Over the past two weeks, the Bitcoin network’s hashrate, block intervals, revenue and difficulty have whipped back and forth, transforming what is typically a metronomic rhythm into something far more theatrical.

Much of that disruption can be traced to the Arctic winter storm that barreled through dozens of U.S. states, pushing miners to dial back operations to relieve strain on regional power grids at the height of the deep freeze.

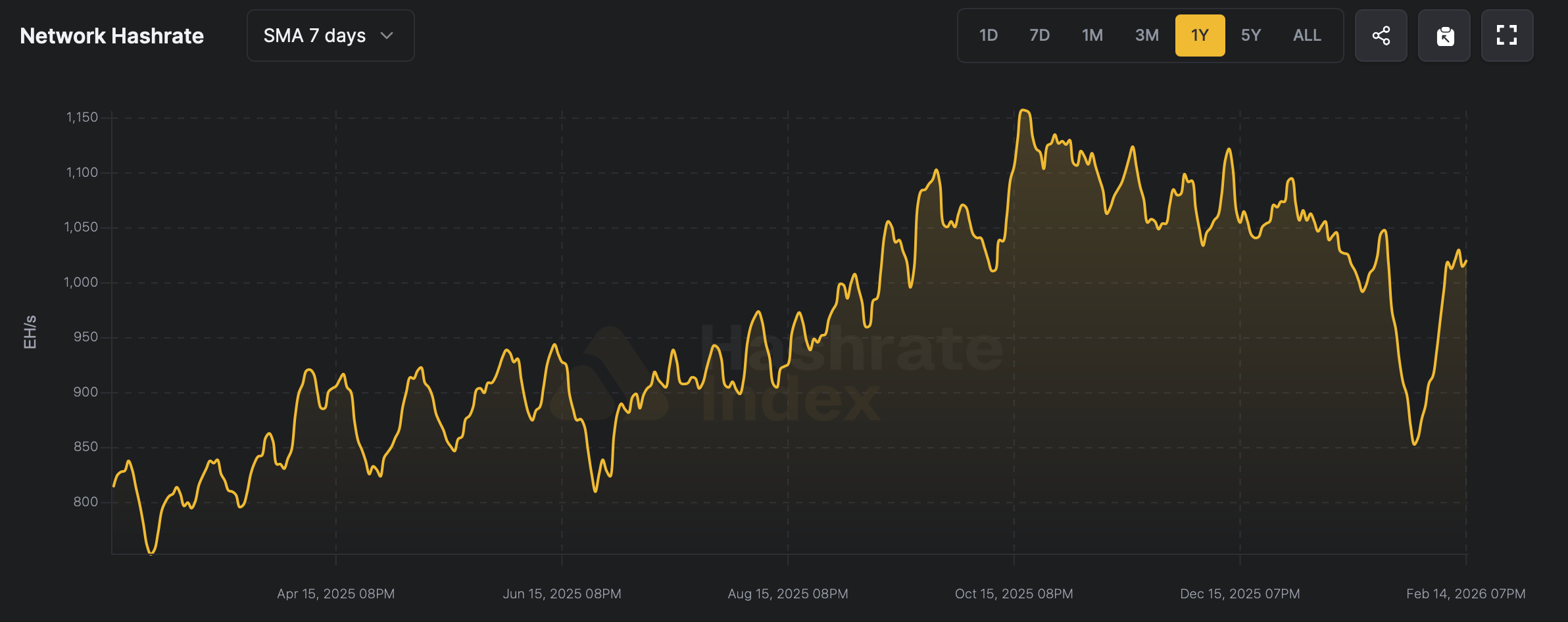

Bitcoin’s hashrate on Feb. 15, 2026.

The chill delivered a measurable jolt. Hashrate fell well below the 1,000 exahash per second (EH/s) mark — the 1 zettahash per second (ZH/s) milestone — dipping well below the 900 EH/s range. Block production slowed accordingly, stretching beyond 12 minutes per block for extended stretches between the Jan. 22 and Feb. 7 difficulty epoch. Then, on Feb. 7 at block height 935424, mining difficulty adjusted downward by a whopping 11.16%.

At the same time, the value of a single petahash per second (PH/s), known as hashprice, softened as BTC retreated to levels not seen since 2024. But the retreat proved temporary. Since touching roughly 800 EH/s, the network’s computing power has roared back above the 1 ZH/s band. As of Sunday at 9 a.m. Eastern time, hashrate stands near 1,030.21 EH/s, according to data from hashrateindex.com.

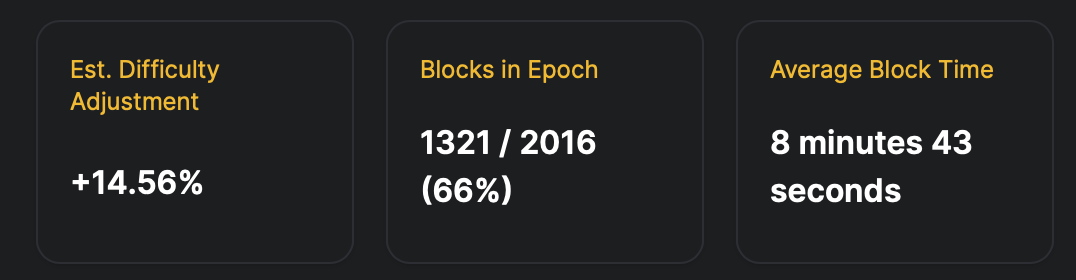

With miners back online, block intervals have quickened beyond the customary 10-minute target. Over the past 24 hours, the average time between blocks clocked in at about 8 minutes and 43 seconds. That acceleration is poised to shape the next difficulty epoch, projected for Feb. 19 — roughly four days away. Early estimates already point to a sizable upward adjustment, potentially enough to fully offset the prior 11.16% decline.

Projected difficulty adjustment via hashrateindex.com.

Current projections indicate a possible 14.71% increase if the present pace holds. Should block times moderate — with roughly 34% of the 2,016-block epoch still to be mined — that estimate would ease. Even so, regardless of the exact figure posted on Feb. 19, the coming adjustment appears primed to deliver a pronounced increase, one that could more than neutralize the last reduction.

Taken together, the recent whipsaw in hashrate and now with the upcoming difficulty highlights how quickly external shocks can ripple through Bitcoin’s finely tuned design. Weather, price action, and miner economics collided, briefly slowing the network before its self-correcting mechanism kicked in.

Now, with computing power restored and blocks arriving faster than schedule, the protocol appears poised to tighten conditions again — a reminder that equilibrium in Bitcoin is rarely static.

- Why did Bitcoin mining difficulty drop by 11.16% on Feb. 7?

The decline followed a sharp hashrate reduction caused by a U.S. Arctic winter storm that forced miners to temporarily curtail operations. - How low did Bitcoin’s hashrate fall during the storm?

Hashrate dipped to roughly 800 EH/s, slipping below the 1 zettahash per second (ZH/s) threshold. - When is the next Bitcoin difficulty adjustment expected?

The next difficulty epoch is projected to occur around Feb. 19, 2026. - Why could the upcoming difficulty increase be significant?

Faster block times and a hashrate rebound above 1 ZH/s are pointing to a potential double-digit upward adjustment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。