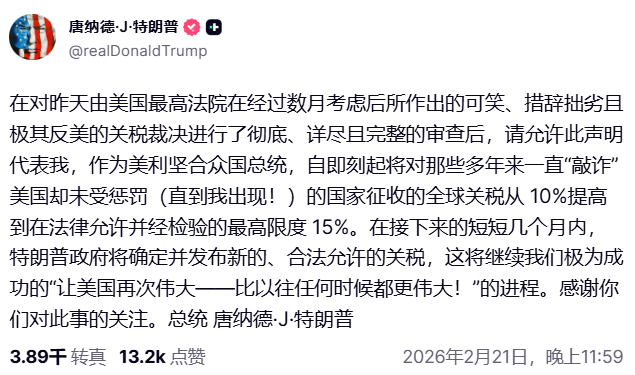

Just tonight, Trump issued another statement, raising the global tariff from 10% to 15%. This is already the maximum cap under the current Section 122 legislation. It should be explained that this does not simply continue to stack on top of the previous basis, but replaces the “emergency power tariff” framework of IEEPA, which was ruled invalid by the Supreme Court of the United States.

However, this does not mean that all existing tariffs are eliminated; tariffs under other statutes such as 232, 301, anti-dumping and countervailing duties may still continue to exist. The actual tax burden on enterprises will ultimately depend on the category and applicable rules.

After switching to Section 122, the White House gained approximately 150 days of a temporary window to impose temporary additional taxes on imports within the scope permitted by this legislation, with 15% being the statutory maximum for this tool. Following this adjustment, compared to the categorization of countries under the IEEPA era, there has been some structural change in the overall tariff level; simply put, “the high is pushed down and the low is raised,” transforming tariffs from country-punishment categories to a more unified flat rate.

PS: Goods entering compliantly under the USMCA pathway from Canada, Mexico, and others still have space for exemption, and the final impact depends more on product categories, origin rules, and whether they fall on the exemption list.

Countries that were hit with tariffs of 20%, 25%, 30%, or even above 40% during the IEEPA era, such as the EU, China, Japan, South Korea, Taiwan, and Southeast Asia, have actually seen a decrease on the reciprocity tariff level, while countries that originally had only a 10% baseline, or maintained lower tax rates through arrangements (such as the UK), will be directly elevated to 15%.

This also means that the logic of supply chain relocation will be changed again. Previously, companies were desperately relocating from high-tax countries to low-tax countries or to paths with more exemptions. Now, with a unified 15%, the marginal benefits of merely changing the place of production have diminished. Companies are more concerned about whether they can make it onto the exemption list, whether they can take advantage of duty-free agreements, and whether they will continue to face additional layers under statutes such as 232 and 301 for different categories.

After IEEPA was rejected, the White House used Section 122 to first extend the general tariffs, negotiating while rewriting longer-term usable tariff tools within the 150-day window period. For companies, uncertainty may rise; the decisions on whether to expand exemptions, how to enforce origin and compliance criteria, and whether to switch to a more long-term legal framework after 150 days will all directly affect costs and pricing.

However, it can be ensured at the very least that the path of using emergency powers to treat tariffs as a regular weapon, as with IEEPA, will be more difficult to replicate than in the past.

@bitget VIP, lower rates, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。