Core Points

Early Token Acquisition: XT Launchpool allows users to participate in selected liquidity pools by staking existing assets (such as XT, ETH, USDT) to earn rewards for new tokens before they are publicly listed, usually at a discounted price.

Principal-Guaranteed Returns: Smart Trend offers structured investment strategies based on BTC/ETH price trends, providing a high "Target Annual Percentage Rate (APR)" if the market reaches the target price; if not, it still guarantees a "Minimum Annual Percentage Rate," balancing returns and safety.

Customized Institutional Lending: VIP Lending provides over-collateralized customized crypto loans for high-net-worth traders, funds, and protocols, with no forced liquidation and no prepayment fees, flexibly meeting institutional-level needs.

Seamless On-Chain Staking: Proof-of-Staking ("Earn On-Chain") manages node management and validator selection for users, allowing long-term holders to earn competitive Annual Percentage Yields (APY) and governance rights without technical operations.

Portfolio Integration: By combining core assets (Proof-of-Staking), satellite assets (Launchpool and Smart Trend), and tactical credit (VIP Lending), balance risk, optimize returns, and maintain liquidity throughout market cycles.

In the rapidly evolving cryptocurrency and decentralized finance (DeFi) space, XT.COM continues to innovate by launching a suite of four powerful yield-generating products. Whether you are an experienced DeFi strategist or a newcomer exploring passive income avenues, XT Earn's four tools—Launchpool, Smart Trend, VIP Lending, and Proof-of-Staking—offer you flexible strategies, robust risk mitigation mechanisms, and the potential for excess returns.

This article will delve into the mechanisms, ideal user profiles, real-world applications, and strategic best practices for each product, helping you seamlessly integrate these products into your overall investment portfolio.

Table of Contents

XT Launchpool: Unlock Early Token Opportunities

XT Smart Trend: Structured Returns and Downside Protection

XT VIP Lending: Customized Crypto Financing for Institutions

XT Proof-of-Staking: Long-Term Secure On-Chain Earnings

Integrating XT Earn's Four Products into Your Portfolio

XT Launchpool: Unlock Early Token Opportunities

Overview and Value Proposition

Launchpool enables XT token holders and stablecoin investors to participate in liquidity pools for selected upcoming token projects by staking existing assets. You do not need to purchase tokens on the open market; instead, you provide liquidity for project launches in exchange for allocations of new tokens, which are typically offered at prices significantly lower than market rates before their official listing.

Mechanism and Workflow

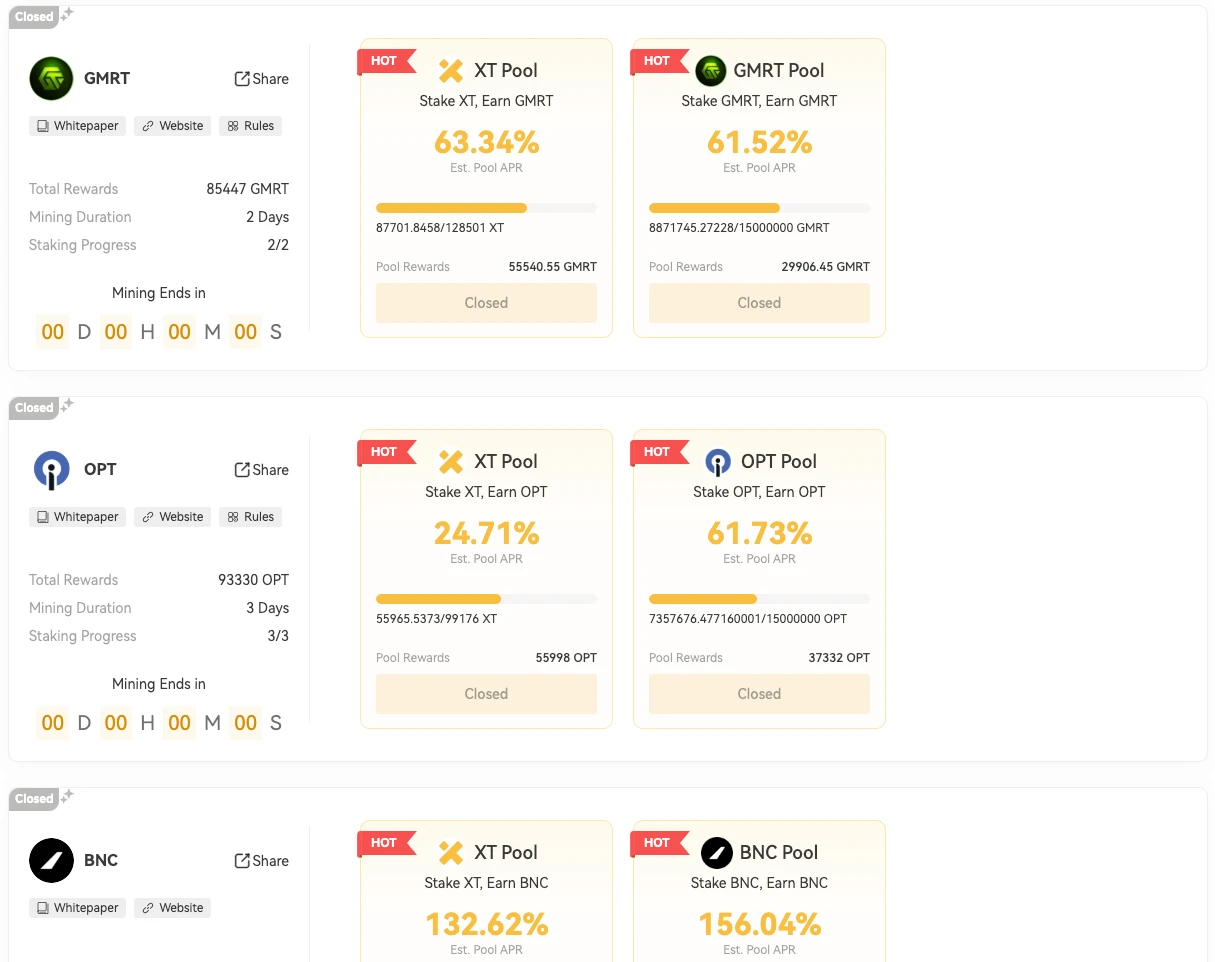

Pool Selection: Visit the Launchpool center to browse currently active and upcoming liquidity pools. Each pool's information includes project overview, tokenomics, pool size, staking options, and expected Annual Percentage Rate (APR) range.

Asset Allocation: Allocate supported tokens (such as XT, ETH, or USDT) to one or more liquidity pools. Your share of rewards is determined by the proportion of your staked assets to the total participation in the pool.

Reward Accumulation: During the event period, rewards continuously accumulate. You can track earnings in real-time through the dashboard or mobile app.

Token Claiming and Recycling: After the subscription period ends, you can claim the tokens earned. The earned tokens have no lock-up period, allowing for immediate redemption, re-staking, or portfolio rebalancing.

Use Cases and Examples

Early Bullish Investors: When a promising DeFi or NFT infrastructure token launches, participating in early allocations through Launchpool can yield returns of 200%-500% upon major market listing.

Capital Efficiency: You can seamlessly participate in new project launches using existing holdings without the need for new capital investment.

Best Practices and Recommendations

Diversify Pools: Reduce risk exposure by allocating smaller staking amounts across 3-5 concurrent pools.

Monitor TVL Dynamics: High Total Value Locked (TVL) may compress APR; prioritize projects with moderate TVL and strong fundamentals.

Set Alerts: Use XT's notification feature to track the opening and closing times of liquidity pools—missing the launch window will result in missed rewards.

XT Smart Trend: Structured Returns and Downside Protection

Introduction and Strategic Positioning

Structured products combine derivatives and fixed-income mechanisms to provide target returns while limiting downside risk. Smart Trend introduces this model on-chain: you can bet on bullish or bearish price trends over a specific period. If the market reaches your target price, you will receive a high "Premium Annual Percentage Rate (APR)"; even if the target is not reached, you can still ensure a minimum "Guaranteed Return Rate."

Product Mechanism

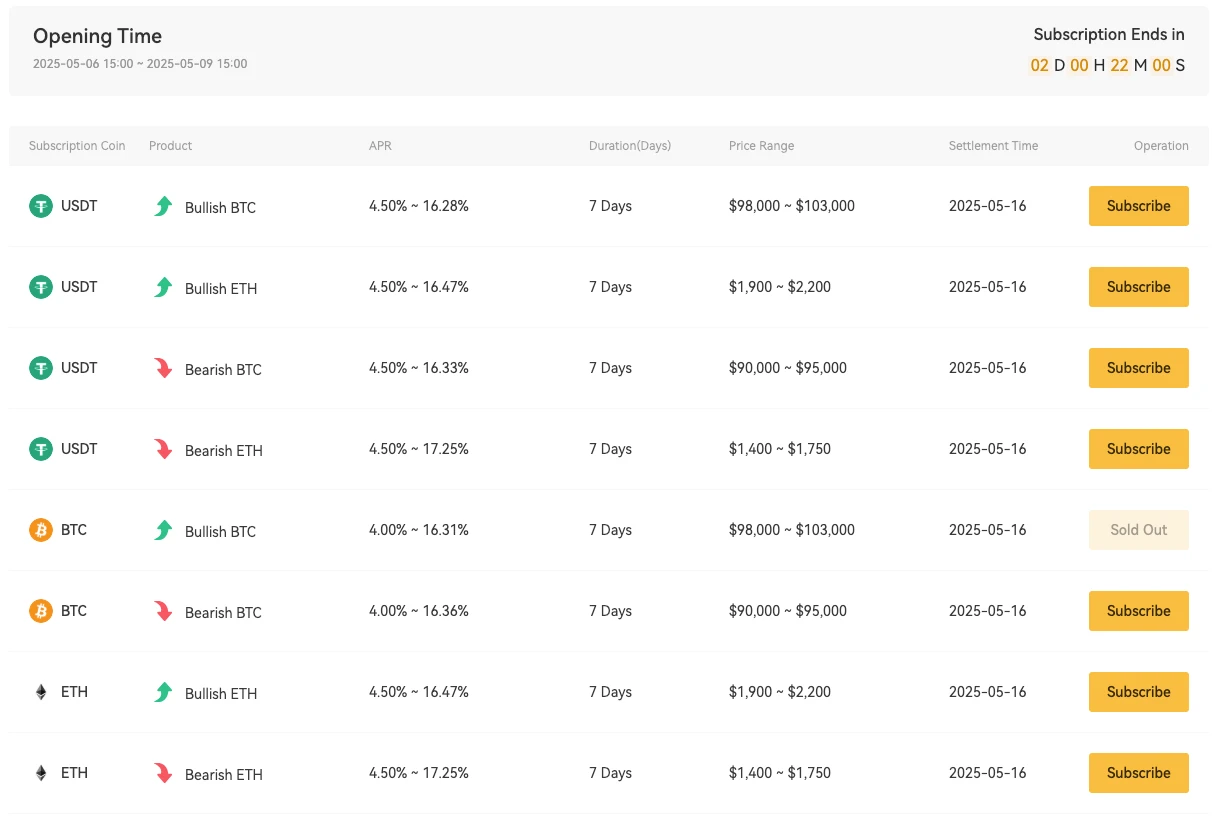

Plan Components: Each Smart Trend series specifies the underlying asset (such as BTC, ETH), subscription window, target price threshold (strike price), maximum holding period, and return tiers (Target APR and Minimum APR).

Subscription and Allocation: Investors directly invest in the settlement currency (such as USDT). Since the deposit and final settlement use the same currency unit, there are no conversion fees.

Settlement Scenarios:

Winning Scenario: If the underlying asset's price reaches or exceeds the preset target price on the settlement date, the subscriber will receive a higher "Target Annual Percentage Rate (Target APR)."

Fallback Scenario: If the price does not reach the target price, the subscriber can still receive the "Minimum Annual Percentage Rate (Minimum APR)," typically between 2%-5%, ensuring the continuous appreciation of the principal.

Ideal User Profile

Conservative Yield Seekers: Users who wish to achieve returns higher than savings accounts while avoiding the volatility of margin trading.

Directional Traders: Experienced traders looking to profit from market views without actively managing positions.

Risk Management and Structured Strategies

Term Selection: Short-term holdings (7-14 days) are suitable for capturing brief volatility peaks; long-term holdings (30-90 days) allow for a wider margin of market fluctuations.

Target Price Diversification: Simultaneously subscribing to both bullish and bearish plans for the same asset creates a payoff structure similar to a straddle option, ensuring the receipt of one of the two premium yield rates.

Comparative Advantages

Unlike standard yield products, Smart Trend completely avoids liquidation risk. Even if market trends go against expectations, the minimum yield rate still applies, making it particularly suitable during volatile altcoin seasons.

XT VIP Lending: Customized Crypto Financing for Institutions

Product Vision

VIP Lending (also known as VIP Loan Service) **is designed for the large-scale and complex needs of hedge funds, trading departments, and corporate treasury management, offering over-collateralized loans with negotiated custom terms, avoiding one-size-fits-all rigid restrictions. Whether you need funds to seize arbitrage opportunities or support operational growth, VIP Lending provides direct institutional-level liquidity solutions on the XT platform.

Core Features

Collateral Flexibility: Accepts a variety of top assets as collateral, including BTC, ETH, USDT, and XT.

Customized Terms and Rates: Loan-to-Value (LTV), interest rates, and repayment plans are customized through direct negotiation with dedicated account managers. Approval and disbursement can be completed within 48 hours.

Seamless Fund Disbursement and Settlement: Once the loan is approved, funds are instantly deposited into your XT trading wallet.

Non-Liquidation Terms: Unlike margin financing, VIP Lending does not automatically liquidate collateral when asset prices fall; instead, it handles overdue situations through negotiation and extension.

Suitable Users for VIP Lending

Arbitrage Traders: Utilize loan funds to bridge price differences across exchanges or chains, capturing arbitrage opportunities.

Market Makers: Maintain the stability of bid-ask spreads by buffering inventory through financing.

Corporate and Project Financing: Crypto-native startups and protocol teams obtain growth capital through non-dilutive token sales.

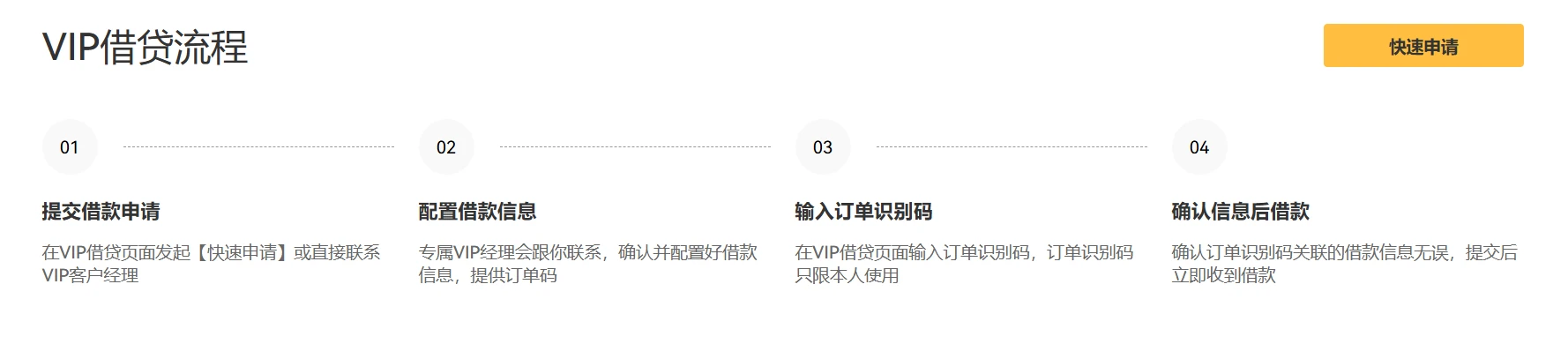

Operational Process

Onboarding and KYC: Verify the qualifications of institutional participants through enhanced KYC/AML (Know Your Customer/Anti-Money Laundering) reviews.

Terms Negotiation: Determine Loan-to-Value (LTV), loan term, interest rate, and collateral asset mix.

Smart Contract Execution: Sign legal agreements and lock on-chain collateral through XT's DeFi-grade custody mechanism.

Monitoring and Support: Provide 24/7 dedicated service desk support for additional collateral, extensions, or early repayments.

Strategic Recommendations

Maintain a Buffer: Keep the collateral value at approximately 110%-115% of the agreed LTV to avoid potential margin call requirements.

Seasonal Financing: Choose shorter loan terms (e.g., 14 days) around high-volatility announcements (e.g., major market events).

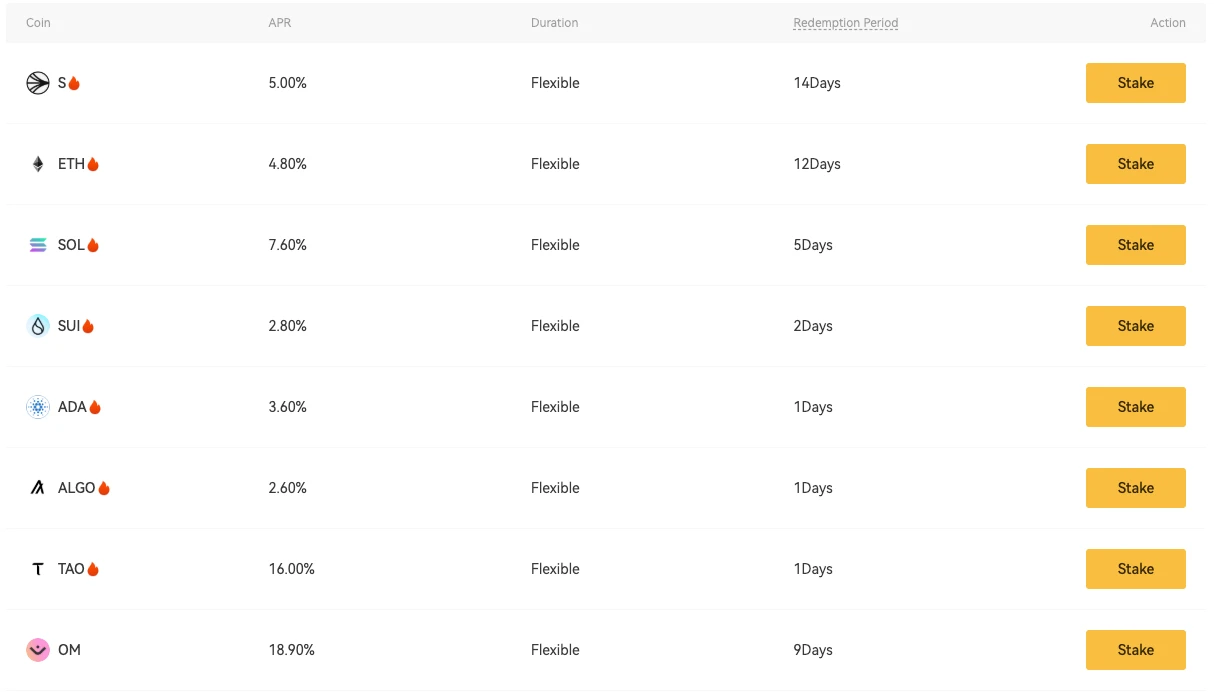

XT Proof-of-Staking: Long-Term Secure On-Chain Earnings

Core Concept

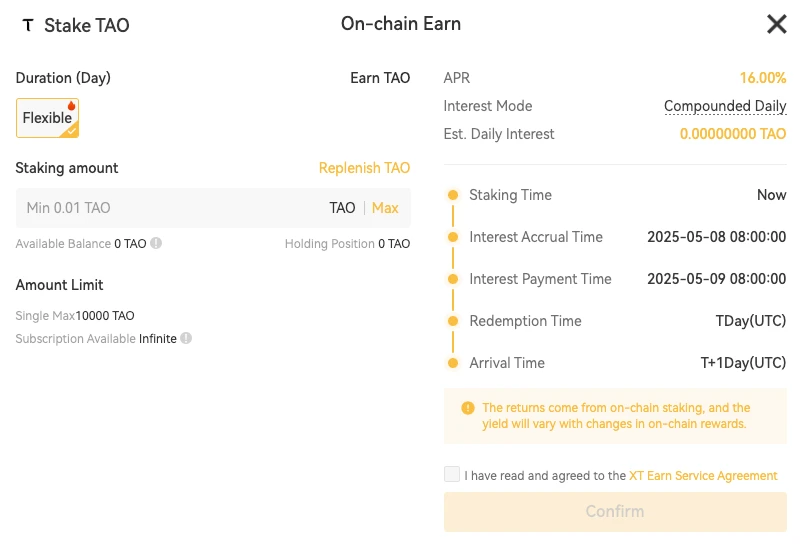

XT's Proof-of-Staking (PoS) **product (also known as "Earn On-Chain") simplifies the process for users to directly participate in Proof-of-Stake networks without needing to run nodes or handle complex setups. Users can seamlessly earn native staking rewards by delegating assets to rigorously vetted validators through XT's user interface.

Staking Mechanism

Asset List: A regularly updated list of assets supported for PoS staking, including ADA, DOT, ETH, SOL, etc.

Term Options: Offers flexible staking (can be unstaked at any time) and locked staking (higher Annual Percentage Rate APR) modes. APR is dynamically adjusted based on network earnings, validator commissions, and lock-up periods.

Reward Distribution: Rewards are accumulated per epoch or daily, automatically reinvested unless the user chooses to withdraw.

Why Proof-of-Staking is Important

Network Security: Stakers directly participate in maintaining network consensus and decentralization, enhancing the security of the blockchain.

Governance Rights: Many protocols grant voting and proposal rights to active stakers, empowering community influence.

Inflation Hedge: Staking can offset token inflation through predictable Annual Percentage Yields (APY), preserving asset purchasing power.

User Profile

Long-Term Accumulators: Investors inclined to "set and forget" (HODL) strategies, seeking returns above market averages.

Governance Advocates: Community members eager to participate in on-chain voting and governance.

Optimization Strategies

Phased Lock-Up Periods: Allocate assets across staking plans with different lock-up periods to balance liquidity and returns.

Validator Diversification: Spread staking across multiple validators to reduce the risk of penalties (slashing) and commission costs due to validator errors.

Integrating XT Earn's Four Products into Your Portfolio

1. Core-Satellite Allocation

Core Portion: Proof-of-Staking for stable, long-term returns (40%-60% of idle assets).

Satellite Portion: Short-term Launchpool and Smart Trend allocations (20%-30%).

Tactical Credit: VIP Lending as a liquidity buffer or tactical financing tool (10%-20%).

2. Risk Management Matrix

Low Risk: Locked Proof-of-Staking + Smart Trend Minimum Annual Percentage Rate (APR).

Medium Risk: Launchpool projects with mid-cap tokens.

High Risk: Arbitrage loans from VIP Lending and aggressive target price plans from Smart Trend.

3. Performance Tracking and Rebalancing

Utilize XT's portfolio dashboard to track real-time return on investment (ROI) metrics for each product.

Rebalance quarterly, adjusting underperforming allocations to higher-yield or newly listed Launchpool projects.

Conclusion and Next Steps

XT.COM's four Earn product pillars—Launchpool, Smart Trend, VIP Lending, and Proof-of-Staking—are designed to serve a diverse user base, from conservative yield seekers to institutional-level players. By deeply understanding the mechanisms of each product and strategically allocating funds, you can:

Maximize upside potential in token issuances

Capture structured yields without the risk of downside liquidation

Unlock large-scale financing without liquidation risks

Directly participate in the security and governance of PoS networks

Visit the XT Earn page now to explore detailed product guides and start building a multi-layered crypto strategy that aligns with your goals, risk tolerance, and market outlook. Your next yield breakthrough is just around the corner!

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 800 quality coins and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a rich variety of trading options, including spot trading, margin trading, and futures trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。