Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Previous Records

Lazy Financial Strategy | DWF's Falcon Confirms Token Launch; Backpack Arbitrage Points (April 7)

New Opportunities

Resolv Launches Airdrop, Timely Registration Required

The yield-generating stablecoin protocol Resolv (Portal: https://app.resolv.xyz) has announced its token RESOLV's economic model and airdrop plan.

The total supply of RESOLV is 1 billion tokens: 10% allocated for the first season of airdrop (unlocked at TGE, top addresses require short-term locking); 40.9% allocated to the ecosystem and community (10% unlocked at TGE, the remaining part unlocked over 24 months); 26.7% allocated to the team and contributors (1-year lockup, 30 months linear unlocking); 22.4% allocated to investors (1-year lockup, 24 months linear unlocking).

Registration for the RESOLV airdrop started on May 9 and will end at 7:59 AM Beijing time on May 17. Users who have not completed the registration process must register in time, or they will lose their airdrop eligibility — unclaimed airdrops will enter the second season airdrop prize pool.

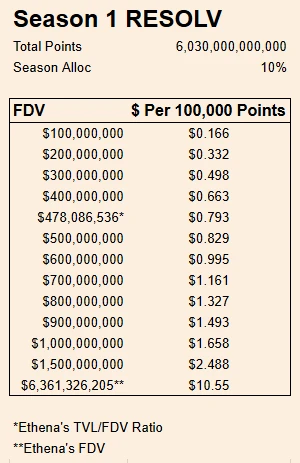

Additionally, the Pendle community has estimated the point value of Resolv under different valuation conditions, as shown in the image below for reference.

Considering that Resolv has recently expanded to the BSC ecosystem, it is speculated that RESOLV may follow the Binance wallet new token route (pure speculation, please refer to official information).

Backpack Introduces 4% Treasury Bond Yield

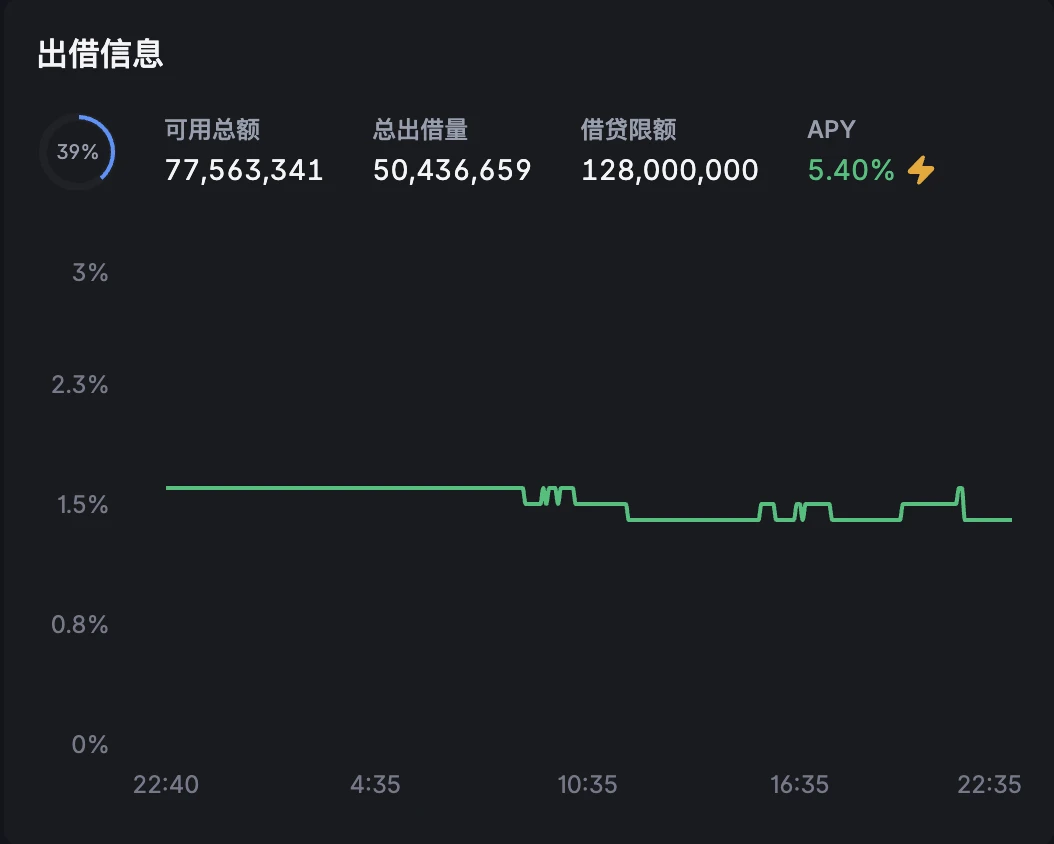

Backpack (Portal: https://backpack.exchange) has recently integrated the stablecoin system within the platform. Currently, stablecoins such as USDC deposited on the platform will be automatically converted to USD, and lending USD can earn an additional 4% treasury bond yield on top of the base lending yield (currently reported: 1.4% + 4% = 5.4%).

Previously, we shared how to use Backpack for arbitrage (finding cryptocurrencies with high funding rates, buying spot while opening equivalent short positions to earn funding rate compensation), which allows users to earn certain yields while accumulating Backpack points. The introduction of treasury bond yields further enriches the earning paths within Backpack, making participation quite recommended.

Aave & Pendle PT Circular Loan Demand Booms

Aave officially supported Pendle PT assets last month, with the currently available pools including eUSDe PT and sUSDE PT, with limits of $400 million and $240 million respectively, both of which are now fully filled.

Considering Aave's inherent security and the liquidity of USDe series assets, this is essentially one of the safest leveraged financial management options available in the market, making it suitable for users with larger capital who are pursuing clear yields. With high demand and limited supply, interested users should keep an eye on pool limits and updates on new pools.

Berachian Pre-deposit Unlocks, Don't Forget to Withdraw

Another key event in the financial management sector this week is that funds participating in the Berachian pre-deposit a few months ago have been unlocked, such as USDe series assets deposited through Concrete. Different pre-deposit channels have different unlocking requirements, but generally, the cycle takes several days. Users who have participated in related activities should not forget to withdraw, as idle funds essentially waste opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。