Life is inherently uncertain, and everything is difficult to judge. When you encounter something, cherish it well; if you miss it, strive to let it go, and then smile as you embark on another journey in life. Li Yu once wrote a poem: "The waves have intentions, a thousand miles of snow; the peach blossoms are silent, a team of spring; a pot of wine, a fishing rod, how many can be as carefree?" In other words, it means: smile at the blooming and falling of flowers, and face life head-on!

The market's performance over the weekend continued to be strong, with a similar upward surge that finally liquidated the short liquidity around 85,000. This was basically in line with our expectations, although the timing was slightly ahead. Overall, this weekend maintained a trend of oscillating upward. In our weekend operations, we chose to set up short positions around 85,600, providing entry points on Saturday night. Subsequently, yesterday, the market began to pull back from the high point of around 86,100, reaching a low near 83,000, a pullback of nearly 3,000 points. Our short positions were reduced and took profits at around 2,000 points, and currently, some friends still hold a small amount of short positions, which has little impact. Congratulations to those who followed along and had a pleasant weekend. This week, we will set sail again to earn more profits.

A new week has begun. Let's first take a look at the overall market. Firstly, on the weekly chart, the candlestick formed a bullish line with a long lower shadow. After this close, the current coin price is above the MA7 line, indicating a chance to maintain strength in the short term. On the technical indicators, the MACD's bearish cycle volume bars are further contracting, and after completing the downward probe, a signal of increased volume and stop-loss has appeared. Currently, the short-term resistance on the weekly chart is located between 90,000 and 93,000. A breakthrough of this resistance would provide further momentum, but we also need time to wait for the end of the bearish cycle adjustment on the weekly level.

On the daily chart, we are currently in a rebound trend structure after probing the bottom. It can be noted that there have been multiple instances of downward probes and closing candles, indicating strong support during the market's decline. The coin price is currently above the short- and medium-term moving averages on the daily chart, and the MACD has also entered a bullish cycle. Essentially, the daily chart shows a strong structure in the short term, while the overall trend background at the daily level is a continuation of the decline. Once again, multiple signals of increased volume and stop-loss have appeared at the important support level below, enhancing the probability of bottoming out. Currently, the price has rebounded to the vicinity of important resistance, indicating that the rebound has not yet reversed, so we will observe the subsequent market to confirm the bottoming situation. In conjunction with previous trends, the daily level has returned to the oscillation area below 88,800, and we need to break through this resistance. This week, it is highly likely that we will undergo a consolidation process.

The four-hour chart is in a high-level oscillation phase, with a slight pullback. On the technical indicators, the MACD has also entered the early bearish phase, and the short-term moving average MA7 has initially turned into a small death cross. However, the pullbacks in the previous few candlesticks have already been recovered, and the current market structure is undergoing an adjustment process.

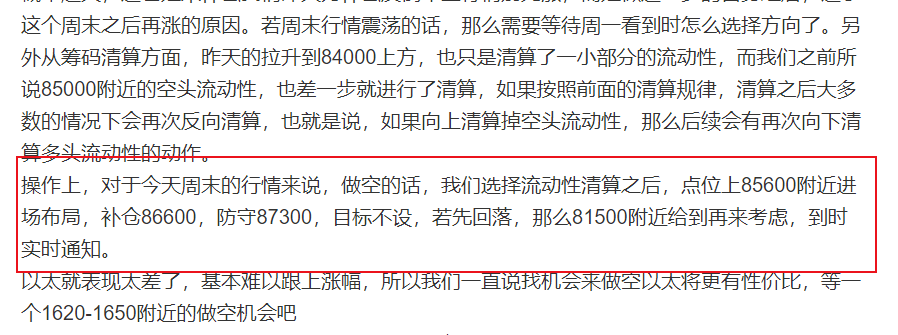

In terms of operations, those still holding short positions should continue to hold. If there is a pullback, consider entering long around 82,500, with additional purchases at 81,500, and a stop-loss at 80,700, targeting 85,500-86,000. In the case of an initial rebound, consider shorting around 86,000, with additional purchases at 87,000, and a stop-loss at 87,800, with no set target, adjusting based on real-time market conditions to capture profit space.

The short position on Ethereum over the weekend was also a successful operation. The Ethereum trend over the weekend was slightly able to keep up with Bitcoin, although it is still somewhat weaker, but much better than before. For the next operation, shorting at 1,650 is still viable, with a stop-loss at 1,720.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and strategies may not be timely. Specific operations should be based on real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。