Recently, the price of Bitcoin has seen a pullback, and assets such as gold and silver have also shown significant volatility. The uncertainty in the macro environment has clearly increased, putting overall pressure on risk assets. Against this backdrop, market sentiment has become cautious, and discussions surrounding crypto assets have gradually shifted from growth expectations to survival capability, with the operating status of miners becoming a focal point and the concept of "shutdown price" frequently mentioned.

This concern is not without basis. Under the dual influence of price declines and tightening macro liquidity, the profitability of the mining industry indeed faces cyclical pressure. The market attempts to use the "shutdown price" indicator to judge whether miners will be forced to exit on a large scale, thereby affecting network security and asset prospects. This concern itself reflects market participation, however, if this concept is regarded as the core basis for assessing industry risk, it often tends to overlook the key differences and self-regulating features in the operational mechanism of Bitcoin mining. In fact, in actual operation, the "shutdown price" is not a simple, unified price warning line.

The Shutdown Price is Often Misunderstood

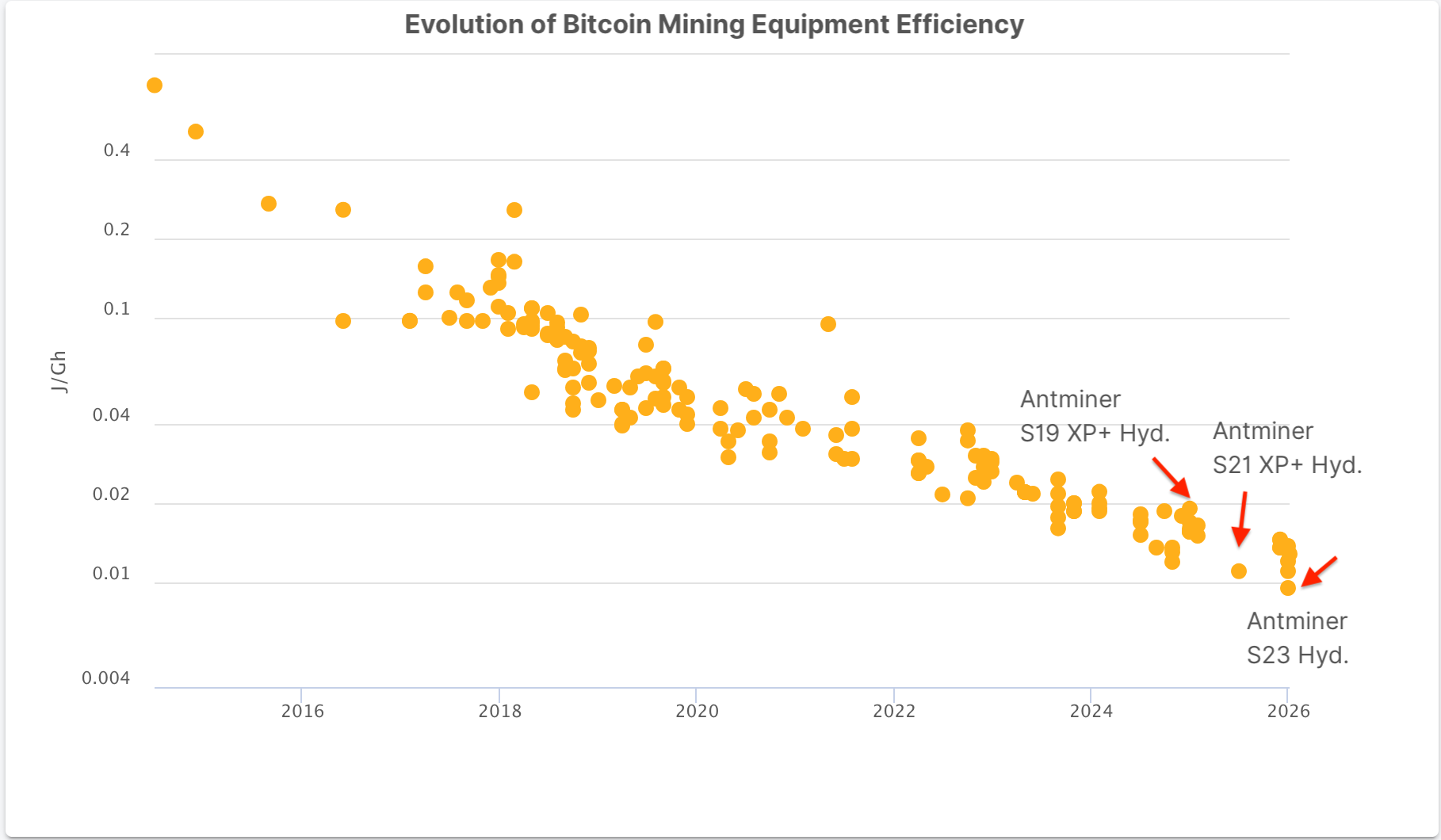

From an industry perspective, there is no "shutdown price" applicable to all miners. The so-called "shutdown price" is more of a theoretical result derived from models based on specific assumed conditions, usually assuming a uniform electricity price, equipment efficiency, and operating cost structure. However, in reality, the cost structure of the mining industry is highly differentiated. Different models of mining machines exhibit significant differences in energy efficiency, and the cost per unit of computing power between next-generation high-efficiency mining machines and old equipment is not comparable; for example, among the current mainstream models, Antminer S23 Hyd (approximately 580 TH/s, 5510W) has an efficiency of about 9.5 J/T, Antminer S21 (approximately 480 TH/s, 5280W) has about 11 J/T, while Canaan Avalon A16XP-300T has about 12.8 J/T. An increase in unit efficiency by 1-2 J/T significantly changes the breakeven range under the same electricity price conditions.

Source: Cambridge Bitcoin Electrical Consumption Index (CBECI), Cambridge Centre for Alternative Finance (CCAF), accessed on February 12, 2026

Different mining sites have distinct energy environments, contract electricity prices, etc. From hydropower, wind power to thermal power, the different energy combinations directly determine the level of marginal cost. Some large mining sites in areas rich in hydropower resources in North America have long-term contract electricity prices as low as $0.03-$0.05/kWh, while in regions with higher energy costs, commercial electricity prices may reach $0.08-$0.12/kWh. The operating pressure on the same model of mining machine thus differs significantly under different electricity price environments. At the same time, differences in operational efficiency, management costs, capital structure, and risk management strategies among miners also affect their ability to withstand price fluctuations.

For these reasons, due to the significant variations in different mining machine models, electricity price structures, and operational efficiencies, there is no unified "shutdown price" in the industry; the actual situation varies according to mining conditions and equipment configurations. Viewing a model result based on average assumptions as an industry "death line" is itself likely to amplify market sentiment.

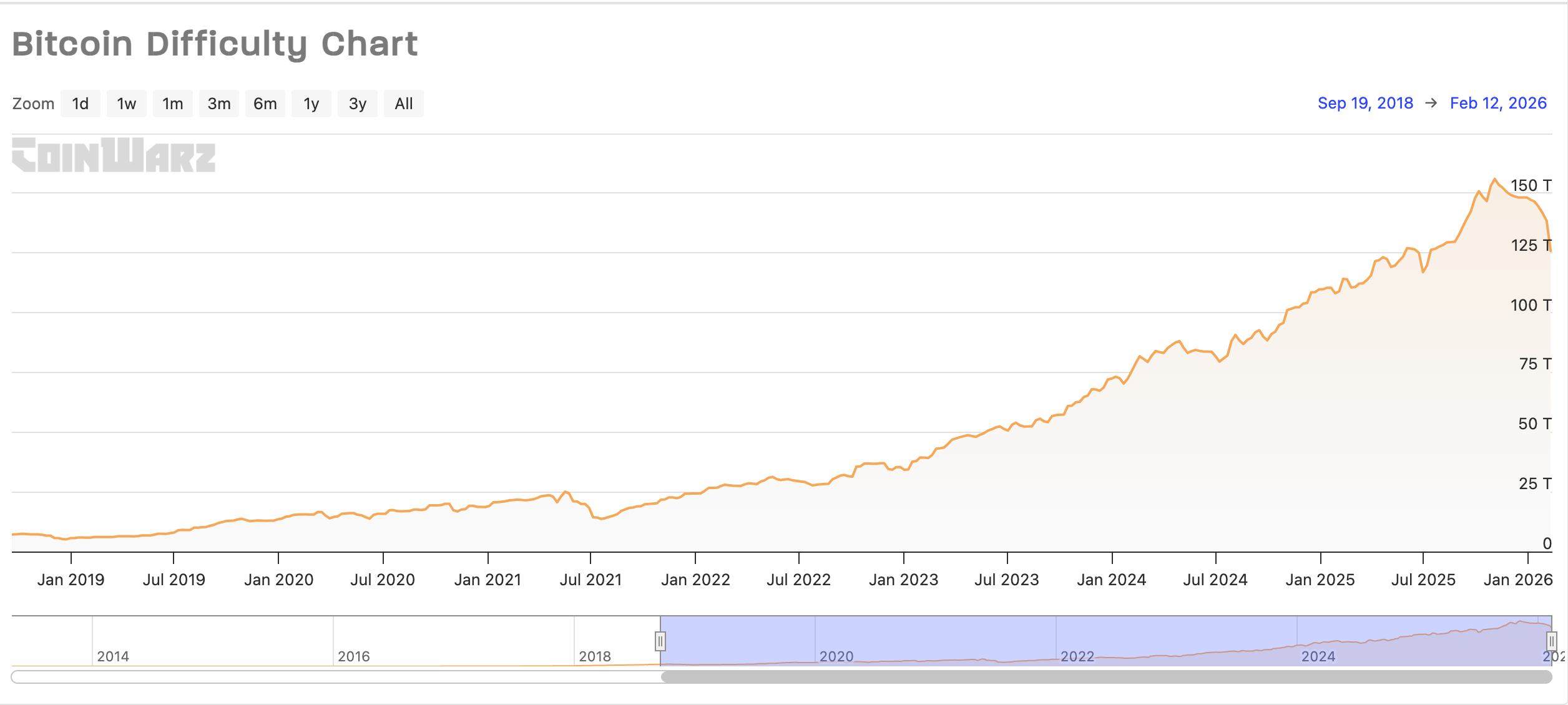

When the price of Bitcoin approaches certain cost ranges amid fluctuations, the real changes occurring in the industry are often closer to a structural adjustment rather than a concentration explosion of systemic risk. During a stage where prices are under pressure and mining difficulty is relatively high, the overall profit margins in the industry narrow, and corrections first appear in marginal computing power that has higher costs and lower efficiency. Some smaller miners with higher energy costs or aging equipment may choose to gradually shut down their equipment, reduce computing power, or adjust their asset structure to relieve operational pressure.

This process is often reflected in the macro data as a phased decline in overall network computing power. A decline in computing power does not mean that network security is compromised; rather, it reflects the natural clearing and metabolism within the industry. In fact, such periodic changes usually accelerate the concentration of computing power into entities with scalable operational capabilities and cost advantages, thereby improving the overall operational efficiency of the industry.

Market Selection and Self-Adaptation

On a deeper level, the "shutdown price" is not an absolute lower limit in terms of price, but more like a reference range in dynamic adjustment. During periods of market volatility, high-cost, low-efficiency miners may choose to temporarily shut down equipment or adjust operational strategies, while the Bitcoin network itself has a mature self-adaptive mechanism. When some computing power exits, the overall mining difficulty will decrease accordingly, and the remaining efficient computing power still operating will gain greater profit margins, thus promoting the network to gradually enter a new balance state. It is this self-regulating capability that allows the Bitcoin mining system to continue operating across multiple cycles and provides high-efficiency miners with improvements in output per unit of computing power and operational environment.

If we extend the timeline, we can see this pattern more clearly. In past cycles, the industry has experienced phases where prices fell below some production cost ranges. In stages such as 2019 and 2022, the price of Bitcoin was also below the production cost range for most mining machines at that time, but subsequently, with adjustments in computing power, changes in difficulty, and market correction, it gradually converged toward new balance ranges. Each round of cyclical adjustments propels the industry toward lower energy costs, higher computing power efficiency, and more specialized and scale-oriented directions, clearing out backward capacity, and is itself an important marker of industry maturity.

How to Move Forward Amid Fluctuations

Returning to the specific level of enterprises, the key to responding to industry volatility lies not in short-term price judgments but in long-term preparation and operational resilience. Taking BitFuFu as an example, the company focuses on mining infrastructure construction and operational efficiency optimization in the long term, continuously deploying new generations of high-energy-efficiency mining machines, and through scaled operations and refined energy cost management, continuously enhances the overall quality of computing power. The company has also deployed diverse energy partnerships to build a competitive electricity cost structure. Thanks to its comprehensive advantages in equipment efficiency, energy structure, and operational systems, its current computing power remains in a stable operational state, allowing the company to maintain relatively stable output performance and a healthy asset structure during the industry adjustment phase.

Short-term market volatility is inevitable, but what the Bitcoin network and mining industry showcase through each cycle is a powerful self-adaptive ability and a persistent evolutionary drive. Behind the discussion of "shutdown price," what is truly worth noting is how the industry completes efficiency leaps amid fluctuations, and those enterprises that remain focused on long-term construction while continuously building cost and efficiency moats.

Winter sifts vitality, and cycles temper true value. What the industry is experiencing is not an exit but a deeper consolidation and upgrade. We are always here, focused, steady, moving forward together with the network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。