The global financial market is facing a highly uncertain game cycle. Trump's strong return and dominance in public opinion mean that the combination of "high inflation + trade conflict + strong dollar" will once again dominate global asset pricing. In the face of this systemic correction, although the crypto market is under short-term pressure, Bitcoin's safe-haven properties are beginning to show, and its resilience is worth paying close attention to. In the short term, survival is the top priority; but looking to the future, opportunities often arise in the most panicked moments. Finding unsinkable ships in the storm may be our first step to turning the tide.

Due to tariff events and other occurrences, Bitcoin's price experienced a significant drop, hitting a low of 74,500 before rebounding. Last night, it saw a rebound of 7,000 points, returning to around 81,500. This temporarily alleviated the market's gloomy sentiment. The four-hour chart indicators show that after testing the lower boundary, the price is continuing to rise with a double bullish candlestick pattern accompanied by a doji. The mid-level resistance at 81,500 is currently the upper resistance; if this level is not broken, the price will still face downward pressure. A breakthrough would lead to a continuation of the upward trend, making this level a key focus in the near term.

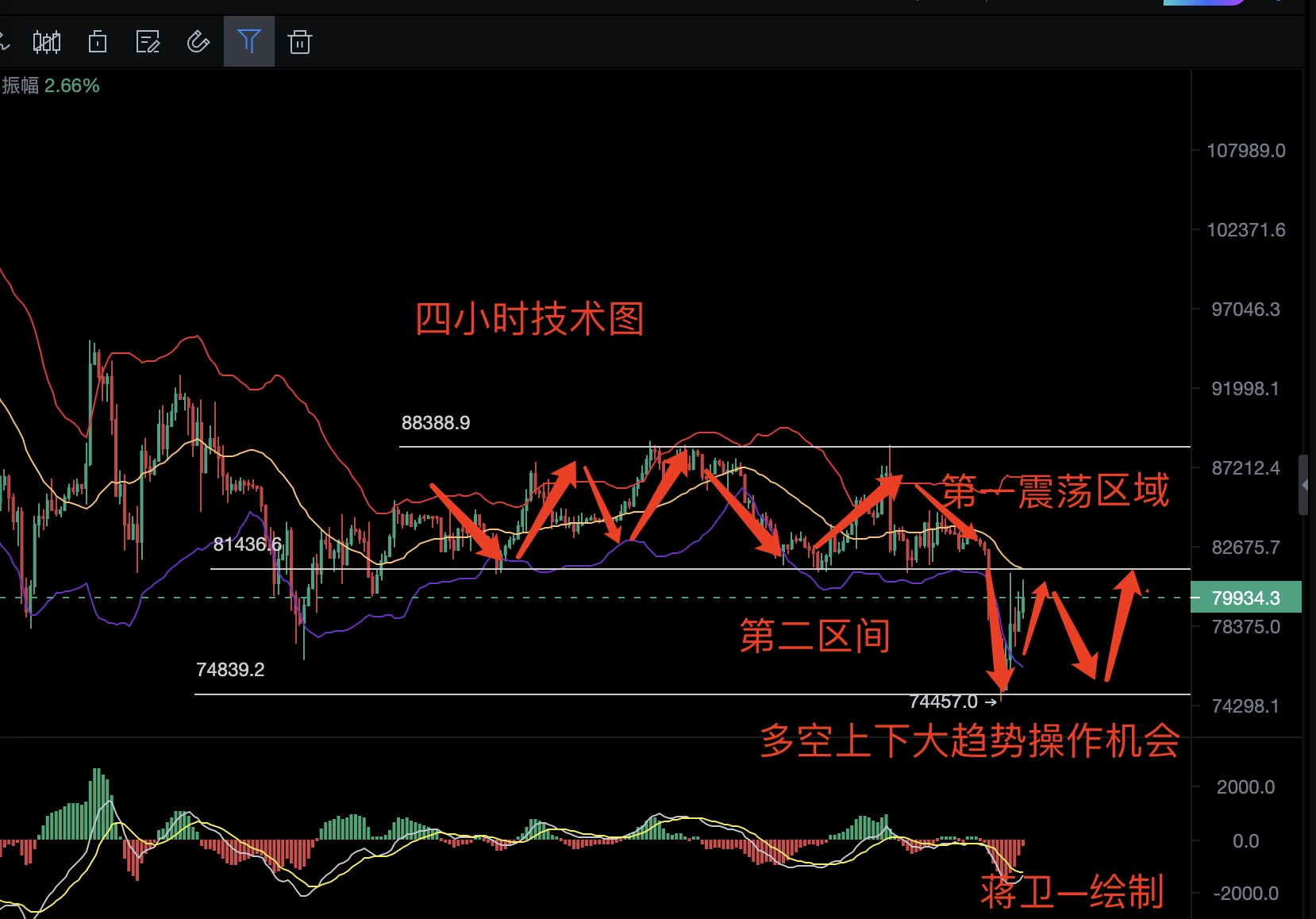

From the area division in the chart below, it can be seen that the price previously oscillated around the first area. The price broke the support level two days ago and is now operating in the second area below, with upper pressure at 81,500 and lower support at 74,500. It is not difficult to see signs of a price rebound in the short term. If a rebound occurs first, then we should short at the pressure level and look for bullish opportunities on the pullback; conversely, if it drops first, we will look for bullish opportunities at the bottom.

Thoughts for reference:

- Short in batches in the 81,000-81,500 area, targeting the 77,000 level.

- Long in batches in the 76,000-76,500 area, targeting 80,500.

The levels are for reference only; specifics should be based on real-time trading.

Follow Jiang Wei's public account, for what can relieve worries, only Jiang Wei.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。