Source: Cointelegraph

Original: “Bitcoin (BTC) profit-taking point at $106,000 before new all-time highs”

Key Points:

Bitcoin has shown a bearish breakout from the ascending channel, with profit-taking risks around $106,000.

Lower-than-expected U.S. Consumer Price Index (CPI) data could boost Bitcoin, but higher CPI may increase bearish pressure, leading to a price drop below $100,000.

Bitcoin's price reached an intraday high of $105,800 on May 12 but fell 3% to $101,400 during the New York trading session. On the short time frame (LTF) charts, Bitcoin fluctuated within an ascending channel pattern before breaking below the bottom range of the pattern, indicating a bearish breakout.

Bitcoin 1-hour chart. Source: Cointelegraph/TradingView

Regarding the stagnation of Bitcoin's bullish momentum, data analysis platform Alphractal noted that Bitcoin's retest near the $106,000 resistance level increases the likelihood of profit-taking. As shown, Bitcoin is currently close to the "Alpha Price" area, and Alphractal's CEO Joao Wedson stated that long-term holders or whales may take profits in this area.

Bitcoin Alpha price level. Source: X.com

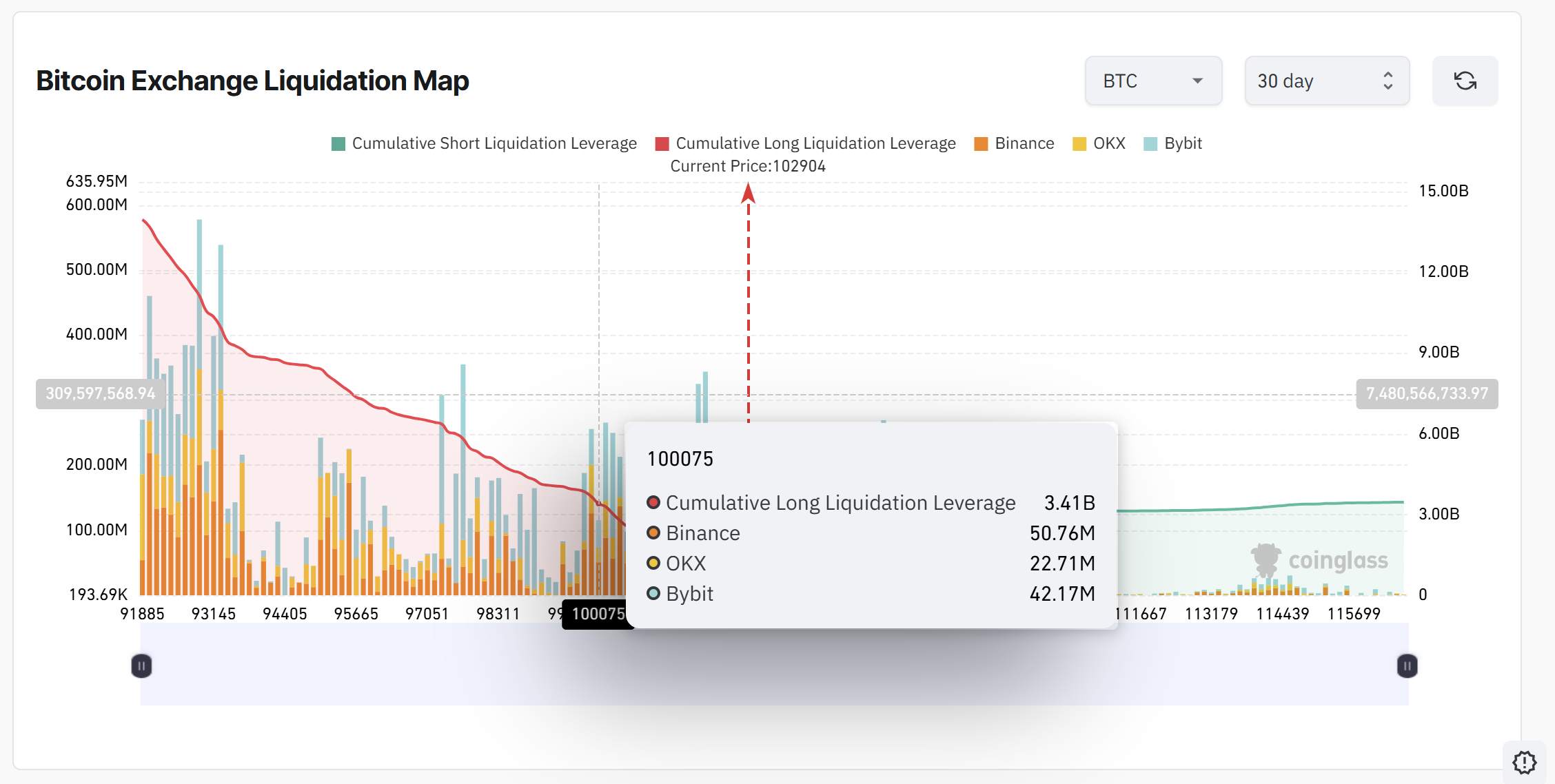

From a liquidation perspective, the risk of a "long" squeeze is also rising; if the price drops to $100,000, over $3.4 billion in leveraged long positions will face liquidation risk. This range may become a price magnet, leading to a retest near the psychological level.

The current pullback in Bitcoin may reflect traders reducing risk exposure ahead of the U.S. Consumer Price Index (CPI) release on May 13. Previously, the CPI released in March was 2.4%, down from 2.8% in February, despite a forecast of 2.5%. The CPI for April is expected to remain at 2.4%, due to stable energy prices amid oil price production balance and slowing wage growth, alleviating inflationary pressures.

U.S. Consumer Price Index data. Source: Investing.com

A lower-than-expected CPI (potentially for the third consecutive time) could be bullish for Bitcoin, potentially suggesting that the Federal Reserve will cut interest rates in 2025, boosting risk assets like stocks and cryptocurrencies. Conversely, a higher-than-expected CPI could be bearish, triggering inflation concerns and strengthening the dollar, putting pressure on Bitcoin.

If bearish pressure on the Bitcoin chart persists after the CPI release, the fair value gap (FVG) between $100,500 and $99,700 on the four-hour chart will become an immediate focus area.

Another FVG is located between $98,680 and $97,363, representing an 8% pullback from recent highs.

Related: Anchorage Digital acquires Mountain Protocol, USDM stablecoin begins liquidation

This article does not contain any investment advice or recommendations. Any investment and trading activities involve risks, and readers should conduct their own research before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。