Someone asked me what I believe in, and I said I only believe in time. Because in this world, only time does not deceive, only time can prove everything, what is true and what is false. For example, when observing people, do not rely on your eyes, as they can easily mislead you; do not rely on your ears either, because they are all lies. Only use time and your heart to feel; the truth cannot be disguised, and the false cannot become real! Therefore, my favorite saying is: time will leave behind the truest people.

If friends who have been following the analysis of the market have a clear operational mindset when facing the market, I believe they must have a clear strategy. As analyzed yesterday, the previous rise was mainly driven by short-term investors, and it is particularly evident that short-term speculators pay special attention to market influences, and short-term profit-taking leads to selling pressure. When Old Trump announced the immediate implementation of a 145% tariff policy on Dongda, the market immediately reacted with a decline, ultimately dropping to around 78,500, which provided us with an opportunity to exit our short position profitably. At the same time, we completed our long position layout, with yesterday's suggestion to enter at 80,000, add positions at 79,000, and set a stop-loss at 78,300. Zongheng also provided real-time operations in the friend circle, and currently, the average price of our long positions is around 79,500, and as of now, the long positions are also profitable by over a thousand points. The market has given us quite a few opportunities; if you have not been able to grasp them, perhaps it is time to consider a different approach; maybe the scenery ahead is even more beautiful.

The U.S. March CPI rose 2.4% year-on-year, the lowest level in seven months, slightly below the expected 2.5%, and a significant decrease from the previous value of 2.8%; the March core CPI year-on-year was 2.8%, lower than the expected 3%, with the previous value at 3.1%, and the CPI month-on-month rate was -0.1%. The data indicates a downward trend in inflation, increasing expectations for interest rate cuts within the year, which is considered a positive signal. However, the negative month-on-month rate indicates a clear risk of deflation and is a sign of economic recession. As a result, U.S. stocks fell, and the cryptocurrency market followed suit.

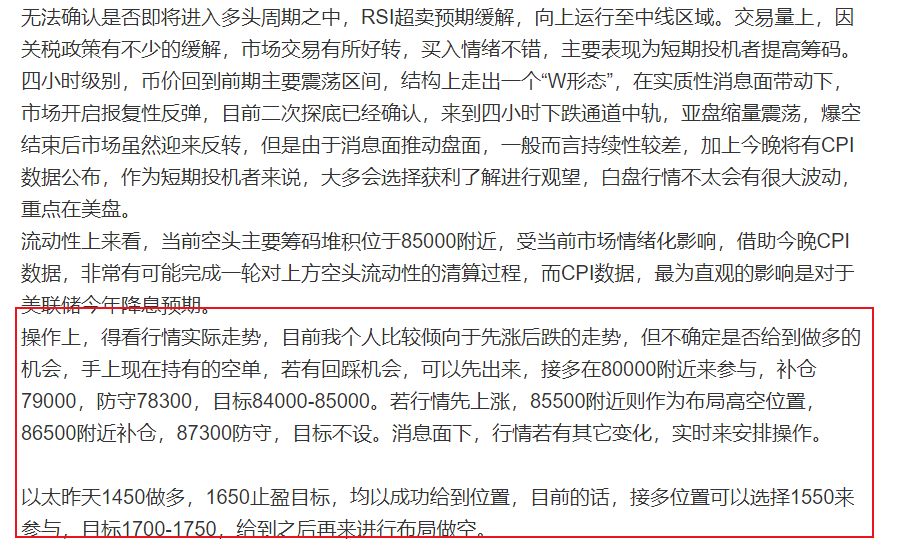

Back to the market, the daily line closed yesterday with a long upper shadow bullish candle. Recently, the closing lines have consistently shown long upper and lower shadows, indicating that the continuation of bullish and bearish trends is not sustainable, and the market's direction is influenced by news stimuli, leading to volatility. The daily line shows a slightly stronger performance in the short term, currently operating above the short-term resistance of the MA7 daily line. In terms of technical indicators, the MACD's bearish cycle continues to contract, and it will take time to enter a bullish phase. The KDJ and RSI are both diverging upwards, with current resistance on the daily level around 83,300.

On the four-hour chart, yesterday's structure formed a "W" shape, which is typically considered a bullish trend in the market. When the price tests the bottom again without breaking the previous low, it indicates that the bearish force has weakened, and the bullish side begins to counterattack, leading to a rebound. In actual performance yesterday, the evening pullback did not break the previous low, confirming the W shape. Currently, we are in a rebound phase. The MACD is in a bullish cycle but contracting, which may indicate a process of indicator repair before entering a bearish cycle. However, as we approach the weekend, with low trading sentiment, it would be good if we could see some oscillation repair during this period. The main resistance on the four-hour chart is the same as on the daily level, located around the previous rebound high of 83,300. Combining our previous emphasis, the current bearish liquidity is mainly concentrated around 85,000. Whether the four-hour bullish pattern can support the clearing of liquidity above in the short term remains uncertain. In terms of market news, tariff policies cannot be increased indefinitely; there will be some emotional cooling in the short term. However, before the market sees substantial positive news, such as when monetary policy returns to easing or whether the economy can avoid a deep recession, the rebound in the market does not indicate a reversal.

In terms of operations, we are still holding long positions. Yesterday, we increased our positions significantly, and now at 81,000, we can consider reducing our positions. If there is a rebound during the day, we can take profits on the long positions. If the market dips again, we can consider entering long in the 79,000-79,500 range. For short positions, we can try when it first touches around 92,500, with a stop-loss at 93,500; the target can be determined by oneself or wait for real-time notifications from Zongheng.

Ethereum's rebound is noticeably weaker. If you still have long positions above 1,550, you can continue to hold. Ethereum's performance has been poor, and as before, the cost-effectiveness of shorting is higher. Wait for a good opportunity to lay out your strategy.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be delayed, and strategies may not be timely. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。