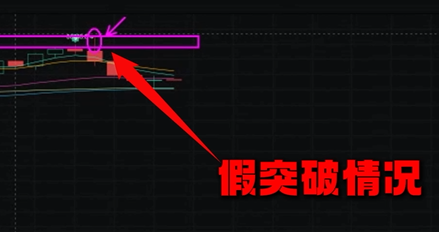

Let's take a look at today's market analysis. First, we will look at Bitcoin. Yesterday, we clearly stated that we should wait and pay attention to the breakthrough situation at 86,000.

Although there was a breakthrough here, it quickly fell back after the rapid breakthrough. Currently, it appears to be a clear false breakout situation.

As we analyzed, the final closing price still came down. Currently, there is potential for a double top formation at the top.

Next, we need to focus on the support level of 83,000 that we mentioned in our previous video. If this level holds,

the price will consolidate and oscillate in the range of 83,000 to 86,000, and after consolidation, there is still a reason for an upward movement.

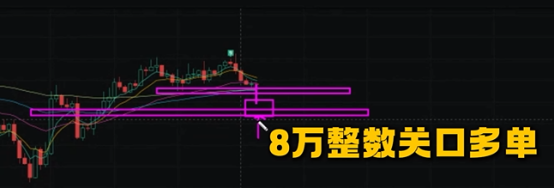

If it fails to hold, the price will further drop, forming a double bottom, and will continue to fall to the 80,000 round number we mentioned earlier.

At that point, we need to pay close attention. If we want to set up long positions, we should do so near the 80,000 round number for a more cautious approach.

However, currently at 83,000, it is still possible to bet on long positions because the stop loss is relatively small. If it stabilizes here,

there is still upward space. This is the current situation of Bitcoin. From a 4-hour perspective, the trend line has clearly broken. This level has fallen below, and whether it can achieve an effective breakthrough and stay above this trend line is still uncertain. Next, we will see how the price consolidates and oscillates in this range to choose a direction.

From the MACD perspective on the 4-hour chart, currently at the position of 823, there are no signs of a stop in the decline. From the MACD perspective, there is still downward space, and at least it needs to wait until the MACD fast and slow lines return to the zero axis.

Even if it does not continue to decline, it at least needs to consolidate at this level. We can patiently wait for the consolidation situation.

This is today's market analysis for Bitcoin.

If you feel confused about trading, feel free to follow our public account: KK Strategy

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。