On May 8, 2025, at 2 AM Beijing time, global financial markets will focus on the Federal Reserve's latest interest rate decision. According to Cointelegraph, although the market generally expects the Federal Reserve to maintain the federal funds rate at 4.25%-4.50%, analysts point out that risk assets like Bitcoin may continue to rise, driven by potential liquidity injections from the U.S. Treasury, the dollar index falling below 100 to a nearly two-year low, and gold prices surging over 12% in 30 days, approaching historical highs. Against the backdrop of increasing global economic uncertainty, this decision not only concerns the direction of U.S. monetary policy but will also profoundly impact global asset pricing and market sentiment.

The Consensus and Concerns of Unchanged Rates

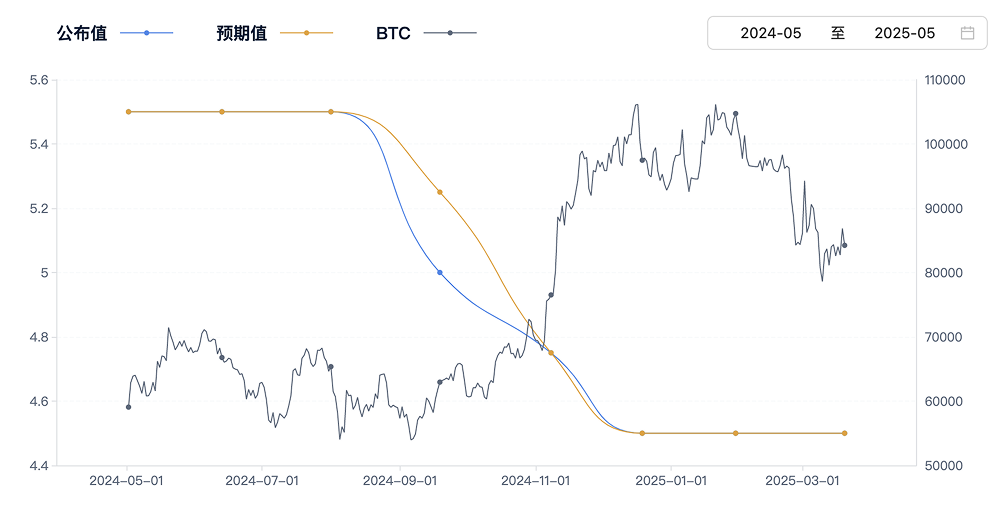

The market's expectations for the Federal Reserve's May decision are highly consistent. According to CME interest rate futures data, the probability of maintaining rates at 4.25%-4.50% is as high as 95.6%. This expectation stems from the Federal Reserve's cautious attitude since it began its easing cycle in September 2024. Last year, the Federal Reserve cut rates by a total of 100 basis points, but inflationary pressures in the U.S. rose at the beginning of 2025, compounded by economic uncertainties caused by the Trump administration's tariff policies, forcing the Federal Reserve to pause rate cuts in March and May. Federal Reserve Chairman Powell previously emphasized that policy decisions would wait for further clarification of Trump's economic policies, especially the potential impact of tariffs on inflation.

However, the apparent calm of unchanged rates masks deeper market tensions. The Summary of Economic Projections (SEP) released after the Federal Reserve's March meeting shows that the expected real GDP growth for 2025 has been revised down to 1.7%, the core PCE inflation expectation has been raised to 2.8%, and the unemployment rate is expected to rise to 4.4%, indicating "stagflation" characteristics. These data suggest that the U.S. economy is facing a dual squeeze of slowing growth and inflationary pressures. The market is generally focused on whether Powell will release dovish signals at the post-decision press conference, such as hinting at a restart of rate cuts in June or July. If Powell's remarks are dovish, Bitcoin may take the opportunity to challenge the $100,000 mark; if he maintains a hawkish stance, a short-term pullback to the $92,000 range is not impossible.

Potential Catalysts from U.S. Treasury Liquidity Injections

Cointelegraph points out that the U.S. Treasury may be forced to inject liquidity to avoid an economic recession, becoming a key driver for the rise of risk assets like Bitcoin. This view has sparked widespread discussion in the market. In April 2025, the dollar index fell below 100, reaching a new low since July 2023, partly due to the erratic nature of Trump's "reciprocal tariffs" policy. The uncertainty surrounding tariff policies has intensified global trade frictions, weakening the dollar's appeal as a safe-haven asset. Meanwhile, the issue of the U.S. debt ceiling has resurfaced, and the Treasury may release liquidity by issuing short-term government bonds or using special measures to support the economy.

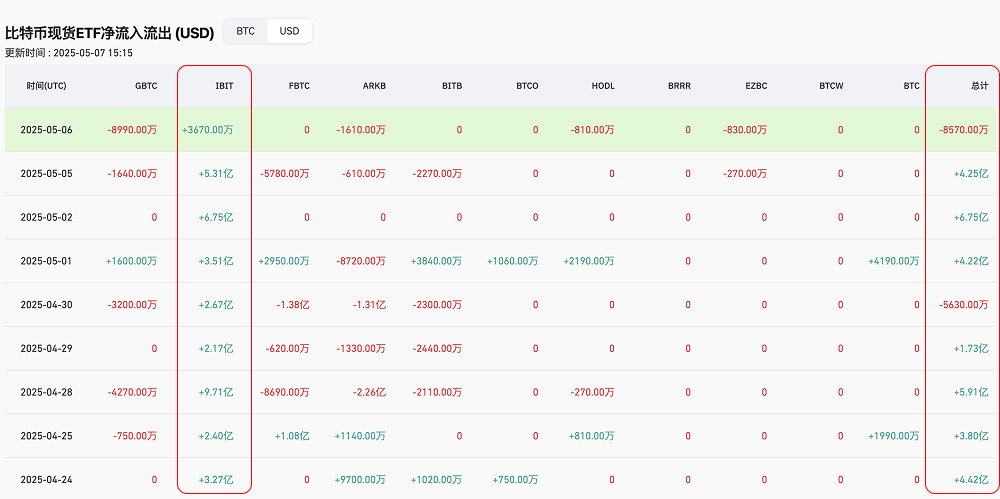

Expectations of liquidity injections have directly stimulated optimistic sentiment in risk assets. On May 5, net inflows into Bitcoin spot ETFs exceeded $400 million, with BlackRock's IBIT fund alone seeing over $500 million in inflows, indicating that institutional investors remain confident in the crypto market. Analysts believe that if the Treasury injects liquidity on a large scale, it could further lower U.S. Treasury yields and boost the performance of high-risk assets like Bitcoin and the stock market. However, this "drinking poison to quench thirst" approach may also exacerbate inflationary pressures, forcing the Federal Reserve to take more aggressive tightening measures in the future.

Dollar Falls Below 100 and the Gold Safe-Haven Surge

The continued decline of the dollar index has become a focal point for the 2025 market. On April 11, the dollar index fell below 100, prompting investors to flock to traditional safe-haven assets like the yen and Swiss franc. The weakness of the dollar is attributed not only to the uncertainty of tariff policies but also to the rising expectations of Federal Reserve easing. The weak dollar has directly pushed up gold prices, with spot gold and COMEX gold futures both breaking through $3,000 per ounce on March 14, reaching historical highs. In the past 30 days, gold prices have risen over 12%, reflecting market concerns about geopolitical risks and economic recession.

The strong performance of gold resonates with the rise of Bitcoin. Bitcoin's dominance surged to 65% before the May FOMC meeting, the highest since January 2021, indicating strong risk-averse sentiment. Analysts point out that the simultaneous rise of gold and Bitcoin is not coincidental; both benefit from a weakening dollar and a declining trust in fiat currencies. However, gold's safe-haven attributes tend to appeal more to traditional investors, while Bitcoin attracts institutional and retail investors seeking high returns. If the dollar comes under further pressure after the Federal Reserve's decision, Bitcoin may break through the $98,000 resistance level.

Market Game and Investors at a Crossroads

The Federal Reserve's May decision is not only a barometer of monetary policy but also a watershed for global asset pricing. The market generally expects Powell to reiterate a cautious stance, but subtle changes in wording could trigger significant volatility. If Powell hints at future rate cuts, risk assets may experience a surge; if he emphasizes inflation risks, the market may face a short-term adjustment. Additionally, the recent hints from the Trump administration regarding a "national-level Bitcoin reserve" plan and the advancement of state-level cryptocurrency legalization bills further provide policy support for Bitcoin.

For investors, this decision represents a moment of both opportunity and risk. The continued inflow into Bitcoin spot ETFs and the safe-haven surge in gold indicate that market expectations for easing policies are still rising. However, the Federal Reserve's "hidden agenda"—to guide global capital flows toward U.S. assets through short-term easing while laying the groundwork for long-term rate hikes—should not be overlooked.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。