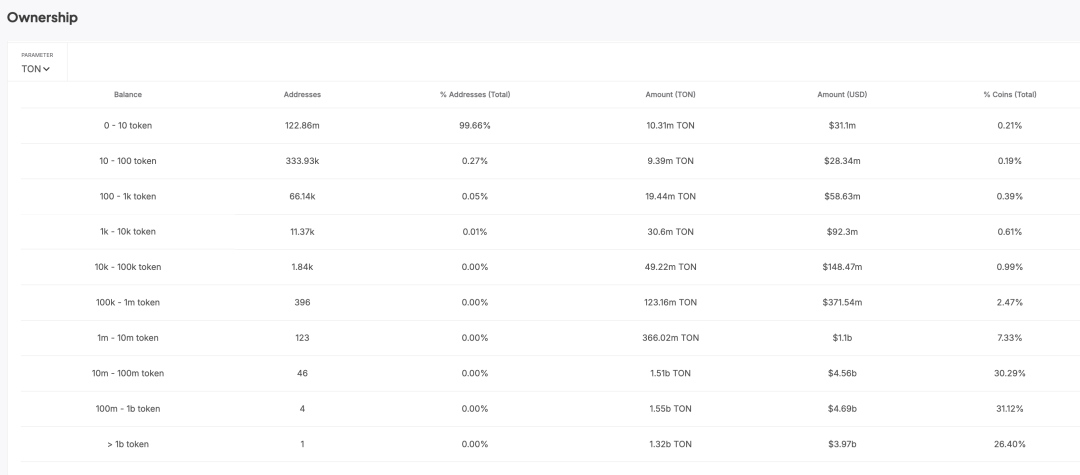

Severe Imbalance in TON's Chip Distribution

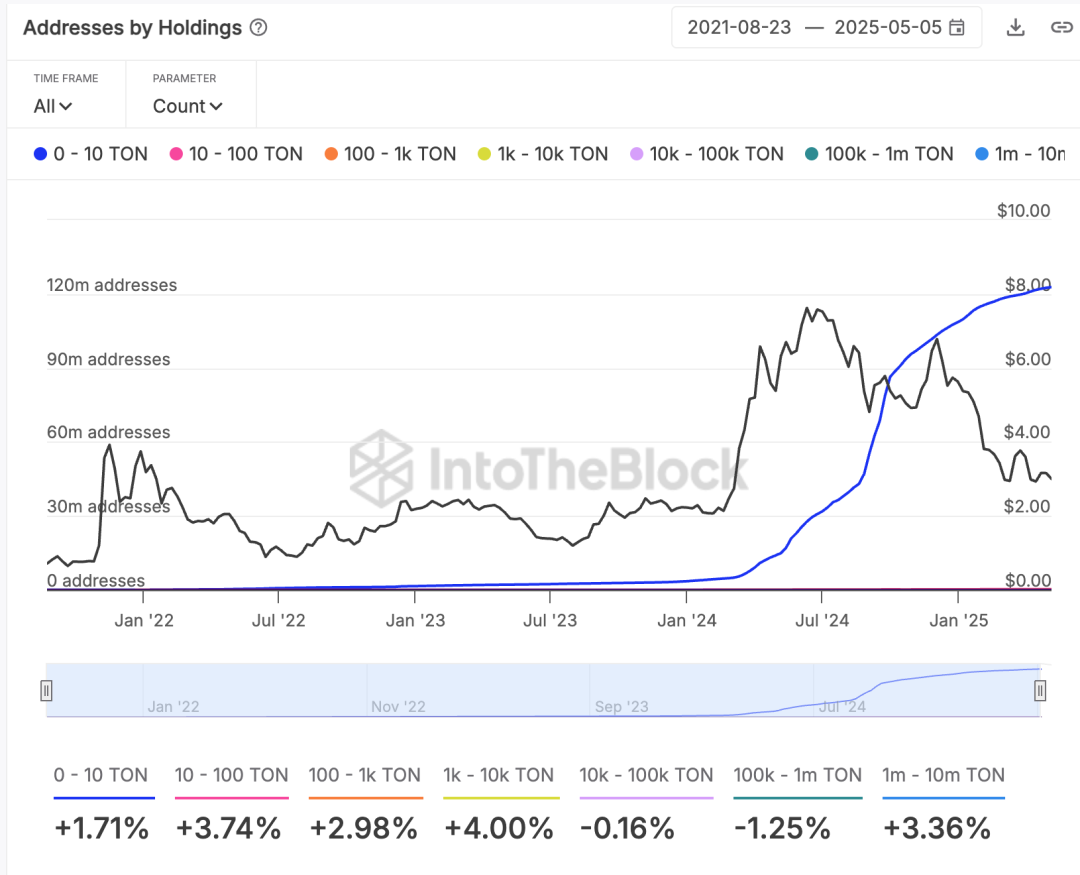

TON is highly polarized, with users holding less than 100 TON accounting for nearly 99.9%. Since March 2024, retail investors have surged: according to Addresses by Holdings data, there are currently about 123 million addresses holding TON, with most (122.54 million) holding fewer than 10 TON. Before March 2024, there were over 500 addresses holding more than 100K TON, which slowly increased after March, peaking at 1.3K in August 2024. However, the latest data shows that the number of large holders has decreased as TON's popularity wanes, currently around 600.

According to Into the Block data: although there are many addresses holding less than 1K TON, they only account for just over 1% of the total tokens.

TON's situation differs from other public chains; they need to build a development path suitable for themselves under historical constraints.

TON's Valuation Decline, but Upside Potential Remains

TON's Price, Market Cap, and Liquidity

According to CMC data, TON's price reached an ATL of $0.5194 in September 2021 and an ATH of $8.25 on June 15, 2024.

1⃣️, 2⃣️ Official support: In November 2021, TON was listed on centralized exchanges and received public support from Telegram's founder.

3⃣️: At the end of February and early March 2024, overall trading volume surged, with significant capital inflow. On one hand, Mirana Ventures invested $8 million to support TON in March, while on the other hand, Telegram users surpassed 900 million, along with IPO news.

4⃣️: From June to late July 2024, followed by a drop on August 25 when CEO Durov was arrested (about 20%).

There have been several major price increases:

In the past year, the TON token has dropped over 50% from its peak, and its market cap has also significantly shrunk. Meanwhile, the total value locked (TVL) in the TON ecosystem has experienced a sharp decline, plummeting from a peak of over $770 million to the current $140 million, a drop of nearly 80%.

Although the price has halved from its peak, in terms of market cap, TON still has room for recovery. The key lies in whether it can convert ecological heat into long-term value: as of May 11, 2025, Ethereum's market cap was $306.36 billion. If ETH aims for a 10% annual growth, it needs an additional inflow of about $30 billion. In comparison, SOL's current market cap is $91.93 billion, requiring $9 billion to achieve the same growth rate. Meanwhile, TON's current market cap is $8.64 billion, which, although down 65.65% from its mid-2024 peak market cap of $25.17 billion, indicates significant upside potential.

TON's market cap has experienced several phases, rising from a $4 billion market cap in mid-2023 to $7 billion at the beginning of 2024, and peaking at around $13 billion in August 2024 (FDV $27 billion), with the market cap nearly doubling every six months. However, it has now retreated to around $8 billion (FDV $17 billion).

From November 2022 to June 2023, the construction of the TON ecosystem led to an increase in market cap, stabilizing around $3 billion.

From June to August 2023, the TG bot gained immense popularity, and in July-August, TON integrated a built-in wallet and launched the TAPP application center, leading to a surge in interest in the bot ecosystem and the overall narrative of TON's ecology.

Starting in March 2024, due to continued financing and ecosystem development, the market cap soared.

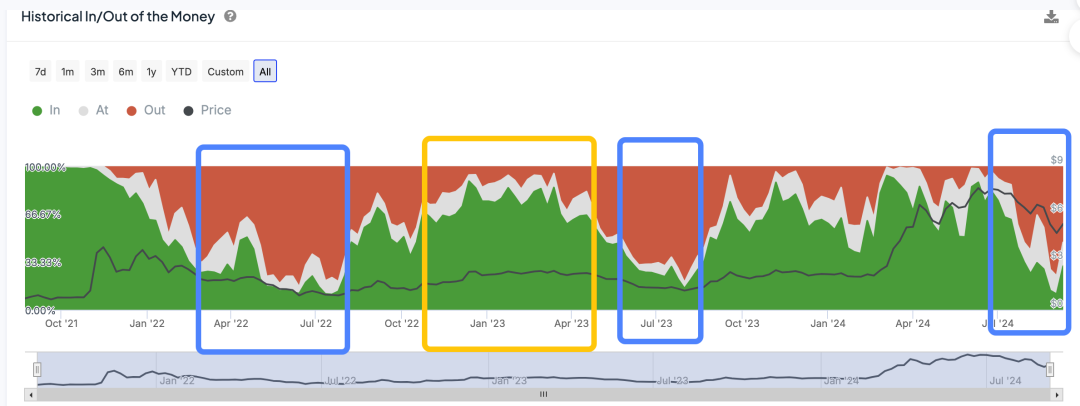

Liquidity inflow/outflow history: According to Into the Block data, significant selling periods occurred from April to June 2022, June 2023, July 2024, and currently in April-May 2025. Additionally, the end of 2022 and the beginning of 2023 were times of substantial capital inflow into TON.

On May 29, 2024, Durov sold 2,564,103 TON OTC, but it did not affect the price of TON. Prior to this, Durov had been intermittently selling TON since mid-March.

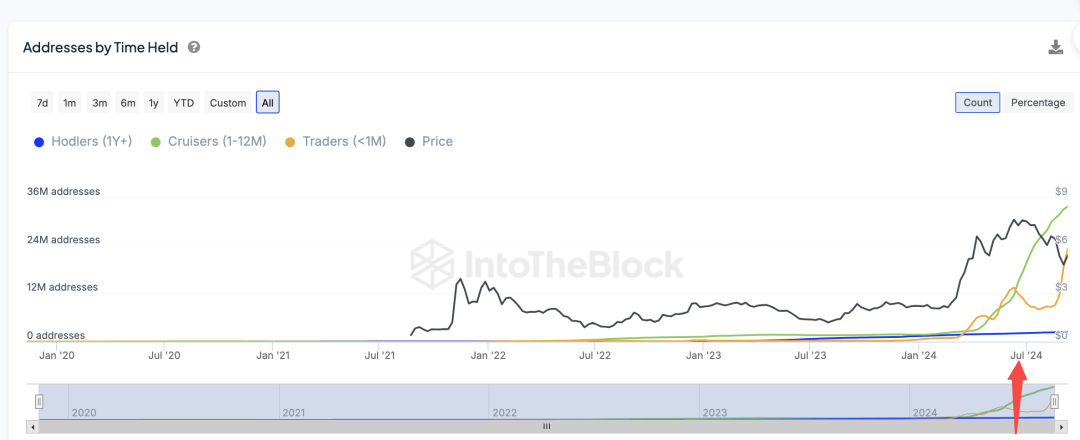

From June 10, 2024, the price and number of short-term traders continued to decline, while the number of holders for less than a year increased, indicating that most are those who entered in June 2023 (purchasing and selling TON), continuing to hold during the price drop (being stuck).

TON's Inflation is Controllable, Application Scenarios Await Expansion

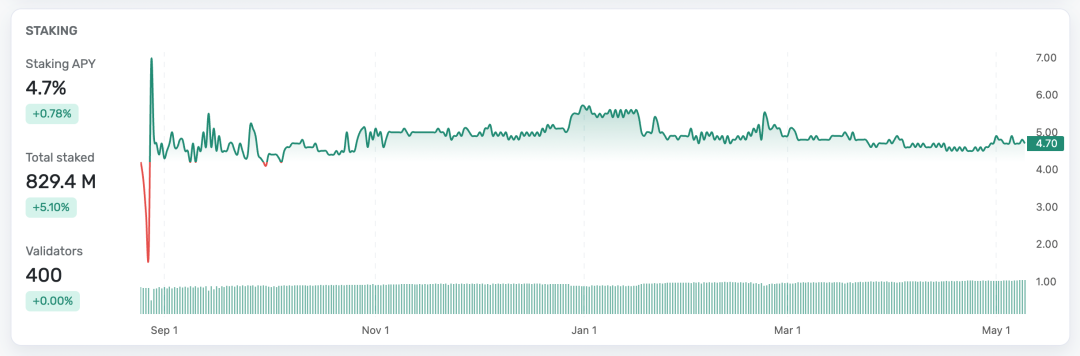

Token Supply: The initial supply of TON tokens was 5 billion, with no upper limit, growing at a rate of about 0.6% per year (approximately 30 million tokens). Tokens are used to reward validators, and if validators behave improperly, their staked tokens will be slashed. Currently, staking TON can yield an APY of about 4.7%.

Token Utility: Smart contract transaction processing fees, services for payment platform applications, staking, cross-chain transactions, governance, and storage services for TON. In the future, it can be used to pay for TON proxy services. Currently, TON can be directly purchased with a credit card, and then used to buy virtual goods like anonymous accounts.

TG Stars is TON's solution for gradually transitioning web2 users into crypto, allowing direct credit card top-ups:

The app store will support this in the future, with official statements indicating that digital goods will have a unique payment channel. The official also states that Telegram Stars is just the beginning. Future updates will bring more features and functionalities to Stars, such as gifts for content creators and micro-payments.

However, the TG official has linked the two most important parts of MKT—traffic generation and withdrawal—to TON: 1) Advertising can only be placed after recharging TON; 2) Developers must withdraw earnings through TON, meaning that the product is surrounded by TON from "start" to "finish."

For users: It's simple to use, just purchase with a credit card, without involving crypto;

For merchants: Withdrawals must be in TON (some have commented that this is a crypto grift, as it is only useful when cashed out);

For TG: Using Stars instead of real currency to follow Google Play/App Store rules, while also being convertible to TON;

Currently, TG has launched the Telegram Stars intermediary solution to comply with Apple and Google's regulations and enhance user engagement. The official links the core of its future ecosystem (advertising, fund transfers) to the TON ecosystem: to support payments for digital goods and services across the entire Telegram ecosystem, Telegram Stars has been introduced. Users can acquire Stars through in-app purchases on Apple and Google or via PremiumBot, which can then be used to purchase digital products offered by bots, such as e-books, online courses, and items in Telegram games.

The Reality After the Decline of TON Traffic: Growing Pains of Ecological Transformation

TON currently faces a crowded and competitive landscape, with the official no longer focusing on the gaming ecosystem but instead emphasizing the payment side: out of over 1,000 projects, there are only 20 small categories, but in reality, there are only 5 major categories, such as NFT-related (120+), gaming-related (700+ including gambling), trading (CEX, wallets, bridges), social (channels, chats, etc.), and tools (explorers, dev tools, VPN, launchpad). It is evident that TON is not focusing on the previously popular gaming ecosystem, with the gaming category even being the second to last on the official classification page.

However, there is a lack of products in other categories: aside from gaming and memes, other sectors are generally less well-known. Even in the shopping category, there are issues such as a single user base (only supporting Russian-speaking regions) and basic functionality (mostly helping with TON payments);

The continued decline in activity on the TON chain clearly reveals the weakening economic vitality within its ecosystem. Both user participation and transaction frequency have dropped, reflecting a significant reduction in the growth momentum of the ecosystem.

This predicament stems from a combination of factors. On one hand, TON initially relied on Telegram's traffic dividends, quickly attracting users with mini-programs and "Tap to Earn" type mini-games, but failed to establish effective user retention and value accumulation mechanisms. After the wealth effect faded, user interest plummeted, and the traffic dividend rapidly dried up.

On the other hand, the narrative surrounding the TON ecosystem is relatively singular, mainly revolving around social and gaming, lacking in-depth layouts for diversified sectors such as DeFi, AI, and DePIN. According to DeFiLlama data, there are currently only a dozen projects on TON with a TVL exceeding $10 million, with Tonstakers standing out, indicating a high concentration of ecological projects and prominent issues of developmental imbalance.

Additionally, TON's unique development architecture and programming language are not developer-friendly, limiting project incubation and innovation efficiency, further weakening ecological vitality. Although Mini Apps have seamless authorization and payment integration features, theoretically reaching 950 million Telegram users, the ecosystem is actually highly concentrated in gaming and NFTs, with general applications such as tools, payments, and infrastructure still being scarce.

If TON cannot break free from its dependence on short-term popularity and expand into feasible application scenarios starting from the TON token, it will struggle to solidify into sustainable on-chain value. Once the traffic dividend fades, what truly supports the ecosystem must be the healthy structure and diverse capabilities of the projects. From the current composition of the TON ecosystem, the pressure for transformation is gradually becoming apparent.

Where Are TON's Users and Developers?

TON User Surge, But Activity is Declining

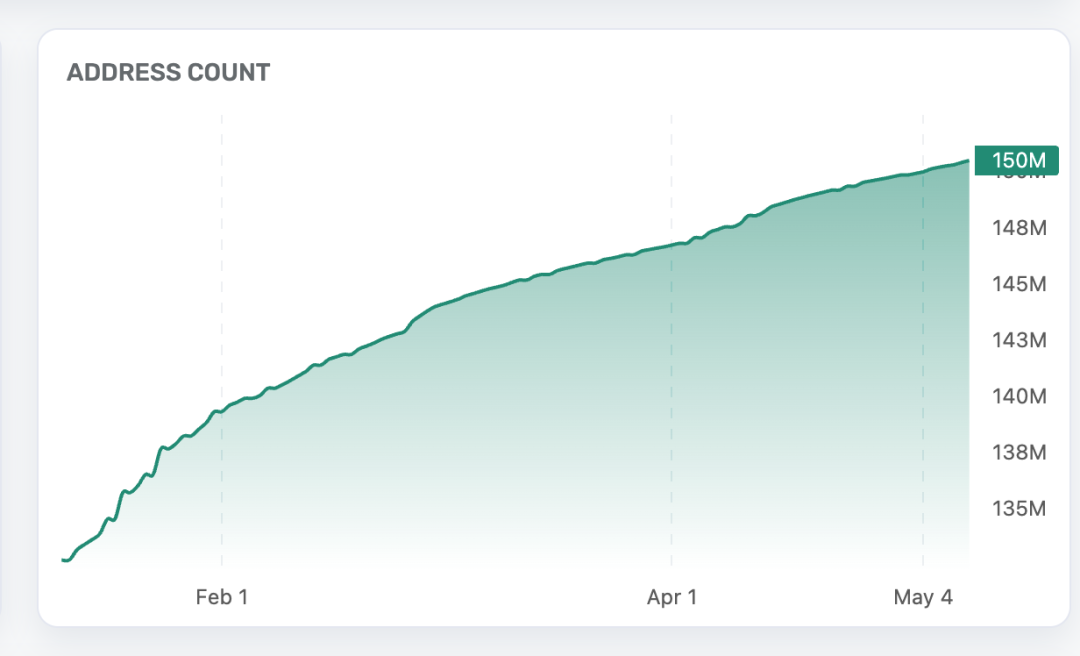

TON's user growth is rapid: According to tonscan data, from mid-May 2024 to early September, the number of TON addresses increased from 20 million to 70 million, with a doubling in August alone (from 45 million to 70 million). From September 2024 to now, TON addresses have doubled again, currently reaching 150 million users, showing very rapid growth;

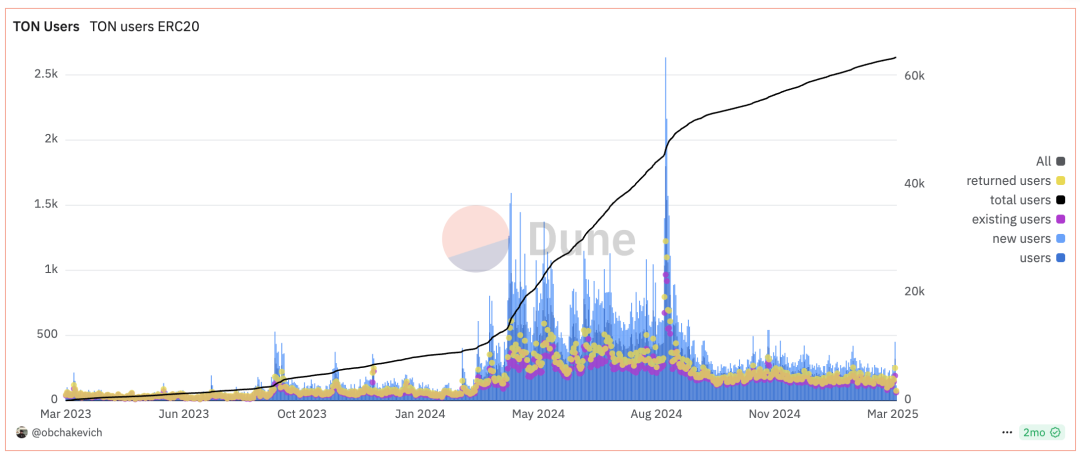

According to Dune data, new users have been increasing at an average rate of 200-300 per day since early 2024, while returning users can cover the loss of users;

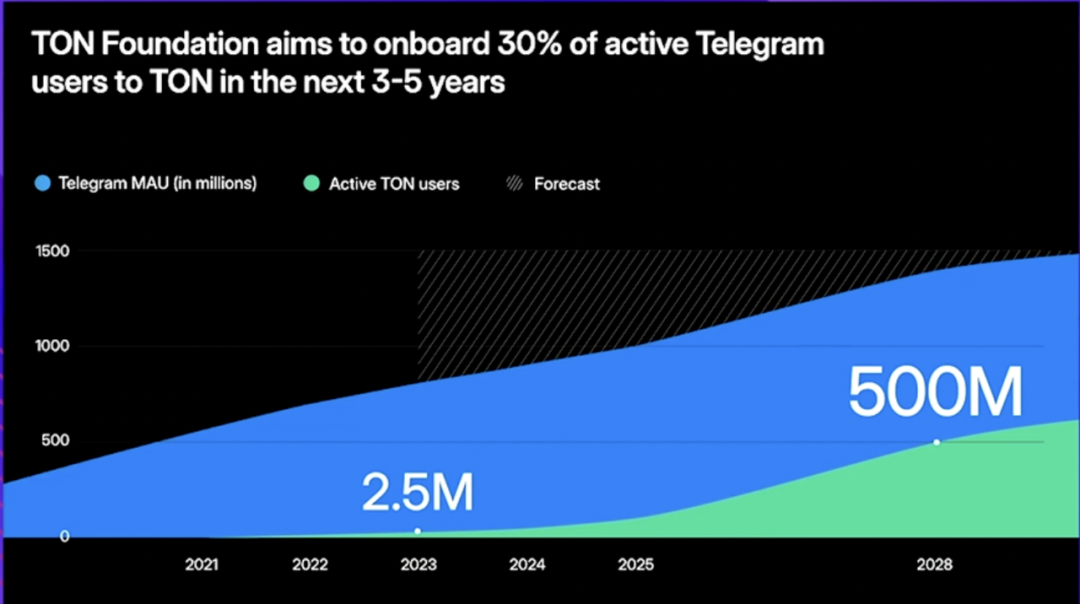

TON is expected to cover 30% of TG users, targeting 500 million users by 2028;

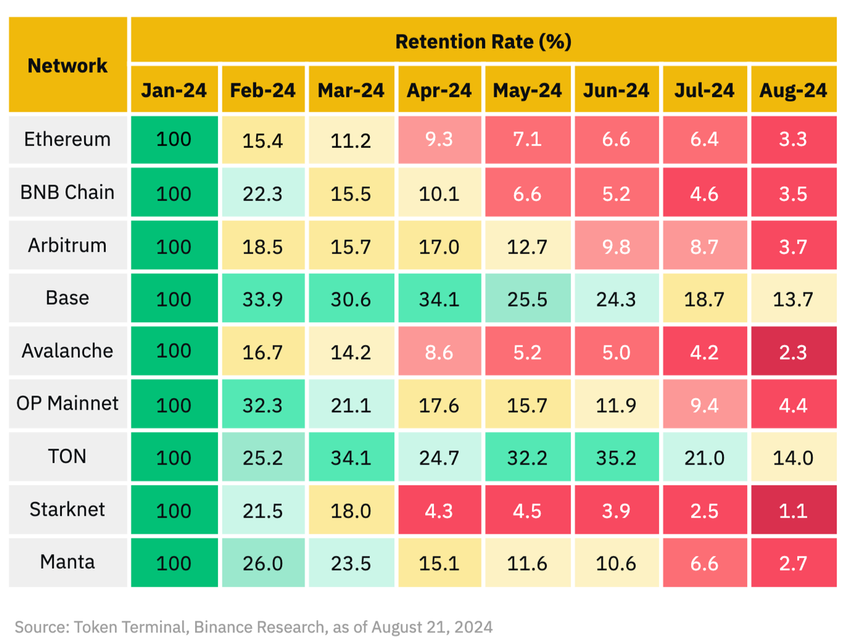

TON users show high stickiness, but the number of active addresses has significantly decreased as the ecosystem has cooled: According to Binance's 2024 report "Web3: The Household Name in the Making," the average retention rate across various chains is 5.4%, while TON has the highest retention rate among all well-known public chains, which is simple to explain: it focuses more on building a strong consumer ecosystem and has a solid product-market fit. Currently, the number of active addresses on TON last month was 2 million (with daily active users at 30,000), compared to over 10 million at the end of 2024, and now the data has significantly decreased, considering the market's attention and capital shifting to other ecosystems.

TON's trading volume has significantly decreased compared to before, but remains stable overall: According to tonscan data, at the end of 2024, TON's trading volume was consistently around 4 million transactions per day, while the current trading volume has dropped to 2.5 million transactions. In comparison, the daily transaction count on the BTC chain is between 300,000 and 400,000, while ETH remains stable at around 1.1 to 1.3 million.

TON Developer Ecosystem Under Pressure, Infrastructure Needs Strengthening

The small number of TON validators has led to a certain degree of centralization: Currently, there are 400 validators on TON, an increase from 361 at the end of 2024, distributed across 26 countries, with staked amounts nearing 700 million TON, accounting for 12% of the total token supply and 28% of the circulating token supply;

This difference in the number of validators means that each validator needs to handle more transaction requests (centralization). When transaction volume surges, validators may not be able to process all transactions in a timely manner, leading to block delays or even interruptions (this may be the reason for the pause in TON block production after Durov's arrest): On August 28, the TON blockchain experienced two interruptions in one day, totaling 10 hours.

The issues with the TON network are: 1) TON has high hardware and network requirements for validators, requiring at least 300,000 TON to become a validator; 2) There is an insufficient number of validators. Compared to other PoS public chains, TON's number of validators is notably low. Currently, the TON network has only 400 validator nodes, while Ethereum has surpassed 1 million validators, and Solana's validator count also far exceeds that of TON.

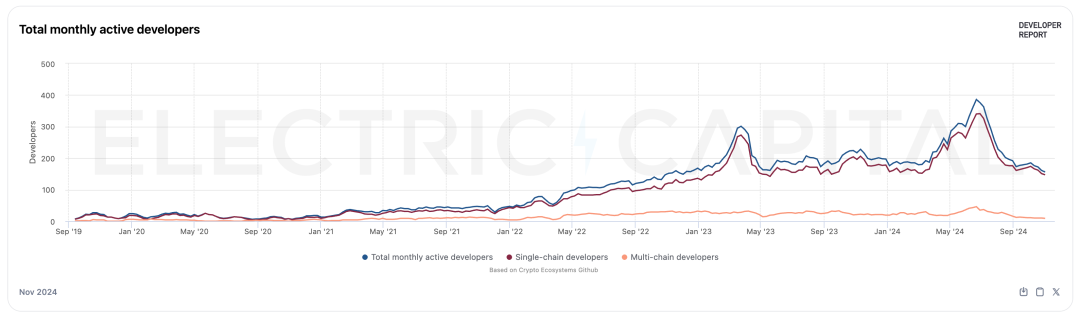

The number of developers is stable but has decreased: Many developers come from Telegram, with core developers mostly from South Korea and Russia, characterized by strong technical abilities but average product experience. According to the developer report data, as of May 2025, there are 30 full-time developers on TON (with a daily code change of 10+), and over 150 active developers per month, a decrease of 100 from the end of 2024. Compared to other ecosystems, this number is generally low (ETH has over 2,000, while others like Polygon, Arbitrum, and Solana range between 500-600);

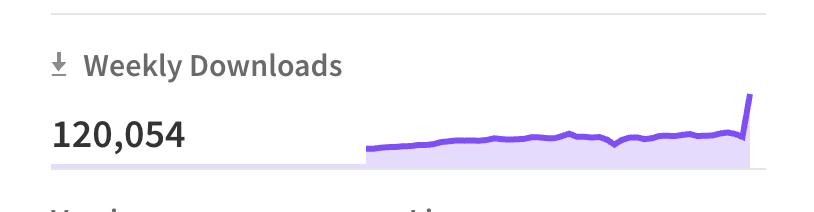

The TON Connect SDK is an essential SDK for developers to link to the TON ecosystem (connect your app to TON wallets via the TonConnect protocol), with its download volume increasing from an average of 10,000 per week at the beginning of 2024 to over 25,000 during the peak of the ecosystem in August 2024, and now averaging 12,000 per week;

TON's growth exhibits a typical "user-first" characteristic, but this also masks the issues of unstable ecological foundations and insufficient developer support. If TON does not continue to find a sustainable direction that can adapt to TG applications, it will struggle to compete with other public chains.

The Future of TON: Moving Towards Compatibility and Connectivity

Despite TON having a large potential user base, the development of its ecosystem faces a significant obstacle: incompatibility with mainstream Ethereum Virtual Machine (EVM) applications. Therefore, in the face of Ethereum's strong ecosystem and the trend of inter-chain interoperability, TON is also making key adjustments—launching the TAC architecture to bridge the gap with the EVM world.

TAC is a TON network expansion that connects TON with EVM-compatible applications, creating a unified experience for users and developers. With TAC, users can interact with any EVM application using their TON wallet, and developers can migrate EVM applications to TON without rewriting code or learning new frameworks.

At its core, it is not a compatibility layer but an independent EVM public chain built with Cosmos SDK + Ethermint, utilizing dPoS consensus and achieving BTC staking security through Babylon. This chain supports full EVM smart contract execution and serves as the "EVM native zone" on TON.

Cross-chain communication is managed by TAC's sequencer network. Each cross-chain transaction must first achieve 66% consensus within the sequencer group before undergoing cross-group verification, ensuring that messages are securely delivered and the process is immutable.

The entire process is supported by a Proxy smart contract system: the Proxy contract on TON is responsible for initiating messages and locking assets, while the EVM-side Proxy contract (written in Solidity) receives messages and completes interactions. For users, the entire cross-chain process is transparent, and the experience feels like using a native DApp.

TAC also enhances economic security through a staking mechanism. Sequencers and validators must stake assets to participate in verification, earning rewards for good behavior and facing penalties for malicious actions, thereby ensuring stable and efficient network operation.

Overall, TAC is not a bridge but rather a native expressway from TON to EVM, expanding the ecological boundaries of TON and allowing Web3 users to truly "carry one wallet and traverse all worlds" across multiple chains.

The practical application logic of TAC is not complex. Here is a real scenario demonstrating how a user completes a token exchange operation on an EVM DEX using a TON wallet—TON users exchanging tokens on an EVM DEX: 1) The user connects the DEX frontend with their TON wallet and selects the tokens to exchange; 2) The TON Proxy contract locks the assets and generates a cross-chain message; 3) The sequencer network performs verification and consensus; 4) The EVM Proxy contract receives the validated message and completes the exchange logic; 5) The transaction result is returned to the user's wallet via the reverse path.

The story of TON is not simply one of "explosive growth" or "collapse." Its past is marked by a decentralized restart following the SEC ban, with a complex chip structure and an ecological narrative heavily reliant on Telegram's platform capabilities. Its present features explosive user growth but also faces bottlenecks in activity and developer support. Its future hinges on the compatibility path opened by the TAC architecture—whether it can connect to the mainstream EVM world, build a robust developer ecosystem, and break through the bottlenecks of payment and scenario implementation will determine whether TON can truly emerge from platform dividends into its own paradigm.

After the traffic fades, what can truly remain is the chain's self-sustaining capability. TON is still at a crossroads.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。