On the second day of the holiday, there was a pullback in U.S. trading hours. From a timing perspective, it is likely related to expectations of geopolitical conflict between the U.S. and Iran. The Chief of Staff of Iran's Armed Forces stated that any attack by the U.S. on Iran would be a lesson for Trump. However, Iran is also preparing for a second round of nuclear negotiations with the U.S. and hopes for world peace, as every time such conflicts occur, it is the money in investors' wallets that gets attacked.

This drop, knowing the reason behind it, is not really scary. As long as it doesn't escalate to physical actions and negotiations can be successful, expectations will return to normal. After all, this is not the main contradiction for the U.S. at the moment. After the holidays, the Supreme Court will inquire about Trump's IEEPA tariffs, and this result will be more important. If Trump cannot use tariffs as a weapon, it will help with market fluctuations.

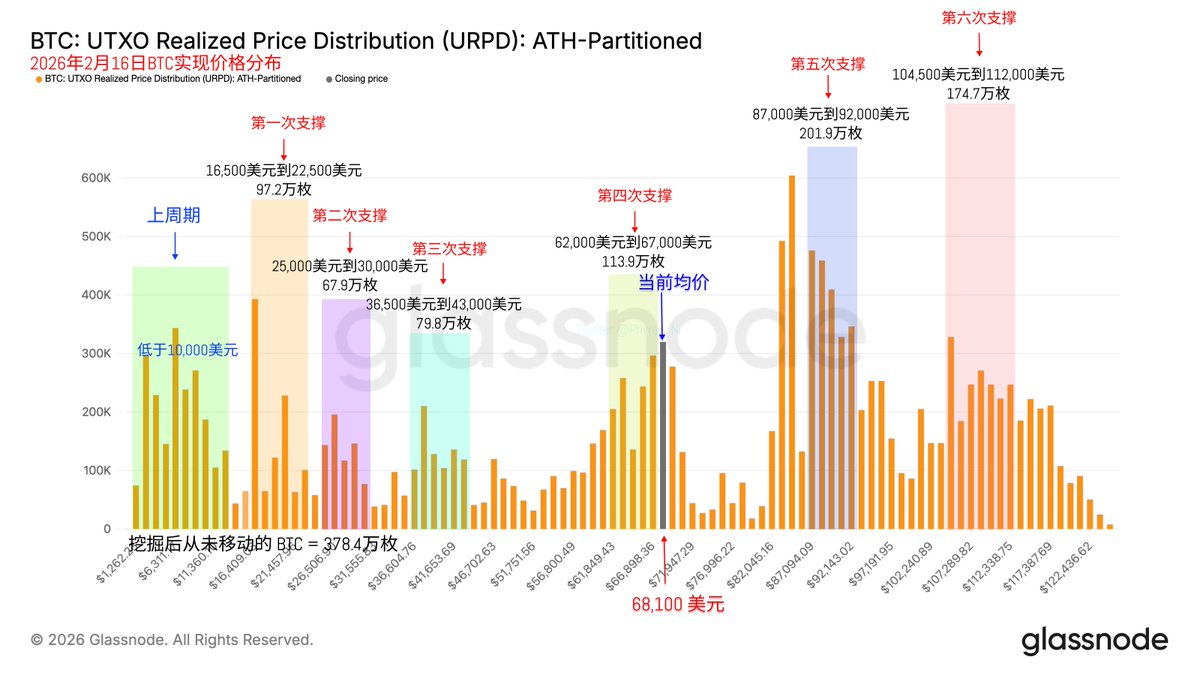

Looking back at Bitcoin's data, it is indeed one of the biggest holidays of the year. The liquidity under the dual holidays in Asia and the U.S. is extremely low, with turnover rates hitting nearly the lowest point in the past year. Most investors are completely uninterested in trading $BTC. Due to this situation, even slight changes in chips and funds may lead to greater volatility than usual.

However, from the data structure, the distribution of chips remains very healthy. Although there has been a slight adjustment, it is not due to any panic or mass sell-off. The vast majority of investors are still indifferent, and the slightly negative fluctuations caused by poor liquidity have been amplified. The U.S. stock market is closed on Monday; let's see what happens on Tuesday.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。