Author: Deep Thinking Circle

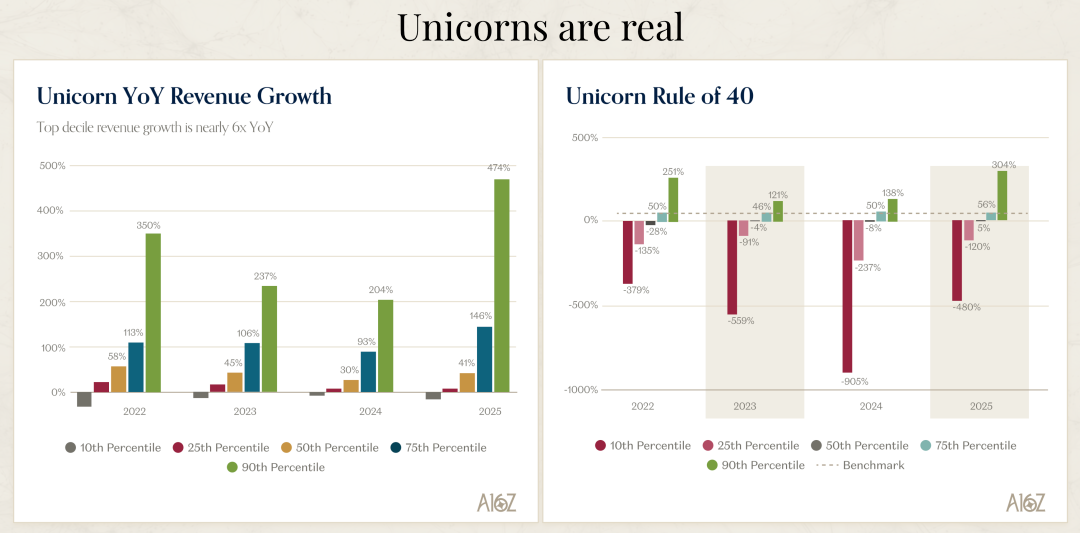

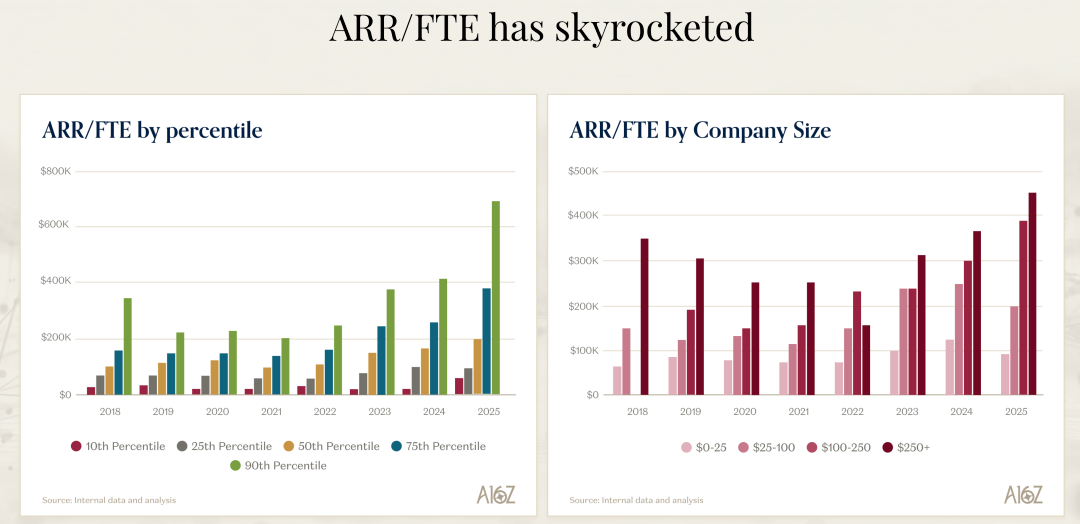

Have you ever thought that the software industry might be undergoing a transformation more intense than the shift from command line to graphical interface? Recently, I listened to a deep analysis of the AI market shared by David George from a16z, and I was shocked by a set of data: The fastest-growing AI companies are expanding at a 693% annual growth rate, while their spending on sales and marketing is far lower than that of traditional software companies. This is not an isolated case; the growth rate of the entire AI company cohort is more than 2.5 times that of non-AI companies. What is even more incredible is that these companies’ ARR per FTE (annual recurring revenue per employee) has reached $500,000 to $1 million, while the standard for the previous generation of software companies was $400,000.

What does this mean? It means we are witnessing the birth of an entirely new business model, an era that creates greater value with fewer people and lower costs. D

avid George mentioned in his presentation that this is not a minor adjustment but a complete paradigm shift. Core concepts—version control, templates, documentation, and even the concept of users—are being redefined due to AI agent-driven workflows. I firmly believe that in the next five years, companies that cannot adapt to this change will be completely eliminated.

The Astonishing Truth About AI Company Growth

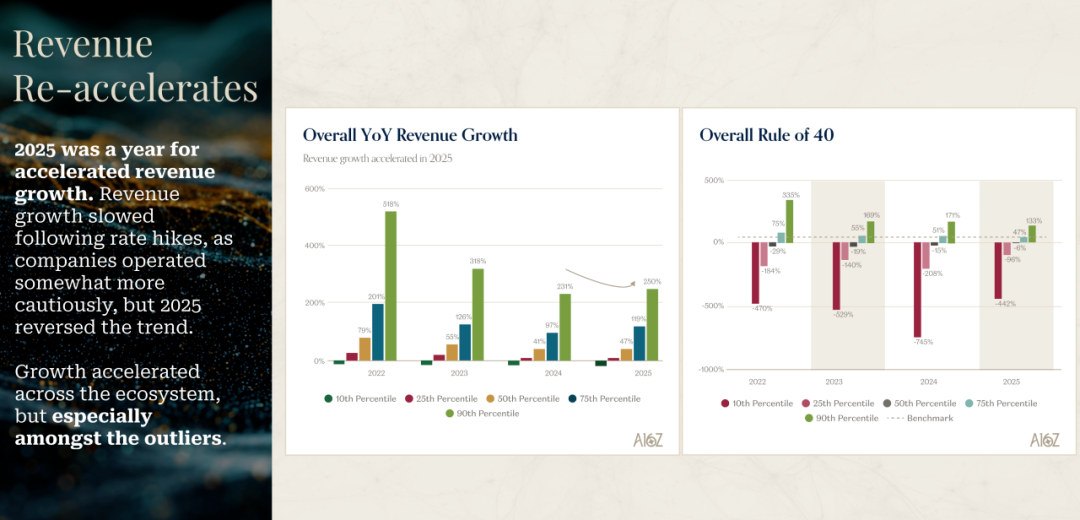

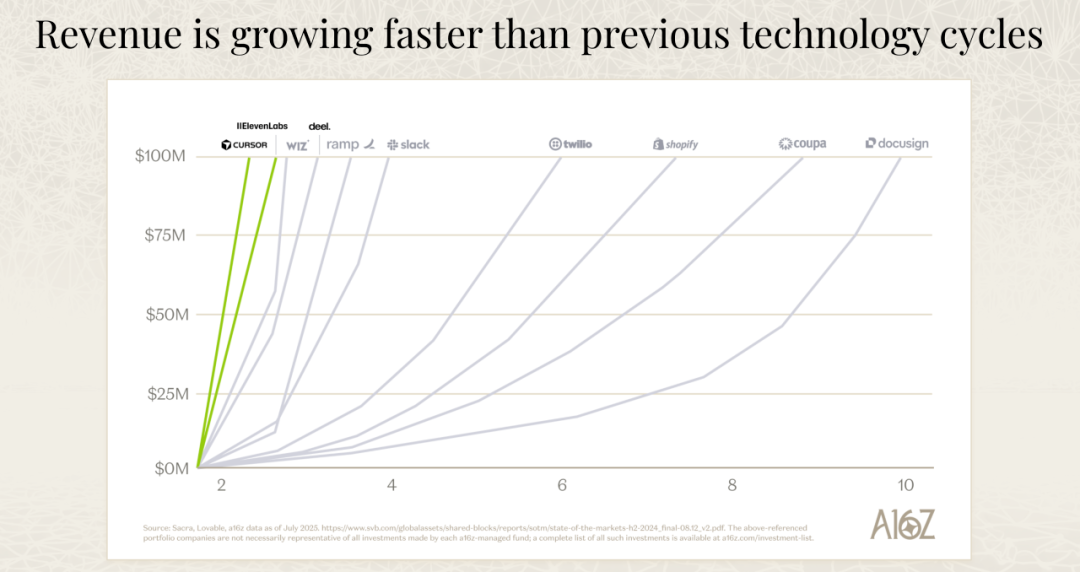

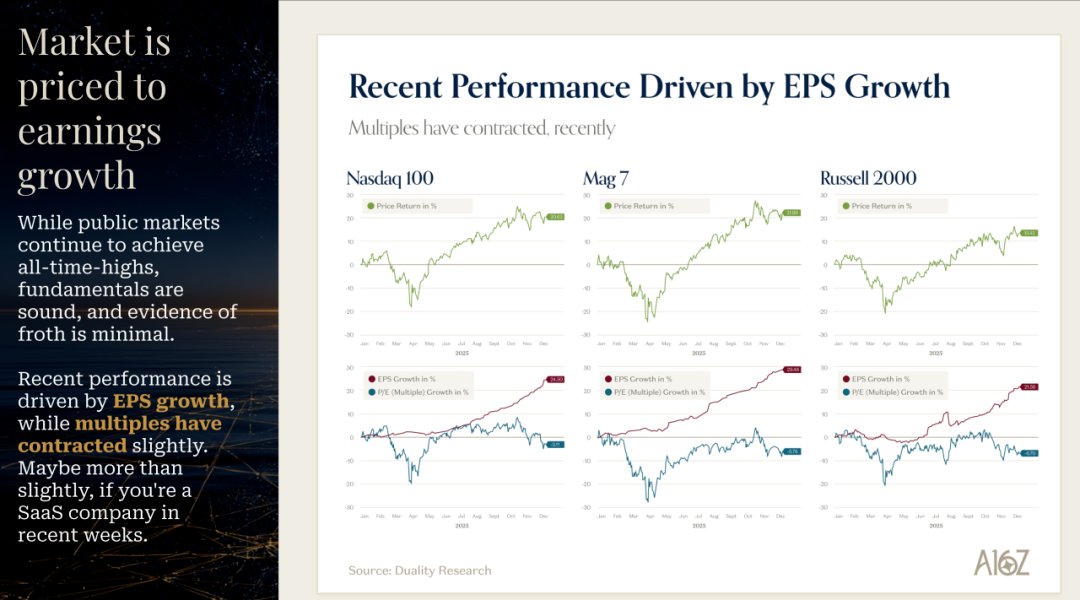

The data presented by David George made me rethink what true growth means. The year 2025 will be a year of accelerated growth for AI companies. After experiencing a slowdown in growth in 2022, 2023, and 2024 due to rising interest rates and contraction in the tech industry, 2025 completely reverses this trend. What is most shocking is that among companies ranked in different tiers, those that are truly outliers are growing at an astonishing speed.

When I first saw this set of data, my immediate reaction was: Is there something wrong with these numbers? The best-performing AI companies are experiencing a year-on-year growth of 693%. David mentioned that their team confirmed this number three times before believing it. But this perfectly aligns with the actual situations and cases they have seen from their portfolio companies. This is not an isolated phenomenon but a systemic change happening across the entire AI sector.

More importantly, the quality of growth is critical. Traditional software companies typically take a long time to reach $100 million in annual revenue, while the fastest-growing AI companies reach this milestone much faster. David particularly emphasized a very important point: this is not because they are spending more on sales and marketing; on the contrary, the fastest-growing AI companies actually spend less on sales and marketing than traditional SaaS (Software as a Service) companies. They grow faster but spend less. What is the reason behind this? It is because the demand from end customers is extremely strong, and the products themselves are highly attractive.

I believe this reveals a profound shift in business logic. In the past software era, growth often depended on strong sales teams and massive marketing budgets. You needed to educate the market, persuade customers, and overcome adoption barriers. But in the AI era, truly outstanding products can speak for themselves. When a product can instantly create value for users and allow them to feel the efficiency improvement during the first use, market demand will generate automatically. This product-driven growth model is much healthier and more sustainable than the traditional sales-driven model.

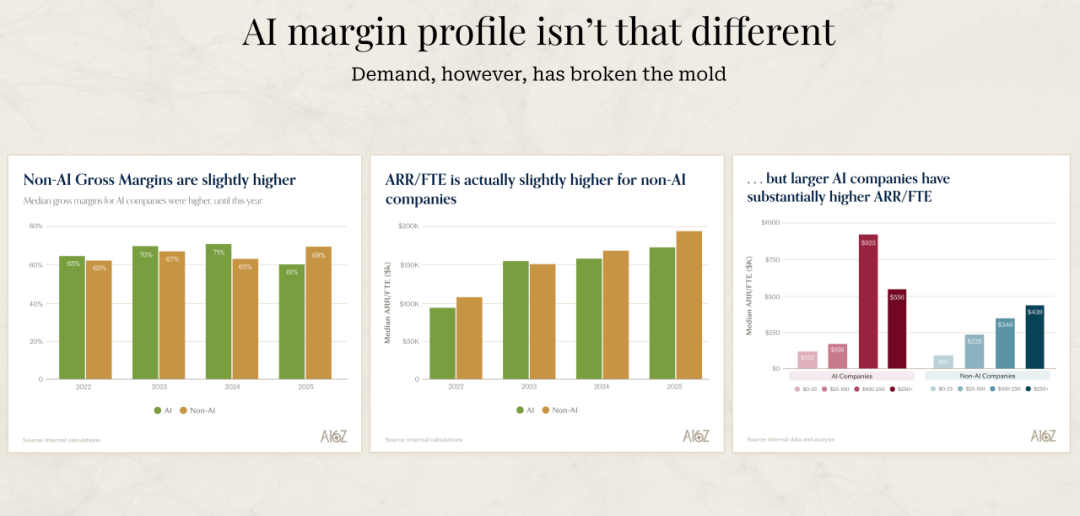

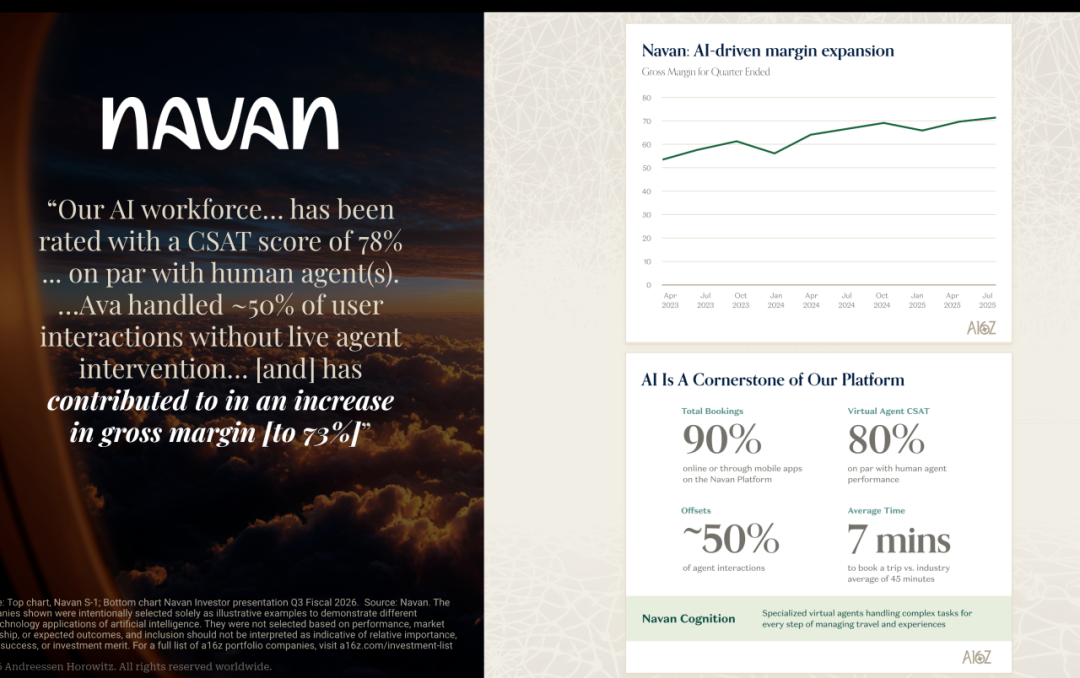

Another set of data presented by David is also quite interesting. The gross margins of AI companies are actually slightly lower than those of traditional software companies. Their team's view is unique: for AI companies, low gross margins are somewhat a badge of honor. Because if low gross margins are due to high inference costs, it indicates two things: first, that people are indeed using AI functionalities; second, that over time, these inference costs will decline. So to some extent, if they see a particularly high gross margin in an AI company, they would be a bit skeptical, as this might mean that the AI functionalities are not what customers are truly purchasing or using.

Why AI Companies Can Be More Efficient

I have been pondering a question: why can AI companies create more revenue with fewer personnel, despite being software companies? David emphasized the ARR per FTE metric in his presentation, which refers to the annual recurring revenue generated per full-time employee. This metric is actually a comprehensive measure of the overall operational efficiency of a company, including not only sales and marketing efficiency but also management costs and R&D costs.

The best AI companies have an ARR per FTE of $500,000 to $1 million, while the standard for the previous generation of software companies is around $400,000. This may seem like just a numerical difference, but it reflects entirely different business models and operational methods behind it. David believes that the primary reason for this difference is the extremely strong market demand for these products, allowing them to push products to market with fewer resources.

But I think this is only a surface reason. The deeper reason is that AI companies have been forced to think about how to operate differently from the beginning. They had no choice but to redesign their internal processes, product development approaches, and customer support systems using AI. This enforced innovation has led them to discover a more efficient business model.

David shared a particularly vivid example. He said that recently, while chatting with the founder of a company, the founder was dissatisfied with the progress of one of their products, so he directly arranged for two engineers, who had in-depth knowledge of AI, to use the latest programming tools such as Claude Code and Cursor to rebuild the product from scratch, giving them an unlimited budget for programming tools. What was the result? The founder said he believed the progress was now 10 to 20 times faster than before. Moreover, the bills generated by these tools were so high that he began to reconsider what the entire organization should look like.

What impressed me about this example is that it is not a gradual improvement but a leap by an order of magnitude. What does a speed increase of 10 to 20 times mean? It means that a project that originally took a year to complete can now be done in just one or two months. This difference in speed can produce decisive impacts in competition. The founder's conclusion was: I need to have the entire product and engineering team work in this way, and I believe this will happen within the next 12 months. But this also means that the structure of the team will undergo fundamental changes. Where are the boundaries between product, engineering, and design? These questions all need to be redefined.

I believe December 2024 marks a turning point in programming. David also shares this feeling. He said it feels like at that moment, programming tools will undergo a qualitative leap. In the next 12 months, this change will either be deeply rooted in companies, or those companies that do not adopt it will lag far behind their peers. This is not alarmist but a reality.

Adapt to AI or Be Eliminated

David mentioned a very stark viewpoint in his presentation: for companies founded before the AI era, they must adapt to the AI era or face extinction. This assertion sounds extreme, but I completely agree. Moreover, this adaptation needs to take place on two levels: the front end and the back end.

On the front end, companies need to think about how to integrate AI natively into their products, rather than simply adding a chatbot into existing workflows. This requires reimagining what products can do with AI and radically disrupting themselves to make changes. David shared several interesting examples. There is a software company from the pre-AI era, whose CEO has been completely transformed by the AI concept. He said, We want to become an AI product. We want the product to say, Your employees have now become your AI agents. How many agents do you have? These are now the topics he is discussing.

There is an even more extreme example. A CEO said, for every task we need to accomplish now, I ask one question: Can I do this with electricity, or must I use blood? This is an extreme shift in thinking. Using electricity refers to using AI and automation, while using blood refers to manual labor. This shift in thinking is very profound; it forces you to reevaluate every process and task within the company.

On the back end, companies need to fully adopt the latest programming models and tools. All developers should use the latest programming assistance tools, and every functional department should use the latest tools. So far, the adoption rate in programming has been the highest, and this is also where the most significant leaps have been observed. But this change is starting to spread to other functional areas.

David mentioned that for those pre-AI companies, the good news is that the evolution of business models is still in the early stages. The most disruptive situation is when technology and product changes occur simultaneously with changes in business models. Currently, technology and products are indeed undergoing dramatic changes, but the transformation of business models has not fully unfolded.

He views business models as a spectrum. On the far left is the licensing model, which is the license and maintenance model of the pre-SaaS era. Then there are SaaS and subscription models, which are usually seat-based, a significant innovation that is very disruptive. You can see what happened with Adobe during this transition. Next is the consumption-based model, which is the billing method based on usage; many task-based businesses have shifted from being seat-based to consumption-based.

The next stage will be the outcome-based model. When you complete a task, ideally when you successfully achieve a task, you will be charged based on the successful completion of that task. Currently, the only domain where this model can truly be realized may be customer support and customer success, as you can objectively measure the resolution of issues. However, as model capabilities improve, if other functions beyond customer support can also measure such outcomes, it will have a tremendous disruptive effect on existing companies.

I find this evolution path very insightful. From licensing to subscription, from subscription to consumption, from consumption to outcomes, each transition is a disruption of the previous generation's business model. And we are now on the eve of the transition from consumption to outcomes. Once AI agents can reliably complete tasks and can be objectively assessed, outcome-based pricing models will become mainstream. By that time, companies still charging by seat will find themselves completely losing competitiveness.

The AI Adoption Dilemma for Large Companies

David's observations on how Fortune 500 companies adopt AI are very interesting. He said there is a huge gap between what he hears from CEOs of these large companies and what actually happens. CEOs are all saying: we must adapt, we urgently want to understand what AI tools we need, we are ready to change, our businesses will fully roll out these tools, we want to become AI companies.

But what actually happens is completely different. The biggest disconnect between this way of thinking and actual business changes is that change management is too difficult. Even just getting people to use AI assistants to help them do their jobs better is already quite challenging. As for actual business management, changing business processes, and change management, those are extremely difficult.

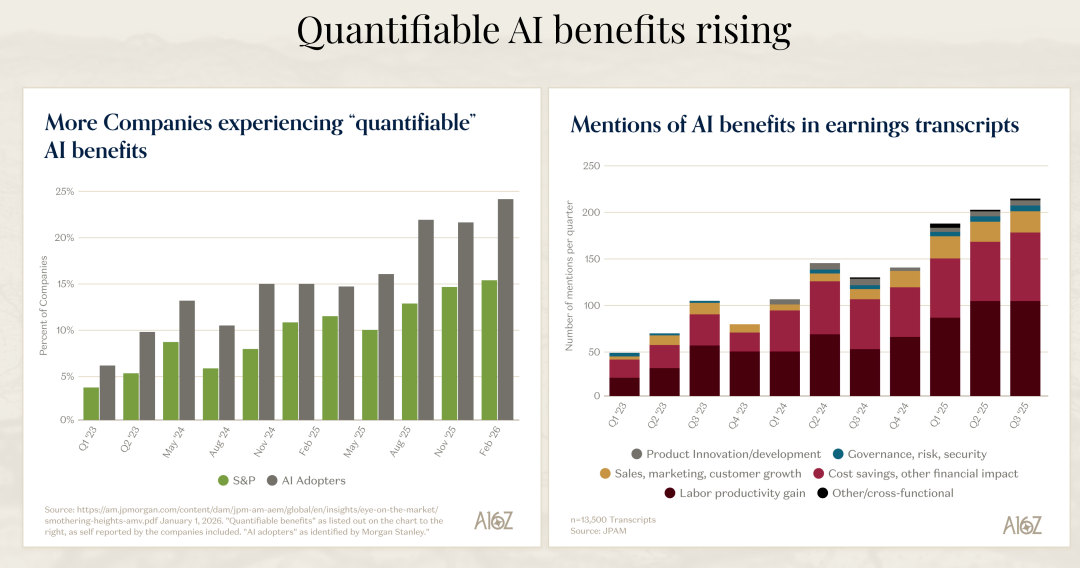

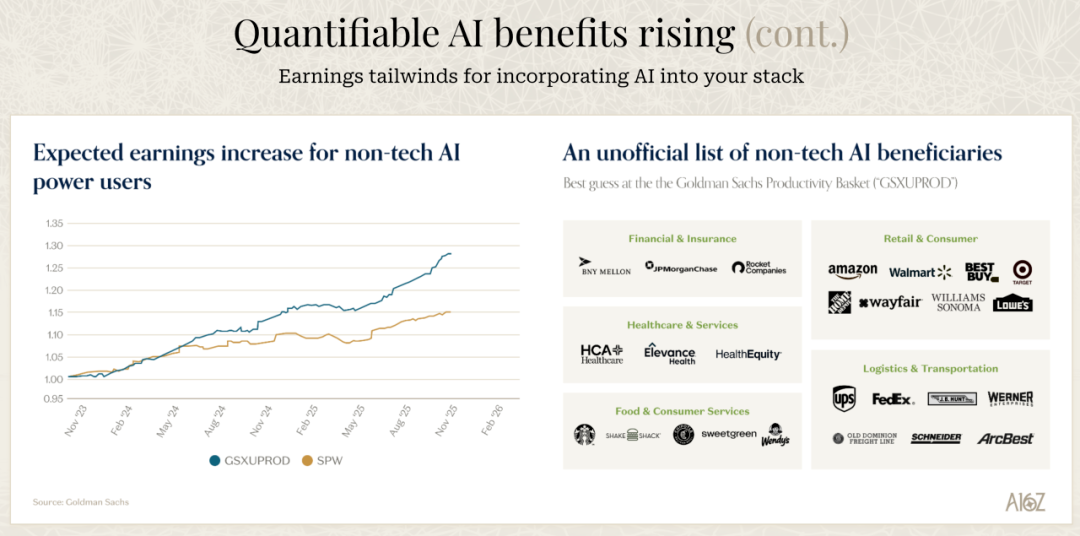

David said he is not surprised that there are some market rumors saying that progress is slower than expected. However, for the best companies that fully embrace AI and know what to do, significant business impacts have already been felt. He mentioned several specific examples: Chime claims they have reduced support costs by 60%; Rocket Mortgage states they saved 1.1 million hours in underwriting, a sixfold increase, equating to an annual saving of $40 million in operating costs.

I think this reveals a key issue: the gap between willingness and capability. CEOs of large companies have the willingness to embrace AI, but whether they have the capability to implement it is another matter. The difficulty of change management is often underestimated. It is not merely a matter of buying some tools or hiring some AI engineers, but rather necessitates fundamentally changing the company's processes, culture, and organizational structure.

Moreover, many large companies need to first adjust their businesses to prepare for AI. Using chatbots is one thing; the productivity gains might not be much. But if you must completely overhaul your systems, information, and back-end to accommodate AI, much of the work may be potential and still accumulating, with no related results observed yet.

David predicts the next 12 months will be very interesting. He believes we will see more cases, but some companies will handle it while others will not. Those that can handle it will gain a significant productivity advantage, while those that cannot will find themselves at a substantial disadvantage. I think this differentiation will happen faster and more dramatically than people expect.

Model Busters and the Future of the Market

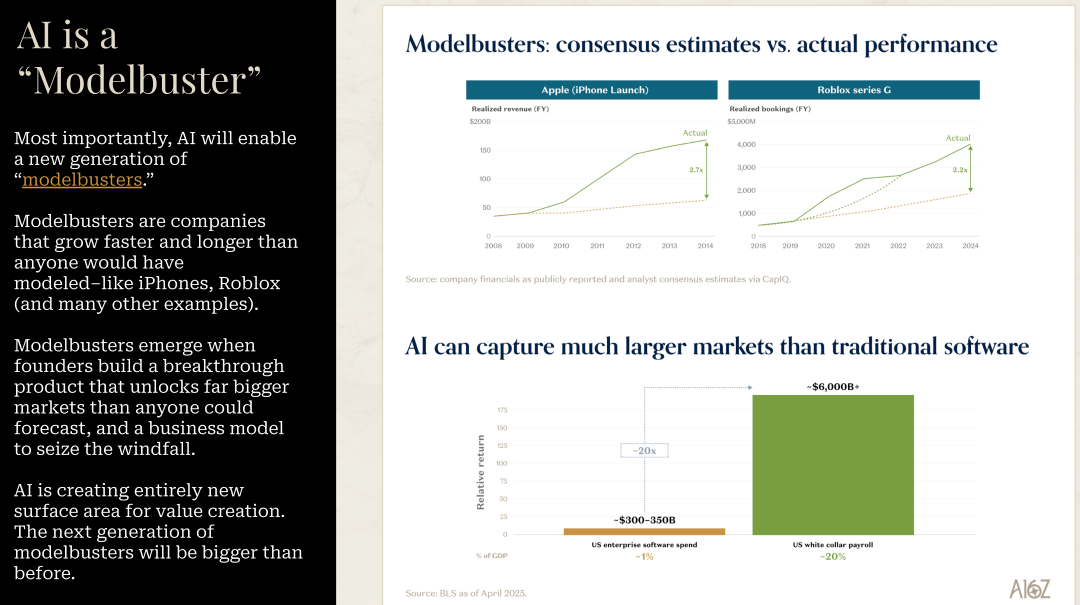

David mentioned a concept in his presentation that I find particularly insightful: Model Busters. This refers to companies whose growth rates and durations far exceed the predictions anyone can make in any context. The iPhone is a classic case of this concept. If you look at the consensus predictions before the iPhone was released and its actual performance 4-5 years later, the consensus predictions deviated by three times. And this is the most watched company in the world.

David believes AI will be the biggest Model Buster he has seen in his career. Many companies in the AI field will outperform any expectations in spreadsheets by a wide margin. I strongly agree with this viewpoint. When a technological platform does not bring incremental improvements but rather a leap by an order of magnitude, traditional predictive models become ineffective.

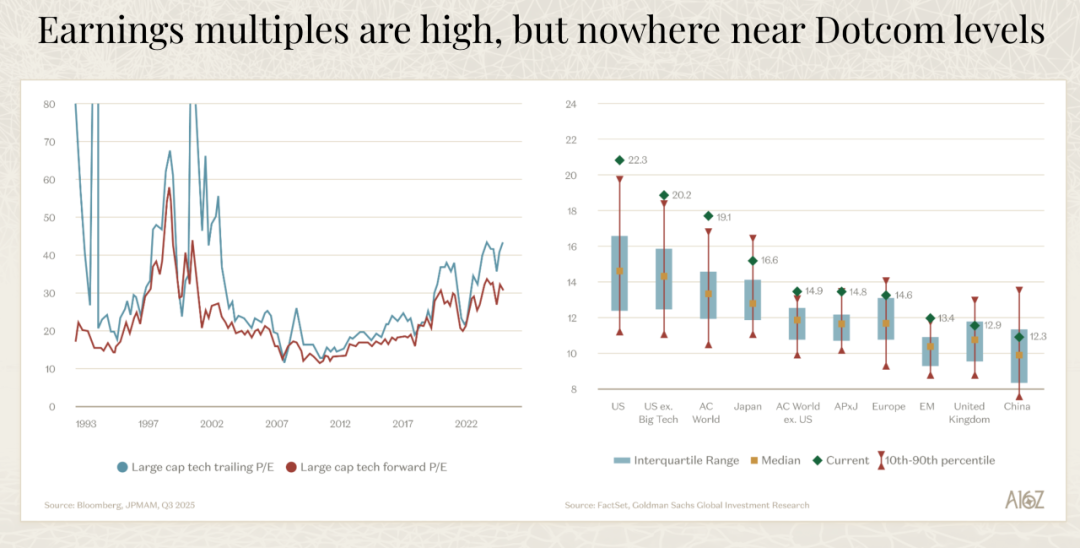

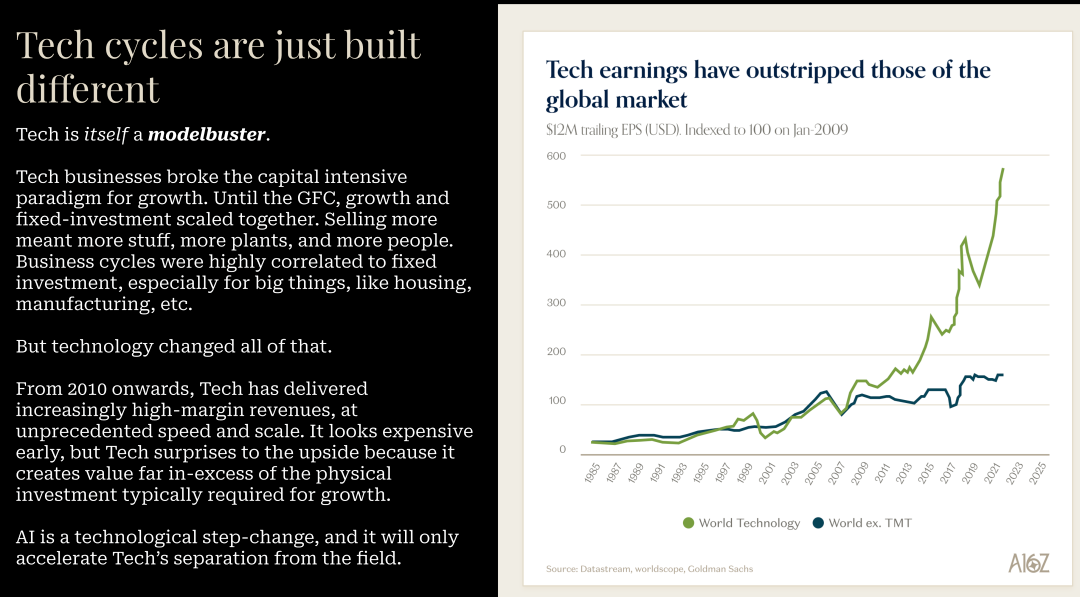

He mentioned that technology itself is a Model Buster. But since 2010, technology has provided high-margin revenues at unprecedented speeds and scales. So it always appears expensive at first, but repeatedly delivers performance that exceeds expectations, creating value far beyond the capital required. He has no reason to believe this time will be any different.

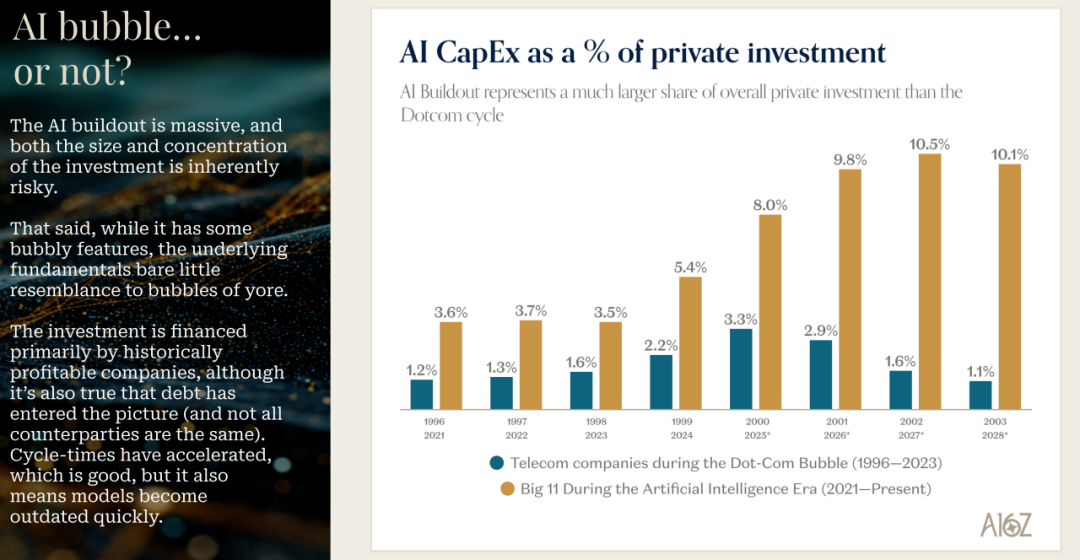

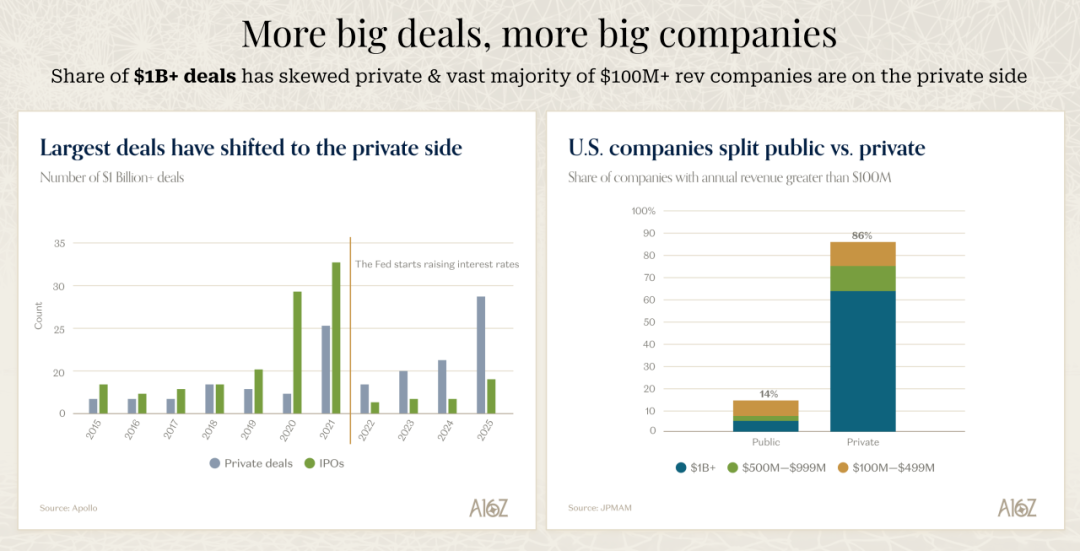

In terms of capital expenditure, David presented data that is quite interesting. Compared to the dot-com bubble period, current capital expenditures are actually supported by cash flow, and the percentage of capital expenditures relative to revenue is much lower. The biggest burden of capital expenditure falls on hyperscaler cloud service providers, which are the best business companies in history.

David particularly mentioned that as portfolio companies, they very much welcome this capital expenditure. He said: Build as much capacity as possible, provide as much supply as possible for training and inference, which is a very good thing. Moreover, the bulk of the burden is borne by the best business companies in history.

A phenomenon they are starting to pay attention to is that debt has entered this equation. You cannot solely rely on cash flow to fund all forecasted future capital expenditures; the market is starting to see some debt. However, overall, they feel quite reassured about companies that finance through cash flow, continue to generate cash flow, and utilize debt, provided the counterparty is companies like Meta, Microsoft, AWS, and Nvidia.

David mentioned a case worth关注: Oracle. Oracle has always been profitable and has been buying back stock, but they have committed to a very large scale of capital expenditure, which is a gamble. They will see negative cash flow for many years to come. The market has started to notice this, and the cost of Oracle's credit default swaps (CDS) has risen to about 2% over the past three months. This is a signal to watch out for.

I believe that this capital-intensive construction phase is necessary but not without risk. The key is to ensure that these investments ultimately generate corresponding returns. Currently, demand far exceeds supply. All hyperscale cloud service providers report that demand greatly exceeds supply. Gavin Baker, who David interviewed, has a good analogy: a large amount of fiber optics were laid during the internet age, and then they sat idle, which is called dark fiber. But in the AI era, there is no such thing as dark GPU. If you install a GPU in a data center, it will be immediately utilized fully.

The Astonishing Speed of Revenue Growth

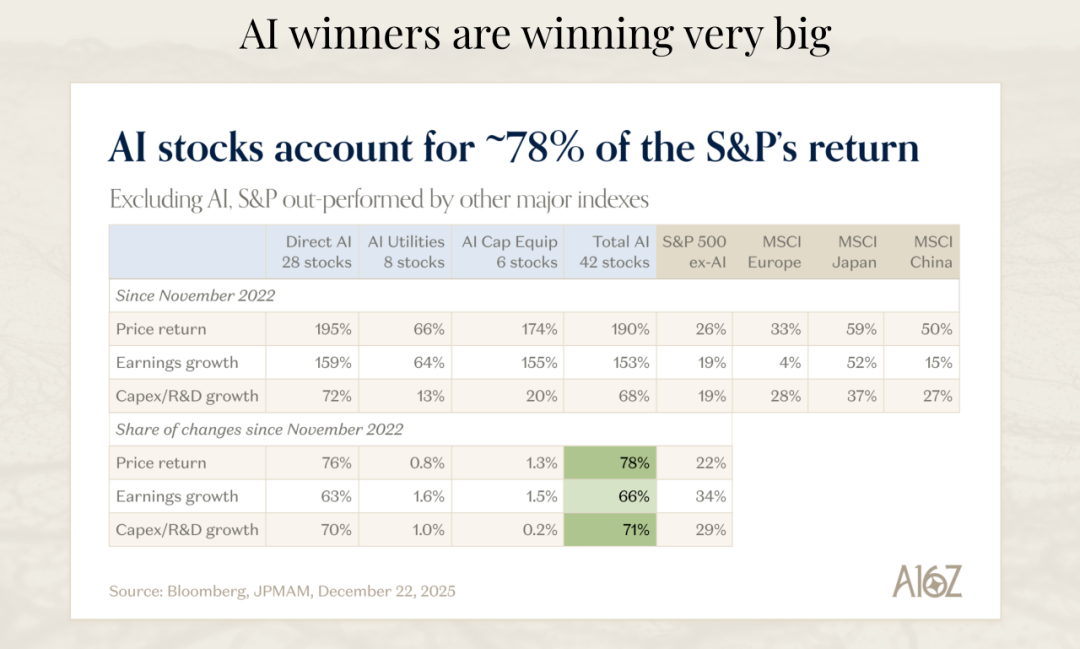

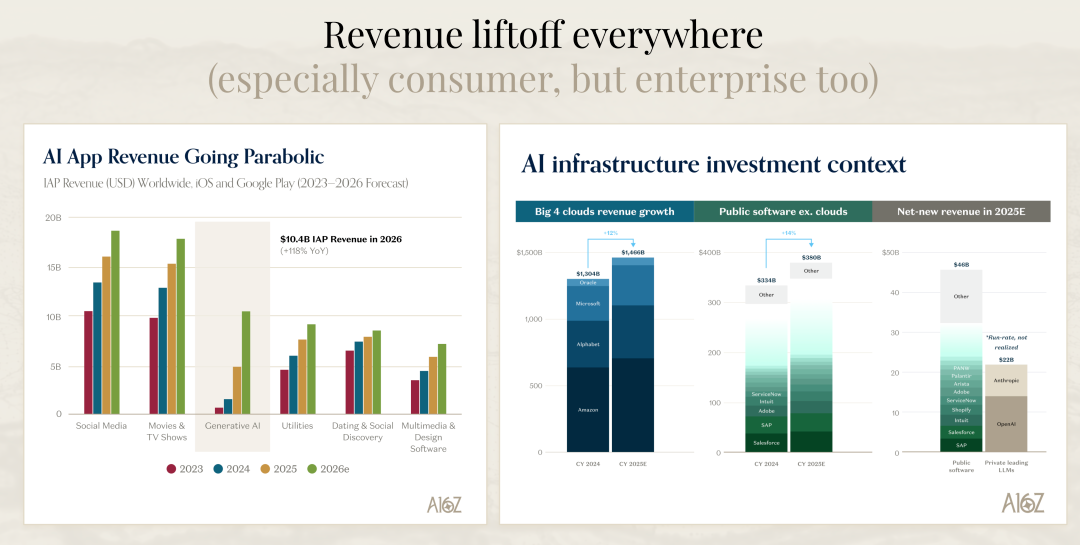

A particularly shocking set of data presented by David involves comparing cloud services, public software companies, and the new net revenues added in 2025. Public software companies will add a total of $46 billion in revenue in 2025. If you only look at OpenAI and Anthropic, based on operating revenue, their added revenue is almost half of this number.

Moreover, David thinks that if a similar comparison is made for 2026, the entire public software industry (including SAP and legacy software companies, not just SaaS) may see the added revenue from AI companies (model companies) reaching 75% to 80%. This pace is simply unbelievable. This means that in just a few years, the new value created by AI companies will surpass the entire traditional software industry.

Goldman Sachs estimates that AI construction will generate $9 trillion in revenue. If we assume a 20% profit margin and a 22x price-to-earnings ratio, this would translate to a new market value of $35 trillion. Currently, approximately $24 trillion in market value has already been factored in. While we can argue about whether this is all attributable to AI or the performance of large tech companies, there is still a lot of market value to compete for, and if these assumptions hold true, there is significant upside potential.

David also did a simple calculation. According to current estimates, by 2030, cumulative capital expenditure for hyperscale cloud service providers will be just under $5 trillion. To achieve a 10% threshold return on this $4.8 trillion or nearly $5 trillion investment, AI annual revenue will need to reach approximately $1 trillion by 2030. Putting this number in context, $1 trillion is about 1% of global GDP to generate a 10% return.

Is this achievable? It may also fall slightly short. But David believes looking only at 2030 is limiting. The returns on these investments may be realized over a longer period, such as between 2030 and 2040. And if we are now at around $50 billion in AI revenue (this is his rough estimate), generated primarily over the past year and a half, then the path from $50 billion to $1 trillion is not unimaginable.

My Thoughts on the Future

After listening to David's presentation, my biggest impression is that we are at the beginning of a historic turning point, not in the mid-term or at the end. This is a product cycle that could last 10 to 15 years, and we have only just begun. This excites me as well as makes me anxious.

The excitement comes from the enormous opportunities that this transformation brings. For those companies that can quickly adapt and fully embrace AI, they will not only gain a competitive edge but are also likely to become the ones defining the next era. We will witness the birth of new unicorns, the emergence of new business models, and entirely different organizational structures.

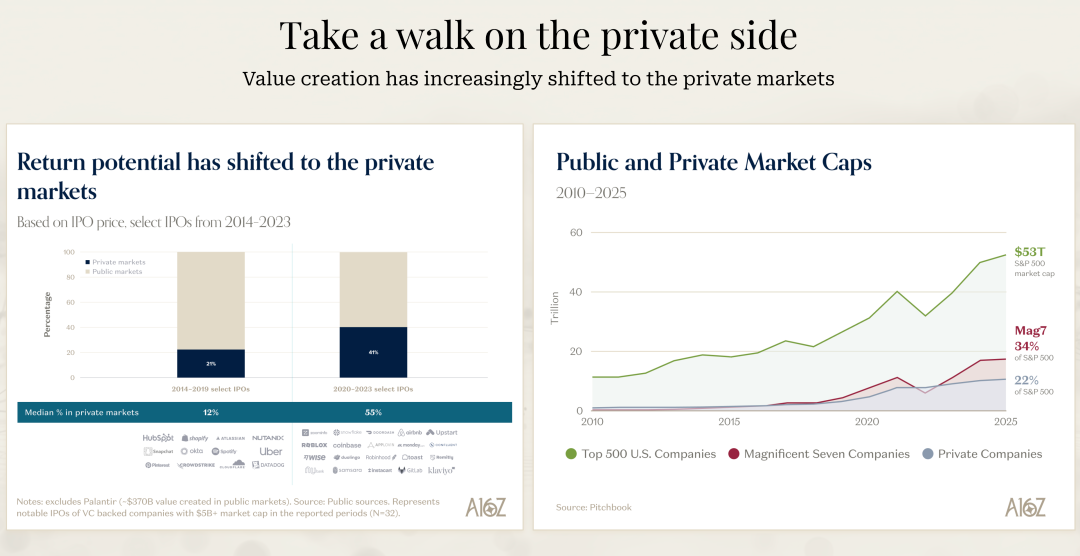

The anxiety stems from the fact that the speed of this change may be much faster than most people expect. The data David mentioned is particularly telling: the average time a company stays in the S&P 500 index has decreased by 40% over the past 50 years. This means the rate at which companies are being disrupted is accelerating. In the AI era, this speed may accelerate further.

I believe there will be a clear differentiation ahead. Some companies will truly understand the potential of AI, fundamentally rethinking their products, processes, and organizational structures. These companies will achieve order-of-magnitude efficiency gains and competitive advantages. Meanwhile, other companies, even if they have the willingness to change, will progress slowly due to challenges in change management, organizational inertia, and technical debt. This differentiation will become increasingly evident in the coming years.

For entrepreneurs, this may be the best of times. Market demand is extremely strong, technological capabilities are evolving rapidly, and the capital market is still willing to support truly potential companies. Moreover, compared to the previous generation of software companies, it is now possible to achieve the same scale with fewer resources and faster speeds. This lowers the barriers to entry for entrepreneurship but also raises the demands for product quality and market fit.

For investors, the key is to identify those true Model Busters. The growth rates and durations of these companies will far exceed any traditional models' predictions. But this also requires investors to have sufficient foresight and patience, willing to trust those seemingly unreasonable growth curves.

For professionals, whether you are an engineer, product manager, designer, or in any other role, it is essential to learn and adapt to new tools and working methods quickly. The example David mentioned—two engineers using the latest programming tools being able to work 10 to 20 times faster than before—is not an isolated case but a trend. Those who can master these new tools and methods will gain significant career advantages.

Finally, I want to say that this transformation is not just a technical layer but also a change in mindset. From "How should we do this?" to "What outcome do we want to achieve?" From "Adding more manpower" to "How to solve this problem with AI?" From "Following established processes" to "Reimagining possibilities." The question of "Do I use electricity or blood?" although it sounds extreme, it captures the essence of this transformation.

We are witnessing the process of the software world being rewritten. This is not an incremental upgrade but a complete reconstruction. And those who can understand this and embrace it will define the next era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。