This Issue Highlights

The statistical period for this week's report covers February 13, 2026 - February 20, 2026.

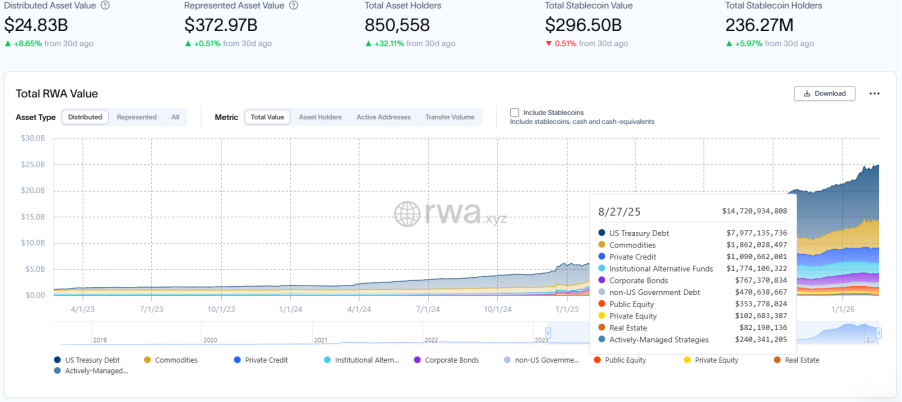

This week, the total market value on the RWA chain has steadily grown to $24.83 billion, with a growth rate of holders at 32% significantly outpacing the scale growth, reinforcing the user expansion drive; the market value of stablecoins has continued to decline but monthly transaction volume is nearing $10 trillion, with turnover reaching a new high of 33.4 times, suggesting significant recovery of retail participation, and the market is transitioning from "capital inflow" to "efficiency-driven".

On the regulatory front: The SEC chairman in the U.S. signaled positive developments at ETHDenver, proposing innovations for tokenized securities trading exemptions and guidelines for the custody of stablecoin payments, allowing room for compliant innovations; the White House is pushing for stablecoin incentives to be included in legislative negotiations, the central bank of Russia plans to study the feasibility of a stablecoin, and the head of Germany's central bank supports a euro-backed stablecoin to maintain payment sovereignty, as the global regulatory framework moves towards refinement amidst differences.

Project updates: Figure issued tokenized stocks, Securitize brought RWA into DeFi lending, Tether Gold launched a dividend mechanism, Société Générale expanded its euro stablecoin to the XRP Ledger, the UAE's digital bank is exploring issuing a dirham stablecoin, and Anchorage Digital is providing regulated stablecoin settlement channels for international banks.

Data Highlights

RWA Track Overview

According to the latest data from RWA.xyz, as of February 20, 2026, the total market value on the RWA chain reached $24.83 billion, up 8.65% from the same period last month, with growth slowing; the total number of asset holders surged to approximately 850,600, representing a 32.11% increase from the same period last month, far exceeding the growth rate of asset scale.

Stablecoin Market

The total market value of stablecoins decreased to $296.5 billion, slightly down 0.78% from the same period last month, marking two consecutive months of decline, reflecting cautious inflow of incremental funds and sustained pressure on the overall liquidity pool; monthly transaction volume surged to $9.9 trillion, up 11.81% from the same period last month, with the turnover rate (transaction volume/market value) reaching 33.4 times, indicating persistent demand for large settlements.

The total number of active addresses increased to 52.48 million, up 11.87% from the same period last month; the total number of holders steadily increased to 236 million, a growth of 8.43% from the same period last month. Both have resonated, with retail participation accelerating recovery from previous lows, and user structure showing positive improvement.

Currently, the main contradiction in the market lies in the continuous divergence between market value contraction and trading activity. Existing funds maintain a high turnover state, but the expansion of the overall liquidity pool is weak, indicating that the market is still transitioning from "capital inflow" to "efficiency-driven".

The leading stablecoins are USDT, USDC, and USDS, with USDT's market value slightly declining by 1.18% compared to the same period last month; USDC's market value decreased by 2.19% compared to the same period last month; USDS's market value increased by 2.34% compared to the same period last month.

Regulatory News

According to CoinDesk, the White House expressed support for certain stablecoin incentive programs during discussions with the banking and crypto sectors, urging the banking industry to reach an agreement on the market structure bill. Sources indicate that if the banking sector agrees, limited stablecoin incentives will be included in the next draft of the U.S. Senate's Digital Asset Market Clarity Act.

At Thursday's meeting, the White House team led by Trump crypto advisor Patrick Witt clearly stated that reward programs for certain activities would remain in the bill, but rewards for stablecoin holdings similar to deposit accounts would be excluded. Blockchain Association CEO Summer Mersinger noted that this meeting made constructive progress in addressing reward-related issues and maintaining the legislative process for market structure. Currently, the bill still needs to address demands from Democrats to strengthen DeFi sector regulation, prohibit government officials from directly participating in the crypto industry, and fill vacancies in CFTC and SEC commissioners.

TASS reports that the First Deputy Governor of the Central Bank of Russia, Vladimir Chistyukhin, stated at the Alfa Talk conference that the central bank plans to conduct a study on the feasibility of creating a Russian stablecoin in 2026. Chistyukhin said that the central bank's traditional stance is to not allow such operations, but considering practices in multiple countries, it will reassess relevant risks and prospects and submit the research results for public discussion.

The U.S. Securities and Exchange Commission's website released Chairman Paul Atkins' speech at the ETHDenver conference, outlining the agency's crypto regulatory signals, primarily including:

1. Clarifying the "Investment Contract" Framework: The commission will study and release a framework that clarifies under what circumstances crypto assets constitute investment contracts and their formation and termination mechanisms.

2. Innovation Exemptions: Considering establishing innovation exemptions that allow pilot trading for certain tokenized securities under limited conditions, including limited trading on new platforms such as automated market makers, to accumulate experience for long-term regulatory framework.

3. Advancement of Rules and Guidelines: Plans to initiate or advance rule-making on issues such as crypto asset financing pathways, custodial rules for non-securities crypto assets (including payment stablecoins), and modernization of transfer agency rules; continue to provide clarity for scenarios not requiring registration via No-action letters and exemption orders, covering wallets, user interfaces, etc.

4. Regulatory Philosophy: Paul Atkins emphasized that regulators should not react to short-term price fluctuations; the SEC's duty is to ensure sufficient information disclosure and clear rules, allowing market participants to make decisions in a transparent environment, rather than "guarding prices".

Rumors of Lagarde's Early Resignation Spark Attention on ECB Successor and Digital Euro Prospects

According to Cointelegraph citing the Financial Times, Christine Lagarde, president of the European Central Bank, is considering an early resignation before her term ends in October 2027, to allow French President Macron and German Chancellor Merz to reach an agreement on a successor before the French elections in April 2027. An ECB spokesperson later responded that Lagarde is "fully focused on her mission and has not made any decisions regarding her term's end".

Lagarde's potential early departure comes at a crucial time for the ECB's advancement of the digital euro. Under her leadership, the ECB has continued its preparations for the digital euro while repeatedly emphasizing the need to manage risks of private digital currencies such as stablecoins under the EU's Crypto Assets Market Regulation. Lagarde has long held critical views on cryptocurrencies like Bitcoin, describing them as "highly speculative", "worthless", and "not backed by any underlying assets". Changes in the ECB leadership could influence the institution's communication focus and priorities regarding digital euro, stablecoin regulation, and crypto-related payment arrangements, although the overall regulatory direction is already determined at the EU level.

The president of the German Central Bank, Joachim Nagel, stated that euro-pegged stablecoins will provide Europe with greater independence, allowing it to break away from dollar-pegged stablecoins that are set to be approved under the upcoming GENIUS Act.

Nagel supports the launch of central bank digital currencies pegged to the euro as well as payment-stablecoins denominated in euros. In preparatory remarks at the U.S. Chamber of Commerce's New Year reception in Frankfurt this Monday, he stated that EU officials are working hard to promote the rollout of retail central bank digital currencies. He believes that euro-denominated stablecoins also help to "make Europe more independent in payment systems and solutions".

The German central bank chief's comments on stablecoins did not mention the risks he highlighted at last week's Euro50 group meeting. Nagel had previously warned that if the market share of dollar-pegged stablecoins significantly exceeds that of euro-pegged stablecoins, domestic monetary policy "could be severely harmed, not to mention Europe's sovereignty could be weakened".

Pound Stablecoin Issuer Agant: UK's Crypto Legislation May Come Into Effect by 2027

Agant CEO Andrew MacKenzie stated that while the direction of Britain's crypto regulatory framework is correct, the pace of progress is insufficient to support the country's ambition to become a global center for digital assets.

MacKenzie believes that the UK government has repeatedly promised to position London as a global hub for crypto and digital asset activities. However, comprehensive legislation covering stablecoins and broader crypto activities is expected to receive parliamentary approval later this year, with formal implementation likely not until 2027.

Agant plans to issue a stablecoin called GBPA, which will be fully backed by pounds. The company has completed registration with the UK's Financial Conduct Authority (FCA), indicating its intention to target institutional investors rather than the retail cryptocurrency market. Agant has positioned GBPA as infrastructure for institutional payments, settlements, and tokenized assets.

Domestic Developments

Shaanxi Province Issues First Digital RMB Sci-tech Bond, Amounting to 300 Million Yuan

According to the Shaanxi Release WeChat account, under the guidance of the People's Bank of China Shaanxi Branch, the Xi'an branch of China Merchants Bank successfully issued the first phase of the 2026 release of sci-tech innovation bonds for a large enterprise in Shaanxi Province, completing the entire fundraising collection in the form of digital RMB, amounting to 300 million yuan. Industry insiders point out that this transaction is not only Shaanxi's first digital RMB sci-tech bond but also represents a practical application of digital RMB in direct financing scenarios, which has positive significance for improving the digital RMB ecosystem and promoting innovation in Shaanxi's financial market business.

In response to the Hong Kong Chief Executive's announcement that the first batch of stablecoin issuer licenses will be issued in March, Legislative Council member Wu Jiezhuang suggested on the X platform that stablecoins be integrated with public financial policies by distributing "night consumption coupons" to rapidly popularize stablecoins, benefiting the public and promoting the development of the Web3 industry. He pointed out that this move could bring "four major benefits":

1. Citizens can directly use stablecoins for consumption and experience digital payments;

2. Help citizens easily open e-wallets and become familiar with digital assets and stablecoins;

3. Lower administrative costs, with compliant stablecoin issuers covering part of the promotion expenses;

4. Long term improvement in public awareness of digital assets, reducing the incidence of fraud cases.

Project Progress

Securitize Announces Partnership with Euler to Bring Tokenized RWA into DeFi Lending

Securitize has partnered with Euler Finance to integrate its DS protocol, enabling DS tokens to be used as collateral in a curated, risk-isolated lending market.

The first services will be launched in a selection market managed by KPK, where whitelisted investors can use tokenized securities as collateral to borrow digital assets.

WLFI to Tokenize Loan Income from Trump Family's Maldives Resort

WLFI announced plans to tokenize loan income rights related to the Trump International Hotel and Resort in the Maldives.

This initiative represents an important step by WLFI in the tokenization of real-world assets (RWA). The project is being co-developed with international luxury real estate developer DarGlobal PLC (which owns properties in the Maldives) and leading tokenization platform Securitize. The Trump Group is participating as a licensed hotel brand partner for the resort.

Figure to Launch Its Tokenized Shares and Conduct a $150 Million Offering

Figure has announced it will directly issue tokenized versions of its shares on the blockchain, bypassing traditional clearing systems. Share token holders will be able to borrow through Figure's DeFi market.

This tokenization of Figure's stock coincides with its secondary public offering, increasing to $150 million. Venture capital firm Pantera Capital participated in this transaction.

Inveniam Merges with MEASA Partners to Strengthen Tokenization of Physical Asset Market

According to PR Newswire, decentralized data infrastructure provider Inveniam has reached a merger agreement with investment and advisory platform MEASA Partners, focusing on income-generating Real-World Assets (RWA) such as real estate, infrastructure, and private credit. Post-merger, MEASA Partners will lead the Inveniam Capital business unit, responsible for providing compliant private RWA solutions for institutional and digital investors. Inveniam will utilize its Smart Provenance decentralized data architecture, combined with MEASA's sovereign and institutional networks in the Middle East and globally, to achieve near-real-time pricing of private assets, quantitative portfolio optimization, and liquidity aggregation across compliant digital markets, aiming to promote AI-based proxy asset management and systematic trading in markets like Abu Dhabi.

Elemental Royalty Corporation emphasizes that this mechanism links tokenized gold ownership to standardized royalty payments on the blockchain. Tether acquired approximately 33% of Elemental in 2025. Investors can gain direct physical gold ownership through allocations to gold royalties, with related companies expected to distribute about 12 cents in dividends to investors on a quarterly basis. Investors who prefer cash dividends can still opt for cash.

Tether Gold Launches Tokenized Dividends on Wall Street, XAUT Market Cap Surpasses $2.5 Billion

According to Cryptopolitan, Tether announced that its gold-backed token Tether Gold (XAUT) has launched a dividend mechanism, becoming the first publicly listed gold company structure that allows shareholders to choose to receive dividends in tokenized gold instead of cash. This move is described as a major breakthrough in the gold industry, with a recent surge in demand for digital gold, pushing XAUT's market cap close to $2.55 billion, leading overall tokenized real-world asset growth.

Rumble Announces Integration of Tether's U.S. Stablecoin USAT in Its Wallet Service

NASDAQ-listed Rumble has announced its integration of the U.S. stablecoin USAT into the non-custodial crypto wallet Rumble Wallet. Currently, this wallet supports USAT, USDT, XAUT, and Bitcoin, allowing users to directly use these crypto assets to tip creators and receive payments globally in stablecoin form, without relying on traditional banks or payment institutions.

Canza Finance Partners with First Digital to Support Institutions Adopting FDUSD

Canza Finance announced that it has reached a strategic integration with First Digital to support institutions and B2B stablecoin settlement processes using FDUSD. Over the past year, Canza Finance has processed approximately $200 million in stablecoin transactions, mainly driven by OTC activity and emerging market cross-border B2B transactions. Through this collaboration, FDUSD will be introduced as an additional settlement option within Canza Finance's client network.

First Digital founder and group CEO Vincent Chok stated that this integration supports the commitment to expanding responsible and scalable stablecoin use cases, and Canza Finance's position in the institutional settlement network makes it a partner in driving FDUSD adoption in emerging markets. Canza Finance stated that supporting FDUSD in its settlement processes aligns with its mission to provide efficient, transparent, and trustworthy digital asset infrastructure for corporate clients.

French Bank Group Societe Generale Expands Euro Stablecoin EURCV to XRP Ledger

According to Cointelegraph, Societe Generale's digital assets division SG-FORGE has expanded its euro-pegged stablecoin EUR CoinVertible (EURCV) to the XRP Ledger, making it the third blockchain deployment for this token after Ethereum and Solana, utilizing Ripple's custodial infrastructure and potentially integrating into Ripple products as collateral for transactions. It is reported that this stablecoin is 1:1 backed by bank cash deposits or high-quality securities, with a current circulation of approximately 70.51 million units, aiming to enhance institutional access to euro-supported tokens while complying with EU MiCA regulations.

UAE Digital Bank Zand Partners with Ripple to Explore Issuance of Stablecoin AEDZ on the XRP Ledger

According to The Fintech Times, UAE AI and blockchain digital bank Zand has established a strategic partnership with Ripple, with both parties advancing the region's digital economy through Zand's UAE Dirham stablecoin AEDZ and Ripple's USD stablecoin RLUSD.

Both parties will pursue multiple initiatives based on their previous payment cooperation, including support for RLUSD in Zand's regulated digital asset custody services and exploring direct liquidity solutions between AEDZ and RLUSD. They will also explore issuing AEDZ on the XRP Ledger, leveraging the public chain's compliance and risk control mechanisms.

Soil Launches RLUSD Yield Protocol on XRP Ledger to Expand Ripple Stablecoin's Use

According to The Block, Soil has launched the first RWA-compliant yield protocol on the XRP Ledger, with its initial $1 million funding pool fully raised within 72 hours.

This launch adds yield functionality to Ripple's USD-pegged stablecoin RLUSD. Meanwhile, according to data from RWA.xyz, the tokenized real-world asset value on the XRP Ledger has surpassed that of Solana.

According to Financefeeds, crypto bank Anchorage Digital has announced the launch of "Stablecoin Solutions" for international banks, aiming to provide non-U.S. financial institutions with a U.S.-regulated digital dollar infrastructure as an alternative to traditional agency banking systems. The solution integrates stablecoin issuance, compliance custody, fiat fund management, and blockchain-native settlement functions, allowing banks to achieve cross-border flow of dollar assets without relying on traditional agency banking networks. Anchorage stated that institutions can hold and settle tokenized dollar assets under its federal banking license framework.

According to an official announcement, the TON Foundation has collaborated with Banxa, a regulated crypto infrastructure provider under the OSL Group, to provide compliant stablecoin payment infrastructure for thousands of SMEs in the Asia-Pacific region.

This collaboration positions TON as the operational payment layer for real business activities in the Asian region. Leveraging OSL's merchant and institutional network along with Banxa's payment channels, SMEs in the Asia-Pacific region can now use TON for actual payment workflows, including business-to-business settlements, cross-border transactions, and consumer-to-merchant payments.

Banxa is responsible for processing exchanges between local fiat currency and digital assets. Although TON's P2P payment infrastructure has been widely adopted in the region, this collaboration extends its application scope to enterprise-level commercial scenarios.

Anchorage is the first crypto-native institution to obtain a U.S. federal banking license, regulated by the Office of the Comptroller of the Currency (OCC). CEO Nathan McCauley stated that stablecoins are gradually becoming core financial infrastructure, and this solution provides banks with a pathway to achieve global dollar flow through blockchain rails while ensuring custody, compliance, and operational controls. Anchorage's initiatives are seen as an attempt to replace traditional agency cross-border clearing systems with regulated stablecoin rails. If adopted by international banks, dollar stablecoins could further integrate into mainstream cross-border payment and fund management processes. However, final implementation will still be dependent on the clarity of regulatory details and global banks' acceptance of tokenized liability structures.

Stablecoin Settlement Company Ubyx Receives Investment from Arab Bank's Accelerator AB Xelerate

According to Chainwire, Arab Bank, a large international bank based in Amman, Jordan, announced that its fintech accelerator AB Xelerate has invested in stablecoin settlement company Ubyx, with specific investment amounts undisclosed. The new funding will support the development of a shared network that enables regulated financial institutions to issue, accept, and exchange digital currencies at par across multiple blockchains and jurisdictions while operating within established regulatory and compliance frameworks. Previously, Ubyx was acquired by banking giant Barclays, planning to explore the development of "tokenized currency".

RWA Trading Platform MSX Launches Cybersecurity Sector Leader $PANW.M

According to official news, MSX has launched spot trading for cybersecurity sector leader $PANW.M. $PANW.M is a global leader in cybersecurity solutions, providing enterprises with comprehensive protection covering networks, cloud, and endpoints, and its latest quarterly financial report was released after the market close on February 17.

Insights Summary

PANews Overview: Stablecoin issuers (like Tether and Circle) have what could be called the "best business model in history": users deposit fiat to exchange for stablecoins, and issuers invest the funds in safe assets like government bonds, enjoying risk-free interest and earning substantial profits with nearly zero cost and risk (Tether's profit is expected to reach $10 billion by 2025).

However, this profit chain is being pried open by downstream applications (wallets, exchanges, DeFi protocols). Applications that control user entry are demanding issuers share profits, leveraging their bargaining power with a "designated default stablecoin" (such as the profit-sharing agreement between Coinbase and Circle) or even trying to bypass issuers by offering their own branded stablecoins (like PayPal's PYUSD) or using "issuing as a service" models.

Yet, the real variable comes from users, especially in developed country markets, where users are increasingly expecting "idle stablecoins to earn interest". This compels the application layer to return the shared profits to users to retain them, thus getting caught in the dilemma of "sandwiched between users' demand for returns and issuers' profit monopoly".

In this secret war, users might actually become the ultimate beneficiaries. As applications compete to attract users, much of the profit will flow back into users' pockets via the application layer from issuers.

In emerging markets, users are more focused on stablecoins' anti-inflation and hedging functions, being less sensitive to returns, which temporarily puts less pressure on issuers like Tether that primarily serve overseas users, but the overall trend is irreversible: user returns are transitioning from "optional" to "essential".

PANews Overview: On February 11, 2026, the Hong Kong SFC released a comprehensive new set of regulations that introduce compliant leverage for the virtual asset market through three paths: firstly, margin financing, allowing licensed brokers to provide financing to securities margin clients, but collateral is limited to Bitcoin and Ethereum with a minimum prudent haircut of 60%, and re-pledging is strictly prohibited, cutting off the leveraged chain; secondly, the first issuance of a perpetual contract framework, limited to professional investors, requiring high transparency disclosure, robust risk control, and the platform to take central counterparty clearing responsibilities; thirdly, allowing platform affiliates to act as market makers, but must set strict conflict of interest firewalls (customer priority, functional independence, information isolation) to address liquidity cold start challenges.

The underlying logic of this design is that "liquidity is designed rather than left to chance". By limiting the most mature assets, the highest safety margins, and the most transparent rules, depth can be cultivated within manageable boundaries.

Ultimately, this intention is to "catch up" for the RWA market, which is facing even greater liquidity dilemmas: the slippage of tokenized gold, stocks, and other RWAs is currently very high, with extremely poor liquidity, primarily due to a lack of compliant leverage tools and market-making mechanisms.

The new regulations provide four demonstrations for RWA: collateral tier management, derivatives transparency templates, "Chinese wall" models for affiliate market-making, and establishing regulatory-market dialogue mechanisms through "digital asset accelerators".

In the end, Hong Kong is using virtual assets as a "laboratory" to refine a complete toolkit of leverage tools from collateral, derivatives to market makers, which will be shifted to the RWA field once data matures and frameworks stabilize.

For practitioners, this means: the window for compliant leverage is opening, but the thresholds are very high; now is a golden window for learning this set of regulatory tools and rehearsing product design.

a16z Crypto Founders Discuss Stablecoins: The "WhatsApp Moment" in the Currency Field Has Arrived

PANews Overview: Stablecoins are becoming the mainstream choice for global payments, with transaction volume exceeding $12 trillion last year, approaching Visa's $17 trillion, but the cost is much lower.

This marks the "WhatsApp moment" in the currency domain: just as WhatsApp transformed each 30-cent international text message into nearly free communications, stablecoins have transformed cross-border payments from high fees and slow settlements into nearly zero-cost, instantaneous transactions. More importantly, currency is becoming software.

Thanks to blockchain's programmability, stablecoins can achieve automatic transactions, smart contract settlements, and other functions unimaginable in traditional finance. Enterprises are starting to adopt on a large scale: Stripe's payment rates have dropped from 3% to 1.5%, SpaceX utilizes stablecoins to circumvent capital controls in high-inflation countries, and Fidelity has even issued its own stablecoin.

This transformation also brings a commonly overlooked effect: stablecoins are becoming a new pillar of dollar hegemony. Leading issuers Circle and Tether hold nearly $140 billion in U.S. Treasury bonds, positioning them among the top 20 holders of U.S. debt, potentially entering the top ten next year, creating strong new demand for U.S. Treasury bonds.

However, to unlock the full potential, a clear regulatory framework is needed, such as the U.S. "Genius Act" and "Clarity Act", which provide clear rules for stablecoins and underlying blockchain networks. Ultimately, just as the internet allows information to flow without borders, stablecoins will enable value to flow across borders, becoming a pipeline and pillar of the new global financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。