New Bitcoin buyers are reluctant to purchase Ethereum or altcoins, with Ethereum's uncertainty reaching an all-time high, and market participants becoming increasingly savvy.

Author: tunez (evm/acc)

Translation: Deep Tide TechFlow

This year's cryptocurrency narrative revolves around three core themes:

The market is rapidly becoming efficient

Stablecoins are quickly globalizing

Trump is playing 4D chess (or checkers)

Let’s break down these themes one by one.

- The market is rapidly becoming efficient ----------

1a - Bitcoin and "Web3" are different things.

Historically, Bitcoin and other crypto markets have been interconnected through the flow of funds. After Bitcoin rises, profits flow into Ethereum, and then to other parts of the market. Today, Bitcoin is experiencing real institutional inflows. These institutions are primarily buying Bitcoin due to its unique attributes (sovereignty, permissionless, limited supply) compared to more controlled currencies around the world. The driving force behind this Bitcoin bull market is not focused on other parts of the market.

Many would assume that these funds would also flow into Ethereum, as it has similar attributes to Bitcoin. But so far, that has not been the case. While Ethereum is decentralized, its main differentiating feature is smart contracts. This means Ethereum's intrinsic value is reflected in its use, not just its technical attributes. Institutions will buy Ethereum, but not because it is decentralized like Bitcoin. They will buy Ethereum (and Solana, etc.) because it is being used, just as they would buy growth stocks.

1b - Ethereum's brand is weakening.

Ethereum's disappointing price performance has dampened the morale of the entire cryptocurrency space, regardless of how supportive you are of Ethereum. This has also led to a general price decline (again, the impact of fund flows).

You can point to many reasons to explain its poor performance, but the most significant is actually the rise of Solana. Before Solana's success, it was easier for people to think about Ethereum's future development rather than its current state.

The bar has been significantly raised, and the market has grown tired of waiting. Solana's surpassing Ethereum is a very real possibility that everyone should consider.

1c - The average IQ of market participants has reached an all-time high.

As coin prices continue to decline, the market has become tougher, and more participants have been wiped out and left. Those who remain have good reasons to continue holding on.

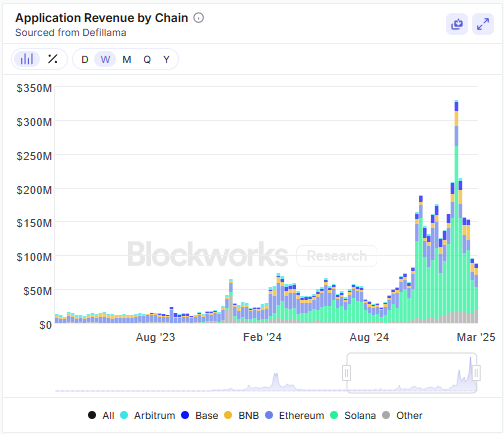

On-chain data is now widely available. You can easily check the TPS (transactions per second), transaction fees, and application revenue for each chain. Many market participants do this regularly.

Source: Blockworks

Moreover, market participants are actually diving deep into on-chain data. The current standard is that you either create a new experience or provide a better experience, or you will be labeled a scam or a waste of resources. No amount of storytelling can change that.

When you combine these dynamics (the decoupling of Bitcoin, Ethereum's weakness, and the general intelligence of the market), you find that the market no longer tolerates empty talk. This can be very confusing for those who do not have real faith in the underlying technology being built. As prices fall, it becomes easier than ever to claim that the entire industry is a scam and that everyone is secretly involved (especially those "evil" venture capital firms).

- Stablecoins are quickly globalizing ----------

Some quick data:

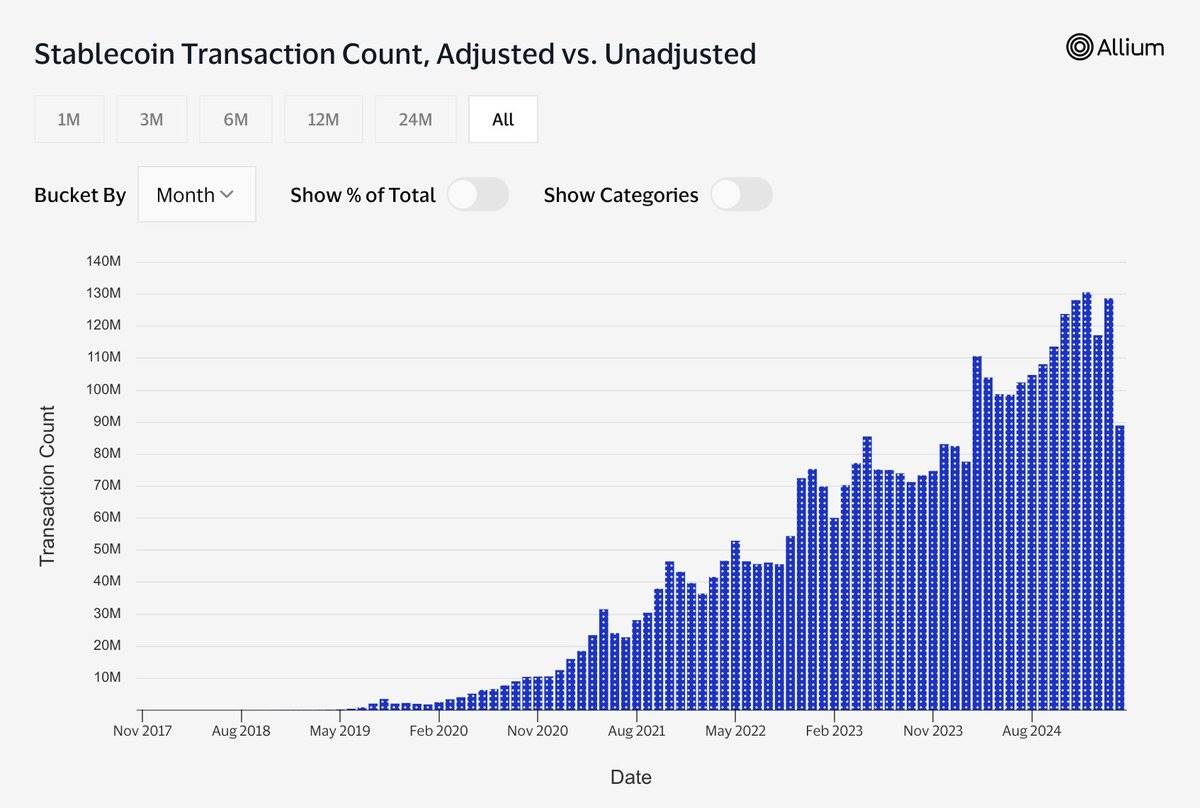

- Stablecoin usage reached an all-time high in 2025.

Source: https://visaonchainanalytics.com/transactions

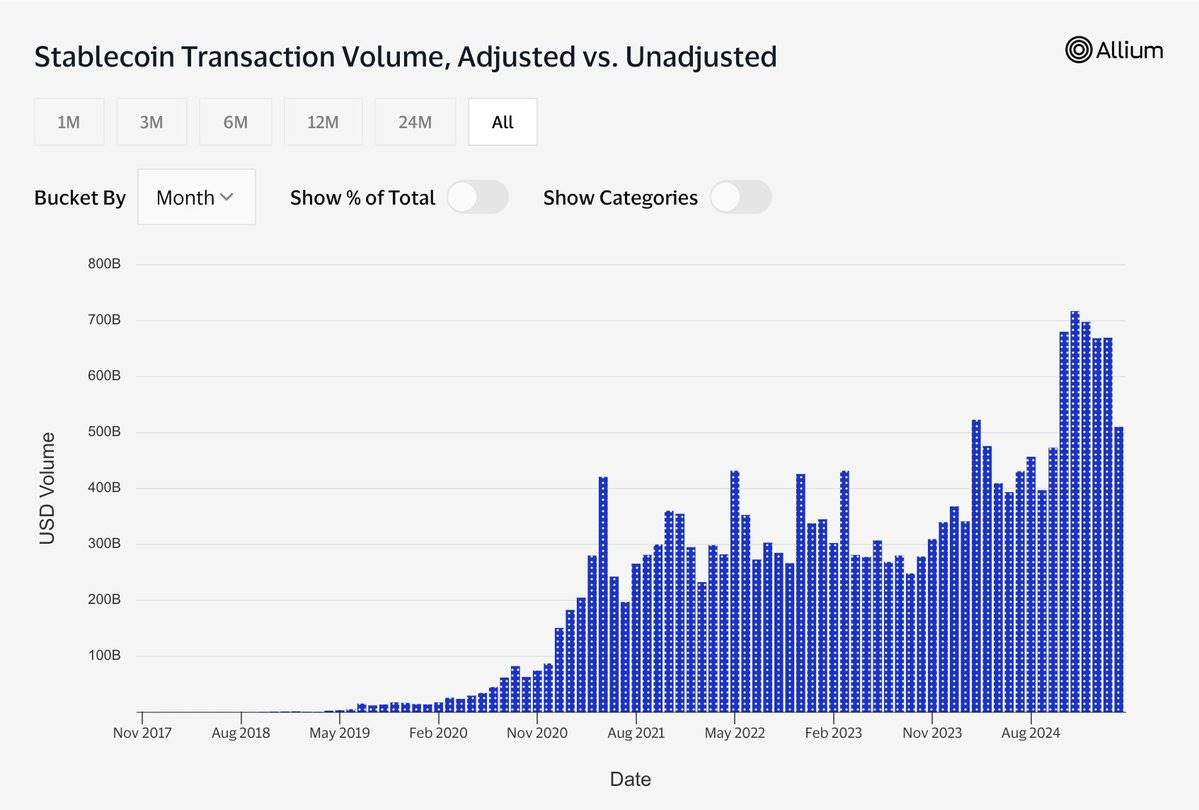

- In the past six months, the daily trading volume of stablecoins has reached $20 billion.

Source: https://visaonchainanalytics.com/transactions

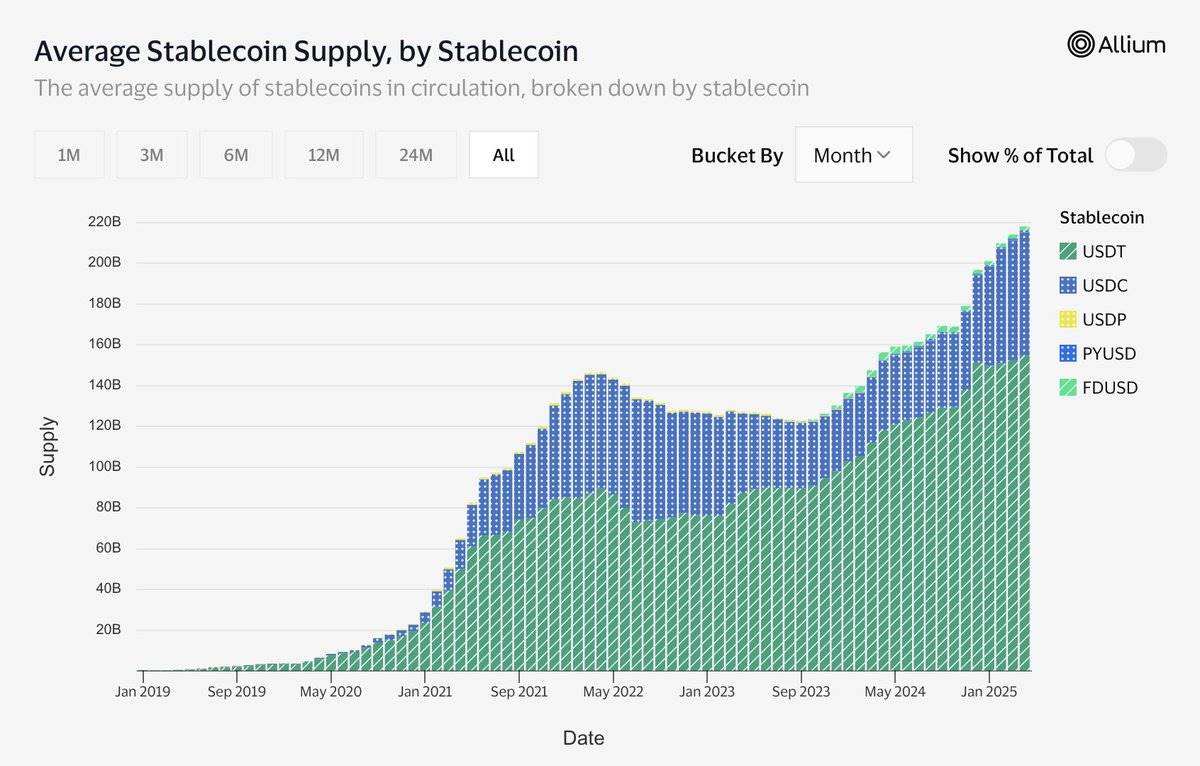

- Since the beginning of 2024, the total supply of stablecoins has increased by $100 billion.

Source: https://visaonchainanalytics.com/supply

I would not define stablecoins as the "killer app" of cryptocurrency, but rather see them as the first sustainable on-chain onboarding mechanism for cryptocurrency.

Traditional cryptocurrency onboarding mechanisms are driven by speculation. After prices rise, people chase those profits. There can be different arguments about the sustainability of this approach, but it has largely driven the industry to trillions of dollars in growth.

There is a difference (and trade-offs) between onboarding cryptocurrency through speculation and through stablecoins.

Speculation often leads people to explore the industry. Through speculation, you chase altcoins on centralized exchanges, and then somehow find yourself buying NFTs on a testnet of a chain that hasn’t even launched two years later. You have that experience because you are constantly chasing profits in stranger places.

With stablecoins, you directly use stablecoins on-chain to transfer value. The downside here is that there is not much reason to explore further profits beyond this mechanism, as you never chased profits in the first place. This is why, despite the rapid growth in stablecoin adoption recently, it has not translated into widespread speculative behavior in the crypto market.

Don’t get me wrong, the adoption of stablecoins represents a sustainable growth of the on-chain economy. At some point, the world of stablecoins and the world of speculation will intersect. But rather than the stablecoin community (ordinary people) lowering standards to cater to the speculator community (speculators), we need to raise standards and provide them with attractive, reasonable use cases, rather than just appealing to gamblers. This is especially good because, as described in theme one, the market is becoming more efficient.

- Trump is playing "4D chess" (or checkers) ---------------

The Trump administration is good news for cryptocurrency because it means that reasonable regulations may (hopefully) be established. This will attract capital, builders, and users into the space.

At the same time, the Trump administration is bad news for cryptocurrency because his economic policies are both extreme and unpredictable. This brings uncertainty, lowers risk appetite, and harms everyone’s coins. Is Trump really playing "4D chess"? No one knows.

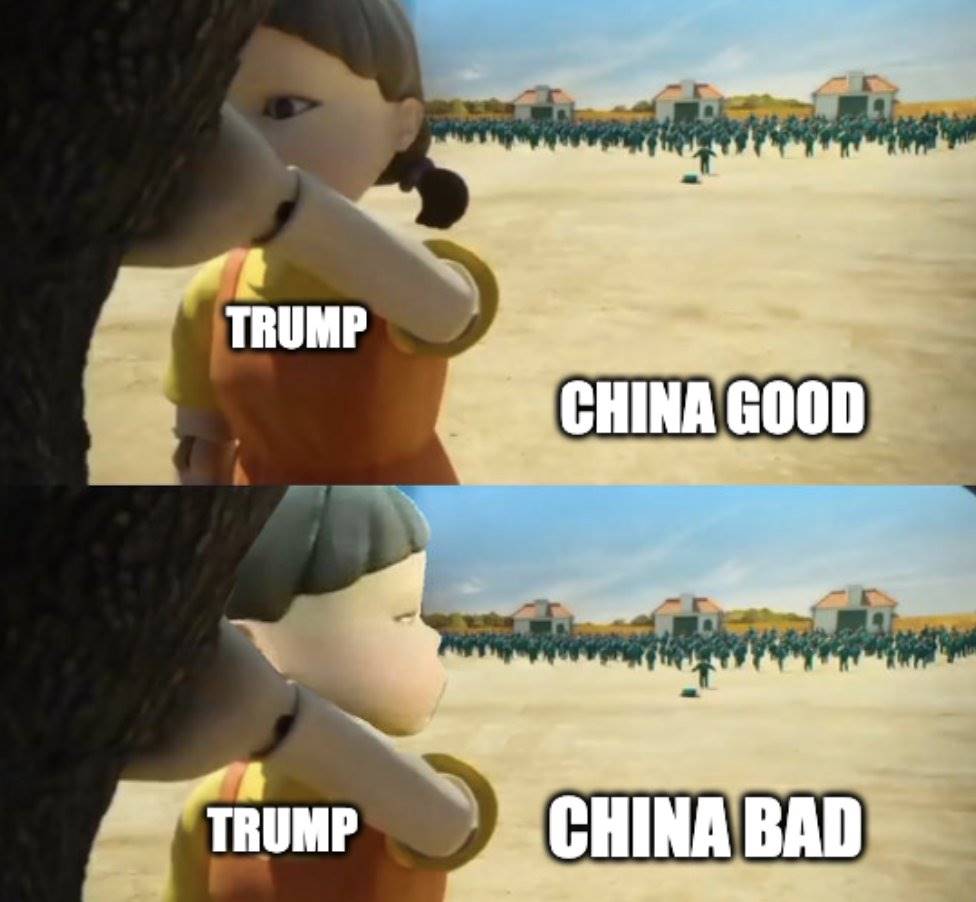

The best way to understand Trump and the market is to imagine him presiding over a game of "Red Light, Green Light" from "Squid Game."

This week you will see this dynamic at play. Trump announced that he would not take a hard stance against China, and Bitcoin rose by 10%. While this is reassuring, it is impossible to predict what the next headline will be.

Summary

New Bitcoin buyers are reluctant to purchase Ethereum or altcoins, with Ethereum's uncertainty reaching an all-time high, and market participants becoming increasingly savvy. These factors are driving the market to become more efficient, affecting prices almost everywhere in the short term.

The adoption and onboarding of stablecoins will only increase. The on-chain economy is growing, and the industry has intrinsic value, with high standards for use cases.

Cryptocurrency will uniquely benefit from this administration, but risk assets will be affected before Trump eases up.

In summary, the common theme behind these three macro crypto trends is short-term pain versus long-term gain. It is easy to feel like things are dying, but I believe the opposite is true. 2025 is the healing year that cryptocurrency needs, and only then can we be ready to take the main stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。