In summary, the Spectra upgrade marks a significant step forward for Ethereum in terms of scalability and user experience, providing opportunities for DeFi/NFT, large applications, and institutional-level use cases.

I. Introduction

Looking back at over a decade of technological evolution in blockchain, Ethereum has always played a dual role as both a leader and a pioneer. From the genesis block in 2015 to the 2022 completion of The Merge, which reduced energy consumption by 99.95%, and to the 2024 EIP-4844 that significantly lowers Layer 2 fees, each upgrade has profoundly changed the possible boundaries of decentralized applications. Today, facing fierce competition from emerging high-performance public chains like Solana and Sui, as well as market demands for low fees, high speed, and ease of use, Ethereum stands at a new crossroads with the Spectra upgrade. In the context of a sluggish ETH price and capital accelerating towards high-speed Layer 1 solutions, the success or failure of Spectra will not only affect Ethereum's own performance and experience but will also reshape the flow logic of funds, developers, and users in the crypto market.

This article will use simple and understandable language to systematically outline Ethereum's upgrade roadmap, break down the content and significance of the Spectra upgrade, and analyze its potential impact on the crypto market. Through this article, readers will understand why Spectra may be the next spark for Ethereum and why it still faces severe challenges.

II. Background and Content of the Spectra Upgrade

The development of Ethereum can be divided into several stages: initially using a Proof of Work (PoW) consensus, it transitioned to a Proof of Stake (PoS) consensus with the "Merge" upgrade in 2022, reducing network energy consumption by approximately 99.95% and laying the foundation for future scalability. After the Merge, Ethereum's official roadmap proposed "Six Major Visions for Ethereum," which are: Merge, Surge, Scourge, Verge, Purge, and Splurge. Each stage corresponds to different goals, with the common aim of enhancing scalability, reducing costs, while maintaining network security and decentralization.

Merge (The Merge): In 2022, Ethereum's mainnet merged with the beacon chain, completing the switch from PoW to PoS consensus mechanism, reducing network energy consumption by nearly 99.95%, and creating possibilities for future scalability technologies (such as proposal-block separation, etc.).

Surge (The Surge): Significantly enhances network throughput through technologies like Rollup and data availability sharding (such as Blob data introduced by EIP-4844), aiming for Ethereum to achieve over 100,000 TPS in total for L1+L2. This stage will also continue to promote data availability sampling (DAS) schemes, initiating data sampling verification capabilities.

Scourge (The Scourge): Designed to enhance resistance to censorship and decentralization, focusing on reducing risks from large validators and single points of control, such as neutralizing MEV (Miner/Validator Extractable Value) issues through mechanisms like enforced proposal-block separation (ePBS).

Verge (The Verge): Originally planned to replace the state root Patricia tree with Verkle trees, allowing validators to verify blocks with minimal "witness" without needing the full state, achieving a stateless client. Additionally, the Verge stage envisions using zero-knowledge proofs (SNARK/STARK) for efficient execution verification, potentially enabling any device (even mobile phones) to validate the network as a full node.

Purge (The Purge): Significantly reduces the storage pressure on nodes regarding historical data through measures like data expiration, protocol simplification (e.g., retaining execution data for a limited time), and removing outdated functionalities. For example, EIP-4444 proposes to unify the retention period for historical blocks and transaction data to one year, in conjunction with future distributed storage mechanisms, so nodes no longer need to permanently store all historical states.

Splurge (The Splurge): Includes various miscellaneous and detail optimizations, such as bringing the EVM into a more efficient and stable state (e.g., adopting a new EVM object format EOF), deepening account abstraction natively (allowing all accounts to have smarter functionalities), optimizing fee models, and introducing more advanced cryptography (verifiable delay functions, obfuscated signatures, etc.).

Source: https://ethroadmap.com/

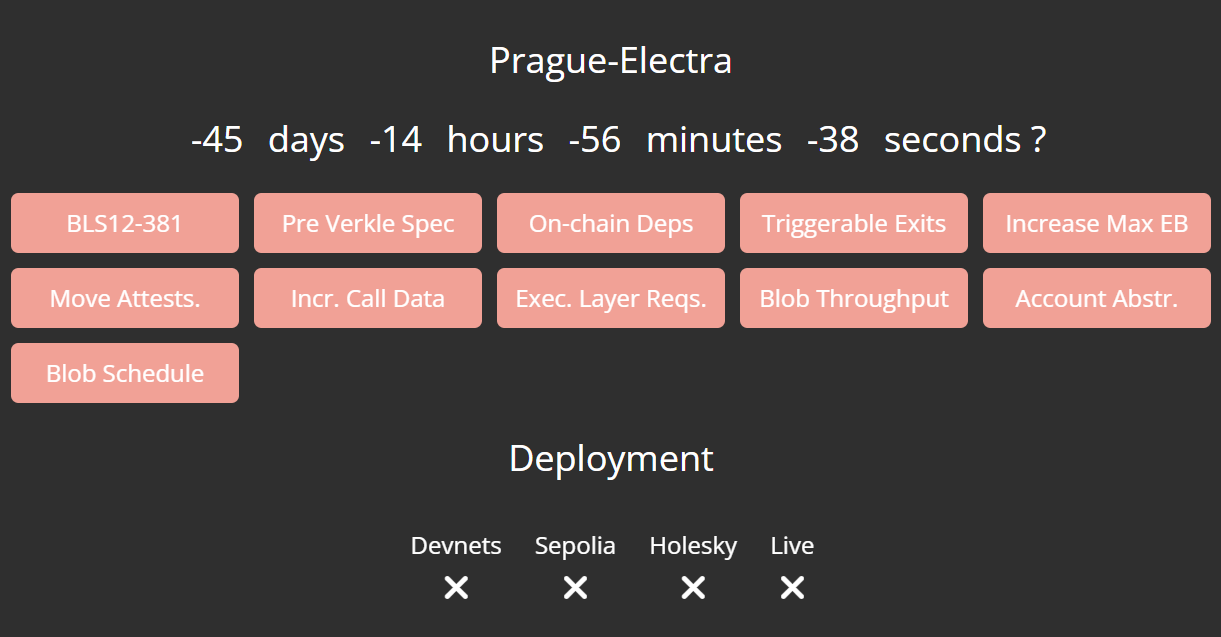

The Spectra upgrade (also known as Pectra, derived from Prague + Electra) is scheduled to officially launch on May 7, 2025, and is the most important network upgrade since the Merge. This upgrade focuses on enhancing scalability and user experience while optimizing validator operations. Core objectives include: smart account support, increased data throughput, and a smooth staking/exit process. Spectra includes approximately 11 core EIPs, covering multiple changes in both the execution layer and consensus layer. Key contents include:

Account Abstraction: EIP-7702 allows ordinary external accounts (EOA) to "temporarily" behave as smart contracts, enabling wallets to bundle transactions, set operational conditions, and have third parties pay gas fees. This means users will no longer need to hold ETH to pay for gas; they can use stablecoins like USDC or DAI, greatly simplifying the entry barrier for newcomers.

Validator Flexibility: EIP-7251 increases the maximum staking balance for validators from 32 ETH to 2048 ETH, allowing large stakers to consolidate multiple validators into a single node, thereby reducing the costs of running multiple nodes. Additionally, EIP-7002 adds an execution layer-triggered exit mechanism, allowing validators to exit by calling a contract without needing to hold the original validator private key, further simplifying the exit process for validators. These changes will reduce operational complexity and improve network availability.

Scalability and Data Availability: EIP-7691 doubles the amount of blob data that can be carried per block (average from 3 to 6, peak from 6 to 9), effectively enhancing Layer 2 (Rollup) throughput and alleviating previous congestion issues. To avoid overly stringent hardware requirements for nodes, PeerDAS (EIP-7594) is introduced—a peer-to-peer data availability sampling protocol. PeerDAS allows the network to confirm L2 data availability through random sampling, without requiring each node to fully download all data, thus improving throughput while maintaining node decentralization.

State Optimization: EIP-2935 introduces new system contracts in the execution layer that can query the most recent 8192 block hashes, preparing for future technologies like Verkle trees. Specifically, this contract allows light nodes to obtain relatively long historical block hashes without storing all history, providing convenient support for decentralized state verification. Additionally, EIP-7549 moves the committee index in attestation messages out of the signature range to simplify the verification work of consensus nodes and improve the efficiency of zero-knowledge proof circuits.

Other Improvements: Spectra also includes incorporating validator deposits into the execution layer (EIP-6110), allowing ETH deposits to be directly merged into the beacon chain at block creation, simplifying the verification of historical deposit data; EIP-7840 fixes the blob configuration parameters of blocks in the client, unifying the parameters for executing consensus; EIP-7623 adjusts the fee pricing of traditional calldata, guiding developers to use more efficient blob storage. Additionally, features like the BLS12-381 curve precompilation (EIP-2537) are introduced to support future zero-knowledge protocols and multi-signature applications.

In simple terms, the Spectra upgrade enables the Ethereum network to run faster and more stably without sacrificing decentralization. Future Ethereum nodes will be able to support larger data volumes, while the required hardware threshold will not increase exponentially, as the newly introduced PeerDAS mechanism alleviates the burden on each node. Higher throughput and more flexible validation mechanisms will bring users lower transaction fees and faster confirmation times, while developers will be able to design more complex and interactive applications based on this foundation.

III. Analysis of the Impact of the Spectra Upgrade on the Crypto Market

1. Capital Outflow and Continued Weakness of ETH

Since the beginning of this year, Ethereum spot ETFs have seen a cumulative net outflow of over $110 million, facing selling pressure. Institutional reductions have caused the ETH/BTC ratio to drop to a five-year low of 0.019, while the SOLETH ratio has increased by 24%. Since Q1, the average L1 gas fee on the ETH network has been 20-30 times higher than that of Solana, with ETH processing around 1.5 TPS during the same period, while Solana peaked over 2,000 TPS. Due to the high staking threshold of 32 ETH, the ETH staking rate is only 28%, while Solana's staking rate reaches 65%.

Source: https://www.coingecko.com/en/coins/ethereum/btc

Source: https://www.coingecko.com/en/coins/solana/eth

2. Restructuring of ETH Supply and Demand Structure Due to the Spectra Upgrade

Smart accounts (EIP-7702) allow direct payment of gas fees using USDC/DAI, removing the "buy ETH first" threshold, with industry expectations of a 15-25% increase in daily active users.

Doubling of blob capacity + PeerDAS is expected to reduce average Layer 2 fees by another 40%, with Rollup transaction volume anticipated to increase 2-3 times within 6 months.

EIP-7251 raises the single validator cap to 2,048 ETH, allowing large nodes to consolidate and reduce the loss of "re-staking" rewards; if 20% of stakers consolidate, the annualized new selling pressure could theoretically decrease by 3-4%.

EIP-7002 allows the execution layer to initiate proactive exits, enhancing liquidity; combined with ETF rules prohibiting staking, Spectra may encourage more long-term funds to stake directly on-chain for returns, reducing circulating chips in the secondary market.

3. Chain Reactions on L1 and L2

Solana occasionally experiences downtime under high load and lacks native abstraction at the smart account level; if Spectra significantly improves the ETH experience, it may divert some high-frequency trading and DeFi funds, suppressing expectations for SOL to "turn around."

Sui relies on differentiation in gaming and social scenarios. After the fee reduction from Spectra, the cost advantages of L2 games (like Immutable, Xai) will become more pronounced, potentially posing competition to Sui.

Layer 2 projects will directly benefit from the upgrade. The increased blob capacity and data availability improvements will make transactions for projects like Arbitrum and Optimism more efficient and cheaper, thereby enhancing the attractiveness of these scaling solutions. As the upgrade is implemented, market participants expect an influx of funds and users into the entire crypto ecosystem (especially Rollup tokens and DeFi platforms).

IV. Opportunities and Challenges Brought by the Spectra Upgrade

The Spectra upgrade brings numerous opportunities for Ethereum and the entire industry:

1. Expected to Consolidate Ethereum's Competitive Advantage: By significantly enhancing scalability and user-friendliness, Spectra enables Ethereum to better respond to challenges from competitors like Solana, Avalanche, and BNB Chain. For instance, as Ethereum improves its processing capacity and reduces fees, investors and developers will be more inclined to continue investing in the Ethereum ecosystem rather than switching to other chains.

2. Enhancing Ethereum's Appeal to Institutions: Higher scalability and stability, combined with upcoming enterprise-level features (such as native privacy and contract accounts), are expected to attract fintech and traditional financial institutions to further participate in the Web3 space. This aligns with Ethereum's long-term vision of becoming a "truly global and secure infrastructure."

3. More User-Friendly for Ordinary Users: Friendly payment methods and lower entry barriers may drive the adoption of mainstream users, contributing to the overall growth of the crypto market.

However, Spectra also faces challenges:

1. Technical Complexity and Implementation Risks: This upgrade integrates multiple cutting-edge technologies (PeerDAS, Verkle, etc.), and unexpected situations occurred during the testing phase: two testnet activations saw validator errors, leading to network forks, forcing developers to conduct a third test to fix the issues. This highlights the complexity of large-scale protocol upgrades, necessitating extreme caution for any similar changes in the future.

2. Fragmentation of the Layer 2 Ecosystem: Currently, there are various L2 solutions on Ethereum, and achieving better cross-chain interoperability and liquidity sharing still requires more standards and infrastructure support.

3. Pressure from Competitors: Other public chains are also accelerating their efforts to improve scalability and user experience. While Spectra enhances Ethereum's leading advantage, the technological iterations of other chains will continue to exist. Strategically, Ethereum needs to enhance decentralization and security attributes while improving performance to maintain its advantage.

V. Outlook and Summary of Future Ethereum Upgrades

Looking ahead, Ethereum's roadmap continues to evolve. After completing Spectra, the next focus will be on further refining the protocol and introducing next-generation technologies. The Ethereum Foundation has proposed incorporating two major upgrade goals, Fusaka and Glamsterdam, into the roadmap after 2025. Fusaka will introduce more comprehensive data availability sampling solutions like PeerDAS, enabling Ethereum to achieve extremely high throughput without "swallowing" the entire network's data volume; Glamsterdam will focus on gas cost optimization and protocol efficiency improvements, ensuring the network maintains high performance under more complex loads, particularly supporting deeply integrated Layer 2 Rollup and ZK technologies. These two upgrades will propel Ethereum towards becoming a truly global high-throughput settlement layer.

In summary, the Spectra upgrade represents a significant step forward for Ethereum in terms of scalability and user experience, providing opportunities for DeFi/NFT, large applications, and institutional-level use cases. However, the high technical difficulty of the upgrade, intensified external competition, unclear regulatory environment, and challenges of multi-layer ecosystem interoperability all place higher demands on Ethereum. Whether the Ethereum ecosystem can fully leverage these opportunities and effectively address the challenges will determine its position in the global crypto market.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" three-in-one service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-weather market volatility monitoring, combined with weekly live strategy broadcasts of "Hotcoin Selected" and daily news briefings of "Blockchain Today," providing precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。