Original text from The Defi Report

Compiled by|Odaily Planet Daily Golem (@web3golem)_

Editor's note: "That season seems to be coming," people have hesitated to directly mention the name of the altcoin season on social media due to too many disappointments. However, on May 8, after three months, BTC once again crossed the $100,000 mark, leading to a collective rise in mainstream altcoins, with ETH's performance being the most remarkable. The topic of "What Happened to Ethereum's 40% Surge in 3 Days" even topped Douyin's hot list, and Nick Tomaino, founder of 1confirmation, boldly stated that ETH will eventually surpass BTC.

However, the price increase does not indicate a significant change in ETH's fundamentals; doubts about Ethereum still exist in the market, along with discussions about whether its biggest competitor, Solana, will surpass it. In January 2023, SOL's trading price was 97% lower than ETH, and now SOL's price is still over 90% lower than ETH, with ETH's market cap being more than three times that of SOL. Does SOL really have the potential to surpass ETH?

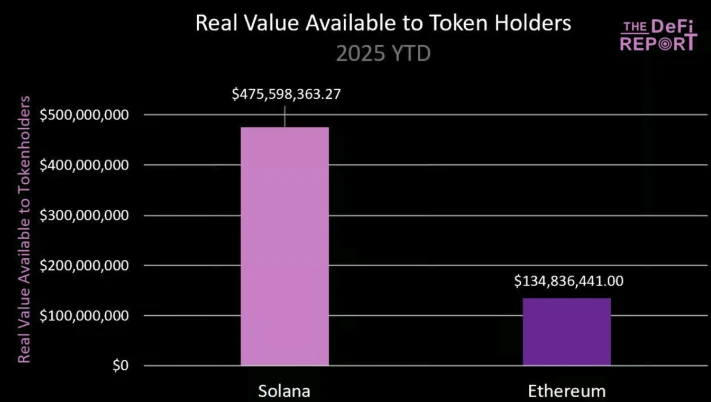

Researchers at The DeFi Report believe that from a fundamental perspective, even if it cannot surpass ETH, SOL's price should absolutely not be more than 90% lower than ETH. Previous analyses primarily compared the two networks based on metrics such as fees, DEX trading volume, stablecoin supply and trading volume, and total TVL. This report from The DeFi Report focuses on comparing the actual value that ETH and SOL token holders can obtain, finding that the actual value obtained by SOL token holders is 3.6 times that of ETH, thus believing that the market's current valuation of ETH is already higher than that of SOL. Odaily Planet Daily compiles the full text as follows, enjoy—

Actual Value Obtained by Token Holders

Solana

The actual value obtained by Solana token holders/stakers = Jito Tips (MEV) earned by validators and shared with stakers. This does not include newly issued SOL, base fees, priority fees, or MEV earned by MEV hunters.

The $475 million shown in the image for Solana is the net value after Jito charges a 6% fee to all validators running Jito Tips routers and block engines. If you hold SOL, you can stake it to trusted validators/LSTs, such as Helius (hSOL), which charges $0 in commission to stakers. In this case, SOL stakers can obtain 94% of the MEV run by Jito (95% of Solana's staked SOL runs on Jito).

Ethereum

The actual value obtained by Ethereum token holders/stakers = MEV + priority fees earned by validators and shared with stakers. It does not include new ETH issuance, base fees, block fees, and the MEV share retained by MEV hunters and block builders.

The estimated $134 million for Ethereum shown in the image has deducted the 10% fee charged by Lido (the most trusted liquid staking provider on Ethereum).

Solana as a Combination of Nasdaq and DTCC

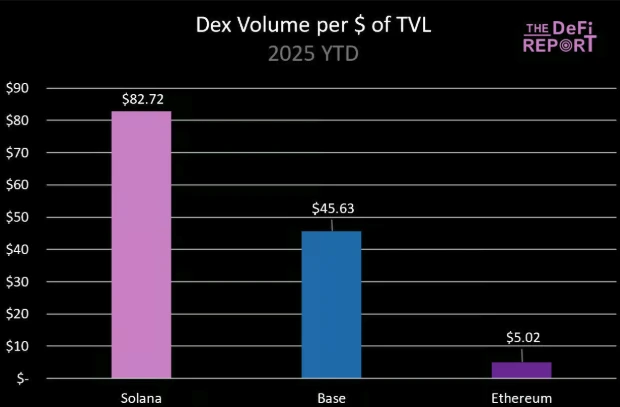

Ethereum's TVL is 6.6 times that of Solana, and its stablecoin supply is 10 times that of Solana. However, in terms of the actual value obtained by token holders from the beginning of the year to date, Solana token holders have obtained actual value that is 3.6 times that of Ethereum. This is because the network's execution capability and circulation speed determine the actual value, allowing validators and token holders to monetize the TVL.

In traditional finance (TradFi), Nasdaq is responsible for execution and circulation speed, while the DTCC (Depository Trust & Clearing Corporation) is responsible for custody/settlement. Ethereum is increasingly resembling the DTCC (custody + accounting for L2 transactions), while Base and other L2 platforms are becoming more like Nasdaq (handling execution/speed). Solana, on the other hand, is increasingly resembling a combination of both.

Integrating Nasdaq + DTCC into one solution means that SOL holders can obtain 100% of the value generated by execution/speed services, while ETH holders can only obtain about 10% of the value (by burning ETH to obtain from L2 platforms). Although Ethereum possesses these assets, they circulate on L2, and the current question is whether ETH token holders can ultimately obtain this value—while Solana currently does not have this issue.

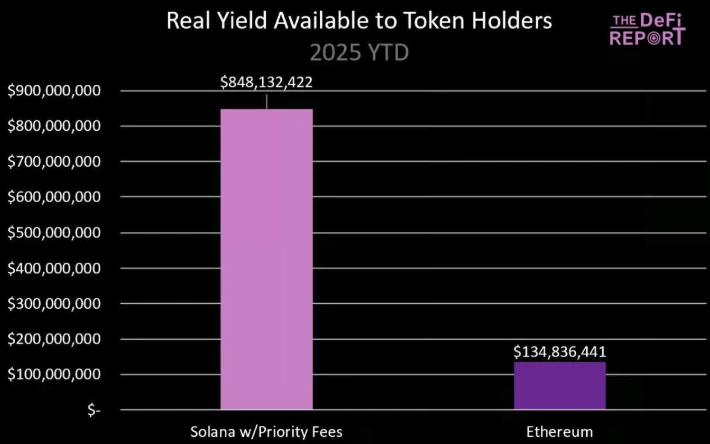

Apart from some innovative LSTs on the Sanctum platform, Solana validators can obtain 100% of the priority transaction fees from user transactions (not shared with stakers). Jito aims to change this situation, and the DAO currently has a governance proposal to update the tip router, which will include priority fees in addition to the MEV currently routed and paid to stakers. According to Jito, this proposal is expected to be implemented in the coming months.

If we include the priority fees (after deducting the tip router fees, amounting to $372 million), the data for the year to date is as follows:

It is currently unclear how strongly validators are willing to share priority fees, but we hope to add this information so you can understand how future data may change.

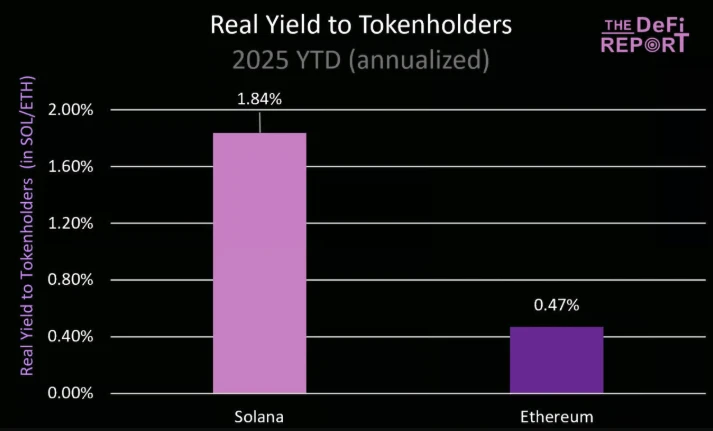

Actual Yield

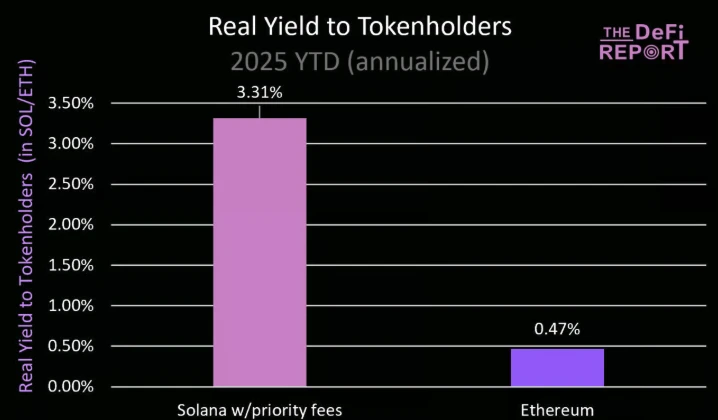

The following chart converts the above data into annualized actual yields (in SOL and ETH):

If we also include Solana's priority fees, the actual annualized yield for Solana token holders is 3.31%:

Total Yield (Including Issuance/Network Inflation)

By staking assets, token holders can obtain newly issued supply/issuance (to incentivize validators/stakers to provide services). This is a key difference between crypto networks and traditional companies, as company shareholders cannot avoid equity dilution.

Solana's "issuance yield" is 7.3%, based on the actual network issuance as of May 6, 2025, while Ethereum's "issuance yield" is 2.78%. As of now, Solana has issued 9.4 million tokens, which will be paid to SOL staked within validator nodes on the network (as of May 6, 2025, the average staked amount is 385 million). Ethereum has paid 329,380 ETH to 34.3 million tokens staked within validator nodes on the network.

Due to Ethereum's extremely low network inflation rate (with an annualized inflation rate of 0.64% based on year-to-date actual data), its "issuance yield" has normalized. Solana's "issuance yield" may continue to decline, as the network's inflation rate is currently 4.5% and decreases by 15% each year until it reaches a final level of 1.5%.

Sources of Actual Value

Meme coins have contributed to more than half of the trading volume on Solana DEX (growing 51% over the past few months), with SOL/USD accounting for about 35% of Solana DEX trading volume, and the remaining 14% from stablecoins, LSTs, and other assets.

Is this a problem for Solana? Yes and no.

Clearly, speculation is one of the strongest demands in cryptocurrency, and Solana has found a product-market fit by providing a better user experience, a situation that is unlikely to disappear in the short term. Additionally, meme coin trading is stress-testing the system and providing valuable feedback to infrastructure providers.

Today it’s memes, but perhaps tomorrow it will be stocks, bonds, currencies, and private assets, which may be Solana's target. Currently, only 1-2% of DEX trading volume on the Ethereum mainnet consists of meme coins, while stablecoin trading volume accounts for about half, and ETH/stablecoin trading volume and other project tokens each account for around 20% of the trading volume.

However, about 50% of DEX trading volume on Base currently comes from memes, the vast majority of which are newly popular memes.

MEV

Some cryptocurrency analysts believe that with the compression/commoditization of base fees, MEV (the value users pay for time-sensitive transactions) is the only sustainable long-term value in L1. We disagree with this view, but we do believe that MEV will drive most of the economic benefits. Therefore, it is necessary to clarify the differences in how MEV operates on Solana and Ethereum, as well as the potential impact on L2.

Ethereum

Ethereum has a memory pool where all transactions pass before being sorted and submitted to validators. This is where MEV is captured, with the main participants being:

Searchers (bots): These bots use machine learning algorithms to identify profitable opportunities in the memory pool.

Block builders: Block builders are responsible for constructing blocks. In other words, they sort transactions into blocks and accept "bribes" from searchers in the process.

Validators: After block builders (with tips) submit blocks, validators approve these blocks.

Workflow:

User submits transaction —> Ethereum memory pool —> “Searchers” (bots) identify value (arbitrage, sandwich attacks, liquidation) —> Submit replacement transaction to block builders (with tips) —> Block builders package transactions —> Submit to validators (with tips) —> Validators approve transactions and retain most of the tips (block builders and searchers retain a portion).

The biggest unknown for Ethereum is what will happen to MEV if most transactions shift to L2 as expected.

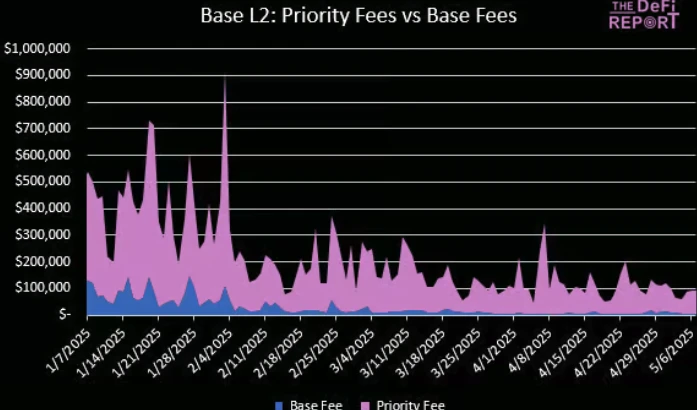

We believe that MEV will transfer to L2 in the form of priority fees. The following chart shows that 85% of fees on Base come from priority fees.

Solana

Solana does not have a memory pool, but it has dedicated validator clients like Jito that implement a form of rolling, private memory pool.

How it works:

Jito's block engine creates a very short window (about 200 milliseconds) during which searchers can submit transaction bundles to be included in the next block. This rolling memory pool is not public, but searchers connected to Jito's infrastructure can access it, allowing them to discover and exploit potential arbitrage opportunities within this brief window.

Searchers typically monitor on-chain status (e.g., order books, liquidity pools) directly by running their own full nodes or RPC endpoints. They detect arbitrage opportunities by observing state changes caused by confirmed transactions, rather than by looking at pending transactions in the memory pool.

When profitable opportunities arise (e.g., price imbalances between DEXs), bots quickly construct and submit their own transactions (usually through Jito or similar relays), hoping to seize the opportunity before others.

Currently, about 50% of arbitrage MEV on Solana is conducted through Jito (the value is shared with stakers via the tip router):

Data: sandwiched.me

If you invest in these networks, you need to understand how to accumulate MEV through staking as a token holder. Currently, SOL holders have a better opportunity to obtain MEV (as well as potential priority fees) compared to ETH holders.

Conclusion

Should SOL's trading price be 93% lower than ETH? From a fundamental perspective, absolutely not. Even considering ETH's outstanding network effects, decentralization, asset collateralization, and other factors, the price difference is still too large.

Our conclusion is that based on ETH's network effects and TVL, the market currently values ETH higher than SOL.

The macro context for ETH is that it will become the home for trillions of tokenized assets such as stocks, bonds, currencies/stablecoins, and private assets in the future. But ultimately, investors should focus on how ETH captures real value from these assets.

Because investors have a choice, if another chain can consistently deliver more value to token holders, then more capital will flow to that asset in the long run. As Benjamin Graham once said, “In the short run, the market is a voting machine. But in the long run, it is a weighing machine.”

ETH can attempt to change this situation through re-staking and blob fee adjustments. For example, using EigenLayer for data availability (DA) with MegaETH, ETH holders can capture additional real value from these networks through re-staked ETH.

But it must be made clear that today, crypto assets are rarely traded based on fundamentals. While we believe that prices will always revert to value, that is not the case at present. Market narratives, trends, influencer effects, and liquidity conditions remain driving factors in the market.

Of course, ETH has been at a disadvantage in narratives over the past few years, but this situation has improved following the recent price surge. A single-day increase of 20% is no small feat for an asset valued at over $220 billion.

Remember: the crypto market has a strong reflexivity, price → narrative → fundamentals. Whether ETH's recent excitement is the beginning of a larger market trend remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。